Enlarge image

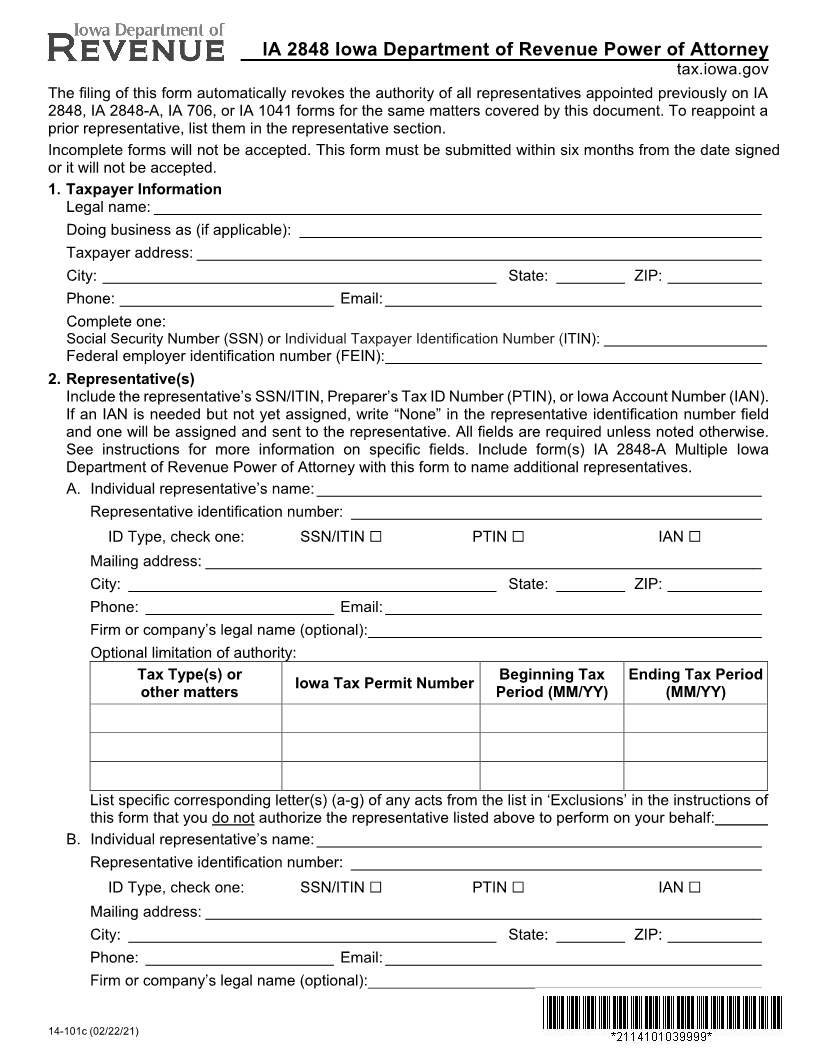

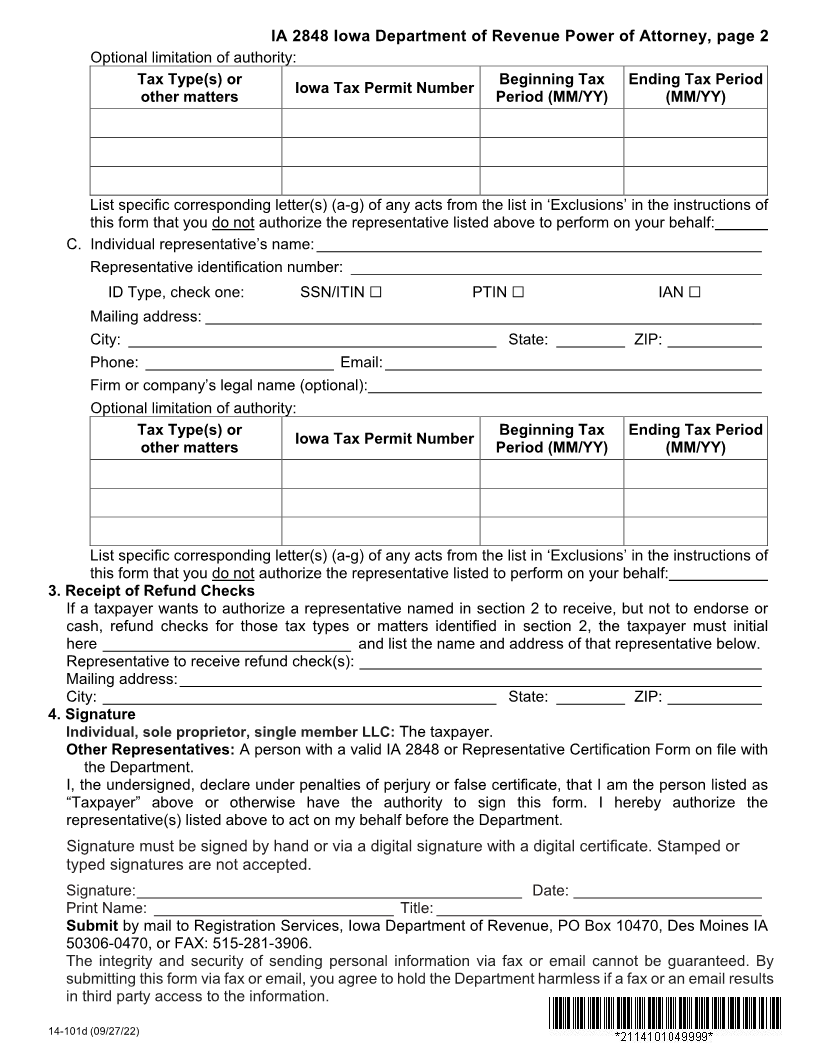

IA 2848 Iowa Department of Revenue Power of Attorney

tax.iowa.gov

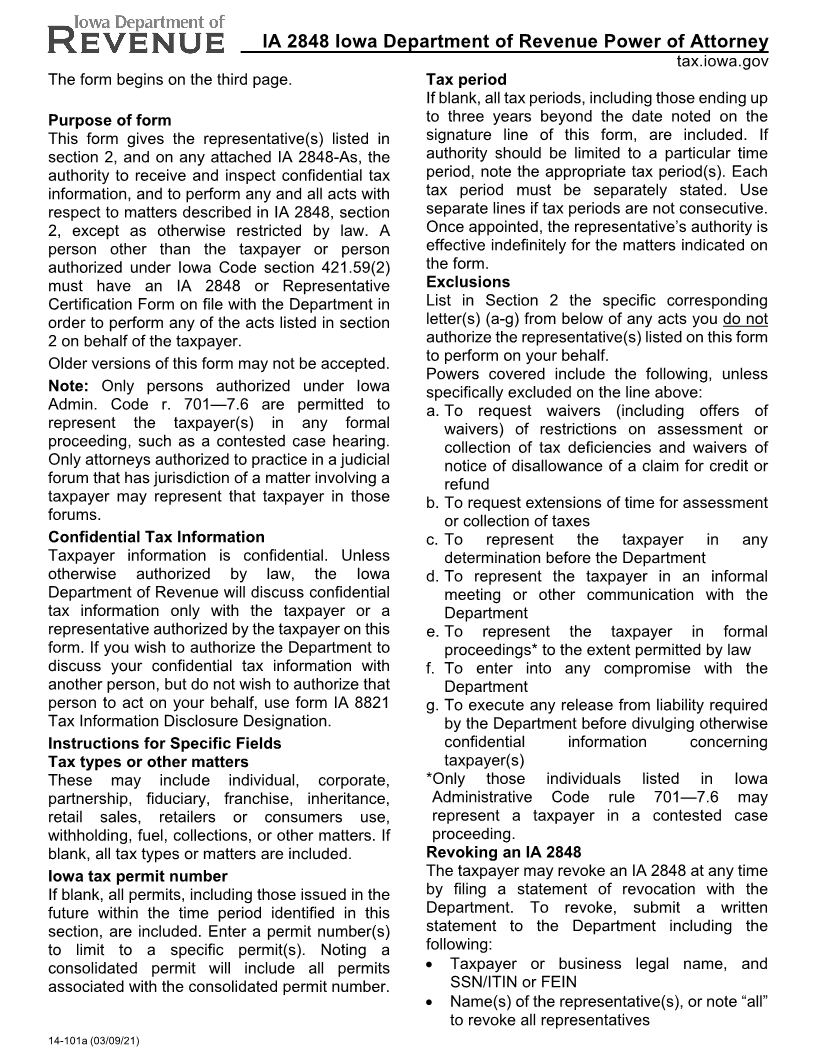

The form begins on the third page. Tax period

If blank, all tax periods, including those ending up

Purpose of form to three years beyond the date noted on the

This form gives the representative(s) listed in signature line of this form, are included. If

section 2, and on any attached IA 2848-As, the authority should be limited to a particular time

authority to receive and inspect confidential tax period, note the appropriate tax period(s). Each

information, and to perform any and all acts with tax period must be separately stated. Use

respect to matters described in IA 2848, section separate lines if tax periods are not consecutive.

2, except as otherwise restricted by law. A Once appointed, the representative’s authority is

person other than the taxpayer or person effective indefinitely for the matters indicated on

authorized under Iowa Code section 421.59(2) the form.

must have an IA 2848 or Representative Exclusions

Certification Form on file with the Department in List in Section 2 the specific corresponding

order to perform any of the acts listed in section letter(s) (a-g) from below of any acts you do not

2 on behalf of the taxpayer. authorize the representative(s) listed on this form

to perform on your behalf.

Older versions of this form may not be accepted.

Powers covered include the following, unless

Note: Only persons authorized under Iowa specifically excluded on the line above:

Admin. Code r. 701—7.6 are permitted to a. To request waivers (including offers of

represent the taxpayer(s) in any formal waivers) of restrictions on assessment or

proceeding, such as a contested case hearing. collection of tax deficiencies and waivers of

Only attorneys authorized to practice in a judicial notice of disallowance of a claim for credit or

forum that has jurisdiction of a matter involving a refund

taxpayer may represent that taxpayer in those b. To request extensions of time for assessment

forums. or collection of taxes

Confidential Tax Information c. To represent the taxpayer in any

Taxpayer information is confidential. Unless determination before the Department

otherwise authorized by law, the Iowa d. To represent the taxpayer in an informal

Department of Revenue will discuss confidential meeting or other communication with the

tax information only with the taxpayer or a Department

representative authorized by the taxpayer on this e. To represent the taxpayer in formal

form. If you wish to authorize the Department to proceedings* to the extent permitted by law

discuss your confidential tax information with f. To enter into any compromise with the

another person, but do not wish to authorize that Department

person to act on your behalf, use form IA 8821 g. To execute any release from liability required

Tax Information Disclosure Designation. by the Department before divulging otherwise

Instructions for Specific Fields confidential information concerning

Tax types or other matters taxpayer(s)

These may include individual, corporate, *Only those individuals listed in Iowa

partnership, fiduciary, franchise, inheritance, Administrative Code rule 701—7.6 may

retail sales, retailers or consumers use, represent a taxpayer in a contested case

withholding, fuel, collections, or other matters. If proceeding.

blank, all tax types or matters are included. Revoking an IA 2848

Iowa tax permit number The taxpayer may revoke an IA 2848 at any time

If blank, all permits, including those issued in the by filing a statement of revocation with the

future within the time period identified in this Department. To revoke, submit a written

section, are included. Enter a permit number(s) statement to the Department including the

to limit to a specific permit(s). Noting a following:

consolidated permit will include all permits • Taxpayer or business legal name, and

associated with the consolidated permit number. SSN/ITIN or FEIN

• Name(s) of the representative(s), or note “all”

to revoke all representatives

14-101a (03/09/21)