Enlarge image

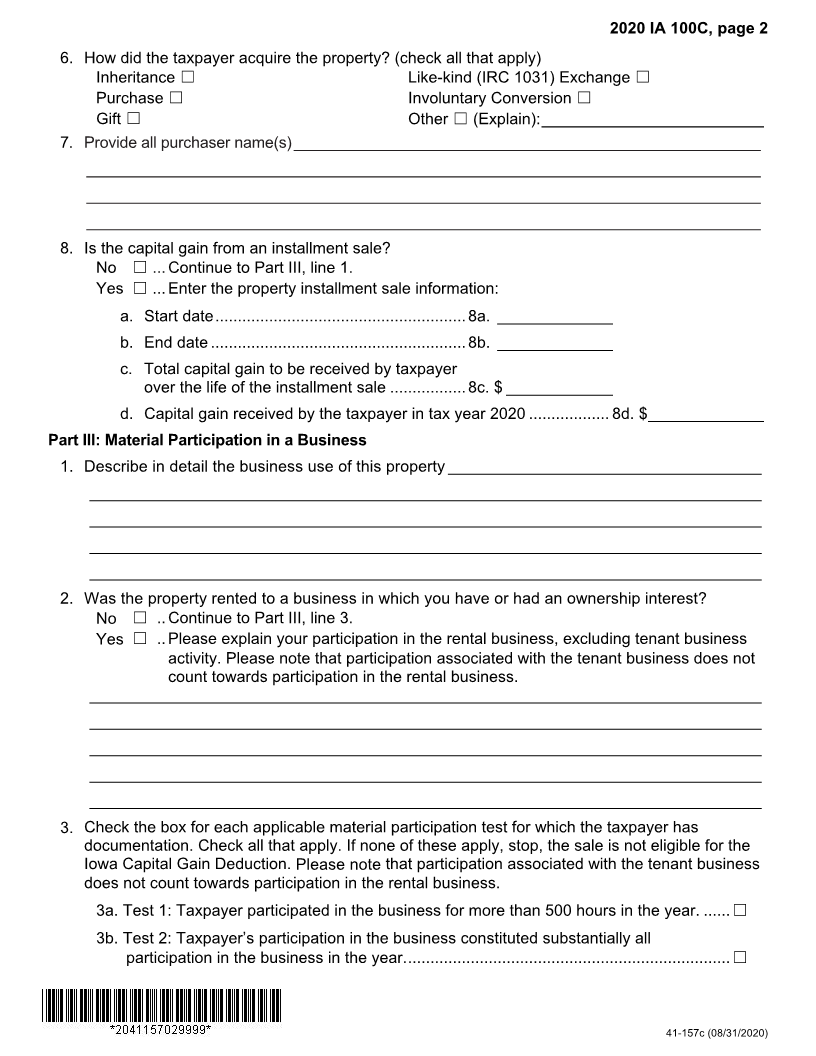

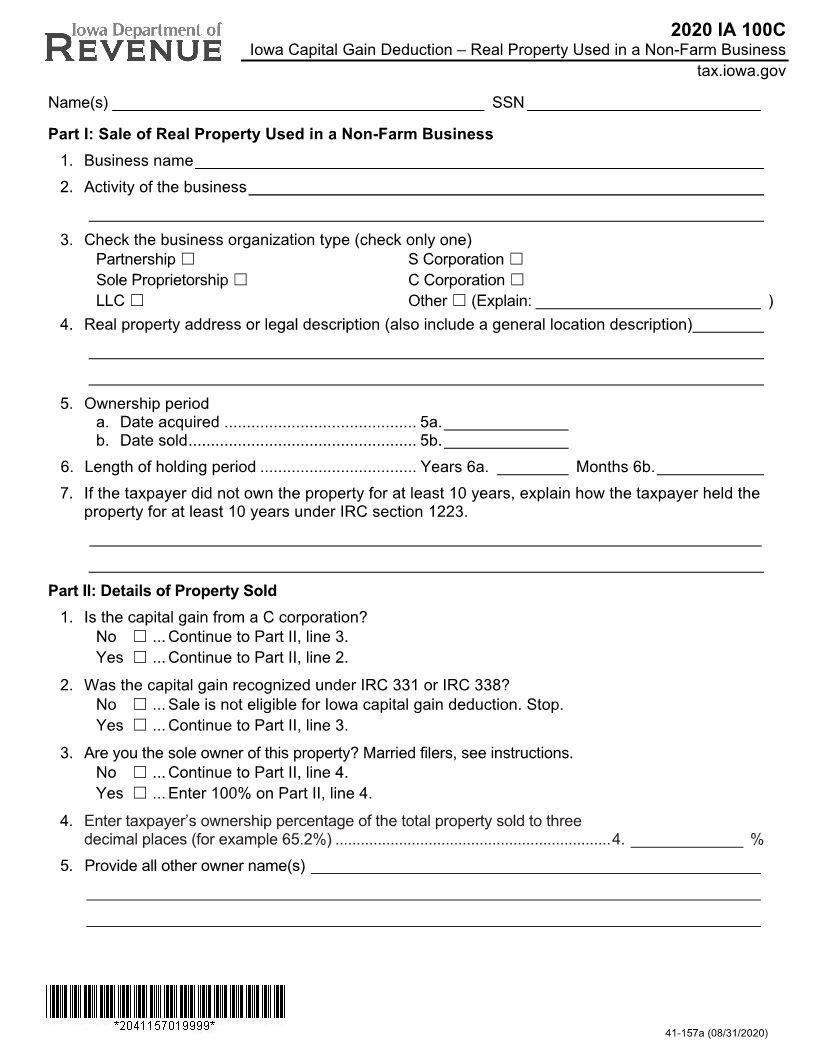

2020 IA 100C

Iowa Capital Gain Deduction – Real Property Used in a Non-Farm Business

tax.iowa.gov

Name(s) ___________________________________________ SSN ___________________________

Part I: Sale of Real Property Used in a Non-Farm Business

1. Business name ________________________________________________________________

2. Activity of the business __________________________________________________________

____________________________________________________________________________

3. Check the business organization type (check only one)

Partnership ☐ S Corporation ☐

Sole Proprietorship ☐ C Corporation ☐

LLC ☐ Other ☐(Explain: __________________________ )

4. Real property address or legal description (also include a general location description) ________

____________________________________________________________________________

____________________________________________________________________________

5. Ownership period

a. Date acquired ........................................... 5a. ______________

b. Date sold ................................................... 5b. ______________

6. Length of holding period ................................... Years 6a. ________ Months 6b. ____________

7. If the taxpayer did not own the property for at least 10 years, explain how the taxpayer held the

property for at least 10 years under IRC section 1223.

___________________________________________________________________________

____________________________________________________________________________

Part II: Details of Property Sold

1. Is the capital gain from a C corporation?

No ☐ ... Continue to Part II, line 3.

Yes ☐... Continue to Part II, line 2.

2. Was the capital gain recognized under IRC 331 or IRC 338?

No ☐ ... Sale is not eligible for Iowa capital gain deduction. Stop.

Yes ☐... Continue to Part II, line 3.

3. Are you the sole owner of this property? Married filers, see instructions.

No ☐ ... Continue to Part II, line 4.

Yes ☐... Enter 100% on Part II, line 4.

4. Enter taxpayer’s ownership percentage of the total property sold to three

decimal places (for example 65.2%) ................................................................. 4. _____________ %

5. Provide all other owner name(s) ____________________________________________________

______________________________________________________________________________

______________________________________________________________________________

41-157a (08/31/2020)