Enlarge image

2021 Iowa Mobile/Manufactured/Modular Home Owner

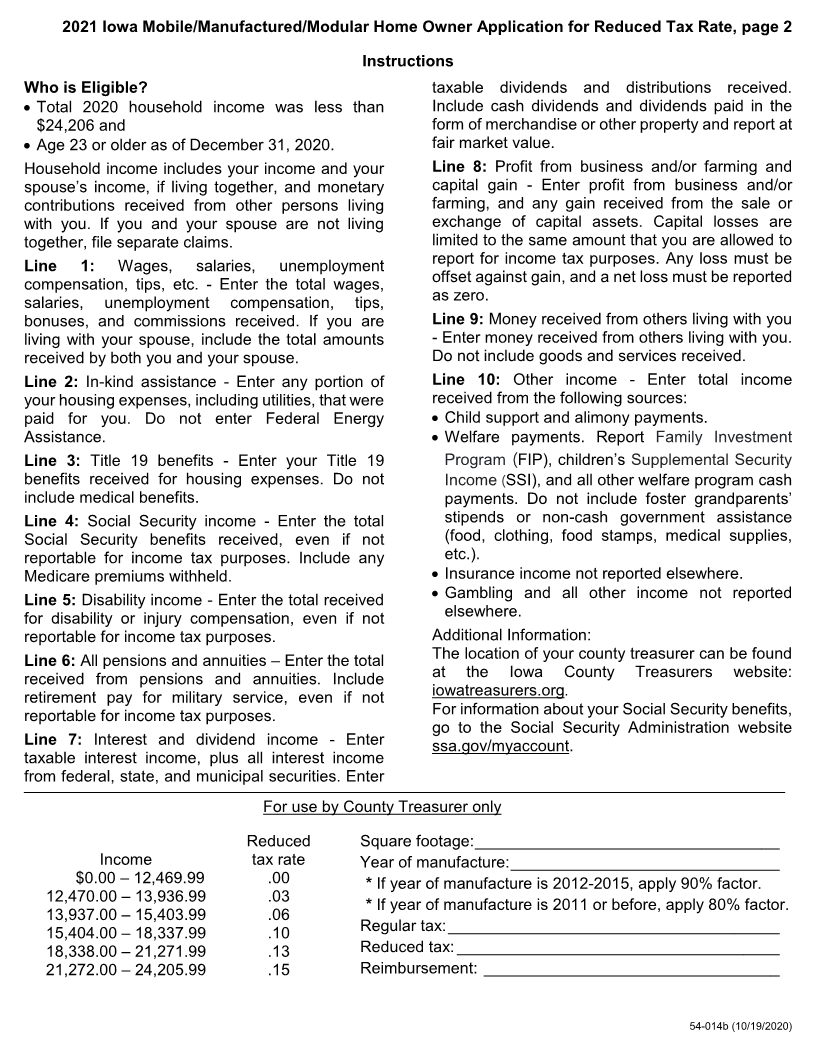

Application for Reduced Tax Rate

Iowa Code section 435.22 and Iowa Administrative Code chapter 701--74

Complete the following personal information:

Your name: ______________________________ Spouse name: ___________________________

Your Social Security Number: _______________ Spouse Social Security Number: _____________

Your birth date (MM/DD/YYYY): ______________ Spouse birth date (MM/DD/YYYY): ___________

Street address: ___________________________ City: ___________________________________

State: ________________ ZIP: ______________ Telephone: ______________________________

Were you age 23 or older as of December 31, 2020? ................................................................ Yes ☐ No ☐

If “No,” stop. No credit is allowed.

2020 Total household income for the entire year (For you and your

spouse). Read instructions before completing.

Use whole dollars only

1. Wages, salaries, unemployment compensation, tips, etc. .................................. , .00

2. In-kind assistance for housing expenses ............................................................ , .00

3. Title 19 benefits (excluding medical benefits) ..................................................... , .00

4. Social Security income ....................................................................................... , .00

5. Disability income ................................................................................................ , .00

6. All pensions and annuities .................................................................................. , .00

7. Interest and dividend income ............................................................................. , .00

8. Profits from businesses and/or farming and capital gain .................................... , .00

If less than zero, enter 0.

9. Money received from others living with you ........................................................ , .00

10. Other income .................................................................................................... , .00

11. Total household income. Add amounts from lines 1-10 .................................... , .00

(If $24,206 or greater, stop. No credit is allowed.)

I, the undersigned, declare under penalties of perjury or false certificate, that I have examined this claim, and,

to the best of my knowledge and belief, it is true, correct, and complete.

Your signature: _________________________________________ Date: _________________________

This claim must be filed or mailed to your county treasurer on or before June 1, 2021. The treasurer may

extend the filing deadline to September 30, 2021. The Director of Revenue may extend the filing deadline

through December 31, 2021.

54-014a (10/20/2020)