Enlarge image

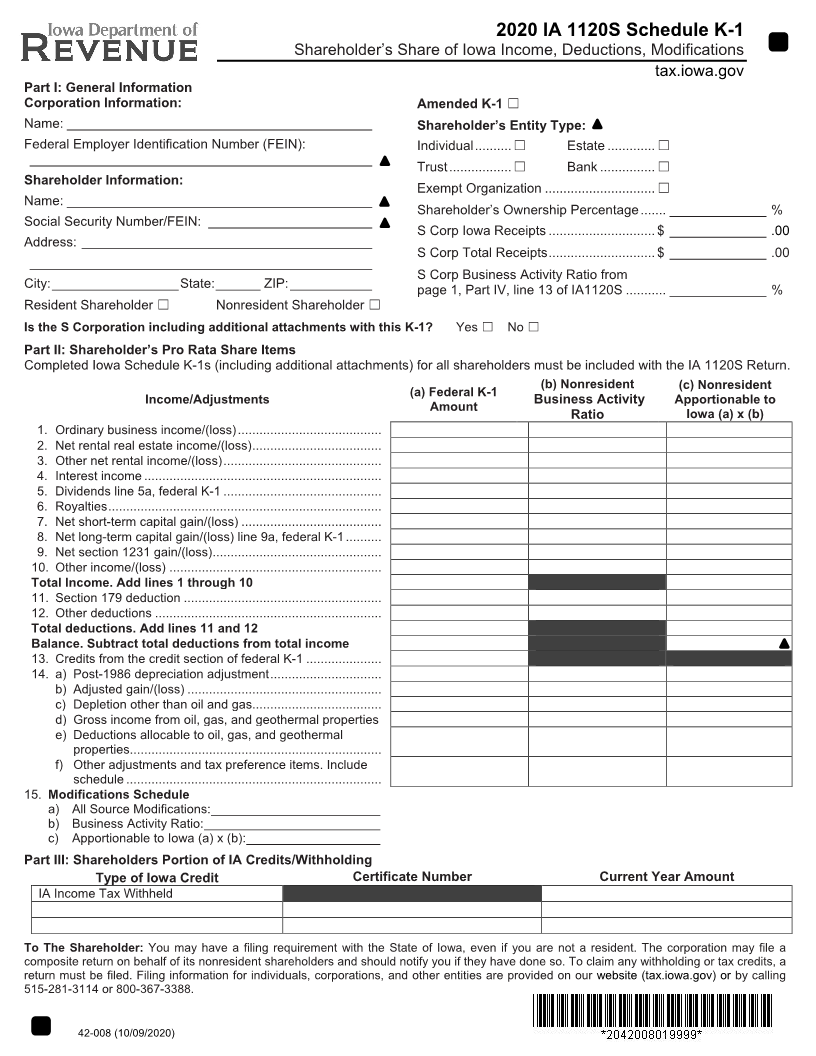

2020 IA 1120S Schedule K-1

Shareholder’s Share of Iowa Income, Deductions, Modifications

tax.iowa.gov

Part I: General Information

Corporation Information: Amended K-1 ☐

Name: _________________________________________ Shareholder’s Entity Type:

Federal Employer Identification Number (FEIN): Individual .......... ☐ Estate ............. ☐

______________________________________________ ☐ Bank ............... ☐

Trust .................

Shareholder Information: ☐

Exempt Organization ..............................

Name: _________________________________________

Shareholder’s Ownership Percentage ....... _____________ %

Social Security Number/FEIN: ______________________

S Corp Iowa Receipts ............................. $ _____________ .00

Address: _______________________________________

S Corp Total Receipts ............................. $ _____________ .00

______________________________________________

S Corp Business Activity Ratio from

City: _________________ State: ______ ZIP: ___________ page 1, Part IV, line 13 of IA1120S ........... _____________ %

Resident Shareholder ☐ Nonresident Shareholder ☐

Is the S Corporation including additional attachments with this K-1? Yes ☐ No ☐

Part II: Shareholder’s Pro Rata Share Items

Completed Iowa Schedule K-1s (including additional attachments) for all shareholders must be included with the IA 1120S Return.

(b) Nonresident (c) Nonresident

(a) Federal K-1

Income/Adjustments Business Activity Apportionable to

Amount

Ratio Iowa (a) x (b)

1. Ordinary business income/(loss) ........................................

2. Net rental real estate income/(loss) ....................................

3. Other net rental income/(loss) ............................................

4. Interest income ..................................................................

5. Dividends line 5a, federal K-1 ............................................

6. Royalties ............................................................................

7. Net short-term capital gain/(loss) .......................................

8. Net long-term capital gain/(loss) line 9a, federal K-1 ..........

9. Net section 1231 gain/(loss) ...............................................

10. Other income/(loss) ...........................................................

Total Income. Add lines 1 through 10

11. Section 179 deduction .......................................................

12. Other deductions ...............................................................

Total deductions. Add lines 11 and 12

Balance. Subtract total deductions from total income

13. Credits from the credit section of federal K-1 .....................

14. a) Post-1986 depreciation adjustment ...............................

b) Adjusted gain/(loss) ......................................................

c) Depletion other than oil and gas....................................

d) Gross income from oil, gas, and geothermal properties

e) Deductions allocable to oil, gas, and geothermal

properties ......................................................................

f) Other adjustments and tax preference items. Include

schedule .......................................................................

15. Modifications Schedule

a) All Source Modifications: ________________________

b) Business Activity Ratio: _________________________

c) Apportionable to Iowa (a) x (b): ___________________

Part III: Shareholders Portion of IA Credits/Withholding

Type of Iowa Credit Certificate Number Current Year Amount

IA Income Tax Withheld

To The Shareholder: You may have a filing requirement with the State of Iowa, even if you are not a resident. The corporation may file a

composite return on behalf of its nonresident shareholders and should notify you if they have done so. To claim any withholding or tax credits, a

return must be filed. Filing information for individuals, corporations, and other entities are provided on our website (tax.iowa.gov) or by calling

515-281-3114 or 800-367-3388.

42-008 (10/09/2020)