Enlarge image

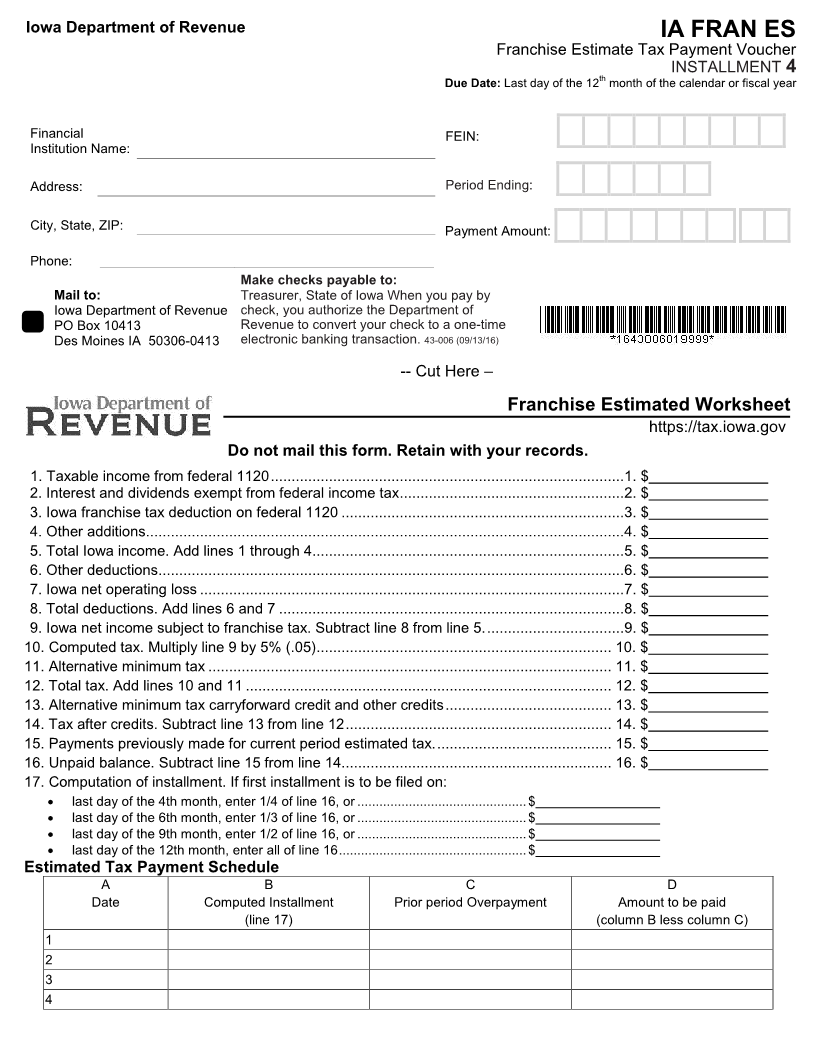

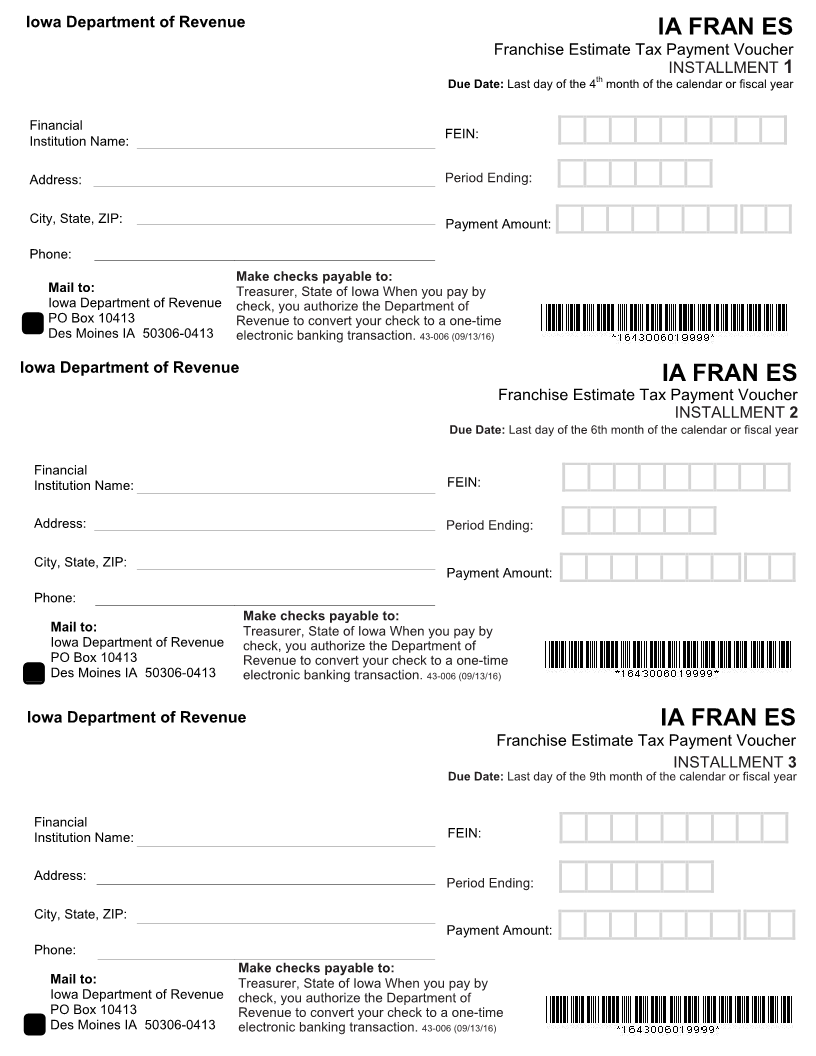

Iowa Department of Revenue IA FRAN ES

Franchise Estimate Tax Payment Voucher

INSTALLMENT 1

th

Due Date: Last day of the 4 month of the calendar or fiscal year

Financial

FEIN:

Institution Name:

Address: Period Ending:

City, State,ZIP: Payment Amount:

Phone:

Make checks payable to:

Mail to: Treasurer, State of IowaWhen you pay by

Iowa Department of Revenue check, you authorize the Department of

PO Box 10413 Revenue to convert your check to a one-time

Des Moines IA 50306-0413 electronic banking transaction. 43-006 (0913/ /16)

Iowa Department of Revenue

IA FRAN ES

Franchise Estimate Tax Payment Voucher

INSTALLMENT 2

Due Date: Last day of the 6th month of the calendar or fiscal year

Financial

Institution Name: FEIN:

Address: Period Ending:

City, State,ZIP:

Payment Amount:

Phone:

Make checks payable to:

Mail to: Treasurer, State of IowaWhen you pay by

Iowa Department of Revenue check, you authorize the Department of

PO Box 10413 Revenue to convert your check to a one-time

Des Moines IA 50306-0413 electronic banking transaction. 43-006 (0 /913 6/1 )

Iowa Department of Revenue IA FRAN ES

Franchise Estimate Tax Payment Voucher

INSTALLMENT 3

Due Date: Last day of the 9th month of the calendar or fiscal year

Financial

Institution Name: FEIN:

Address:

Period Ending:

City, State,ZIP:

Payment Amount:

Phone:

Make checks payable to:

Mail to: Treasurer, State of IowaWhen you pay by

Iowa Department of Revenue check, you authorize the Department of

PO Box 10413 Revenue to convert your check to a one-time

Des Moines IA 50306-0413 electronic banking transaction. 43-006 (0 /913 6/1 )