Enlarge image

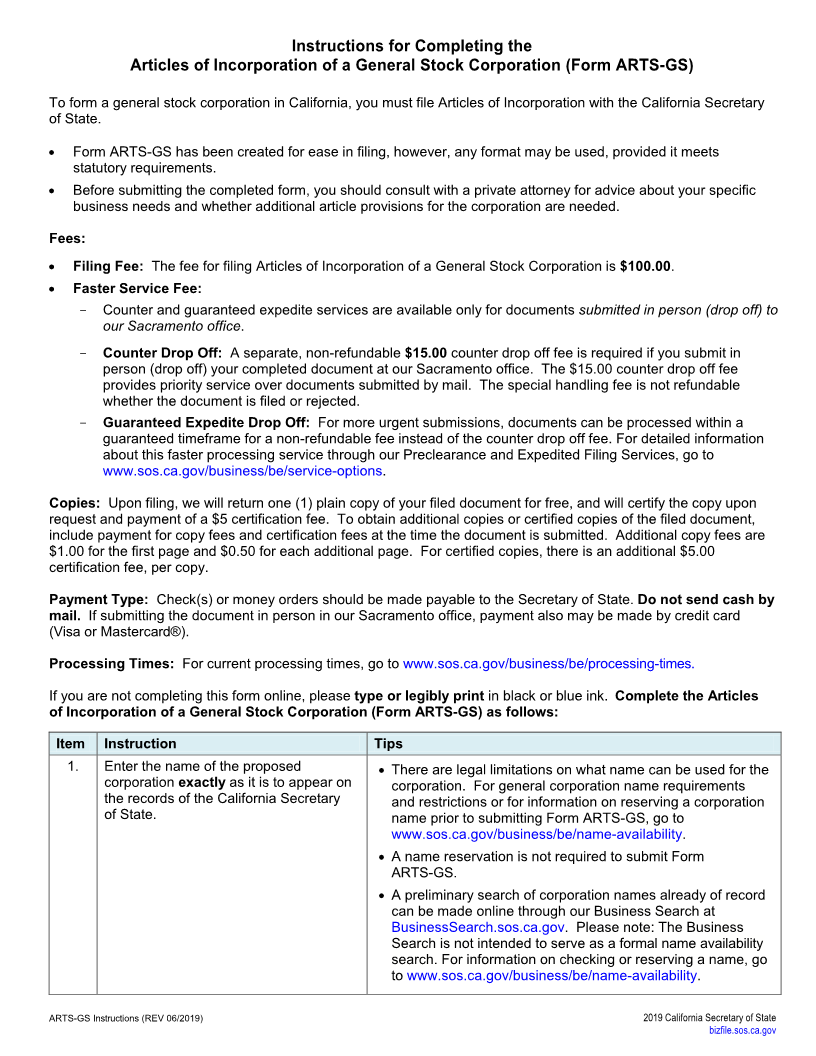

Instructions for Completing the

Articles of Incorporation of a General Stock Corporation (Form ARTS-GS)

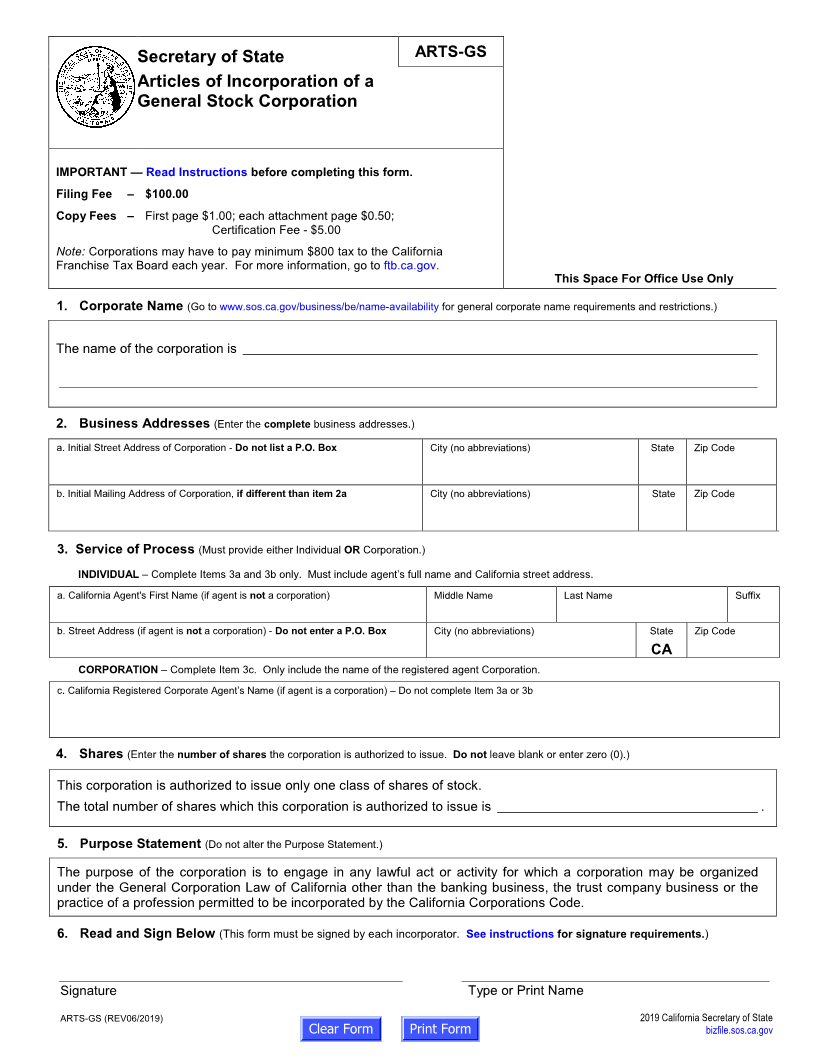

To form a general stock corporation in California, you must file Articles of Incorporation with the California Secretary

of State.

• Form ARTS-GS has been created for ease in filing, however, any format may be used, provided it meets

statutory requirements.

• Before submitting the completed form, you should consult with a private attorney for advice about your specific

business needs and whether additional article provisions for the corporation are needed.

Fees:

• Filing Fee: The fee for filing Articles of Incorporation of a General Stock Corporation is $100.00.

• Faster Service Fee:

- Counter and guaranteed expedite services are available only for documents submitted in person (drop off) to

our Sacramento office.

- Counter Drop Off: A separate, non-refundable $15.00 counter drop off fee is required if you submit in

person (drop off) your completed document at our Sacramento office. The $15.00 counter drop off fee

provides priority service over documents submitted by mail. The special handling fee is not refundable

whether the document is filed or rejected.

- Guaranteed Expedite Drop Off: For more urgent submissions, documents can be processed within a

guaranteed timeframe for a non-refundable fee instead of the counter drop off fee. For detailed information

about this faster processing service through our Preclearance and Expedited Filing Services, go to

www.sos.ca.gov/business/be/service-options.

Copies: Upon filing, we will return one (1) plain copy of your filed document for free, and will certify the copy upon

request and payment of a $5 certification fee. To obtain additional copies or certified copies of the filed document,

include payment for copy fees and certification fees at the time the document is submitted. Additional copy fees are

$1.00 for the first page and $0.50 for each additional page. For certified copies, there is an additional $5.00

certification fee, per copy.

Payment Type: Check(s) or money orders should be made payable to the Secretary of State. Do not send cash by

mail. If submitting the document in person in our Sacramento office, payment also may be made by credit card

(Visa or Mastercard®).

Processing Times: For current processing times, go to www.sos.ca.gov/business/be/processing-times.

If you are not completing this form online, please type or legibly print in black or blue ink. Complete the Articles

of Incorporation of a General Stock Corporation (Form ARTS-GS) as follows:

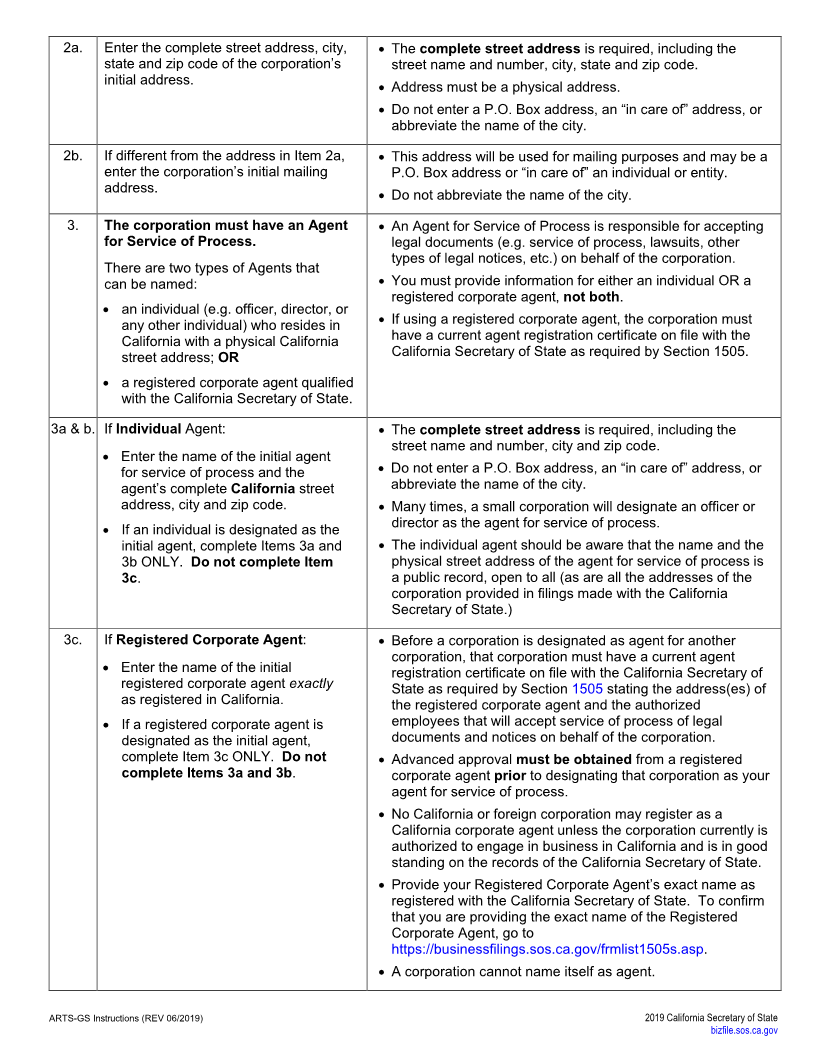

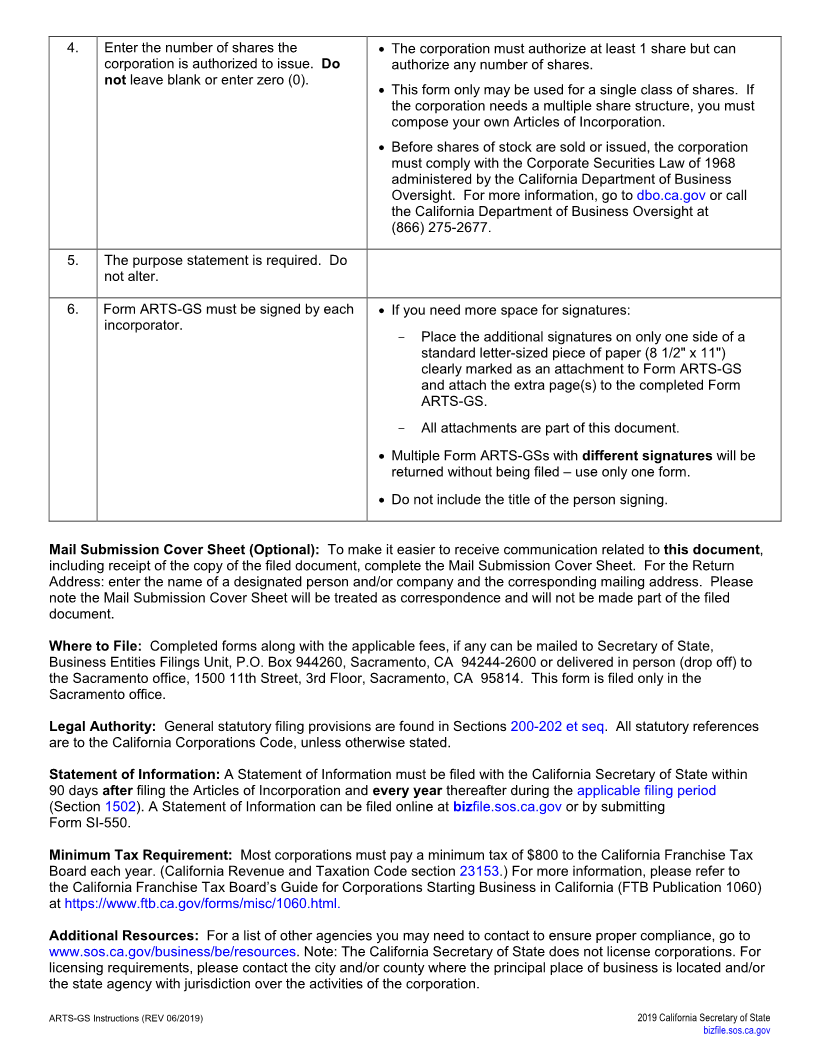

Item Instruction Tips

1. Enter the name of the proposed • There are legal limitations on what name can be used for the

corporation exactly as it is to appear on corporation. For general corporation name requirements

the records of the California Secretary and restrictions or for information on reserving a corporation

of State. name prior to submitting Form ARTS-GS, go to

www.sos.ca.gov/business/be/name-availability.

• A name reservation is not required to submit Form

ARTS-GS.

• A preliminary search of corporation names already of record

can be made online through our Business Search at

BusinessSearch.sos.ca.gov. Please note: The Business

Search is not intended to serve as a formal name availability

search. For information on checking or reserving a name, go

to www.sos.ca.gov/business/be/name-availability.

ARTS-GS Instructions (REV 06/2019) 201 9California Secretary of State

bizfile.sos.ca.gov