- 7 -

Enlarge image

|

III. ELECTRONIC REPORTING (Continued)

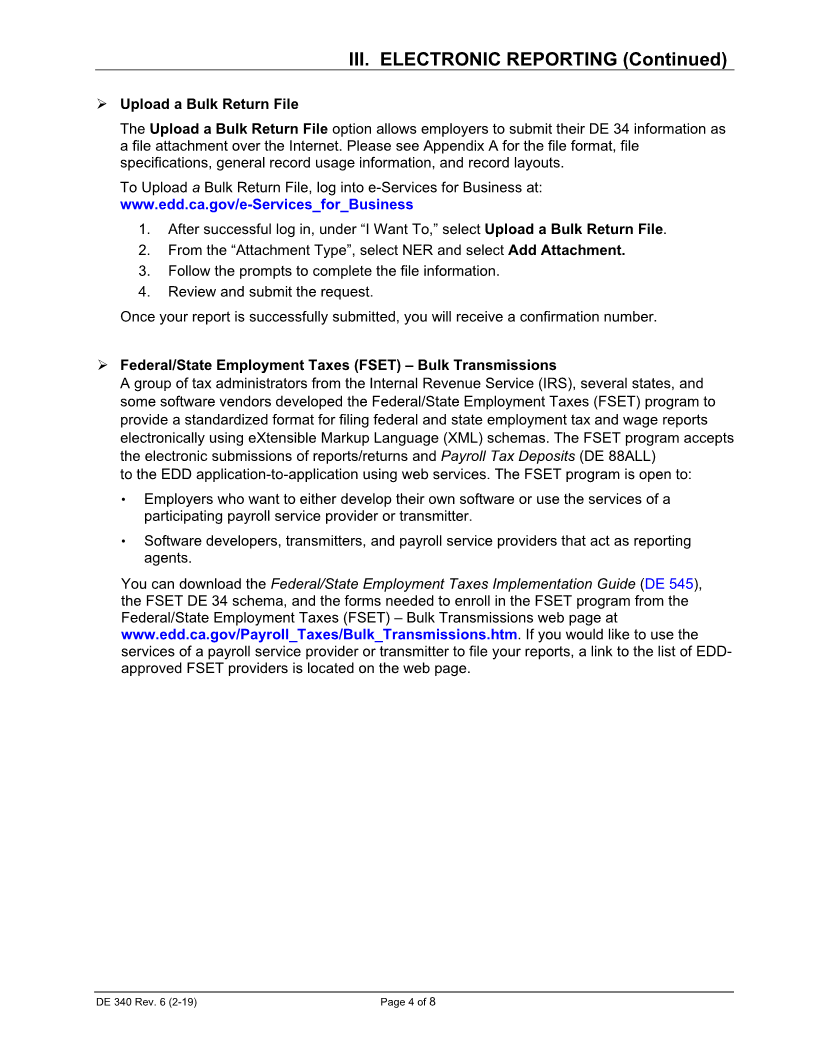

Upload a Bulk Return File

The Upload a Bulk Return File option allows employers to submit their DE 34 information as

a file attachment over the Internet. Please see Appendix A for the file format, file

specifications, general record usage information, and record layouts.

To Upload aBulk Return File, log into e-Services for Business at:

www.edd.ca.gov/e-Services_for_Business

1. After successful log in, under “I Want To,” select Upload a Bulk Return File .

2. From the “Attachment Type”, select NER and select Add Attachment.

3. Follow the prompts to complete the file information.

4. Review and submit the request.

Once your report is successfully submitted, you will receive a confirmation number.

Federal/State Employment Taxes (FSET) – Bulk Transmissions

A group of tax administrators from the Internal Revenue Service (IRS), several states, and

some software vendors developed the Federal/State Employment Taxes (FSET) program to

provide a standardized format for filing federal and state employment tax and wage reports

electronically using eXtensible Markup Language (XML) schemas. The FSET program accepts

the electronic submissions of reports/returns and Payroll Tax Deposits (DE 88ALL)

to the EDD application-to-application using web services. The FSET program is open to:

• Employers who want to either develop their own software or use the services of a

participating payroll service provider or transmitter.

• Software developers, transmitters, and payroll service providers that act as reporting

agents.

You can download theFederal/State Employment Taxes Implementation Guide(DE 545 ),

the FSET DE 34 schema, and the forms needed to enroll in the FSET program from the

Federal/State Employment Taxes (FSET) –Bulk Transmissions web page at

www.edd.ca.gov/Payroll_Taxes/Bulk_Transmissions.htm . If you would like to use the

services of a payroll service provider or transmitter to file your reports, a link to the list of EDD-

approved FSET providers is located on the web page.

DE 340 Rev. 6 (2-19) Page 4 of 8

|