- 3 -

Enlarge image

|

2020 IA 100A, page 3

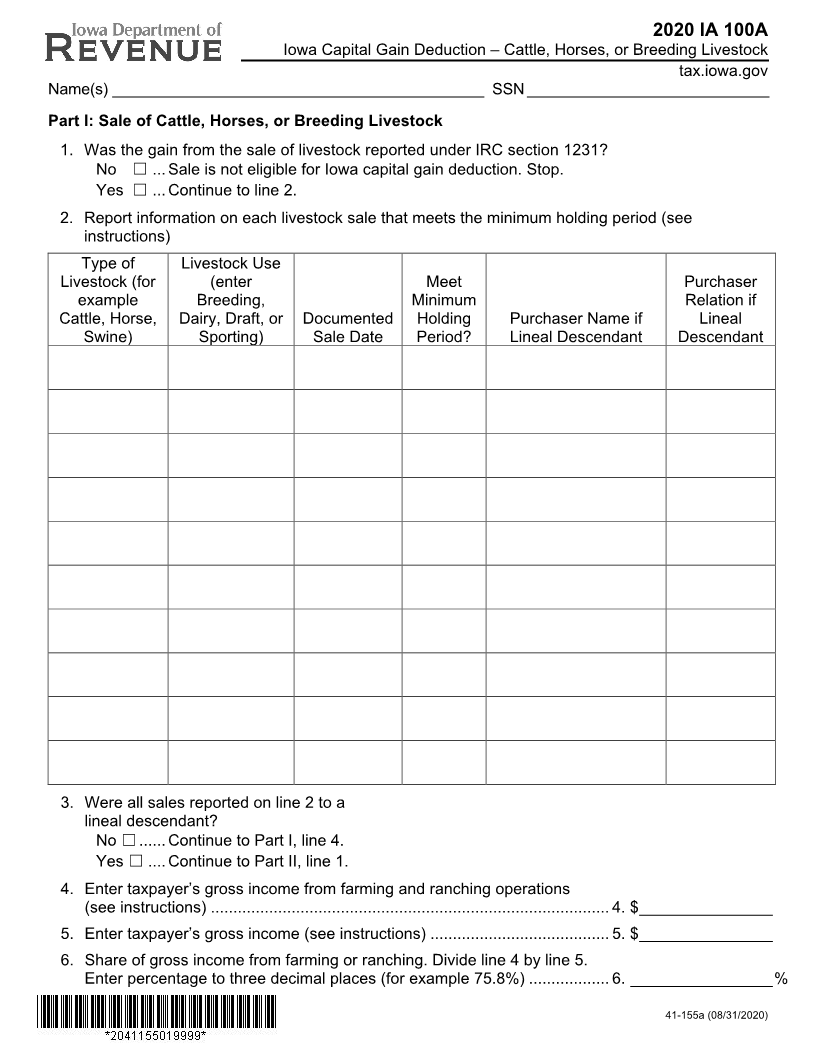

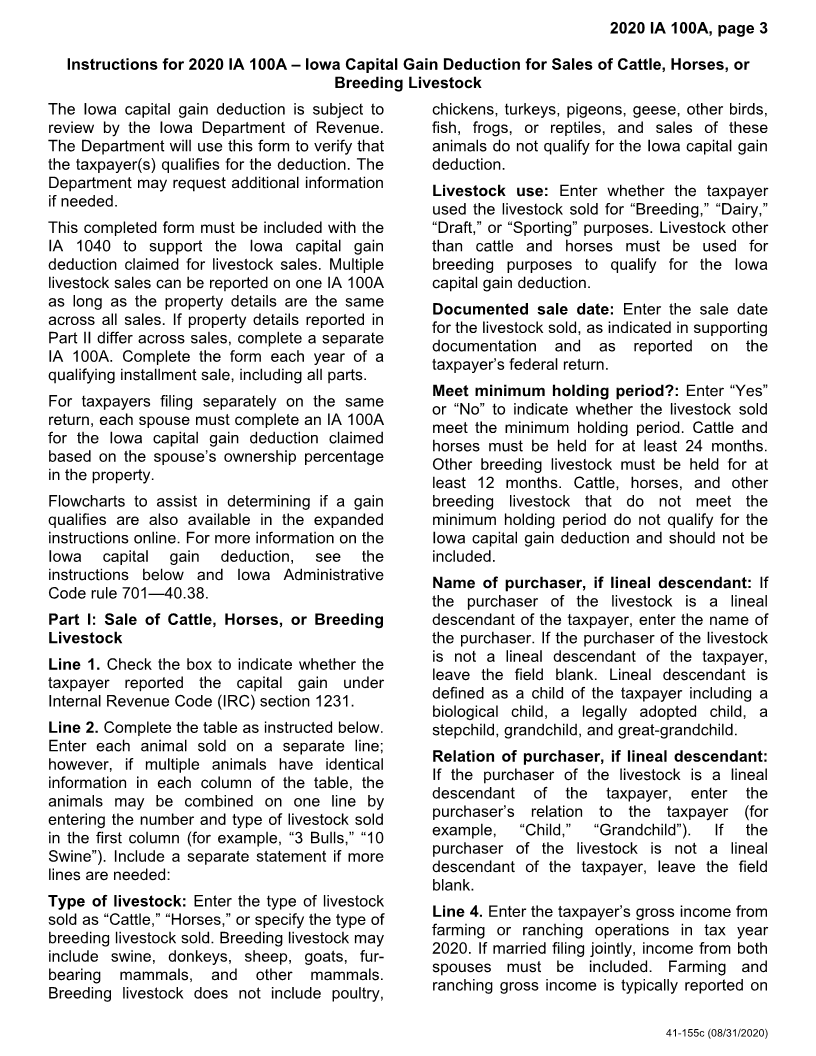

Instructions for 2020 IA 100A – Iowa Capital Gain Deduction for Sales of Cattle, Horses, or

Breeding Livestock

The Iowa capital gain deduction is subject to chickens, turkeys, pigeons, geese, other birds,

review by the Iowa Department of Revenue. fish, frogs, or reptiles, and sales of these

The Department will use this form to verify that animals do not qualify for the Iowa capital gain

the taxpayer(s) qualifies for the deduction. The deduction.

Department may request additional information

Livestock use: Enter whether the taxpayer

if needed.

used the livestock sold for “Breeding,” “Dairy,”

This completed form must be included with the “Draft,” or “Sporting” purposes. Livestock other

IA 1040 to support the Iowa capital gain than cattle and horses must be used for

deduction claimed for livestock sales. Multiple breeding purposes to qualify for the Iowa

livestock sales can be reported on one IA 100A capital gain deduction.

as long as the property details are the same

Documented sale date: Enter the sale date

across all sales. If property details reported in

for the livestock sold, as indicated in supporting

Part II differ across sales, complete a separate

documentation and as reported on the

IA 100A. Complete the form each year of a

taxpayer’s federal return.

qualifying installment sale, including all parts.

Meet minimum holding period?: Enter “Yes”

For taxpayers filing separately on the same

or “No” to indicate whether the livestock sold

return, each spouse must complete an IA 100A

meet the minimum holding period. Cattle and

for the Iowa capital gain deduction claimed

horses must be held for at least 24 months.

based on the spouse’s ownership percentage

Other breeding livestock must be held for at

in the property.

least 12 months. Cattle, horses, and other

Flowcharts to assist in determining if a gain breeding livestock that do not meet the

qualifies are also available in the expanded minimum holding period do not qualify for the

instructions online. For more information on the Iowa capital gain deduction and should not be

Iowa capital gain deduction, see the included.

instructions below and Iowa Administrative

Name of purchaser, if lineal descendant: If

Code rule 701—40.38.

the purchaser of the livestock is a lineal

Part I: Sale of Cattle, Horses, or Breeding descendant of the taxpayer, enter the name of

Livestock the purchaser. If the purchaser of the livestock

is not a lineal descendant of the taxpayer,

Line 1. Check the box to indicate whether the

leave the field blank. Lineal descendant is

taxpayer reported the capital gain under

defined as a child of the taxpayer including a

Internal Revenue Code (IRC) section 1231.

biological child, a legally adopted child, a

Line 2. Complete the table as instructed below. stepchild, grandchild, and great-grandchild.

Enter each animal sold on a separate line;

Relation of purchaser, if lineal descendant:

however, if multiple animals have identical

If the purchaser of the livestock is a lineal

information in each column of the table, the

descendant of the taxpayer, enter the

animals may be combined on one line by

purchaser’s relation to the taxpayer (for

entering the number and type of livestock sold

example, “Child,” “Grandchild”). If the

in the first column (for example, “3 Bulls,” “10

purchaser of the livestock is not a lineal

Swine”). Include a separate statement if more

descendant of the taxpayer, leave the field

lines are needed:

blank.

Type of livestock: Enter the type of livestock

Line 4. Enter the taxpayer’s gross income from

sold as “Cattle,” “Horses,” or specify the type of

farming or ranching operations in tax year

breeding livestock sold. Breeding livestock may

2020. If married filing jointly, income from both

include swine, donkeys, sheep, goats, fur-

spouses must be included. Farming and

bearing mammals, and other mammals.

ranching gross income is typically reported on

Breeding livestock does not include poultry,

41-155c (08/31/2020)

|