Enlarge image

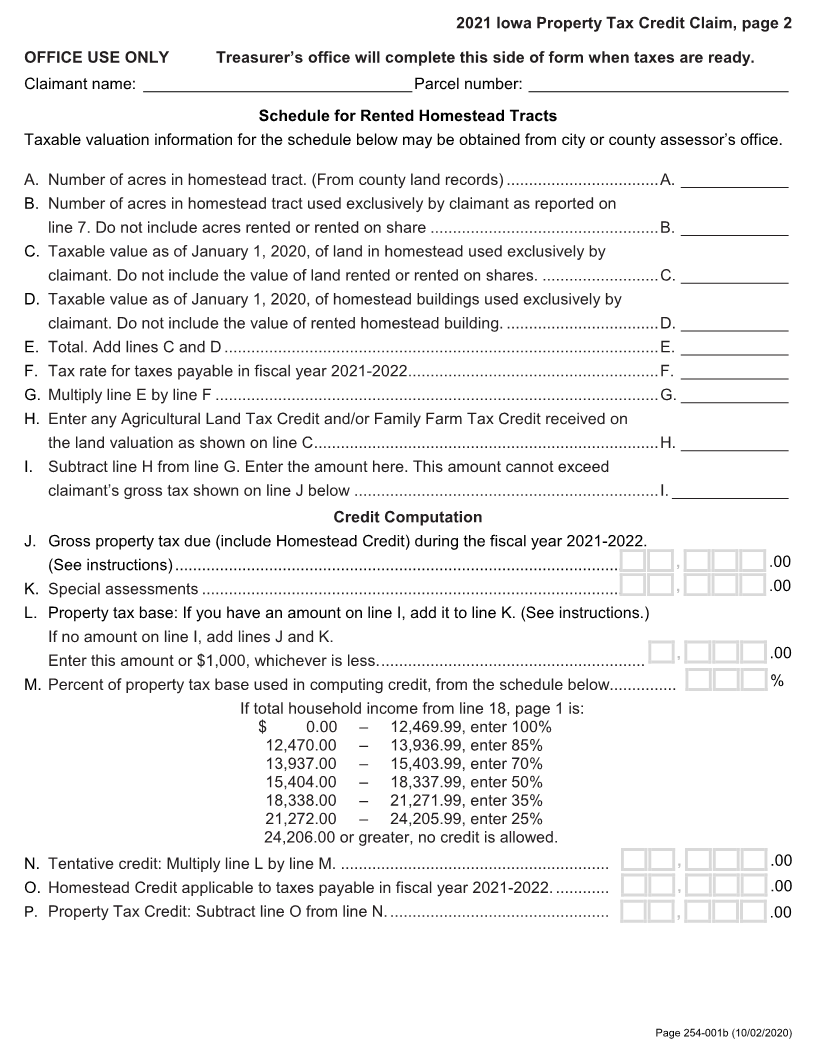

2021 Iowa Property Tax Credit Claim

Iowa Code section 425.16 and Iowa Administrative Code chapter 701--73

Complete the following personal information:

Your name: __________________________________ Spouse name: ________________________________

Your Social Security Number: ____________________ Spouse Social Security Number: __________________

Your birth date (MM/DD/YYYY): __________________ Spouse birth date (MM/DD/YYYY): ________________

Street address: _______________________________ City: ________________________________________

State: __________________ ZIP: _________________ Telephone: ___________________________________

Answer these questions to determine eligibility:

1. Are you currently an Iowa resident? .................................................................................... Yes ☐ No ☐

If “No,” stop. No credit is allowed.

2. Did you file a Property Tax Credit claim in 2020? ............................................................... Yes ☐ No ☐

3a. Were you age 65 or older as of December 31, 2020? ........................................................ Yes ☐ No ☐

3b. Were you totally disabled and age 18 to 64, as of December 31, 2020? See instructions.. Yes ☐ No ☐

4. Were you a resident of a nursing home or care facility during 2020? See instructions ....... Yes ☐ No ☐

If “Yes,” are you renting out your homestead to someone else? ......................................... Yes ☐ No ☐

5a. Is there more than one owner of your homestead? ............................................................. Yes ☐ No ☐

5b. Do any of the owners live elsewhere? ................................................................................ Yes ☐ No ☐

If “Yes,” how many live elsewhere? ....................................................................................

6. Was part of your home rented or used for business purposes during 2020? ...................... Yes ☐ No ☐

If “Yes,” see instructions and enter the percentage here ______ %

7. Was any part of the land in your homestead tract rented during 2020? .............................. Yes ☐ No ☐

If “Yes,” how many acres were used exclusively by you?

2020 Total household income for the entire year (For you and your spouse).

Read instructions before completing. .................................................................. Use whole dollars only

8. Wages, salaries, unemployment compensation, tips, etc. .................................. , .00

9. In-kind assistance for housing expense. ............................................................. , .00

, .00

10. Title 19 benefits (excluding medical benefits). ....................................................

11. Social Security income (include any Medicare premiums withheld). ................... , .00

12. Disability income. ................................................................................................ , .00

13. All pensions and annuities. ................................................................................. , .00

14. Interest and dividend income. ............................................................................. , .00

15. Profit from business and/or farming and capital gain.

If less than zero, enter 0...................................................................................... , .00

16. Money received from others living with you ........................................................ , .00

17. Other income ...................................................................................................... , .00

18. Total household income. Add amounts from lines 8-17. ................................... , .00

If $24,206.00 or greater, stop. No credit is allowed.

I, the undersigned, declare under penalties of perjury or false certificate, that I have examined this claim, and,

to the best of my knowledge and belief, it is true, correct, and complete.

Your signature: ______________________________________________ Date: ______________________

Return this form to your county treasurer on or before June 1, 2021, or, if the treasurer has extended the filing

deadline, on or before September 30, 2021. The Director of Revenue may extend the filing deadline through

December 31, 2022, for good cause. You may be contacted for additional information.

Page 254-001a (10/20/2020)