Enlarge image

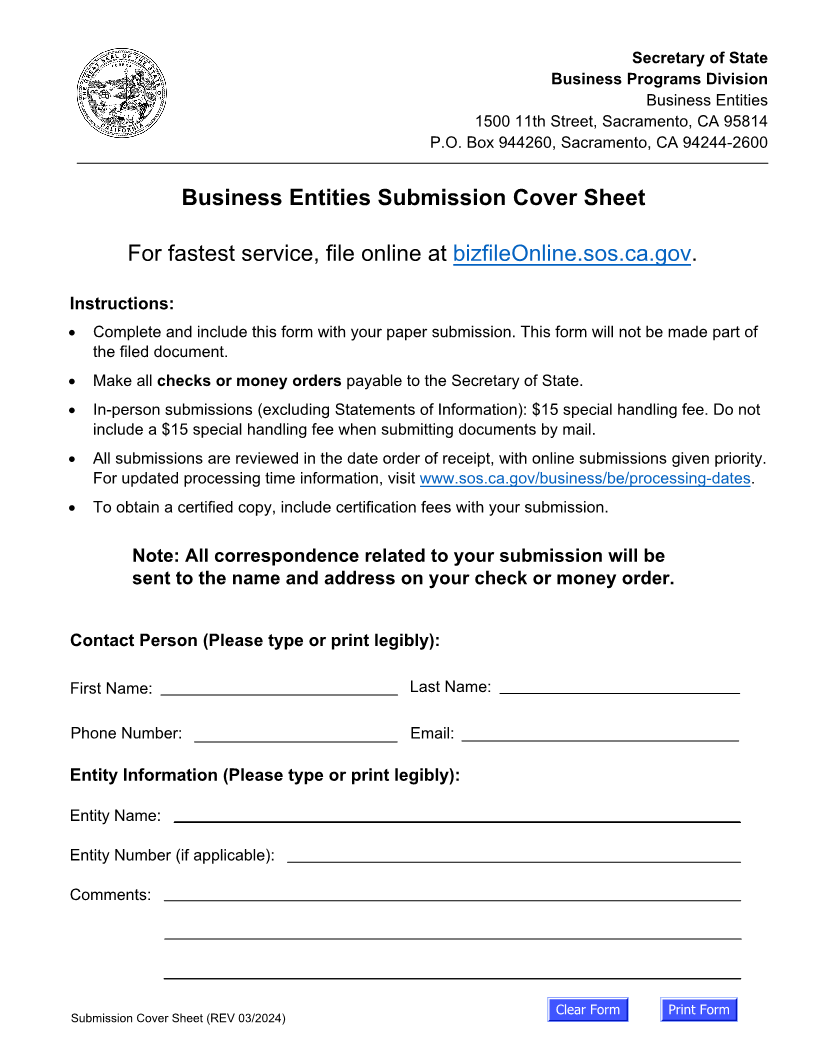

Secretary of State

Business Programs Division

Business Entities

1500 11th Street, Sacramento, CA 95814

P.O. Box 944260, Sacramento, CA 94244-2600

Business Entities Submission Cover Sheet

For faste stservice, file online at bizfileOnline.sos.ca.gov.

Instructions:

• Complete and include this form with your paper submission. This form will not be made part of

the filed document.

• Make all checks or money orders payable to the Secretary of State.

• In-person submissions (excluding Statements of Information): $15 special handling fee . Do not

include a $15 special handling fee when submitting documents by mail.

• All submissions are reviewed in the date order of receipt , with online submissions given priority.

For updated processing time information, visit www.sos.ca.gov/business/be/processing-dates.

• To obtain a certified copy, includ ecertification fees with your submission.

Note: All correspondence related to your submission will be

sent to the name and address on your check or money order.

Contact Person (Please type or print legibly):

First Name: Last Name:

Phone Number: Email:

Entity Information (Please type or print legibly):

Entity Name:

Entity Number (if applicable):

Comments:

Clear Form Print Form

Submission Cover Sheet (REV 03/2024)