Enlarge image

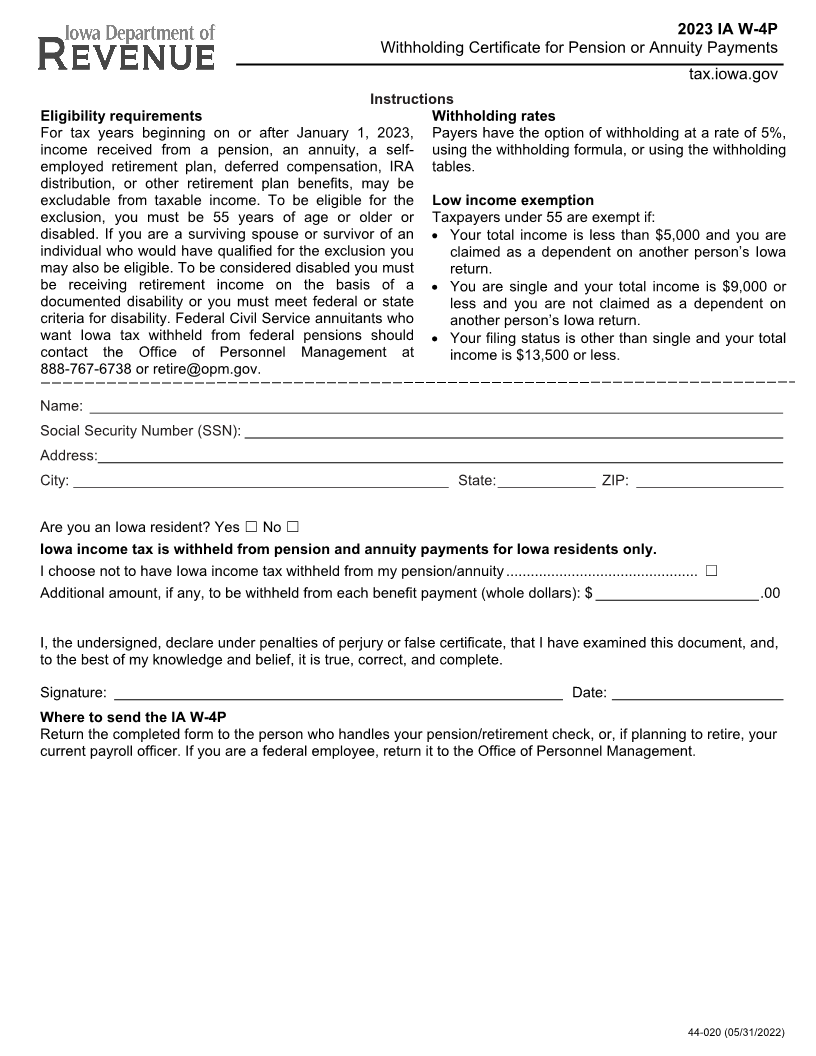

2023 IA W-4P

Withholding Certificate for Pension or Annuity Payments

tax.iowa.gov

Instructions

Eligibility requirements Withholding rates

For tax years beginning on or after January 1, 2023, Payers have the option of withholding at a rate of 5%,

income received from a pension, an annuity, a self- using the withholding formula, or using the withholding

employed retirement plan, deferred compensation, IRA tables.

distribution, or other retirement plan benefits, may be

excludable from taxable income. To be eligible for the Low income exemption

exclusion, you must be 55 years of age or older or Taxpayers under 55 are exempt if:

disabled. If you are a surviving spouse or survivor of an • Your total income is less than $5,000 and you are

individual who would have qualified for the exclusion you claimed as a dependent on another person’s Iowa

may also be eligible. To be considered disabled you must return.

be receiving retirement income on the basis of a • You are single and your total income is $9,000 or

documented disability or you must meet federal or state less and you are not claimed as a dependent on

criteria for disability. Federal Civil Service annuitants who another person’s Iowa return.

want Iowa tax withheld from federal pensions should • Your filing status is other than single and your total

contact the Office of Personnel Management at income is $13,500 or less.

888-767-6738 or retire@opm.gov.

Name: _____________________________________________________________________________________

Social Security Number (SSN): __________________________________________________________________

Address: ____________________________________________________________________________________

City: ______________________________________________ State: ____________ ZIP: __________________

Are you an Iowa resident? Yes ☐ No ☐

Iowa income tax is withheld from pension and annuity payments for Iowa residents only.

I choose not to have Iowa income tax withheld from my pension/annuity ............................................... ☐

Additional amount, if any, to be withheld from each benefit payment (whole dollars): $ ____________________ .00

I, the undersigned, declare under penalties of perjury or false certificate, that I have examined this document, and,

to the best of my knowledge and belief, it is true, correct, and complete.

Signature: _______________________________________________________ Date: _____________________

Where to send the IA W-4P

Return the completed form to the person who handles your pension/retirement check, or, if planning to retire, your

current payroll officer. If you are a federal employee, return it to the Office of Personnel Management.

44-020 (05/31/2022)