Enlarge image

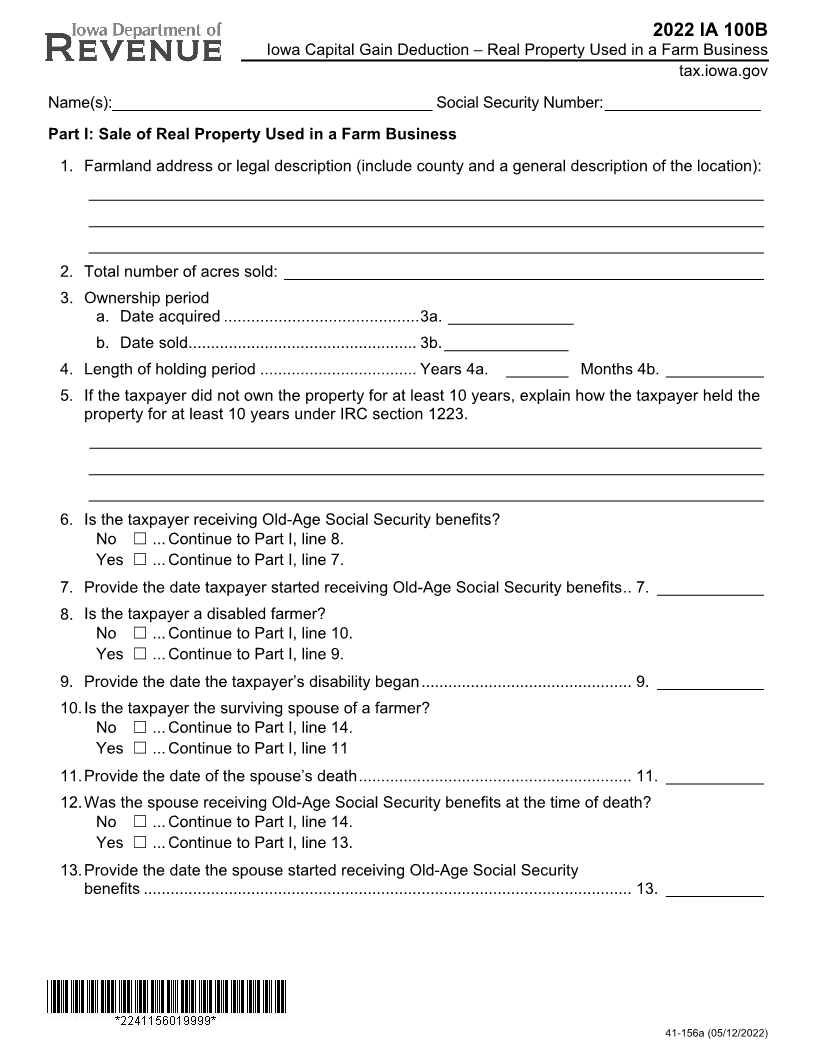

2022 IA 100B

Iowa Capital Gain Deduction – Real Property Used in a Farm Business

tax.iowa.gov

Name(s): _____________________________________ Social Security Number: __________________

Part I: Sale of Real Property Used in a Farm Business

1. Farmland address or legal description (include county and a general description of the location):

____________________________________________________________________________

____________________________________________________________________________

____________________________________________________________________________

2. Total number of acres sold: ______________________________________________________

3. Ownership period

a. Date acquired ........................................... 3a. ______________

b. Date sold ................................................... 3b. ______________

4. Length of holding period ................................... Years 4a. _______ Months 4b. ___________

5. If the taxpayer did not own the property for at least 10 years, explain how the taxpayer held the

property for at least 10 years under IRC section 1223.

___________________________________________________________________________

____________________________________________________________________________

____________________________________________________________________________

6. Is the taxpayer receiving Old-Age Social Security benefits?

No ☐ ... Continue to Part I, line 8.

Yes ☐... Continue to Part I, line 7.

7. Provide the date taxpayer started receiving Old-Age Social Security benefits .. 7. ____________

8. Is the taxpayer a disabled farmer?

No ☐ ... Continue to Part I, line 10.

Yes ☐... Continue to Part I, line 9.

9. Provide the date the taxpayer’s disability began ............................................... 9. ____________

10. Is the taxpayer the surviving spouse of a farmer?

No ☐ ... Continue to Part I, line 14.

Yes ☐... Continue to Part I, line 11

11. Provide the date of the spouse’s death ............................................................. 11. ___________

12. Was the spouse receiving Old-Age Social Security benefits at the time of death?

No ☐ ... Continue to Part I, line 14.

Yes ☐... Continue to Part I, line 13.

13. Provide the date the spouse started receiving Old-Age Social Security

benefits ............................................................................................................. 13. ___________

41-156a (05/12/2022)