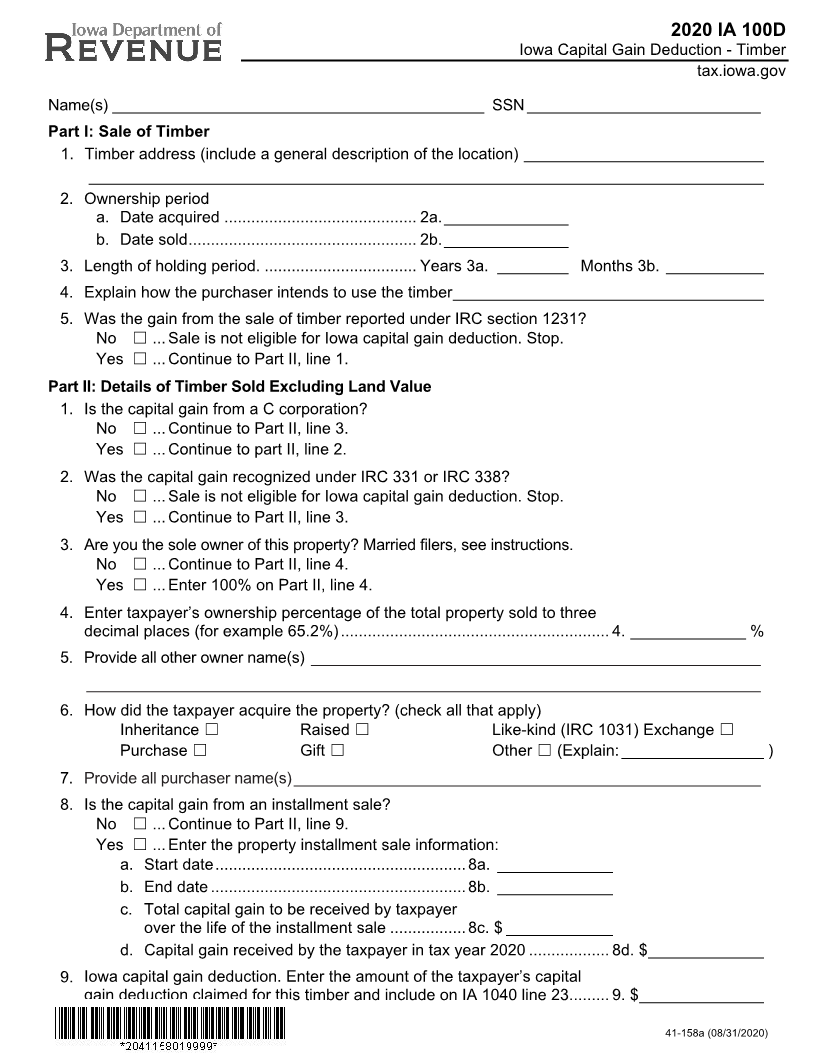

Enlarge image

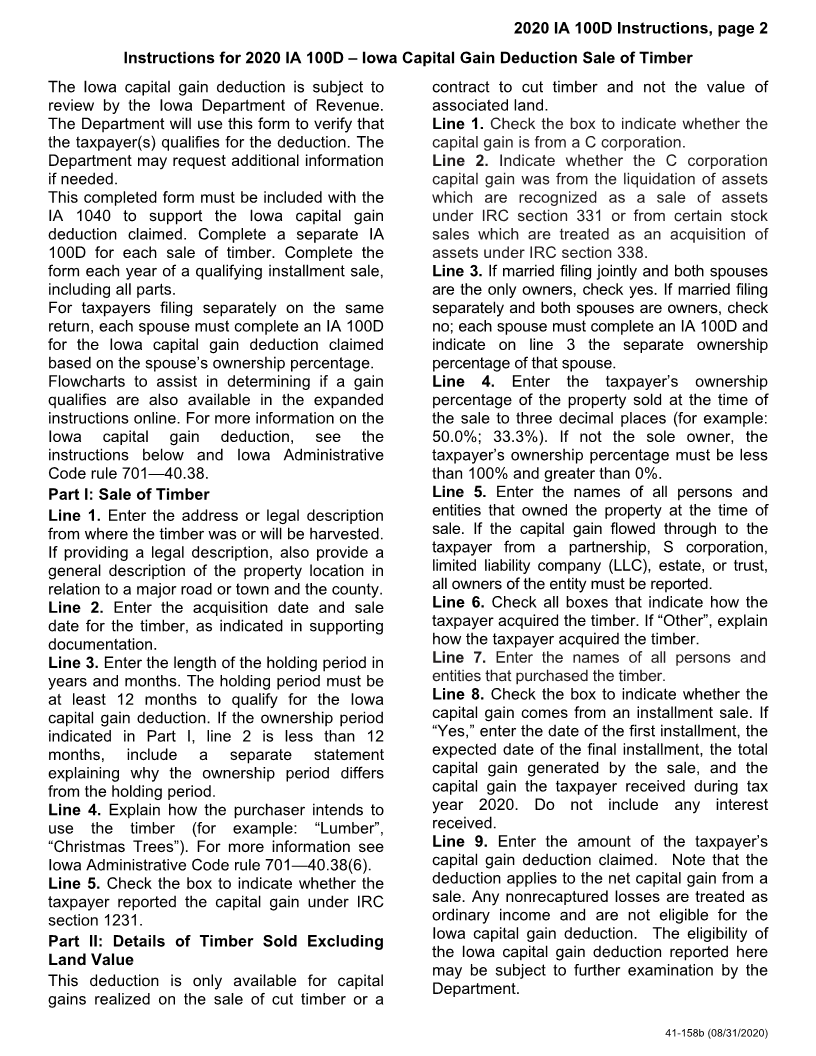

2020 IA 100D

Iowa Capital Gain Deduction - Timber

tax.iowa.gov

Name(s) ___________________________________________ SSN ___________________________

Part I: Sale of Timber

1. Timber address (include a general description of the location) ___________________________

____________________________________________________________________________

2. Ownership period

a. Date acquired ........................................... 2a. ______________

b. Date sold ................................................... 2b. ______________

3. Length of holding period. .................................. Years 3a. ________ Months 3b. ___________

4. Explain how the purchaser intends to use the timber ___________________________________

5. Was the gain from the sale of timber reported under IRC section 1231?

No ☐ ... Sale is not eligible for Iowa capital gain deduction. Stop.

Yes ☐... Continue to Part II, line 1.

Part II: Details of Timber Sold Excluding Land Value

1. Is the capital gain from a C corporation?

No ☐ ... Continue to Part II, line 3.

Yes ☐... Continue to part II, line 2.

2. Was the capital gain recognized under IRC 331 or IRC 338?

No ☐ ... Sale is not eligible for Iowa capital gain deduction. Stop.

Yes ☐... Continue to Part II, line 3.

3. Are you the sole owner of this property? Married filers, see instructions.

No ☐ ... Continue to Part II, line 4.

Yes ☐... Enter 100% on Part II, line 4.

4. Enter taxpayer’s ownership percentage of the total property sold to three

decimal places (for example 65.2%) ............................................................ 4. _____________ %

5. Provide all other owner name(s) ____________________________________________________

______________________________________________________________________________

6. How did the taxpayer acquire the property? (check all that apply)

Inheritance ☐ Raised ☐ Like-kind (IRC 1031) Exchange ☐

Purchase ☐ Gift ☐ Other ☐(Explain: ________________ )

7. Provide all purchaser name(s) ______________________________________________________

8. Is the capital gain from an installment sale?

No ☐ ... Continue to Part II, line 9.

Yes ☐... Enter the property installment sale information:

a. Start date ........................................................ 8a. _____________

b. End date ......................................................... 8b. _____________

c. Total capital gain to be received by taxpayer

over the life of the installment sale ................. 8c. $ ____________

d. Capital gain received by the taxpayer in tax year 2020 .................. 8d. $ _____________

9. Iowa capital gain deduction. Enter the amount of the taxpayer’s capital

gain deduction claimed for this timber and include on IA 1040 line 23. ........ 9. $ ______________

41-158a (08/31/2020)