Enlarge image

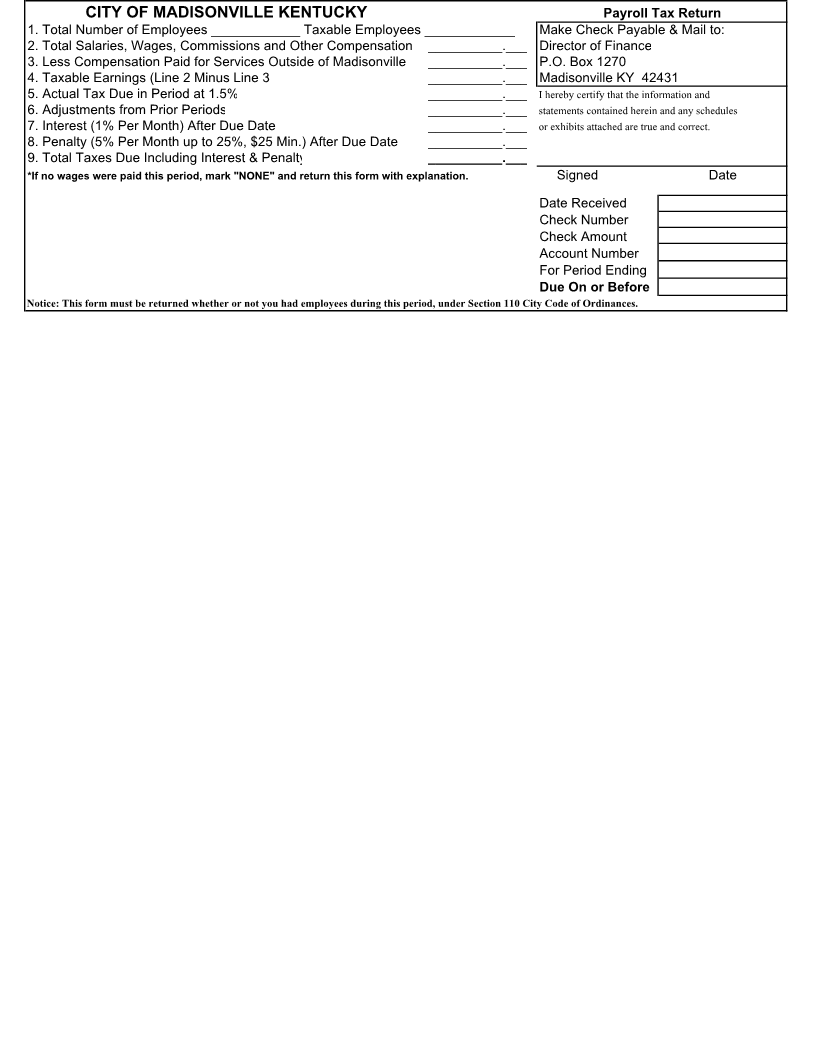

CITY OF MADISONVILLE KENTUCKY Payroll Tax Return 1.Total Number of Employees ____________ Taxable Employees _____________ Make Check Payable & Mail to: 2.Total Salaries, Wages, Commissions and Other Compensation __________.___ Director of Finance 3.Less Compensation Paid for Services Outside of Madisonville __________.___ P.O. Box 1270 4.Taxable Earnings (Line 2 Minus Line 3 __________.___ Madisonville KY 42431 5.Actual Tax Due in Period at 1.5% __________.___ I hereby certify that the information and 6.Adjustments from Prior Periods __________.___ statements contained herein and any schedules 7.Interest (1% Per Month) After Due Date __________.___ or exhibits attached are true and correct. 8.Penalty (5% Per Month up to 25%, $25 Min.) After Due Date __________.___ 9.Total Taxes Due Including Interest & Penalty __________.___ *If no wages were paid this period, mark "NONE" and return this form with explanation. Signed Date Date Received Check Number Check Amount Account Number For Period Ending Due On or Before Notice: This form must be returned whether or not you had employees during this period, under Section 110 City Code of Ordinances.