Enlarge image

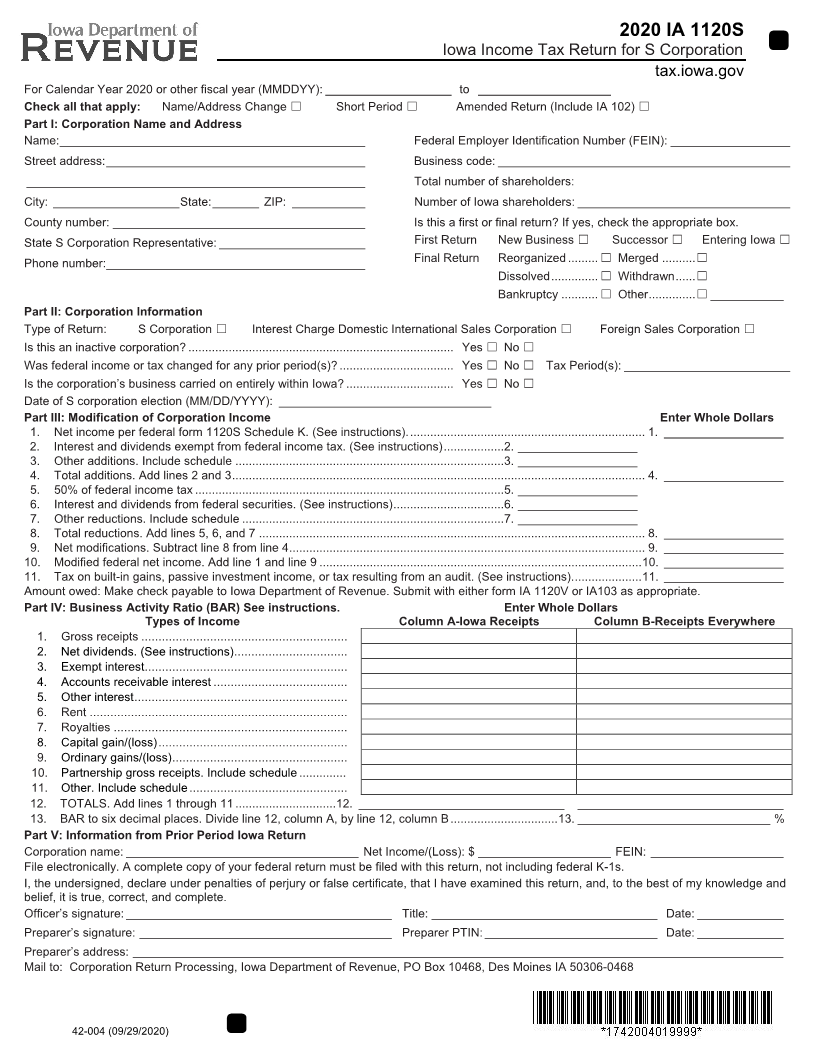

2020 IA 1120S

Iowa Income Tax Return for S Corporation

tax.iowa.gov

For Calendar Year 2020 or other fiscal year (MMDDYY): ___________________ to ____________________

Check all that apply: Name/Address Change ☐ Short Period ☐ Amended Return (Include IA 102) ☐

Part I: Corporation Name and Address

Name: ______________________________________________ Federal Employer Identification Number (FEIN): __________________

Street address: _______________________________________ Business code: ____________________________________________

___________________________________________________ Total number of shareholders:

City: ___________________ State: _______ ZIP: ___________ Number of Iowa shareholders: ________________________________

County number: ______________________________________ Is this a first or final return? If yes, check the appropriate box.

State S Corporation Representative: ______________________ First Return New Business ☐ Successor ☐ Entering Iowa ☐

Phone number: _______________________________________ Final Return Reorganized ......... ☐ Merged .......... ☐

Dissolved .............. ☐ Withdrawn ...... ☐

Bankruptcy ........... ☐ Other .............. ☐___________

Part II: Corporation Information

Type of Return: S Corporation ☐ Interest Charge Domestic International Sales Corporation ☐ Foreign Sales Corporation ☐

Is this an inactive corporation? ............................................................................... Yes ☐ No ☐

Was federal income or tax changed for any prior period(s)? .................................. Yes ☐ No ☐ Tax Period(s): _________________________

Is the corporation’s business carried on entirely within Iowa? ................................ Yes ☐ No ☐

Date of S corporation election (MM/DD/YYYY): ________________________________

Part III: Modification of Corporation Income Enter Whole Dollars

1. Net income per federal form 1120S Schedule K. (See instructions). ...................................................................... 1. __________________

2. Interest and dividends exempt from federal income tax. (See instructions) ..................2. __________________

3. Other additions. Include schedule ................................................................................3. __________________

4. Total additions. Add lines 2 and 3 ........................................................................................................................... 4. __________________

5. 50% of federal income tax ............................................................................................5. __________________

6. Interest and dividends from federal securities. (See instructions) .................................6. __________________

7. Other reductions. Include schedule ..............................................................................7. __________________

8. Total reductions. Add lines 5, 6, and 7 ................................................................................................................... 8. __________________

9. Net modifications. Subtract line 8 from line 4 .......................................................................................................... 9. __________________

10. Modified federal net income. Add line 1 and line 9 ................................................................................................ 10. __________________

11. Tax on built-in gains, passive investment income, or tax resulting from an audit. (See instructions). .................... 11. __________________

Amount owed: Make check payable to Iowa Department of Revenue. Submit with either form IA 1120V or IA103 as appropriate.

Part IV: Business Activity Ratio (BAR) See instructions. Enter Whole Dollars

Types of Income Column A-Iowa Receipts Column B-Receipts Everywhere

1. Gross receipts ............................................................

2. Net dividends. (See instructions) .................................

3. Exempt interest ...........................................................

4. Accounts receivable interest .......................................

5. Other interest ..............................................................

6. Rent ...........................................................................

7. Royalties ....................................................................

8. Capital gain/(loss) .......................................................

9. Ordinary gains/(loss) ...................................................

10. Partnership gross receipts. Include schedule ..............

11. Other. Include schedule ..............................................

12. TOTALS. Add lines 1 through 11 ..............................12. _______________________________ _______________________________

13. BAR to six decimal places. Divide line 12, column A, by line 12, column B ................................ 13. _____________________________ %

Part V: Information from Prior Period Iowa Return

Corporation name: ___________________________________ Net Income/(Loss): $ ____________________ FEIN: ____________________

File electronically. A complete copy of your federal return must be filed with this return, not including federal K-1s.

I, the undersigned, declare under penalties of perjury or false certificate, that I have examined this return, and, to the best of my knowledge and

belief, it is true, correct, and complete.

Officer’s signature: ________________________________________ Title: __________________________________ Date: _____________

Preparer’s signature: ______________________________________ Preparer PTIN: __________________________ Date: _____________

Preparer’s address: __________________________________________________________________________________________________

Mail to: Corporation Return Processing, Iowa Department of Revenue, PO Box 10468, Des Moines IA 50306-0468

42-004 (09/29/2020)