Enlarge image

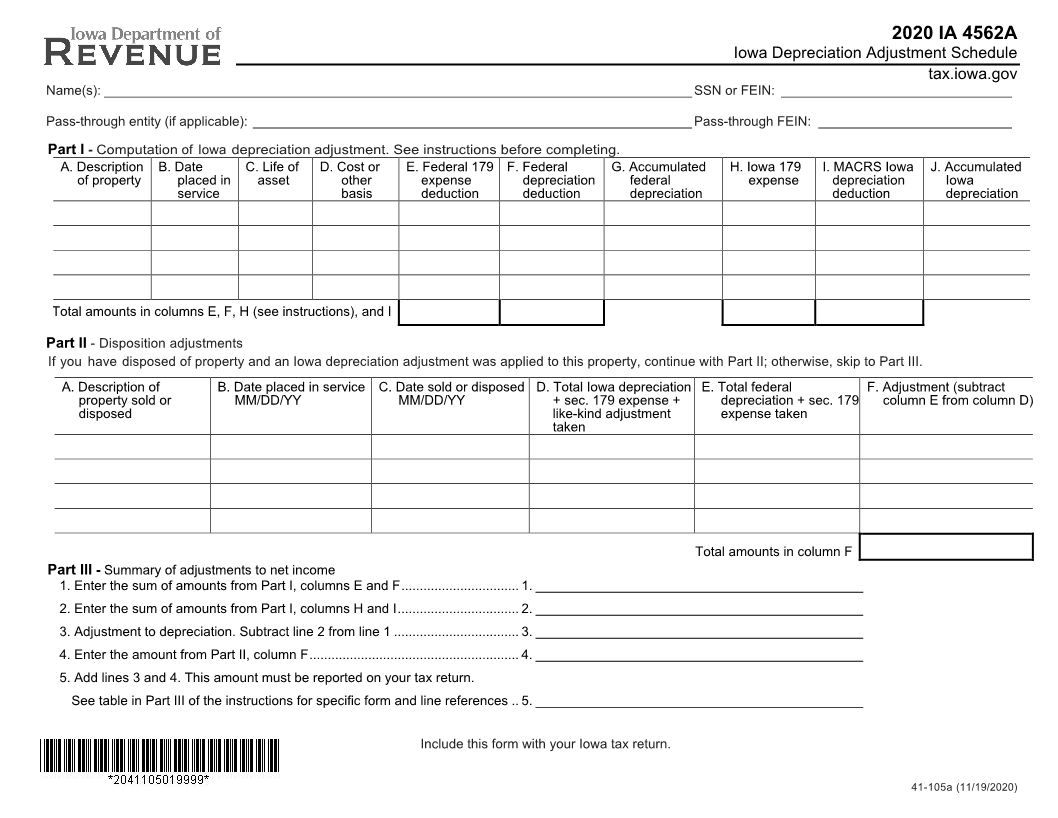

2020 IA 4562A

Iowa Depreciation Adjustment Schedule

tax.iowa.gov

Name(s): _______________________________________________________________________________ SSN or FEIN: _______________________________

Pass-through entity (if applicable): ___________________________________________________________ Pass-through FEIN: __________________________

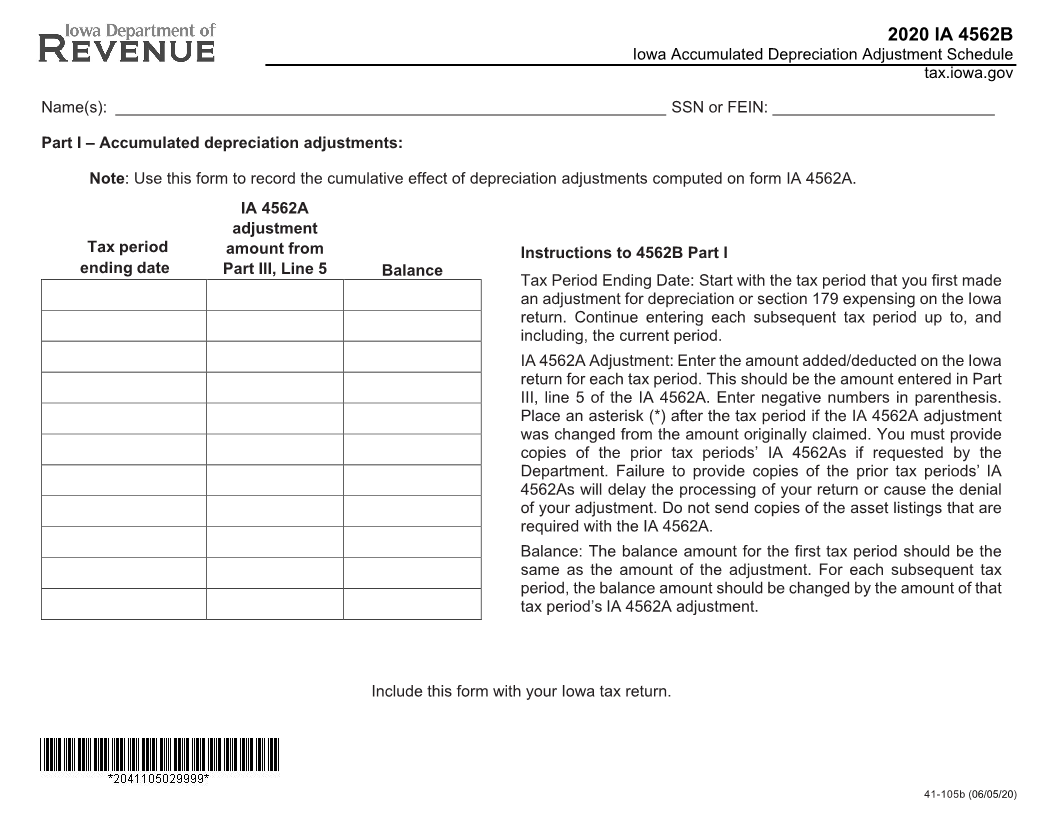

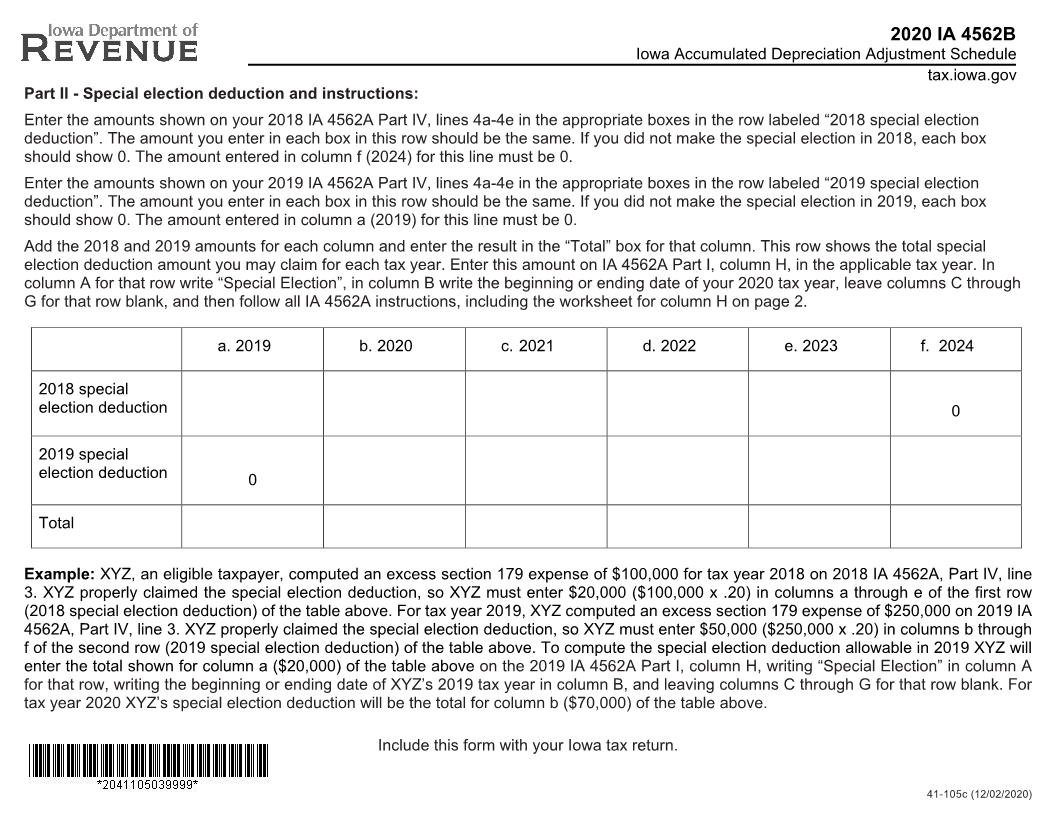

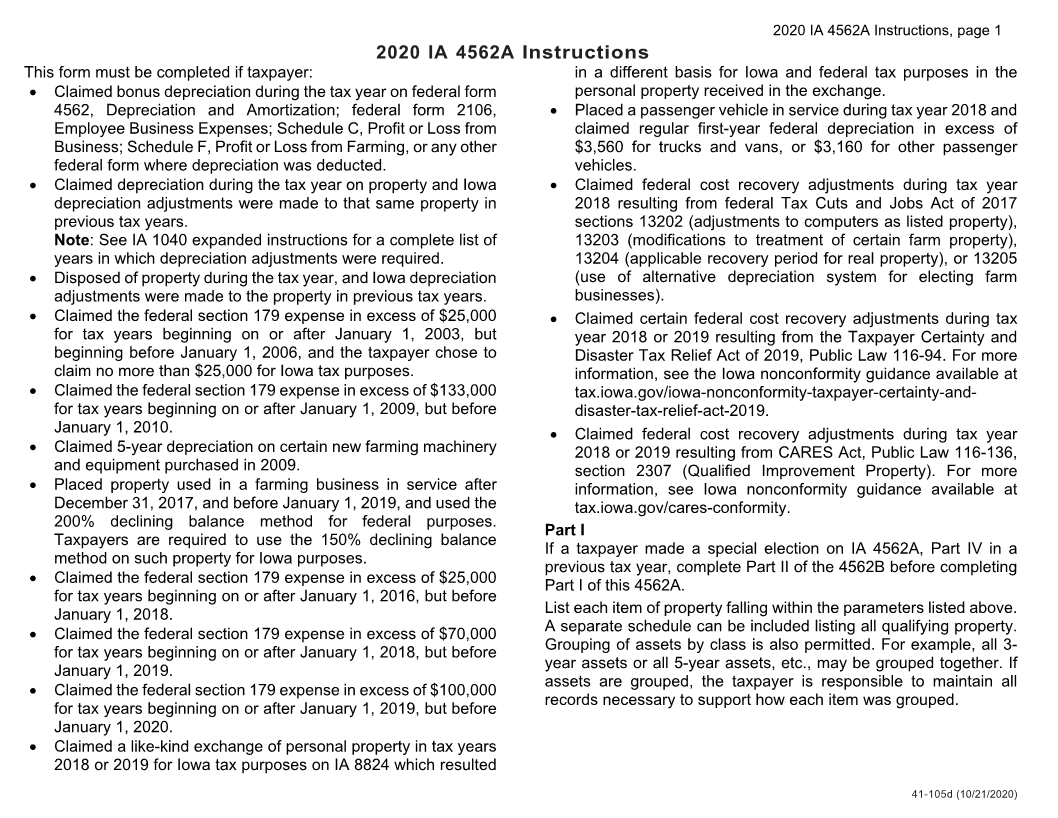

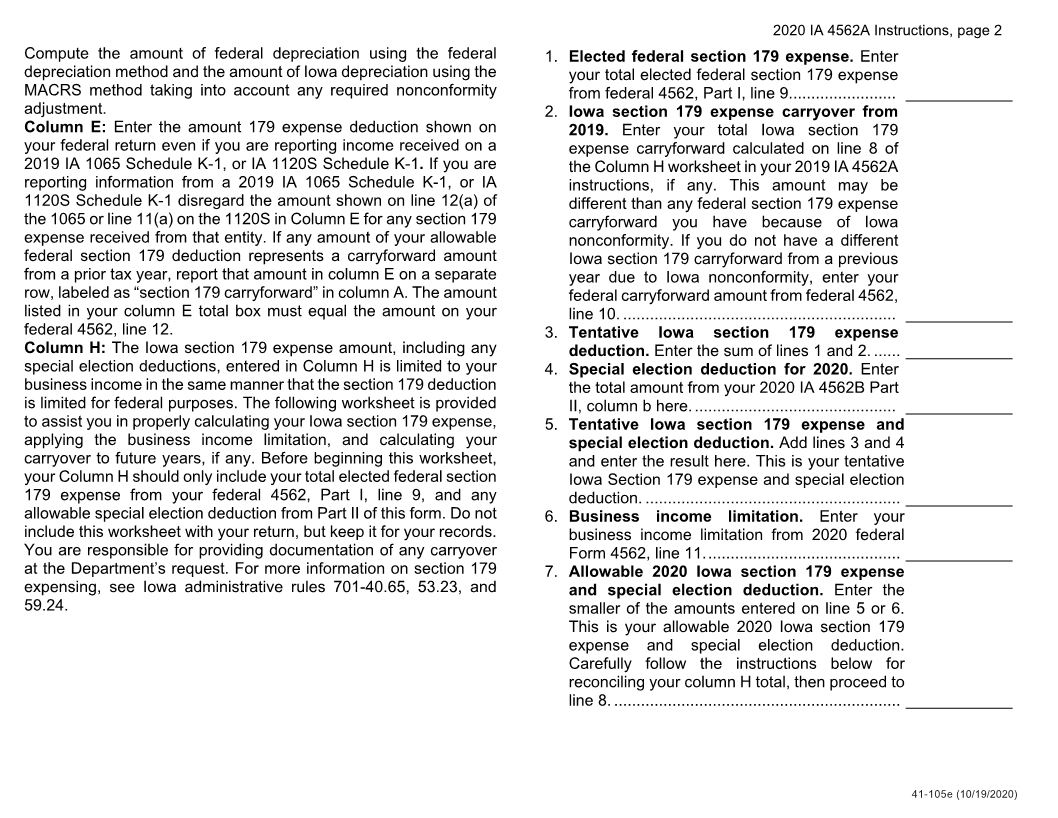

Part I - Computation of Iowa depreciation adjustment. See instructions before completing.

A. Description B. Date C. Life of D. Cost or E. Federal 179 F. Federal G. Accumulated H. Iowa 179 I. MACRS Iowa J. Accumulated

of property placed in asset other expense depreciation federal expense depreciation Iowa

service basis deduction deduction depreciation deduction depreciation

Total amounts in columns E, F, H (see instructions), and I

Part II - Disposition adjustments

If you have disposed of property and an Iowa depreciation adjustment was applied to this property, continue with Part II; otherwise, skip to Part III.

A. Description of B. Date placed in service C. Date sold or disposed D. Total Iowa depreciation E. Total federal F. Adjustment (subtract

property sold or MM/DD/YY MM/DD/YY + sec. 179 expense + depreciation + sec. 179 column E from column D)

disposed like-kind adjustment expense taken

taken

Total amounts in column F

Part III -Summary of adjustments to net income

1. Enter the sum of amounts from Part I, columns E and F ................................ 1. ____________________________________________

2. Enter the sum of amounts from Part I, columns H and I ................................. 2. ____________________________________________

3. Adjustment to depreciation. Subtract line 2 from line 1 .................................. 3. ____________________________________________

4. Enter the amount from Part II, column F ......................................................... 4. ____________________________________________

5. Add lines 3 and 4. This amount must be reported on your tax return.

See table in Part III of the instructions for specific form and line references .. 5. ____________________________________________

Include this form with your Iowa tax return.

41-105a (11/19/2020)