- 53 -

Enlarge image

|

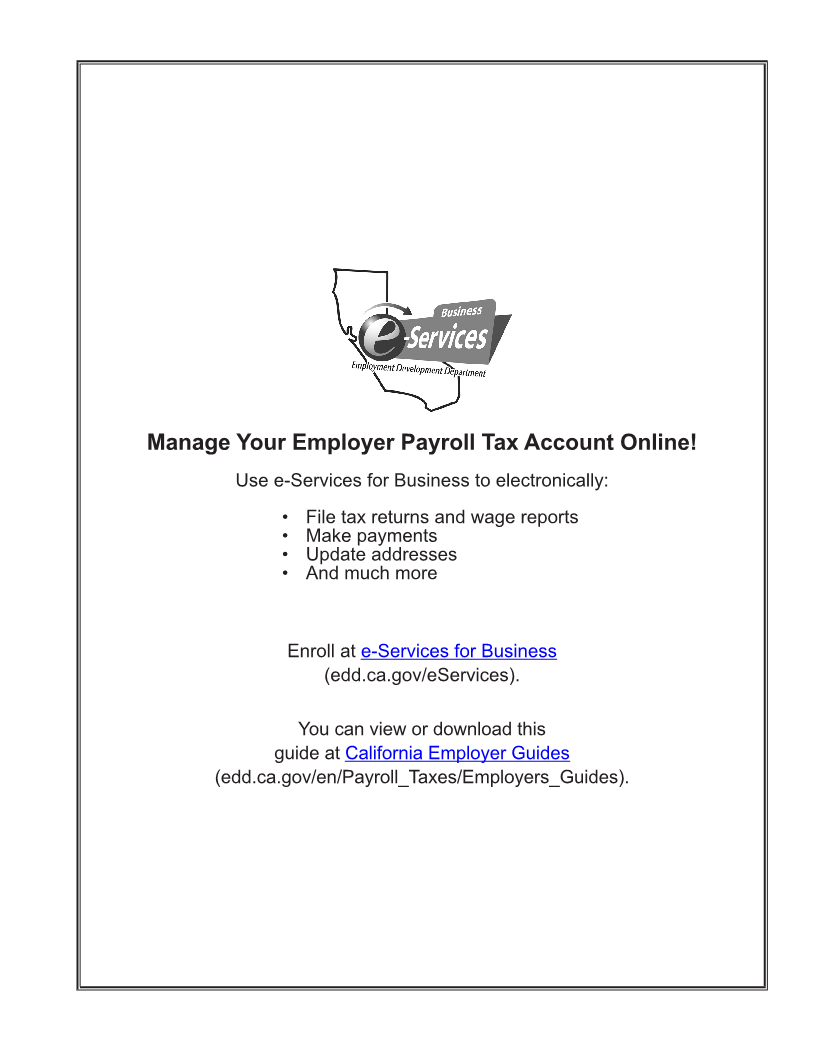

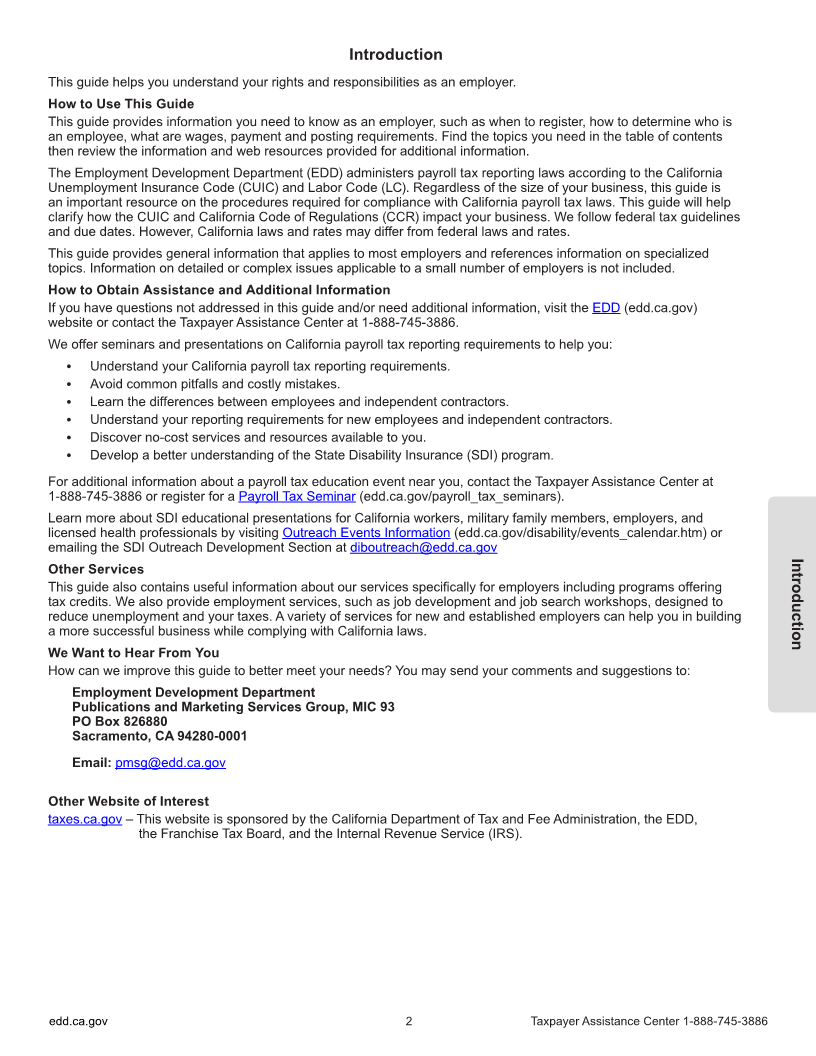

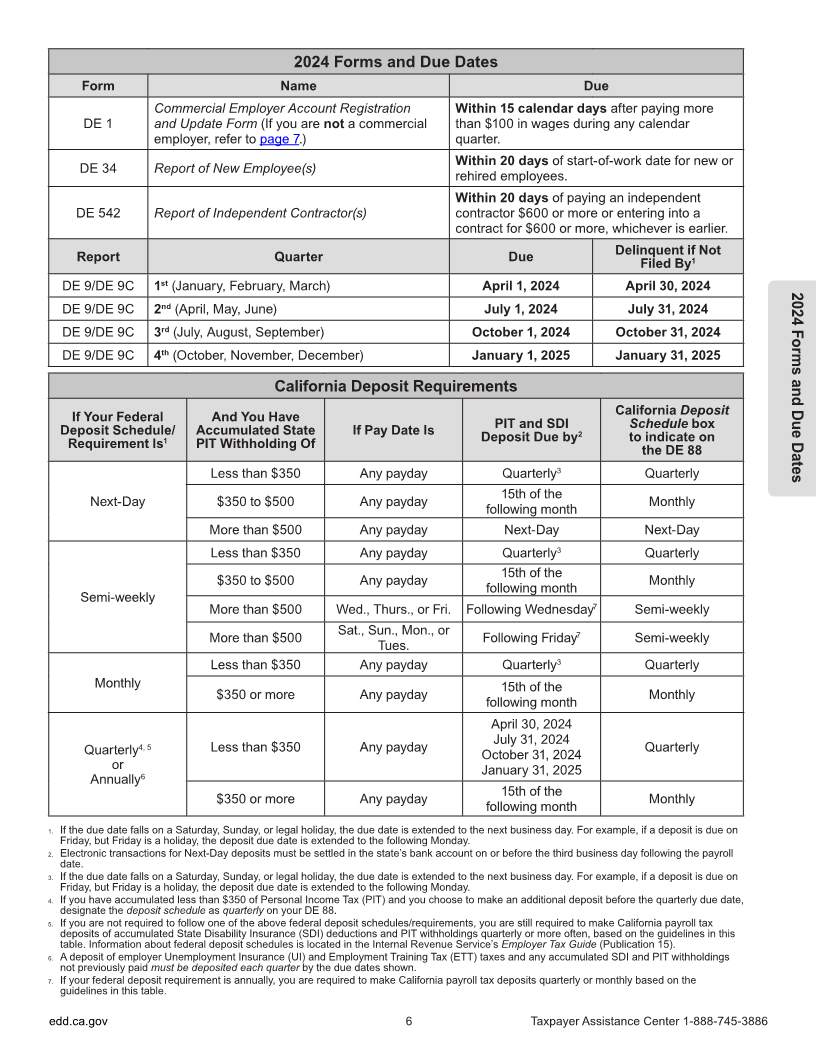

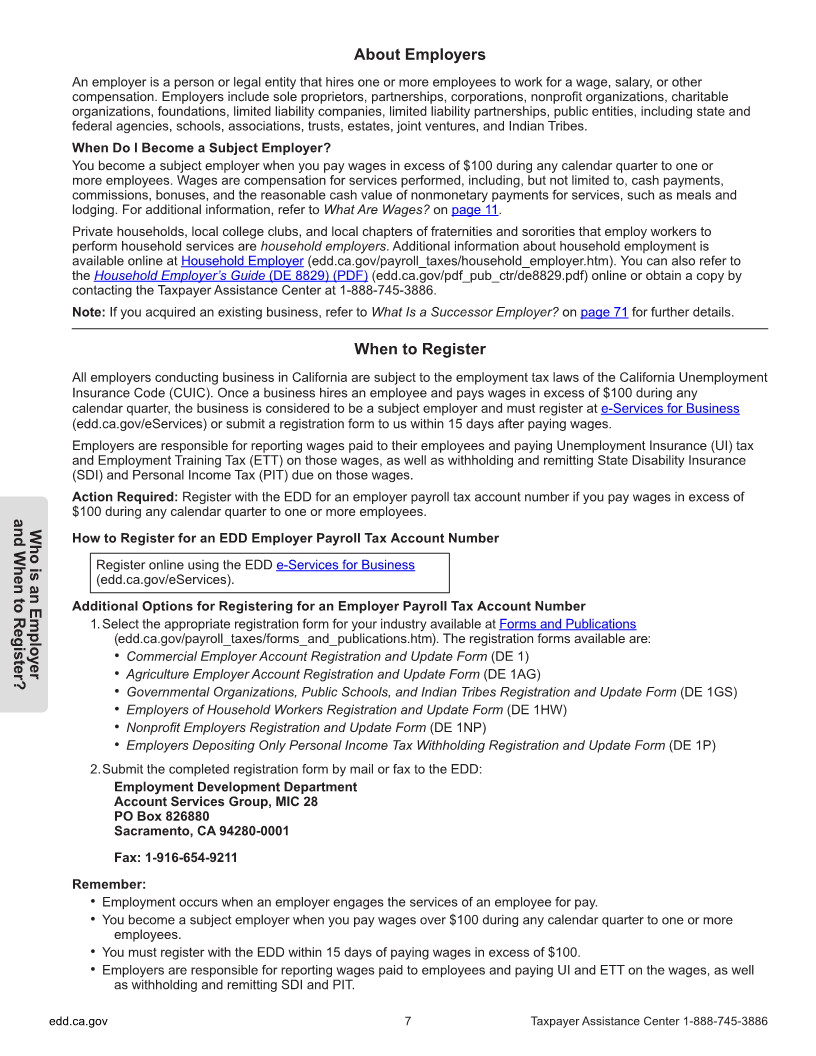

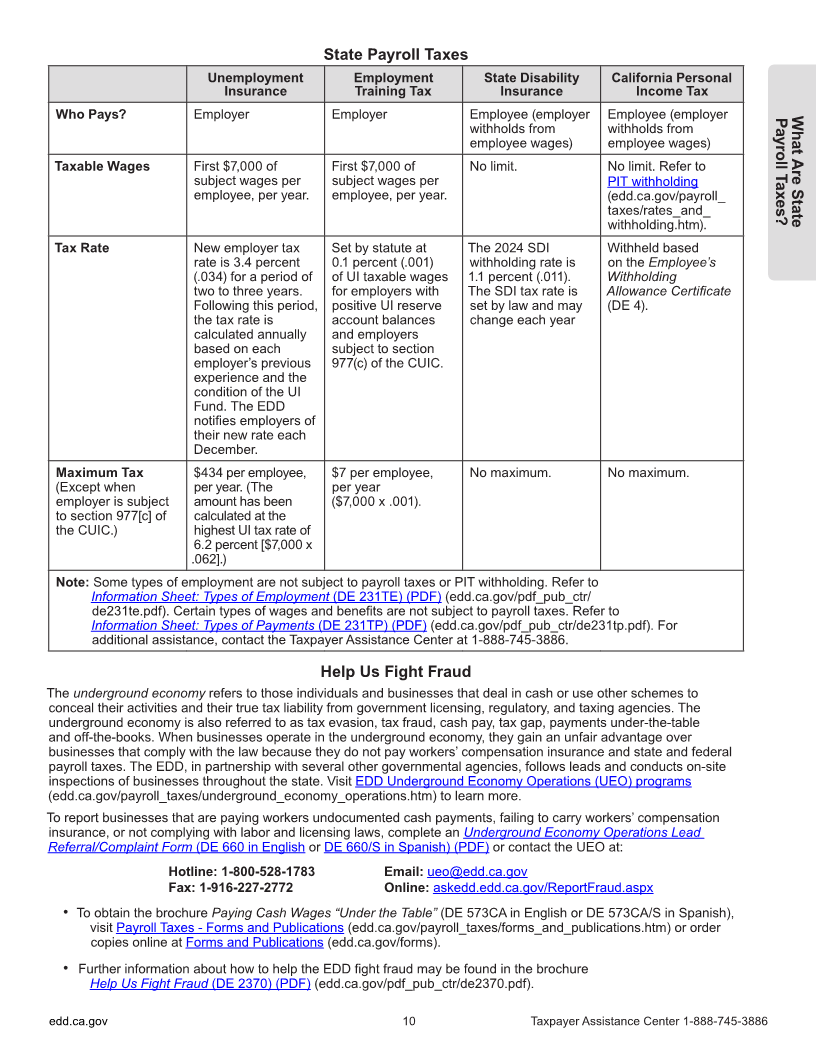

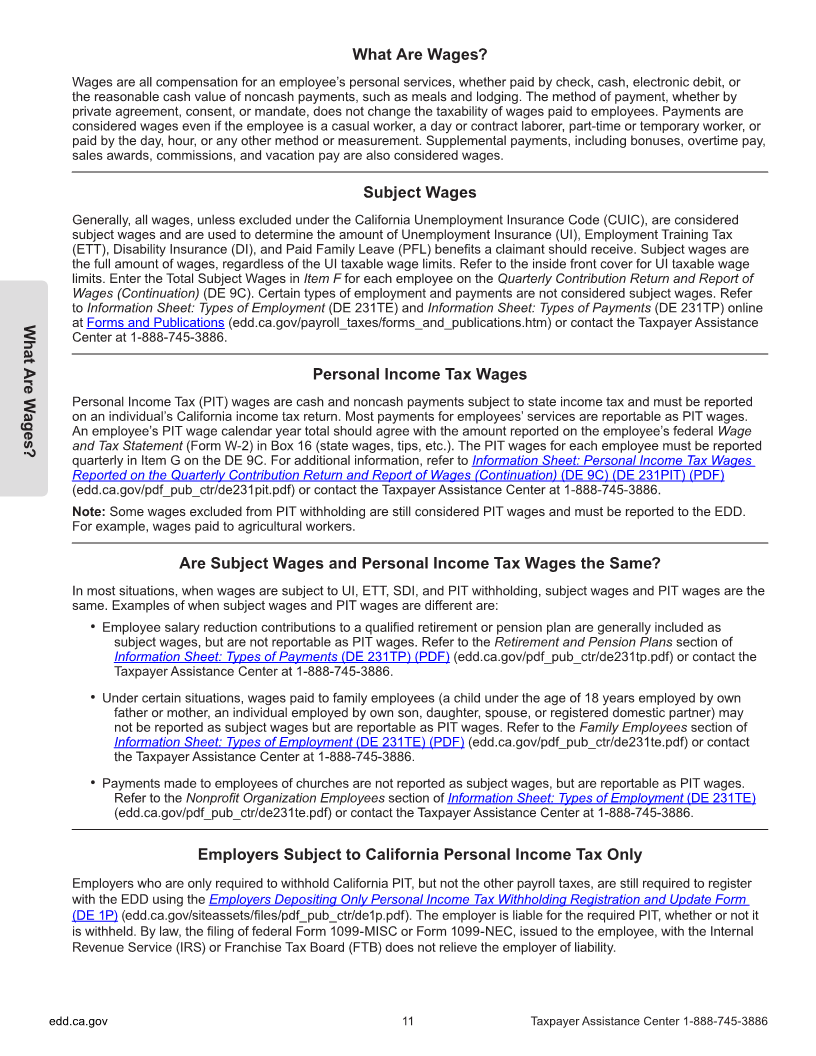

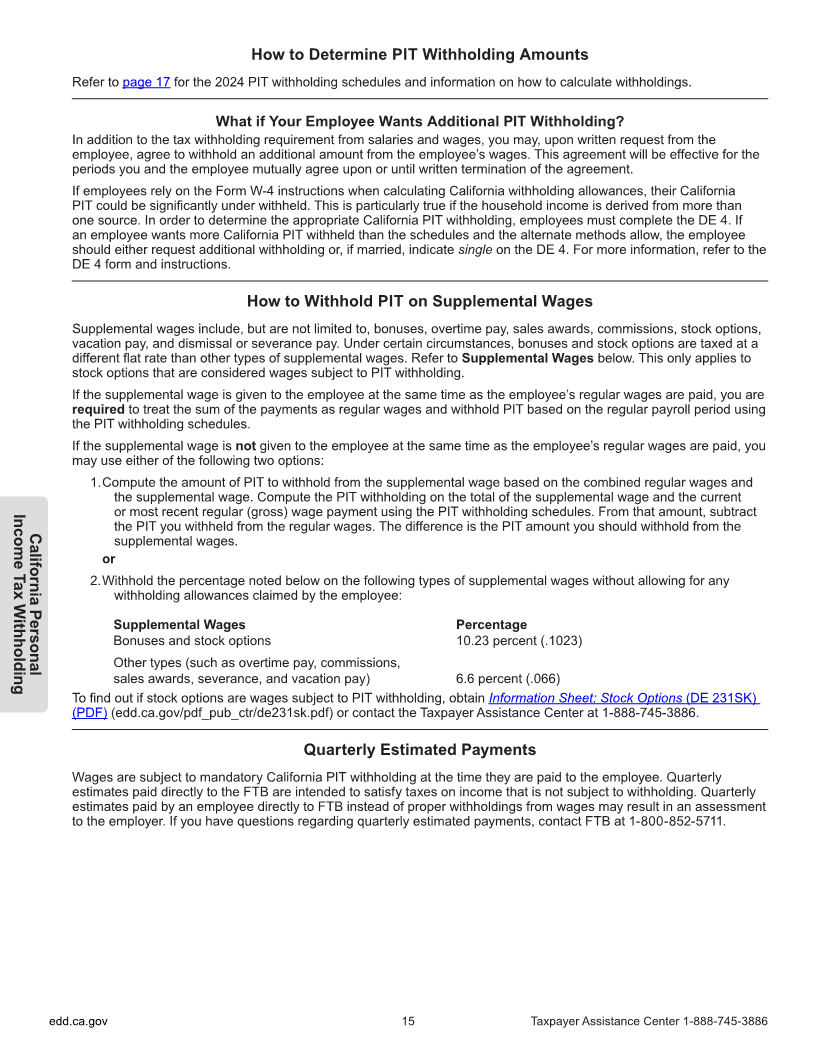

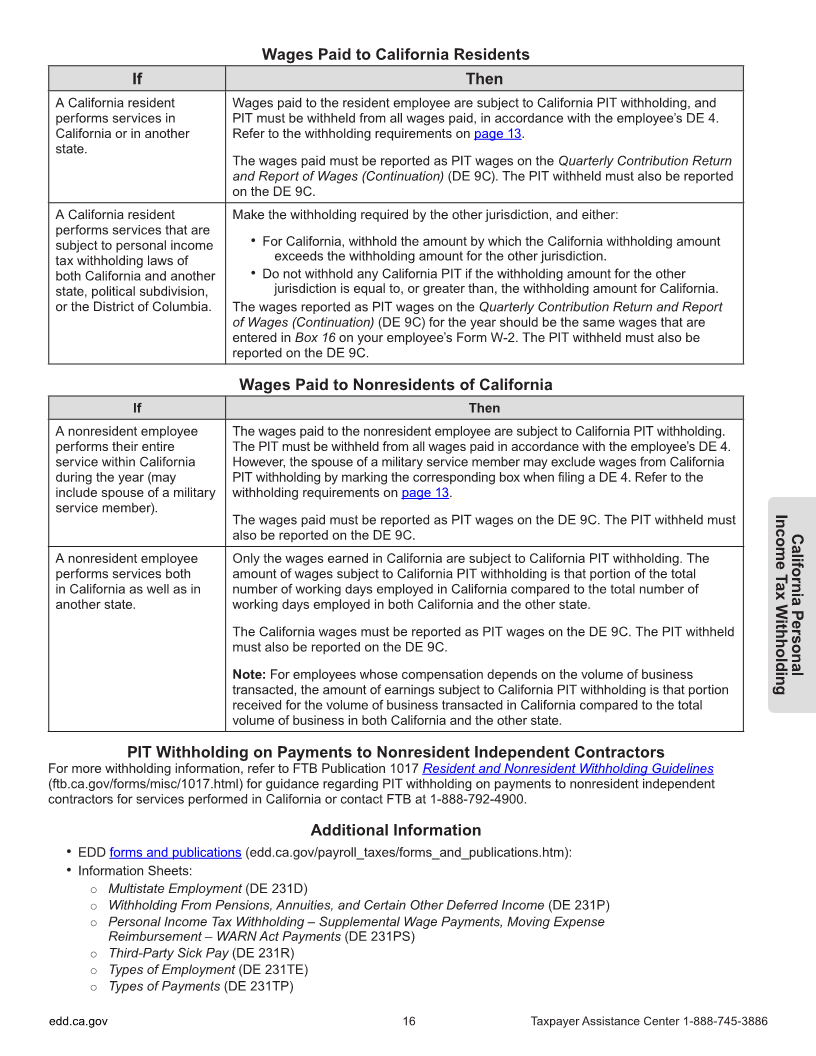

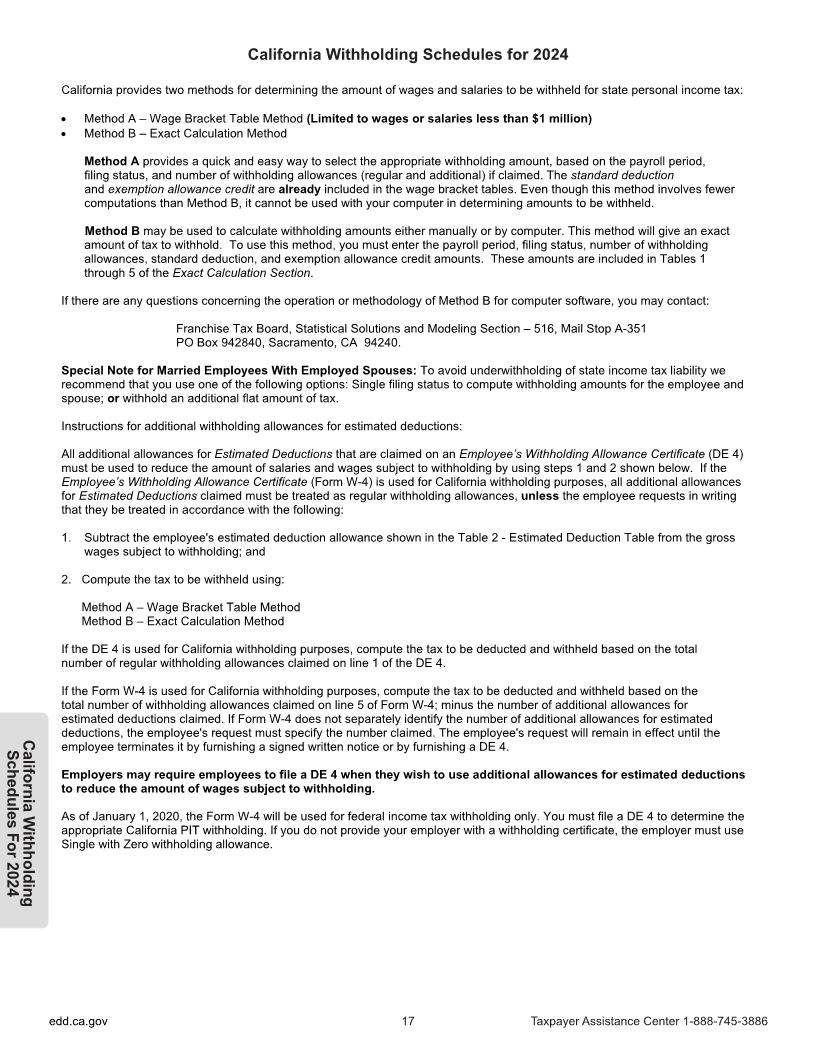

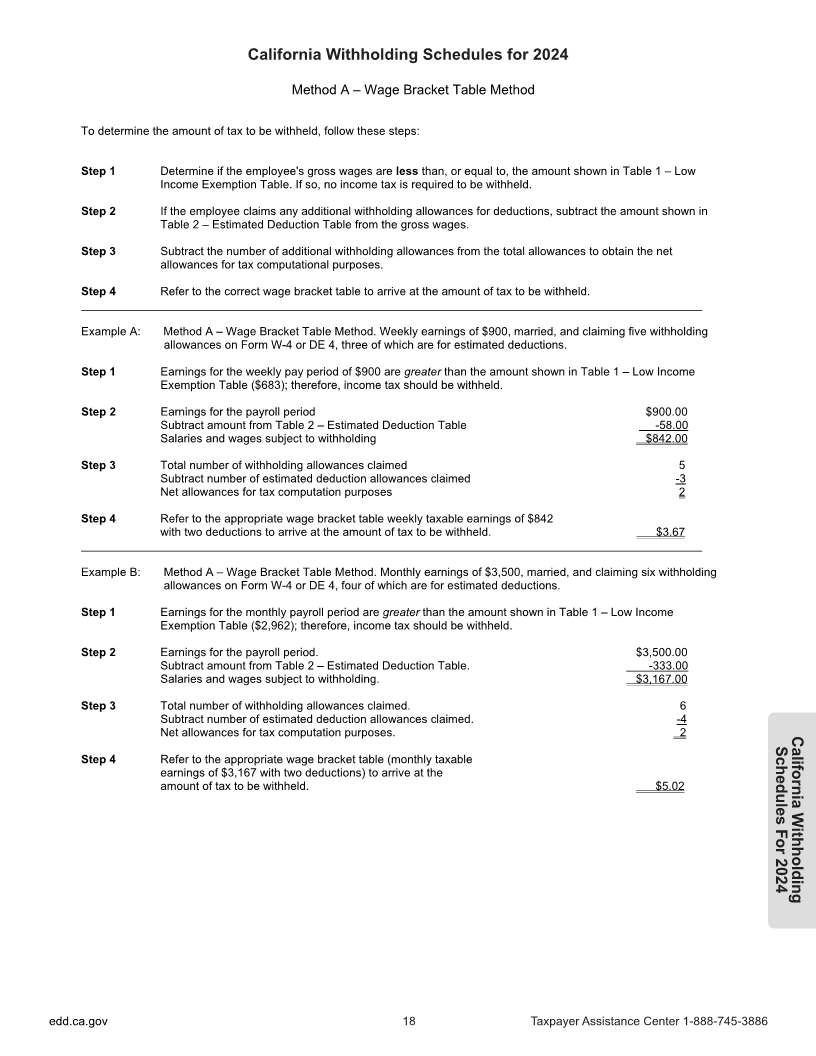

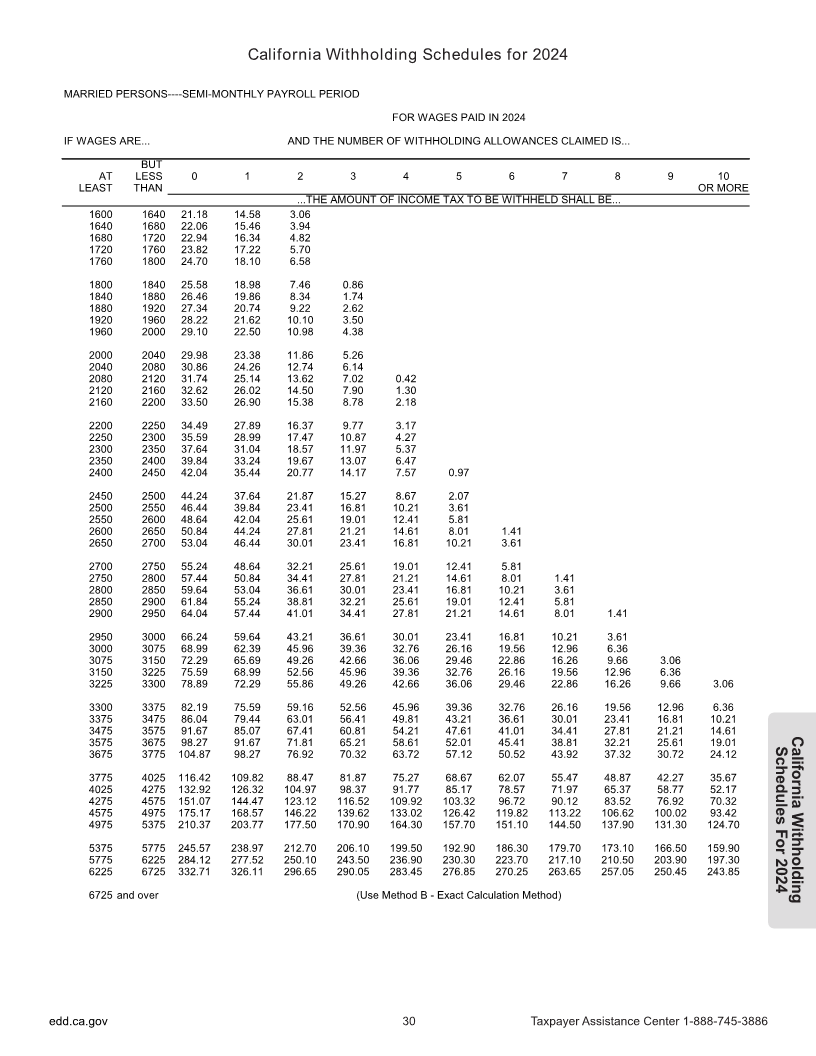

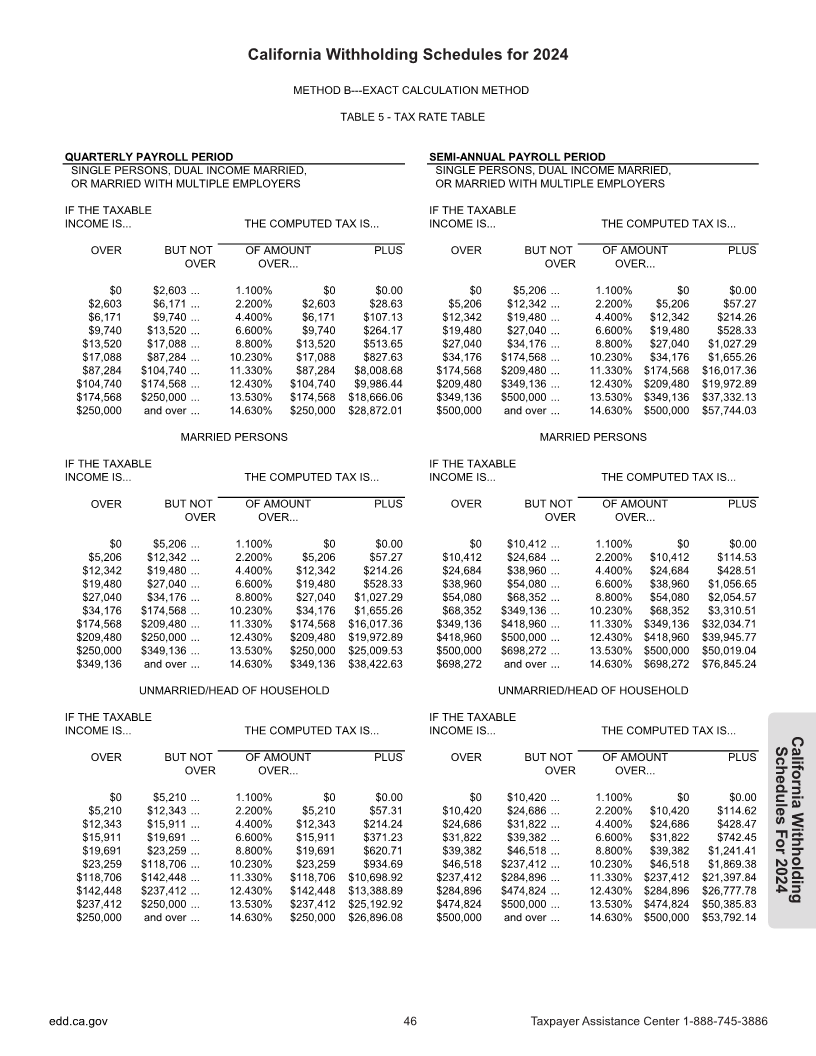

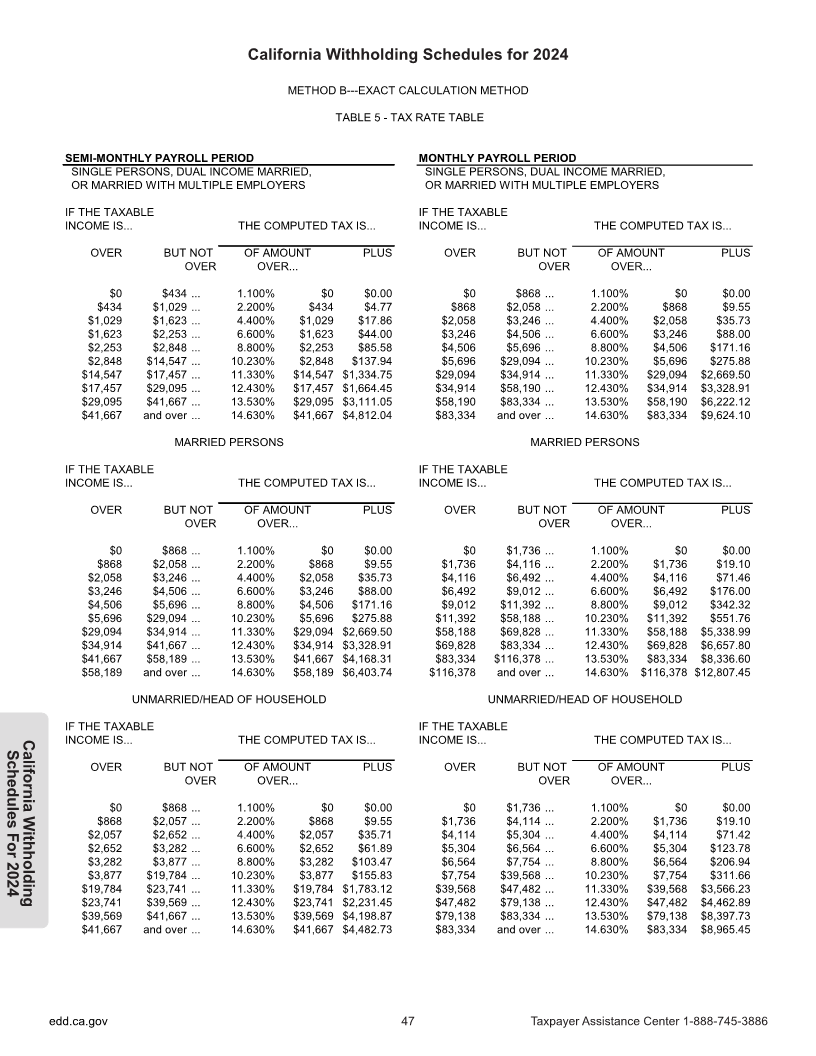

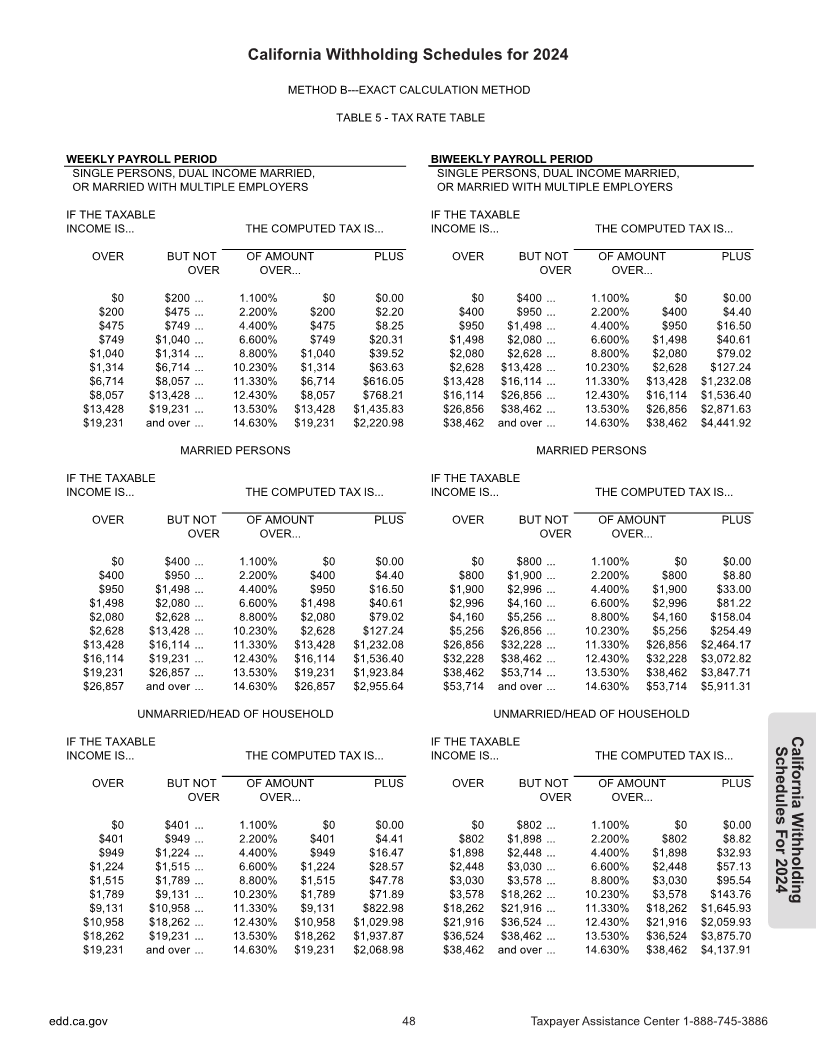

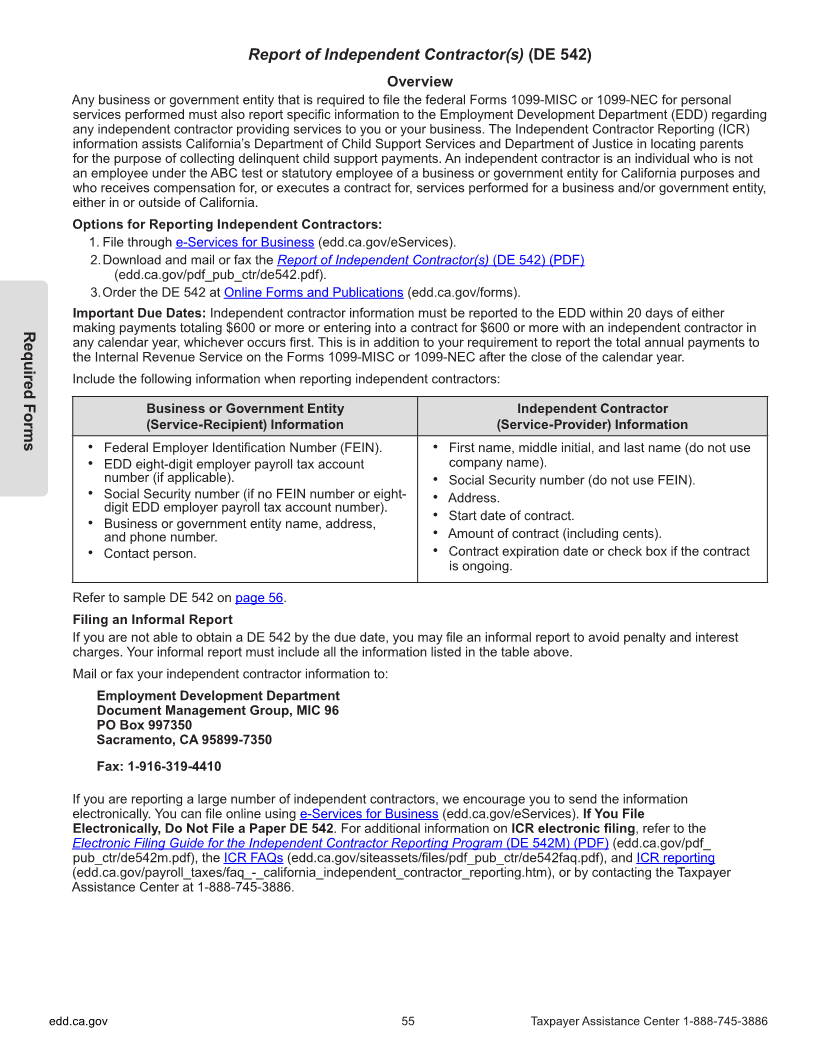

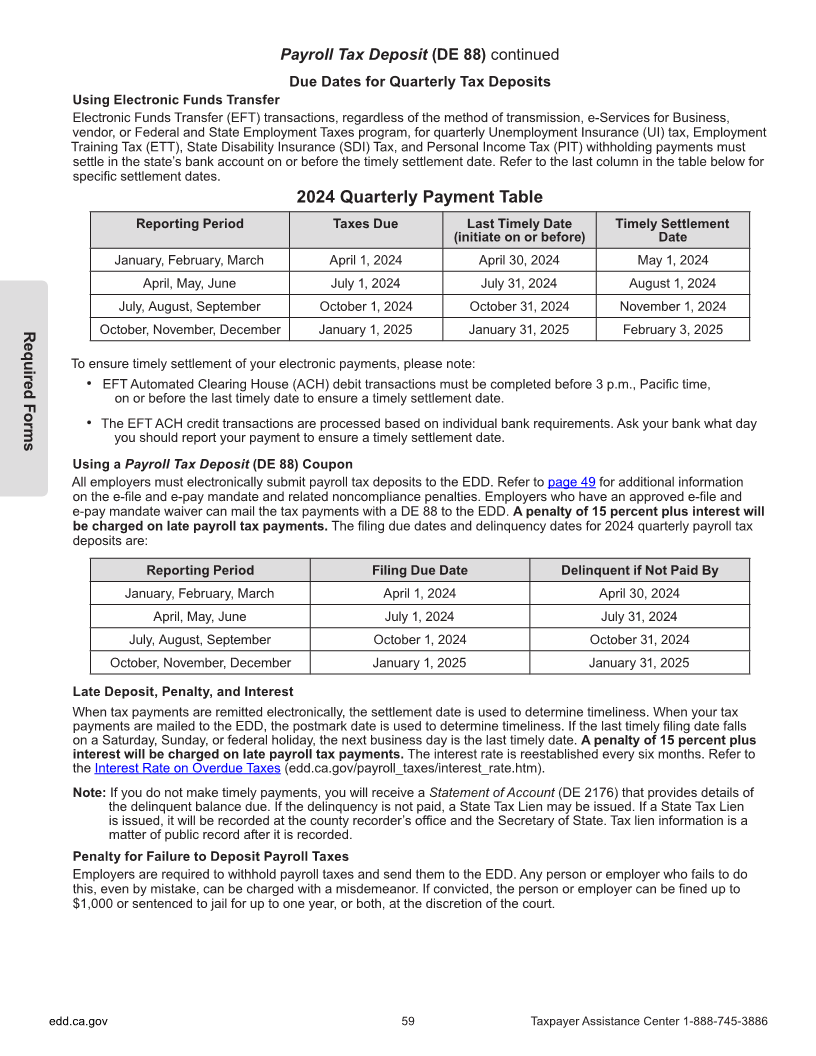

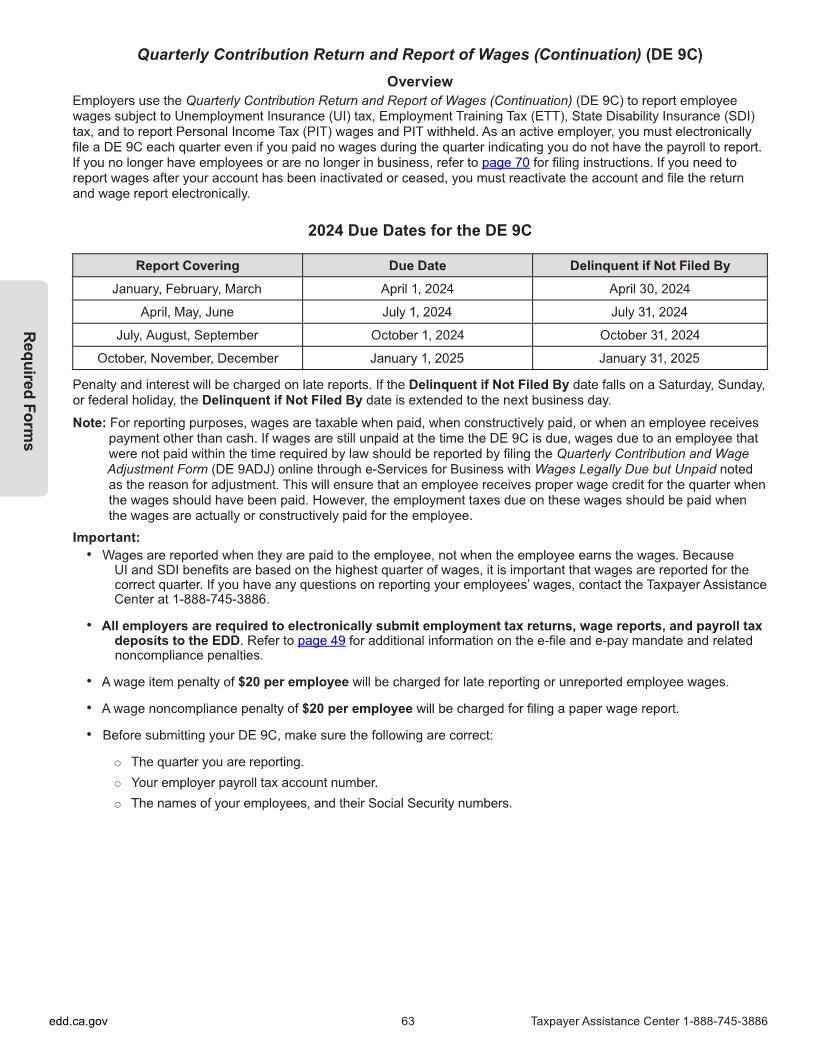

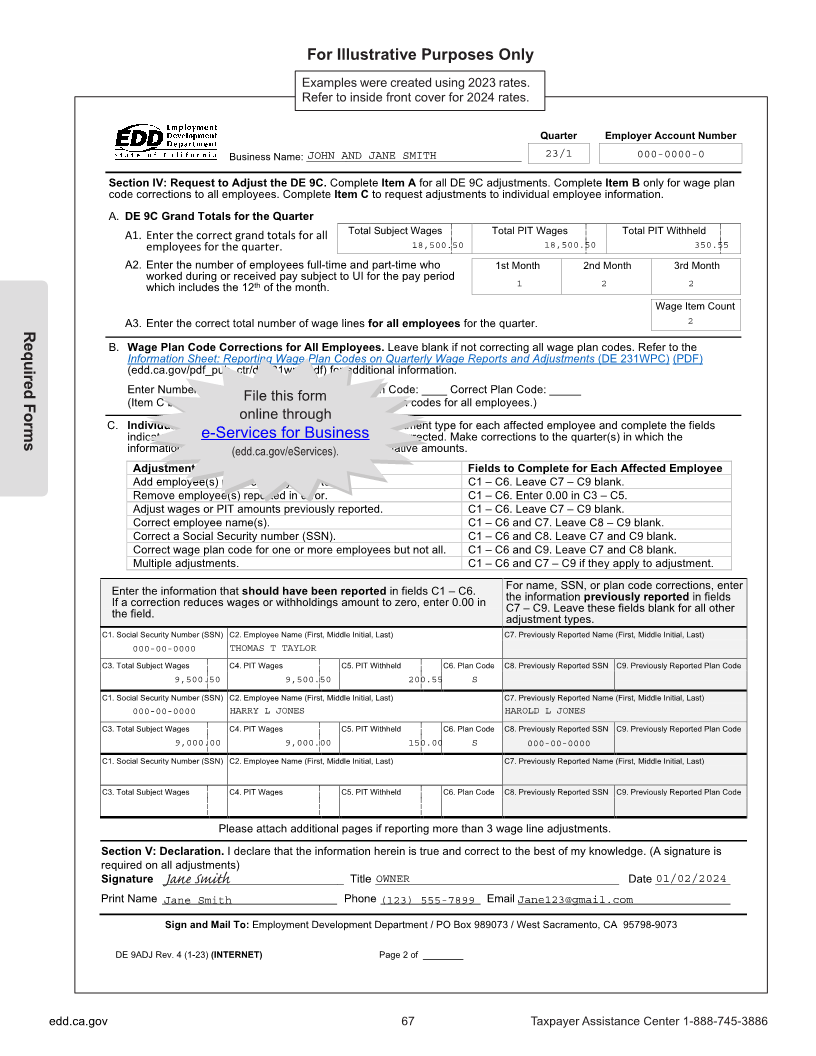

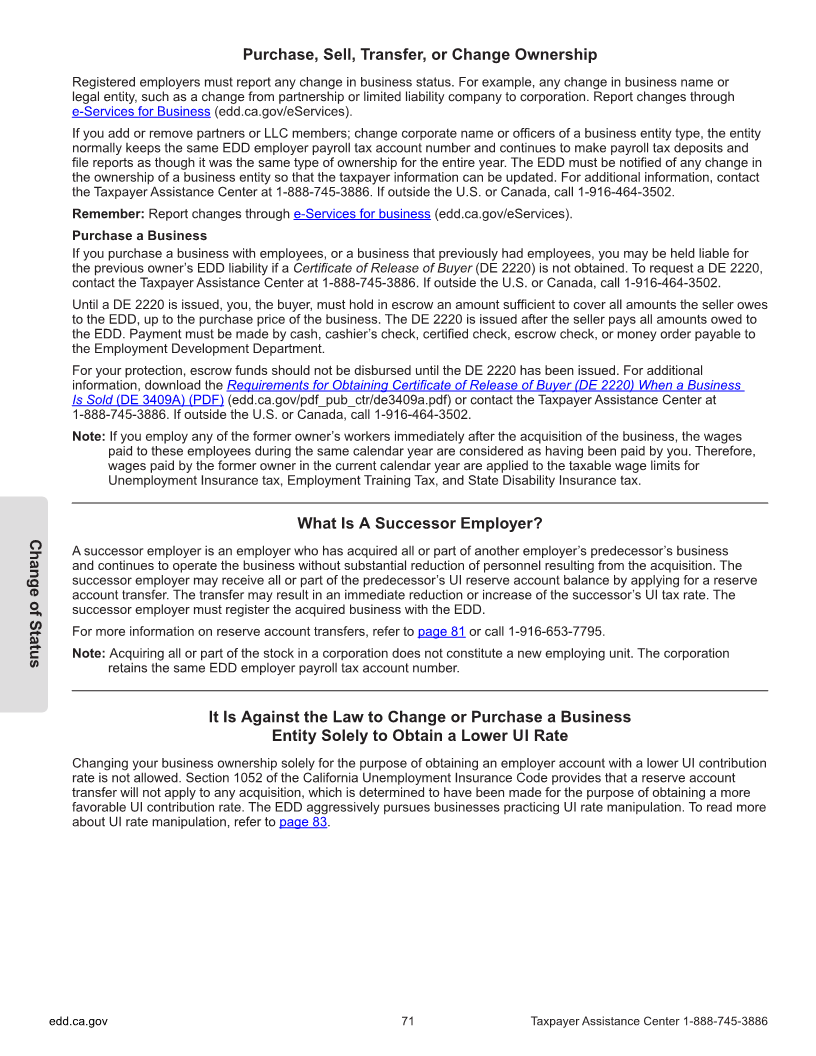

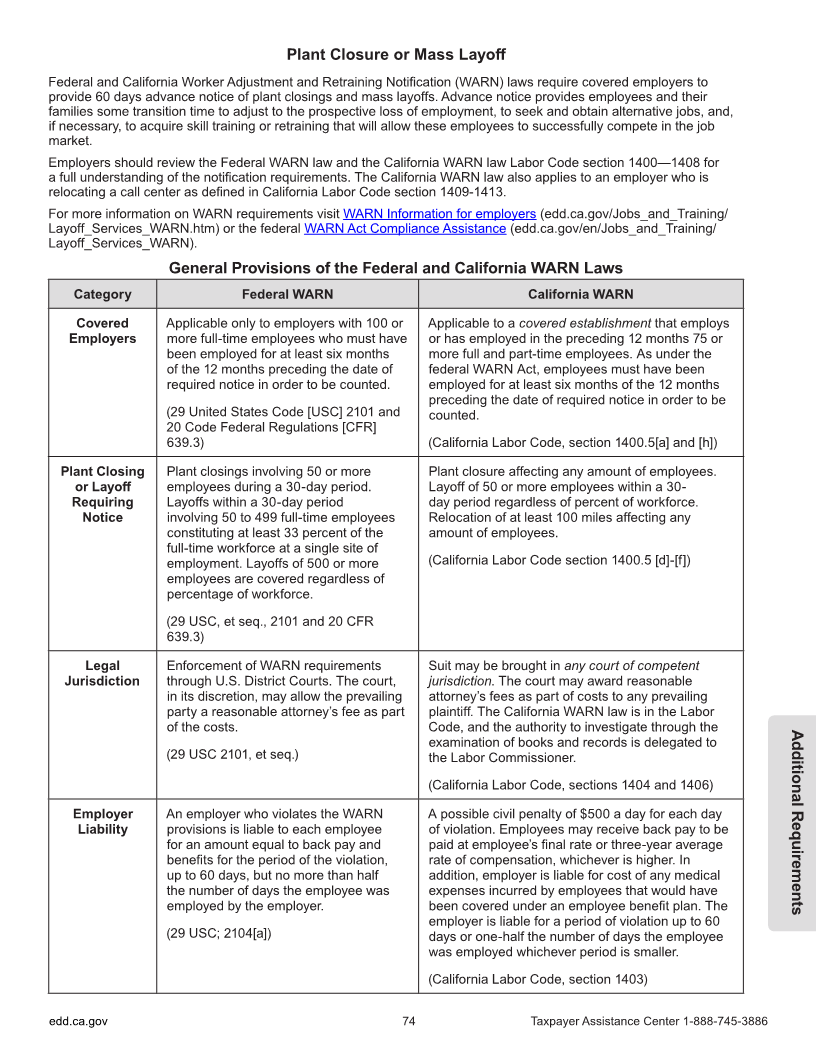

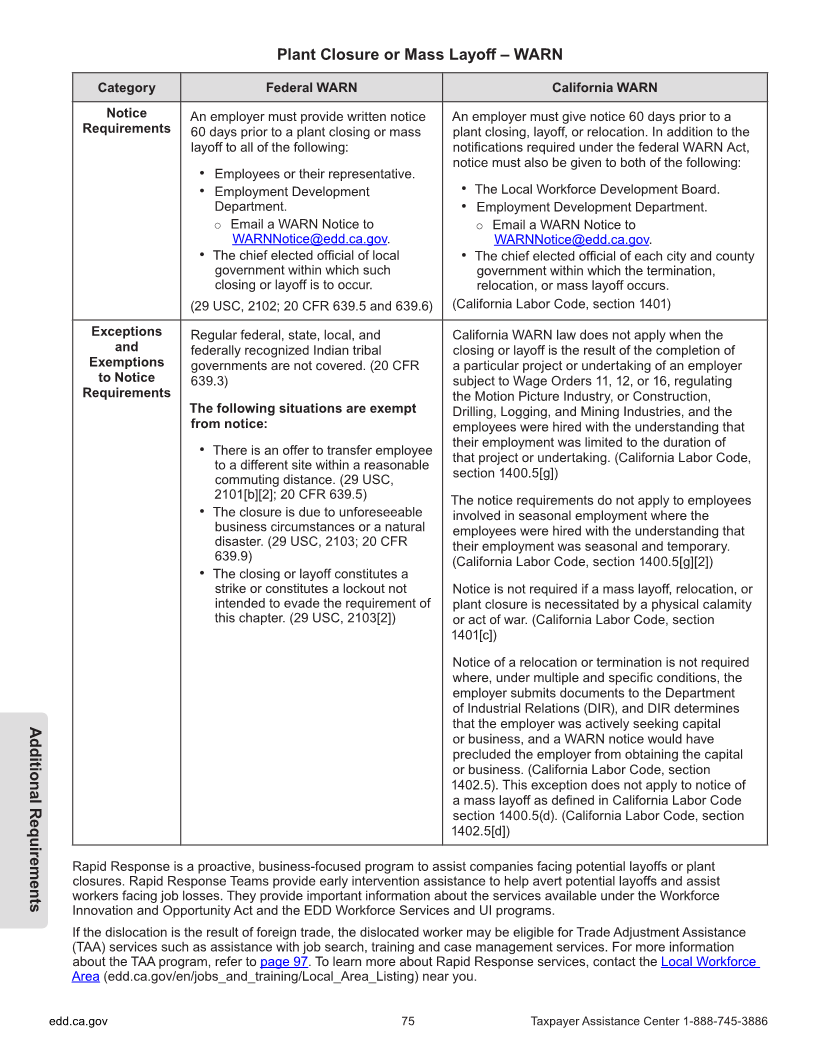

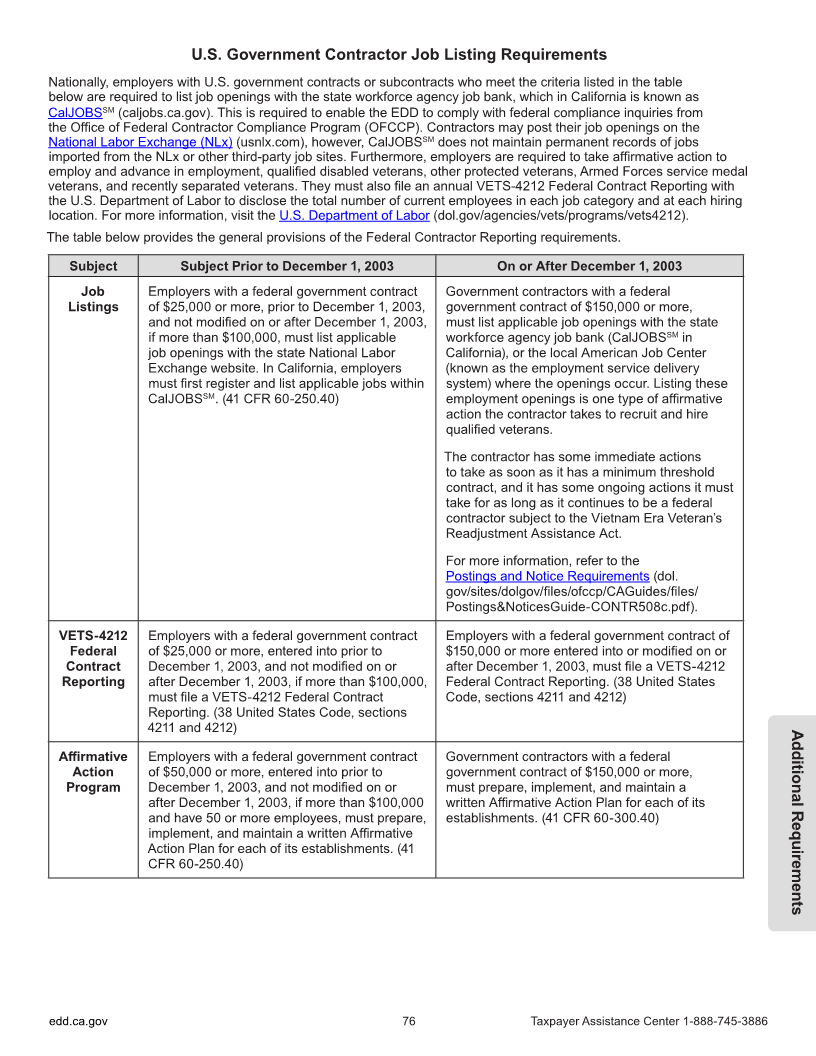

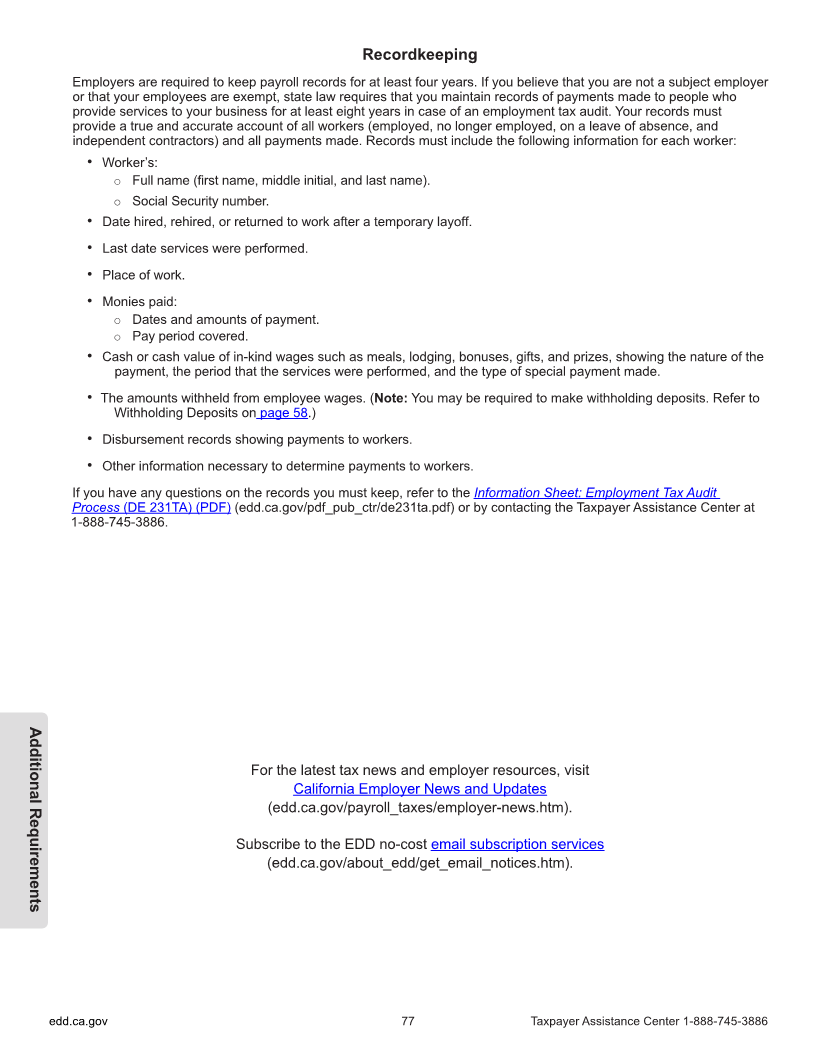

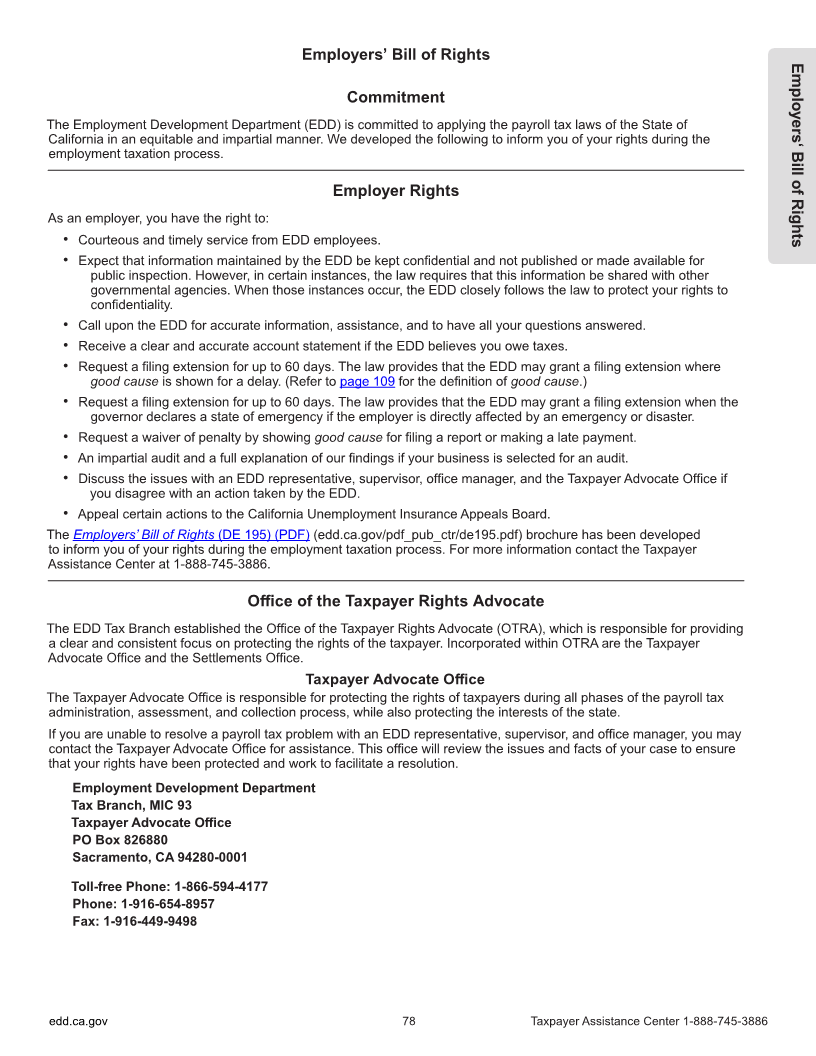

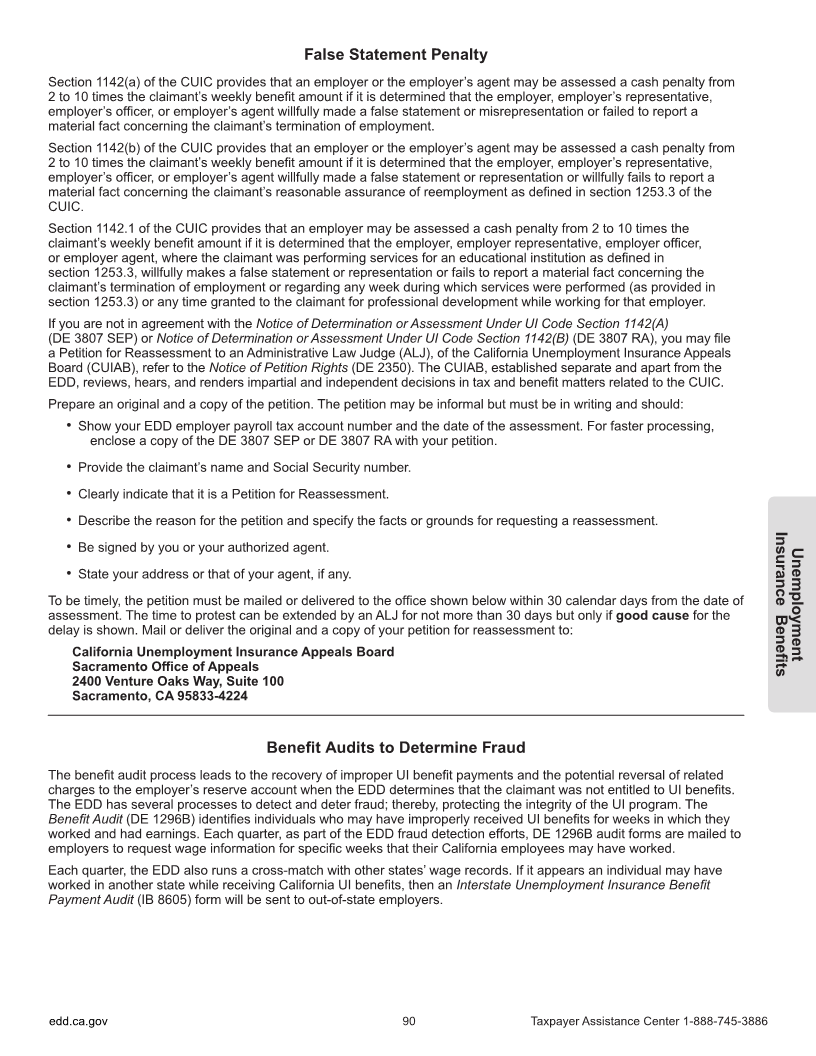

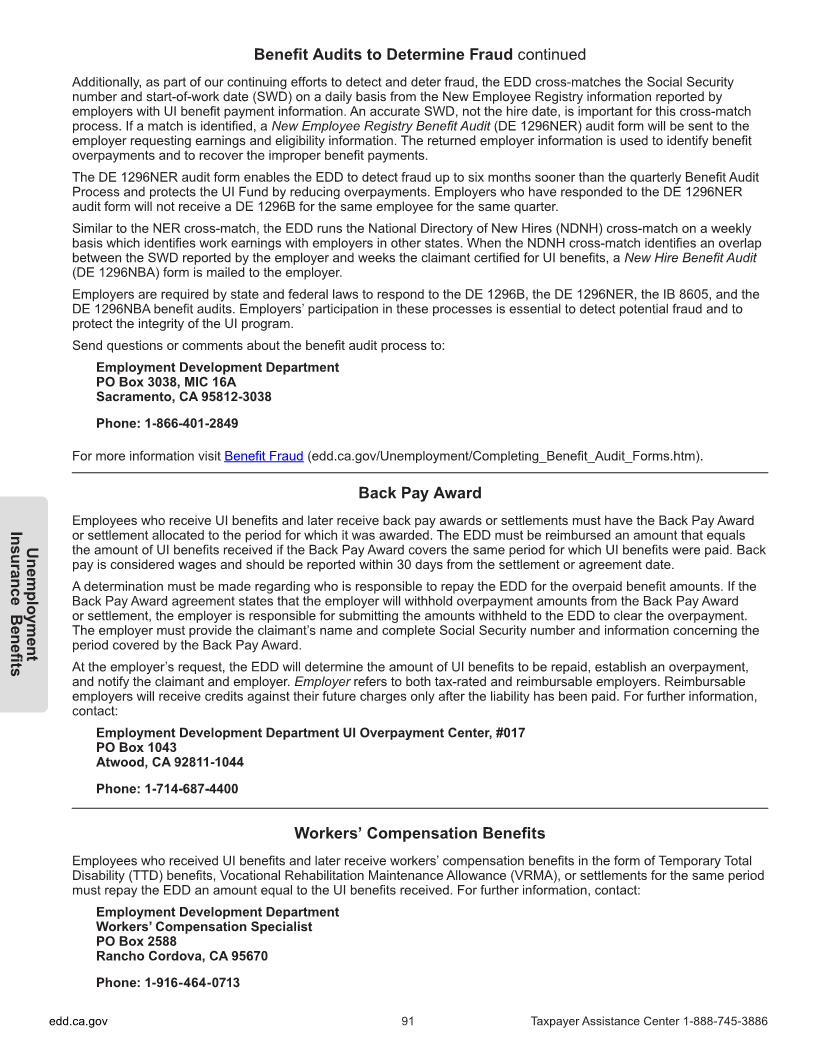

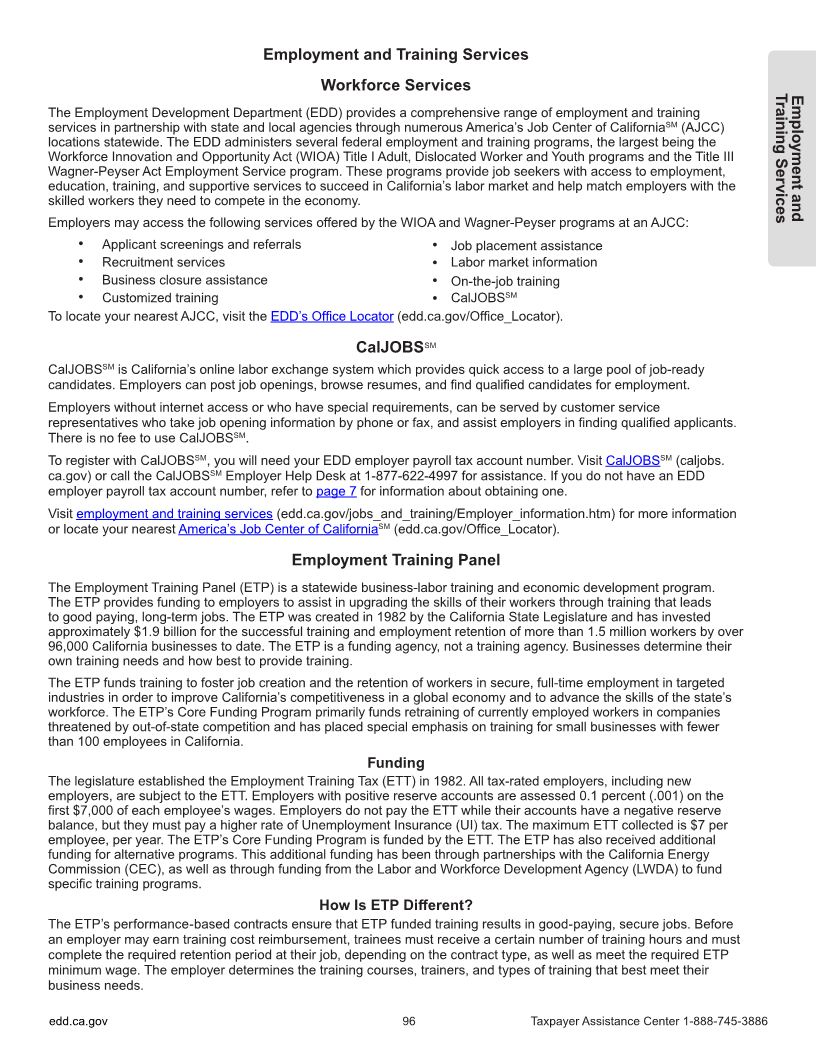

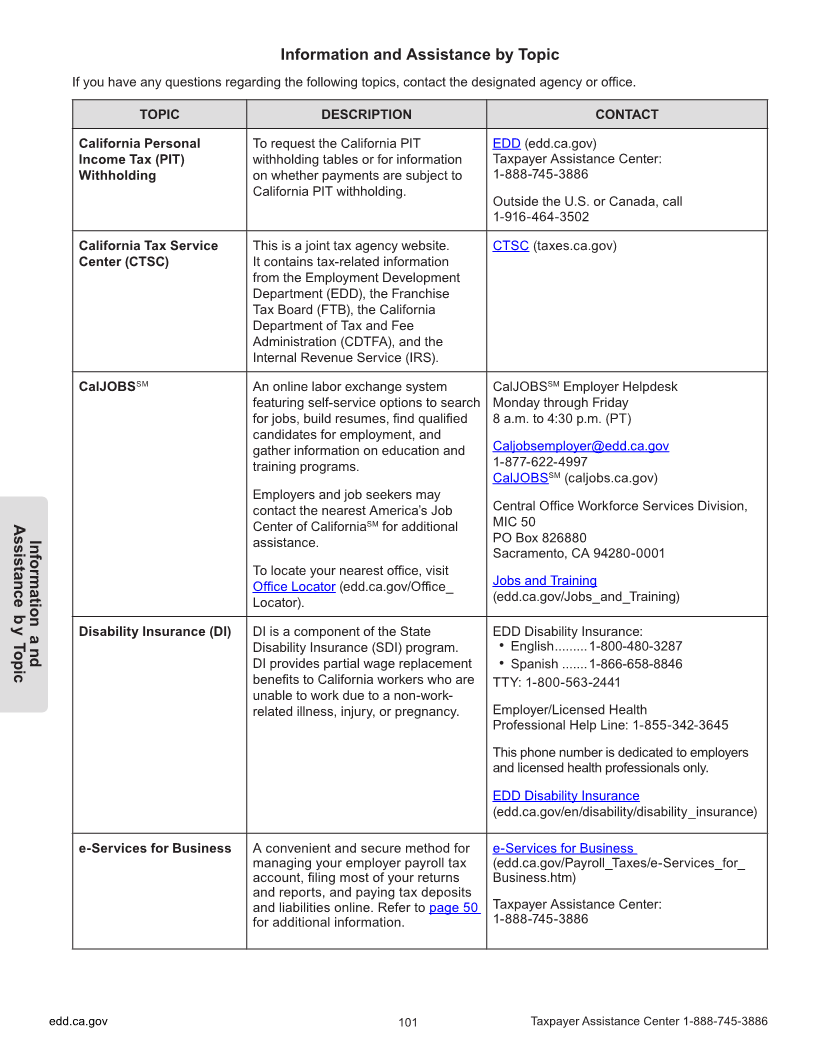

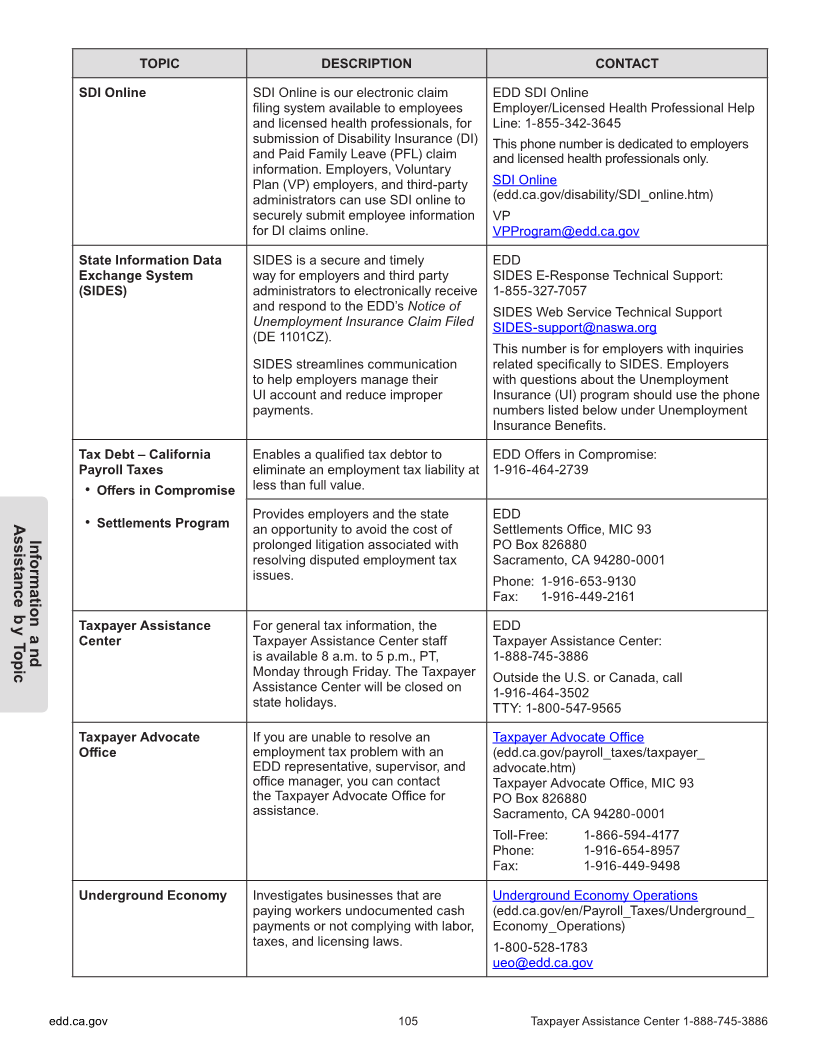

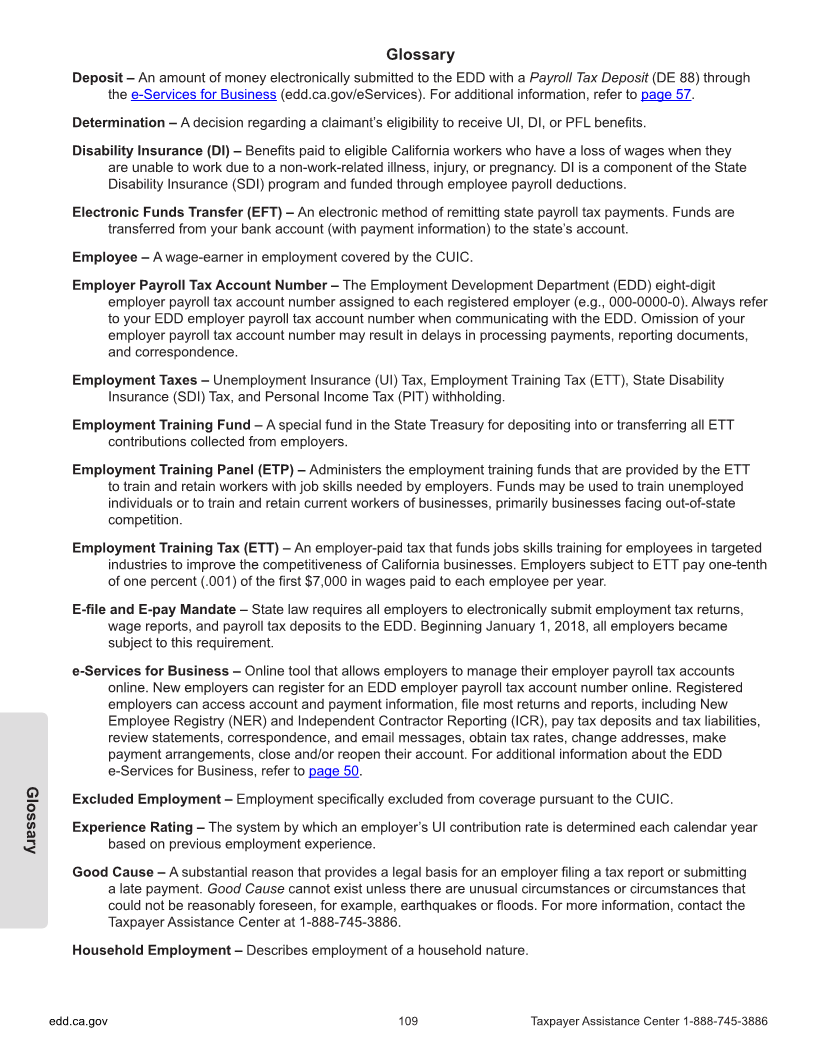

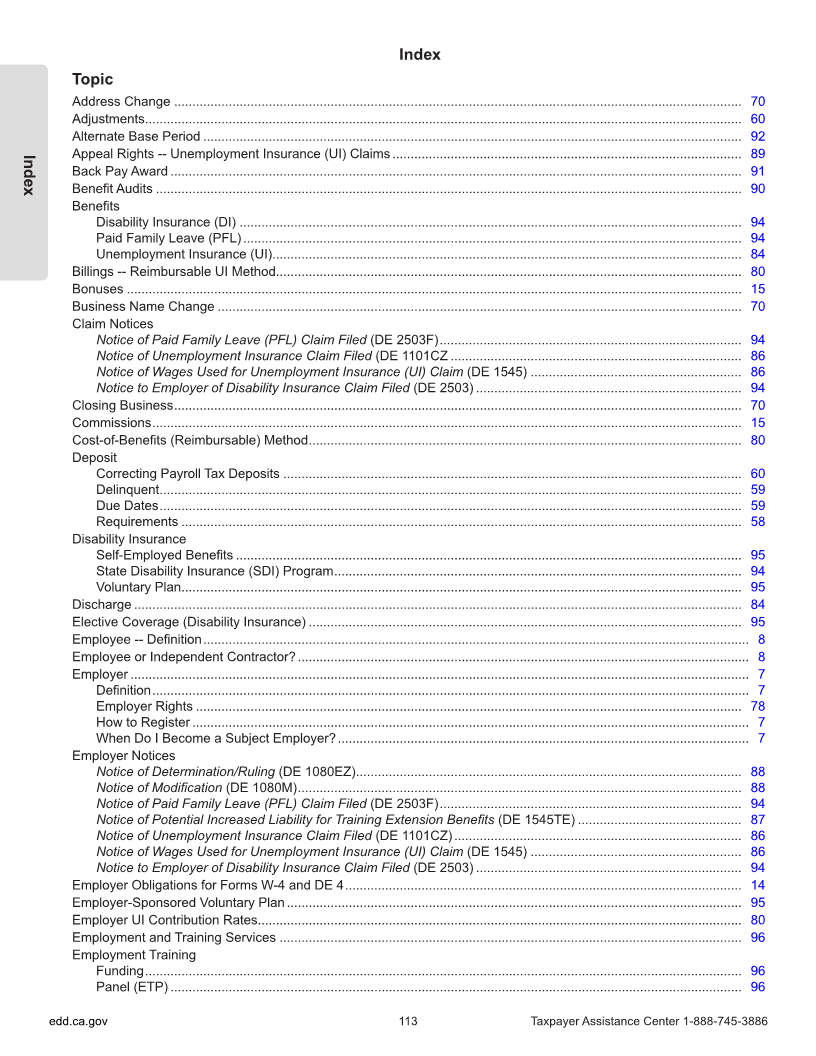

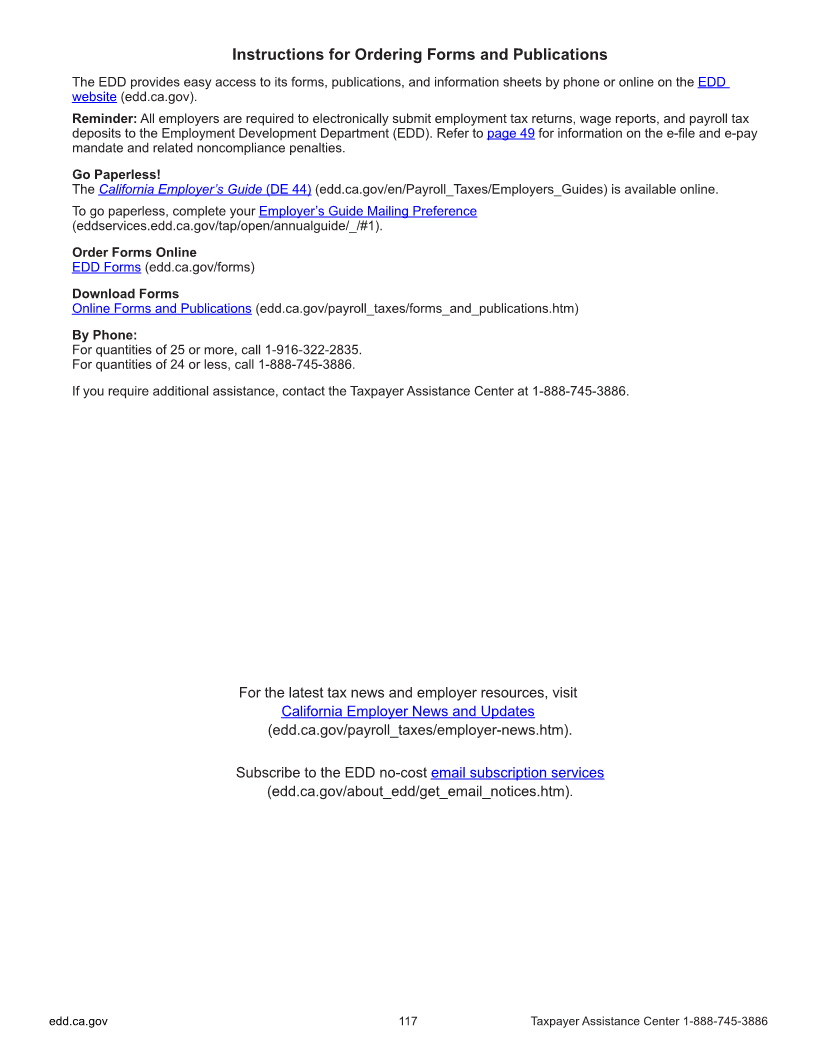

California Withholding Schedules for 2024

METHOD B---EXACT CALCULATION METHOD

TABLE 5 TAX RATE TABLE -

QUARTERLY PAYROLL PERIOD SEMI-ANNUAL PAYROLL PERIOD

SINGLE PERSONS, DUAL INCOME MARRIED, SINGLE PERSONS, DUAL INCOME MARRIED,

OR MARRIED WITH MULTIPLE EMPLOYERS OR MARRIED WITH MULTIPLE EMPLOYERS

IF THE TAXABLE IF THE TAXABLE

INCOME IS... THE COMPUTED TAX IS... INCOME IS... THE COMPUTED TAX IS...

OVER BUT NOT OF AMOUNT PLUS OVER BUT NOT OF AMOUNT PLUS

OVER OVER... OVER OVER...

$0 $2,603 ... 1.100% $0 $0.00 $0 $5,206 ... 1.100% $0 $0.00

$2,603 $6,171 ... 2.200% $2,603 $28.63 $5,206 $12,342 ... 2.200% $5,206 $57.27

$6,171 $9,740 ... 4.400% $6,171 $107.13 $12,342 $19,480 ... 4.400% $12,342 $214.26

$9,740 $13,520 ... 6.600% $9,740 $264.17 $19,480 $27,040 ... 6.600% $19,480 $528.33

$13,520 $17,088 ... 8.800% $13,520 $513.65 $27,040 $34,176 ... 8.800% $27,040 $1,027.29

$17,088 $87,284 ... 10.230% $17,088 $827.63 $34,176 $174,568 ... 10.230% $34,176 $1,655.26

$87,284 $104,740 ... 11.330% $87,284 $8,008.68 $174,568 $209,480 ... 11.330% $174,568 $16,017.36

$104,740 $174,568 ... 12.430% $104,740 $9,986.44 $209,480 $349,136 ... 12.430% $209,480 $19,972.89

$174,568 $250,000 ... 13.530% $174,568 $18,666.06 $349,136 $500,000 ... 13.530% $349,136 $37,332.13

$250,000 and over ... 14.630% $250,000 $28,872.01 $500,000 and over ... 14.630% $500,000 $57,744.03

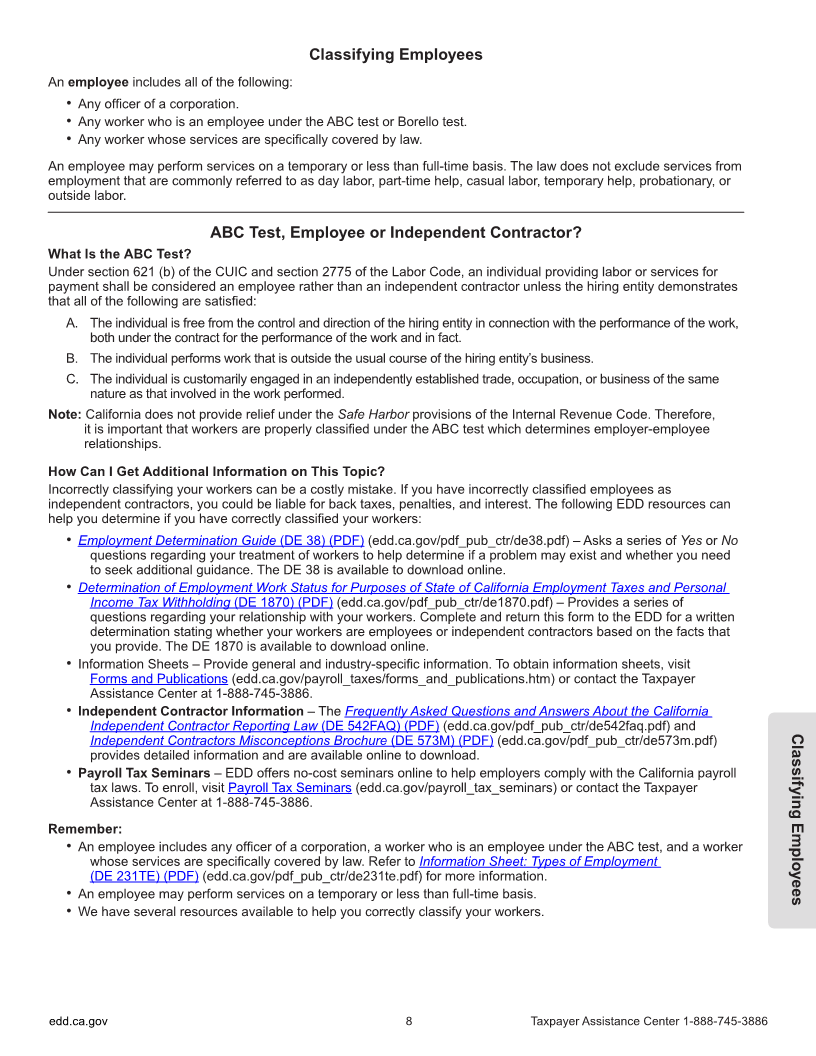

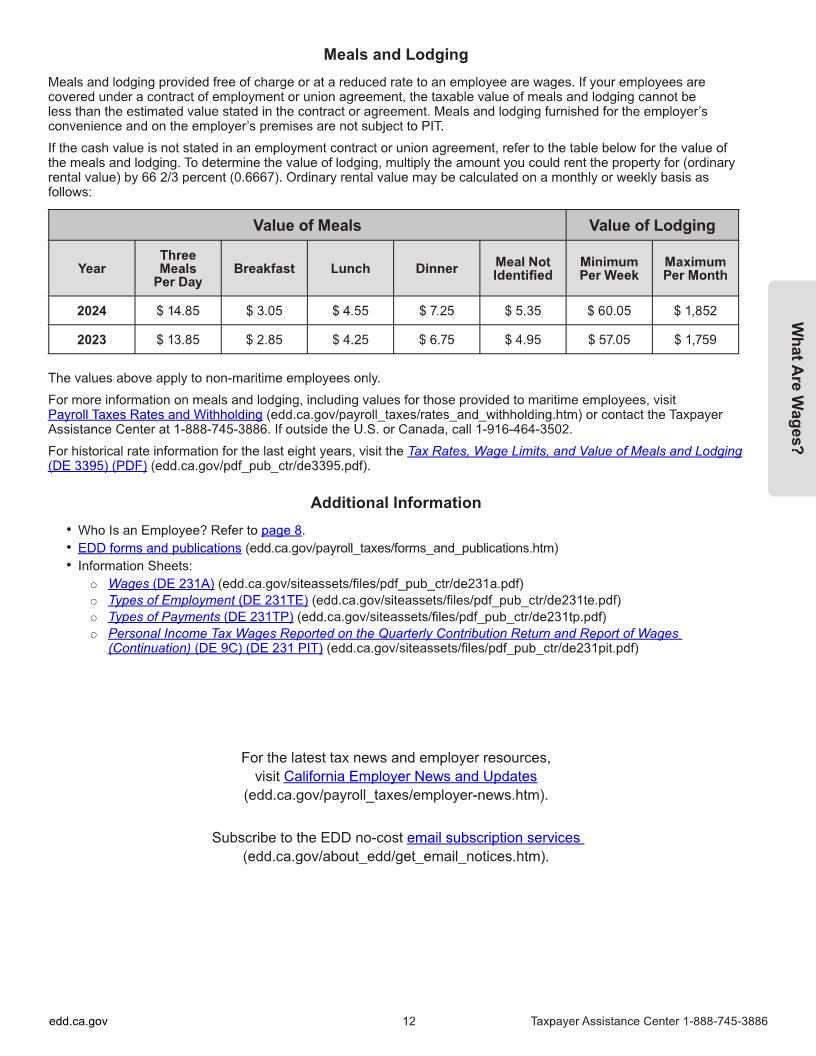

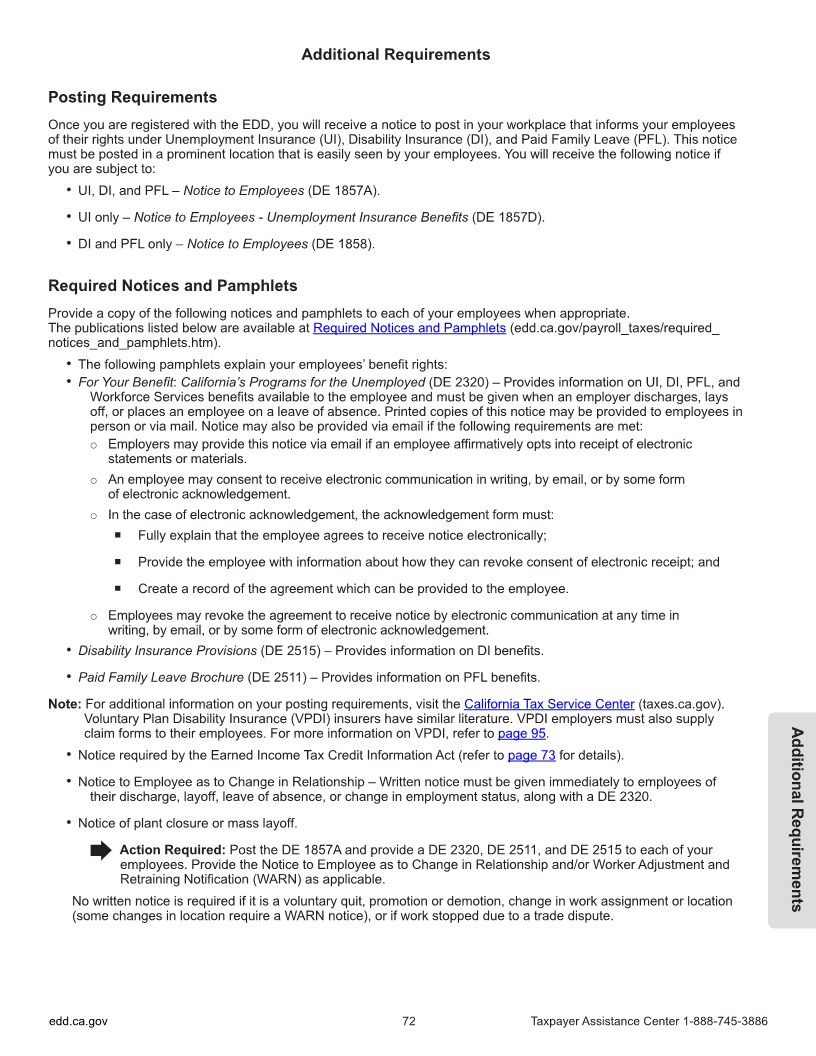

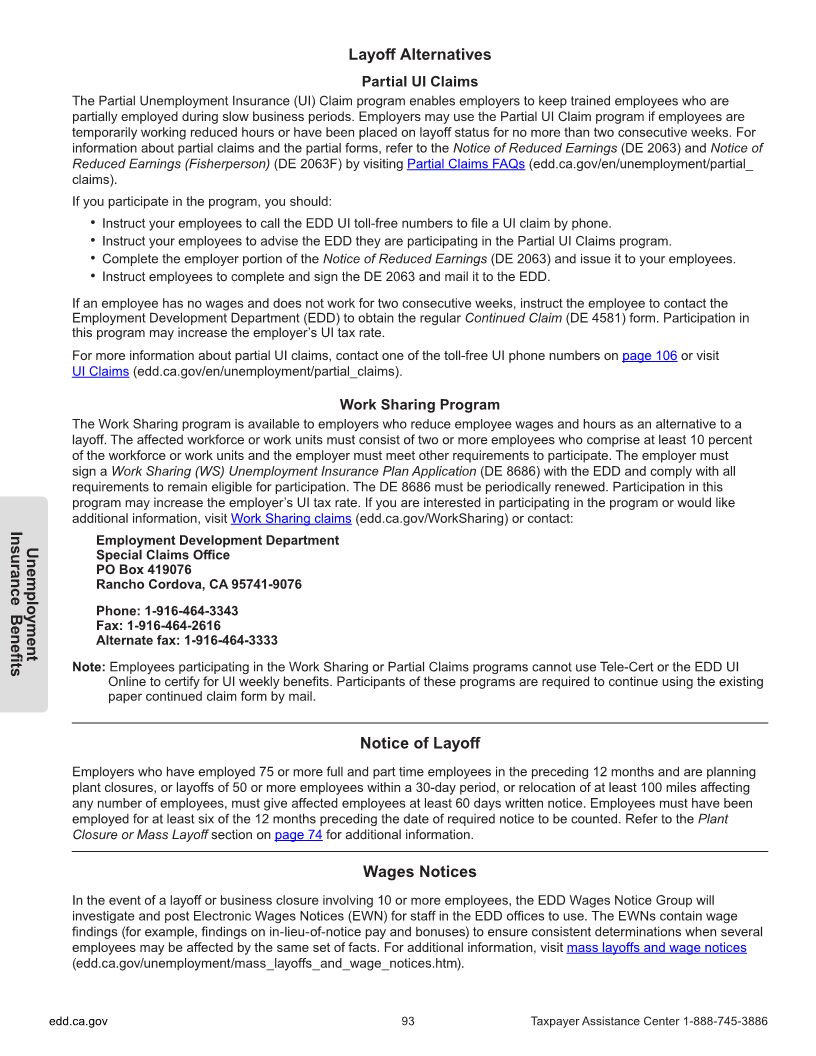

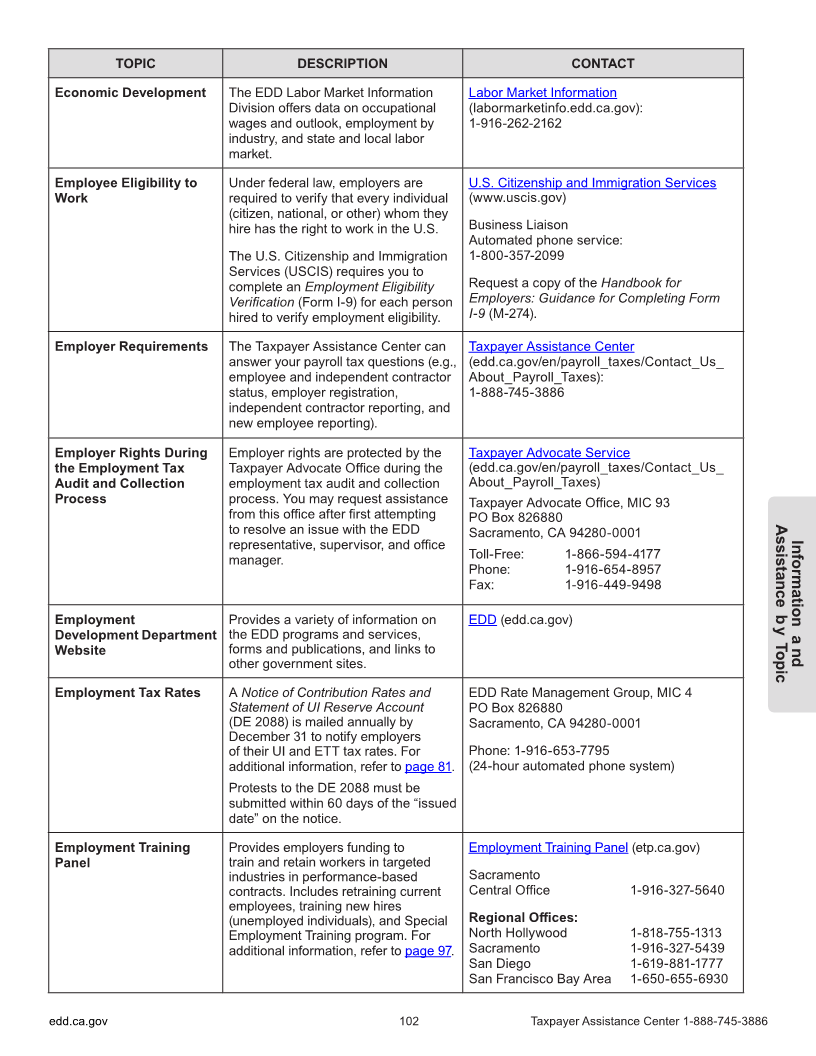

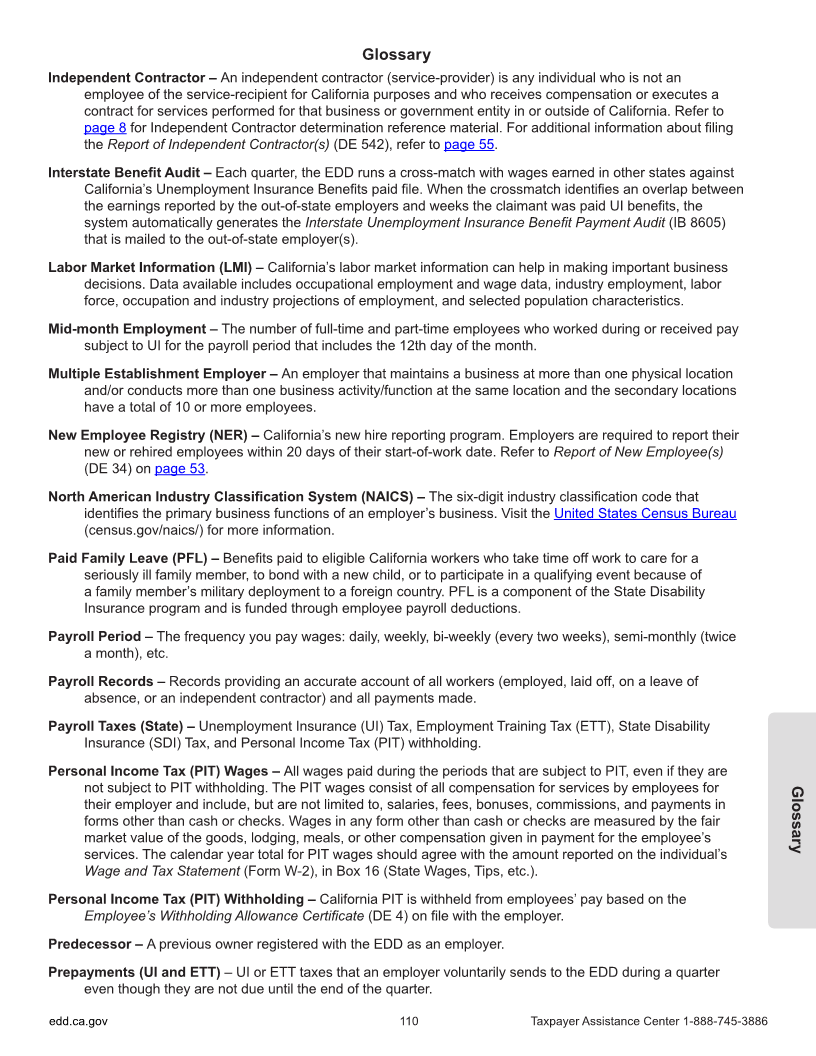

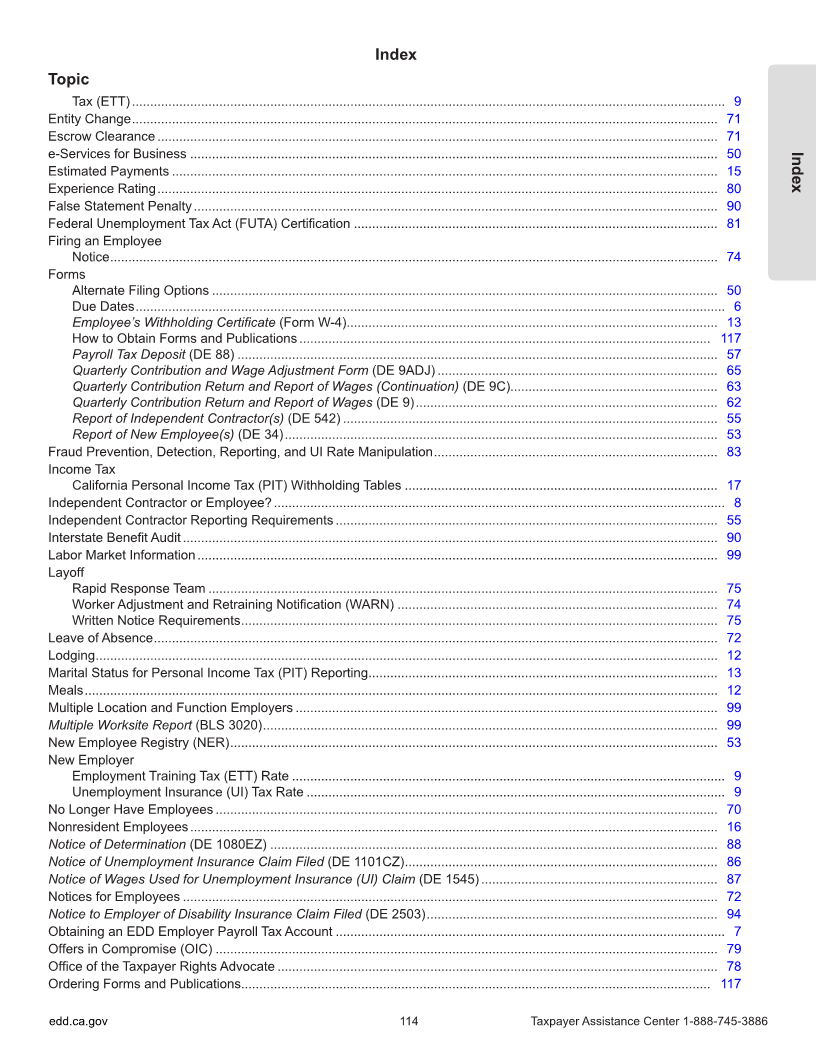

MARRIED PERSONS MARRIED PERSONS

IF THE TAXABLE IF THE TAXABLE

INCOME IS... THE COMPUTED TAX IS... INCOME IS... THE COMPUTED TAX IS...

OVER BUT NOT OF AMOUNT PLUS OVER BUT NOT OF AMOUNT PLUS

OVER OVER... OVER OVER...

$0 $5,206 ... 1.100% $0 $0.00 $0 $10,412 ... 1.100% $0 $0.00

$5,206 $12,342 ... 2.200% $5,206 $57.27 $10,412 $24,684 ... 2.200% $10,412 $114.53

$12,342 $19,480 ... 4.400% $12,342 $214.26 $24,684 $38,960 ... 4.400% $24,684 $428.51

$19,480 $27,040 ... 6.600% $19,480 $528.33 $38,960 $54,080 ... 6.600% $38,960 $1,056.65

$27,040 $34,176 ... 8.800% $27,040 $1,027.29 $54,080 $68,352 ... 8.800% $54,080 $2,054.57

$34,176 $174,568 ... 10.230% $34,176 $1,655.26 $68,352 $349,136 ... 10.230% $68,352 $3,310.51

$174,568 $209,480 ... 11.330% $174,568 $16,017.36 $349,136 $418,960 ... 11.330% $349,136 $32,034.71

$209,480 $250,000 ... 12.430% $209,480 $19,972.89 $418,960 $500,000 ... 12.430% $418,960 $39,945.77

$250,000 $349,136 ... 13.530% $250,000 $25,009.53 $500,000 $698,272 ... 13.530% $500,000 $50,019.04

$349,136 and over ... 14.630% $349,136 $38,422.63 $698,272 and over ... 14.630% $698,272 $76,845.24

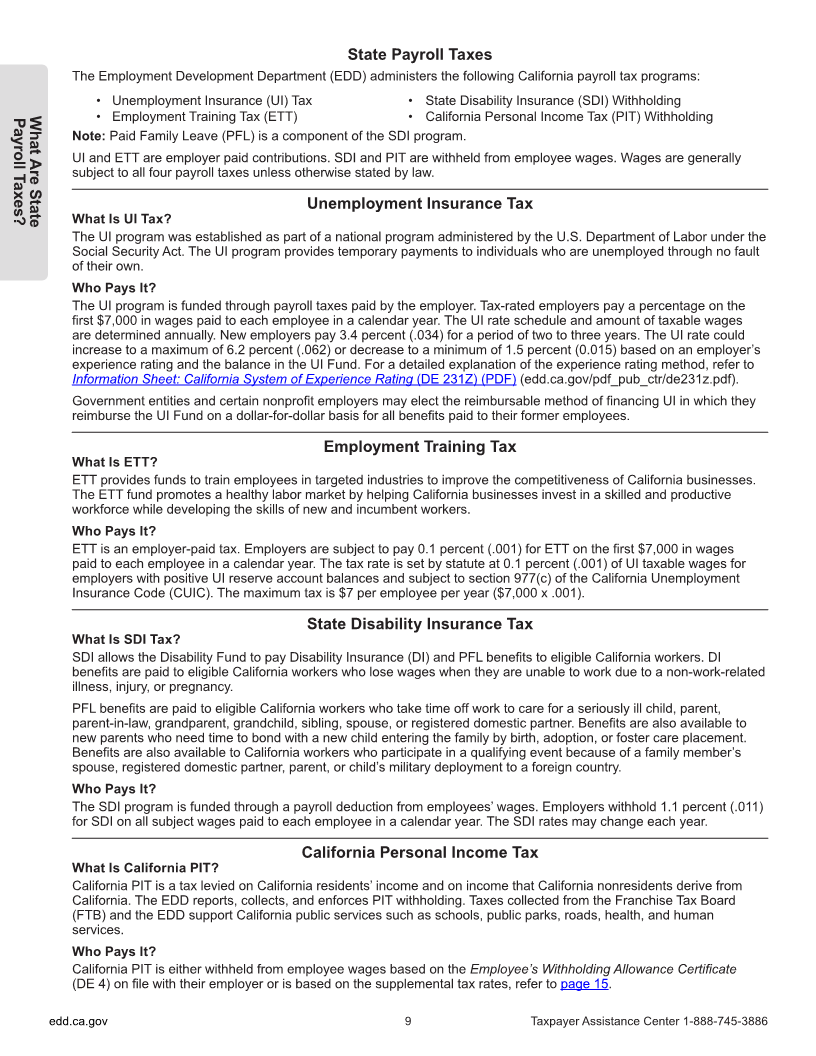

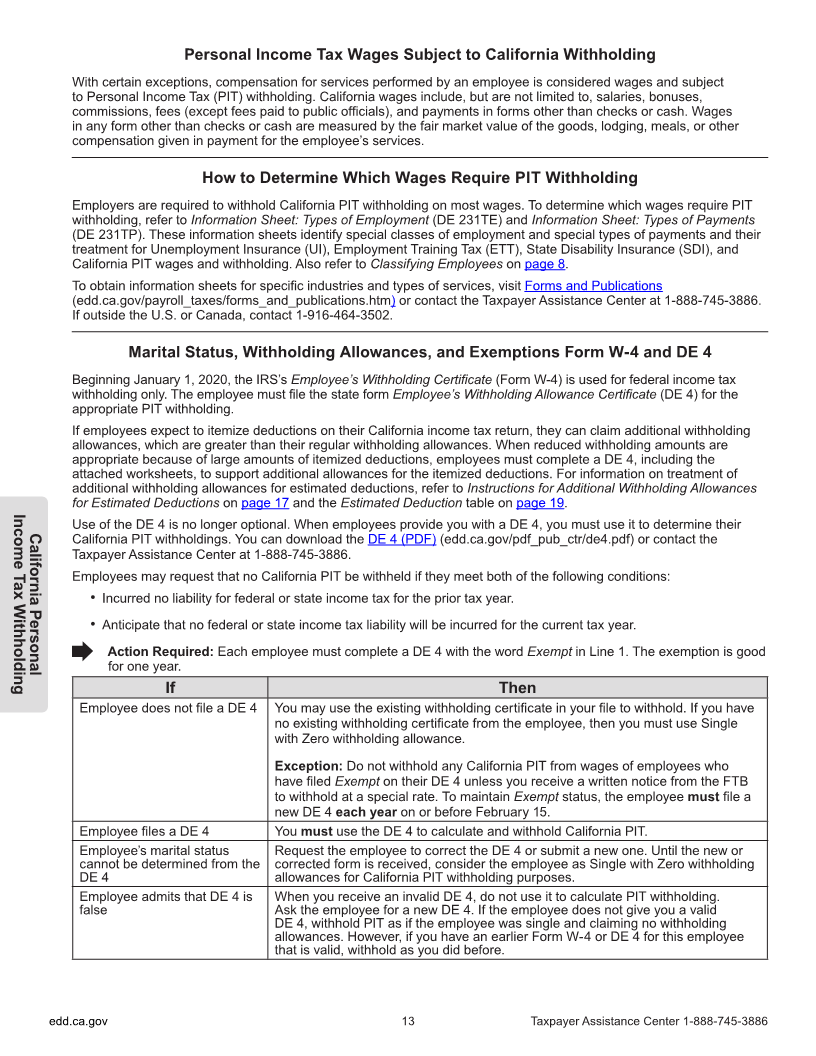

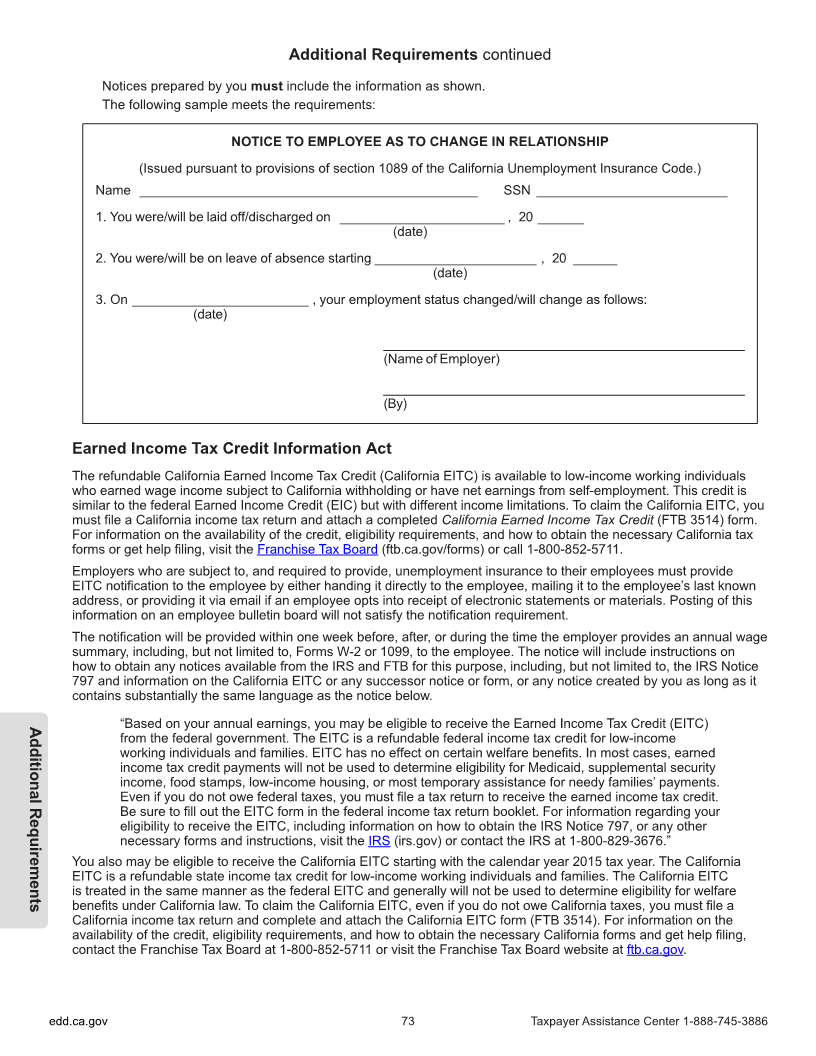

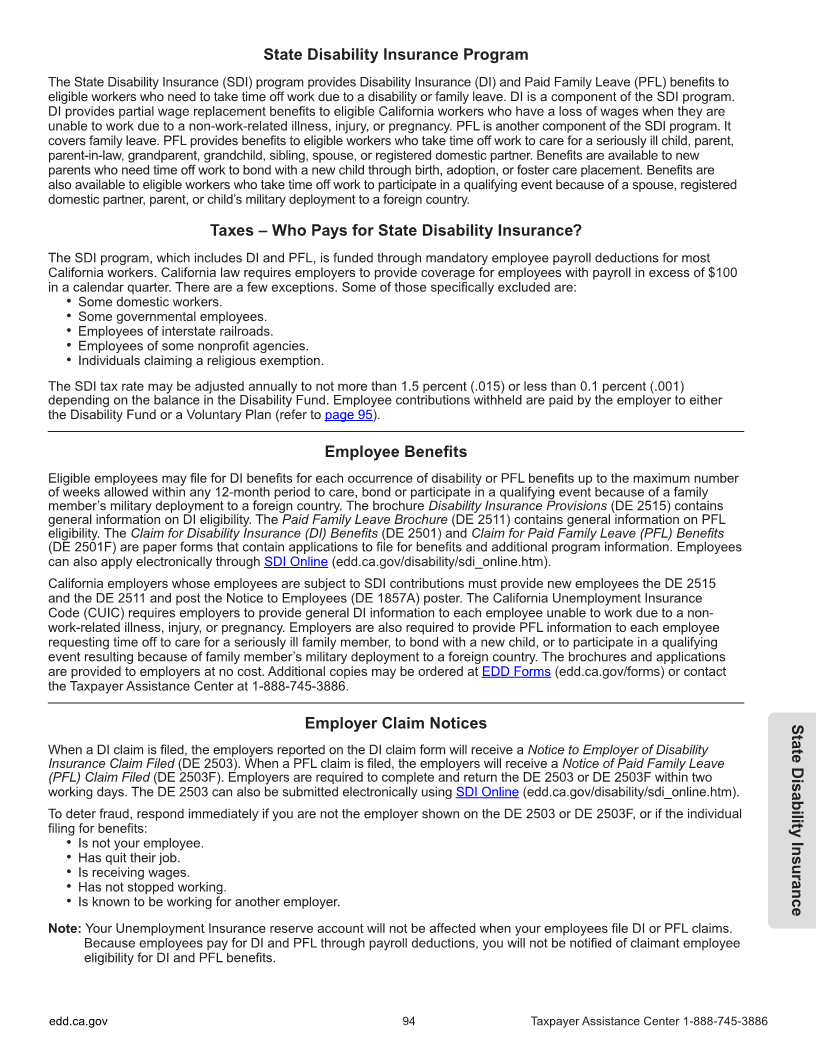

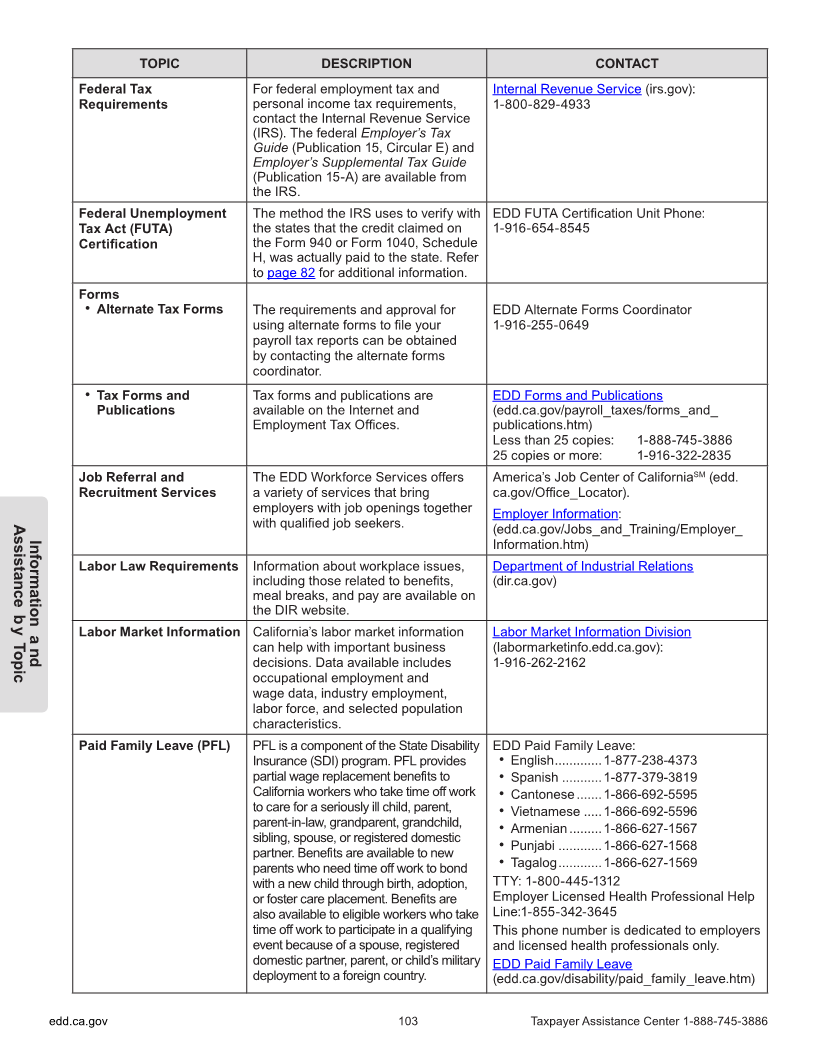

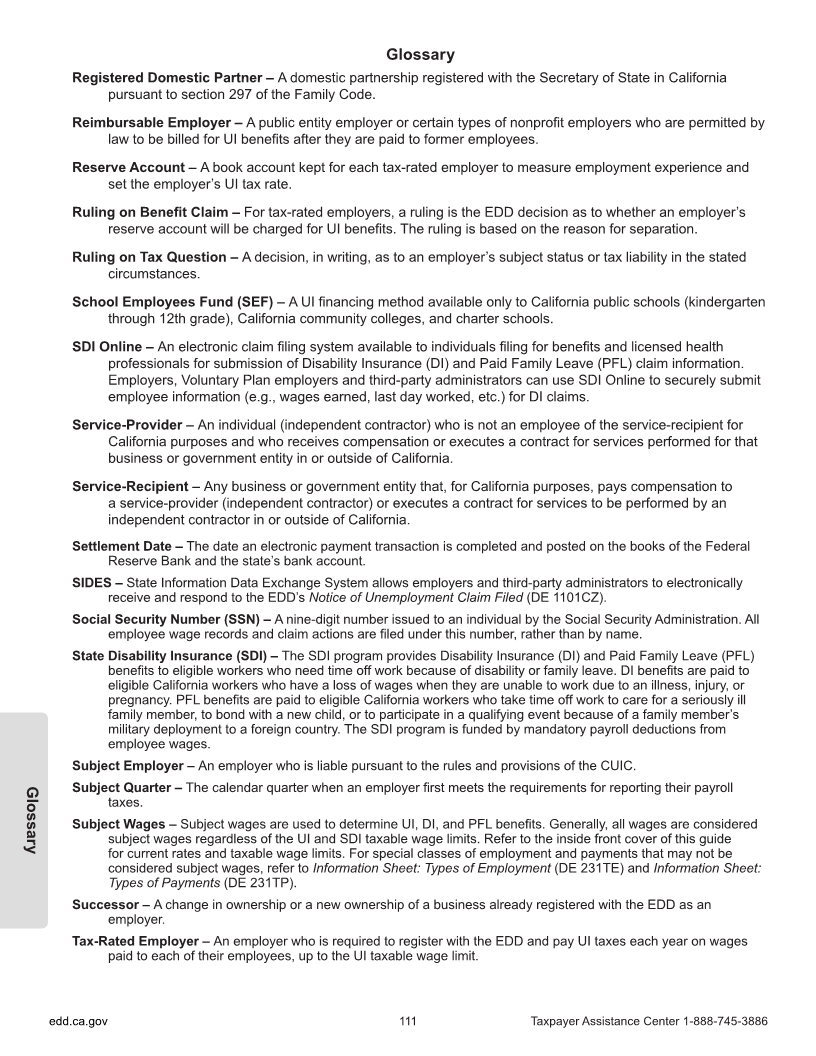

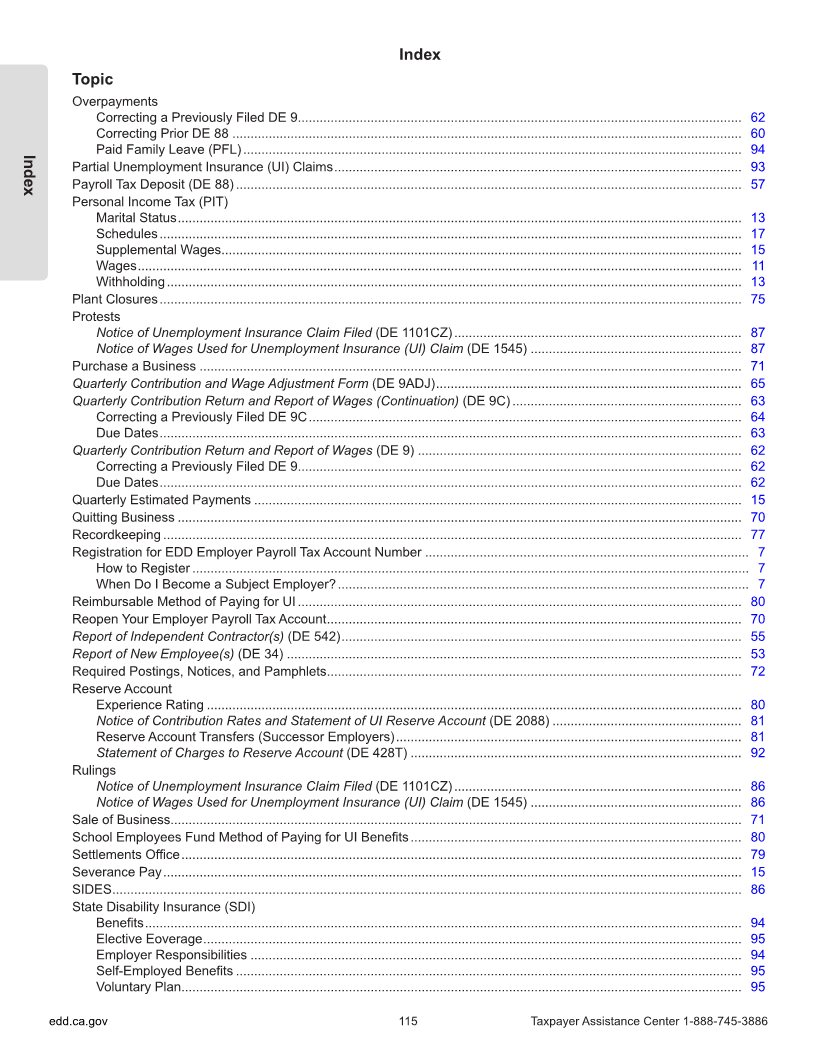

UNMARRIED/HEAD OF HOUSEHOLD UNMARRIED/HEAD OF HOUSEHOLD

IF THE TAXABLE IF THE TAXABLE

INCOME IS... THE COMPUTED TAX IS... INCOME IS... THE COMPUTED TAX IS... California Withholding

Schedules For 2024

OVER BUT NOT OF AMOUNT PLUS OVER BUT NOT OF AMOUNT PLUS

OVER OVER... OVER OVER...

$0 $5,210 ... 1.100% $0 $0.00 $0 $10,420 ... 1.100% $0 $0.00

$5,210 $12,343 ... 2.200% $5,210 $57.31 $10,420 $24,686 ... 2.200% $10,420 $114.62

$12,343 $15,911 ... 4.400% $12,343 $214.24 $24,686 $31,822 ... 4.400% $24,686 $428.47

$15,911 $19,691 ... 6.600% $15,911 $371.23 $31,822 $39,382 ... 6.600% $31,822 $742.45

$19,691 $23,259 ... 8.800% $19,691 $620.71 $39,382 $46,518 ... 8.800% $39,382 $1,241.41

$23,259 $118,706 ... 10.230% $23,259 $934.69 $46,518 $237,412 ... 10.230% $46,518 $1,869.38

$118,706 $142,448 ... 11.330% $118,706 $10,698.92 $237,412 $284,896 ... 11.330% $237,412 $21,397.84

$142,448 $237,412 ... 12.430% $142,448 $13,388.89 $284,896 $474,824 ... 12.430% $284,896 $26,777.78

$237,412 $250,000 ... 13.530% $237,412 $25,192.92 $474,824 $500,000 ... 13.530% $474,824 $50,385.83

$250,000 and over ... 14.630% $250,000 $26,896.08 $500,000 and over ... 14.630% $500,000 $53,792.14

edd.ca.gov 46 Taxpayer Assistance Center 1-888-745-3886

|