Enlarge image

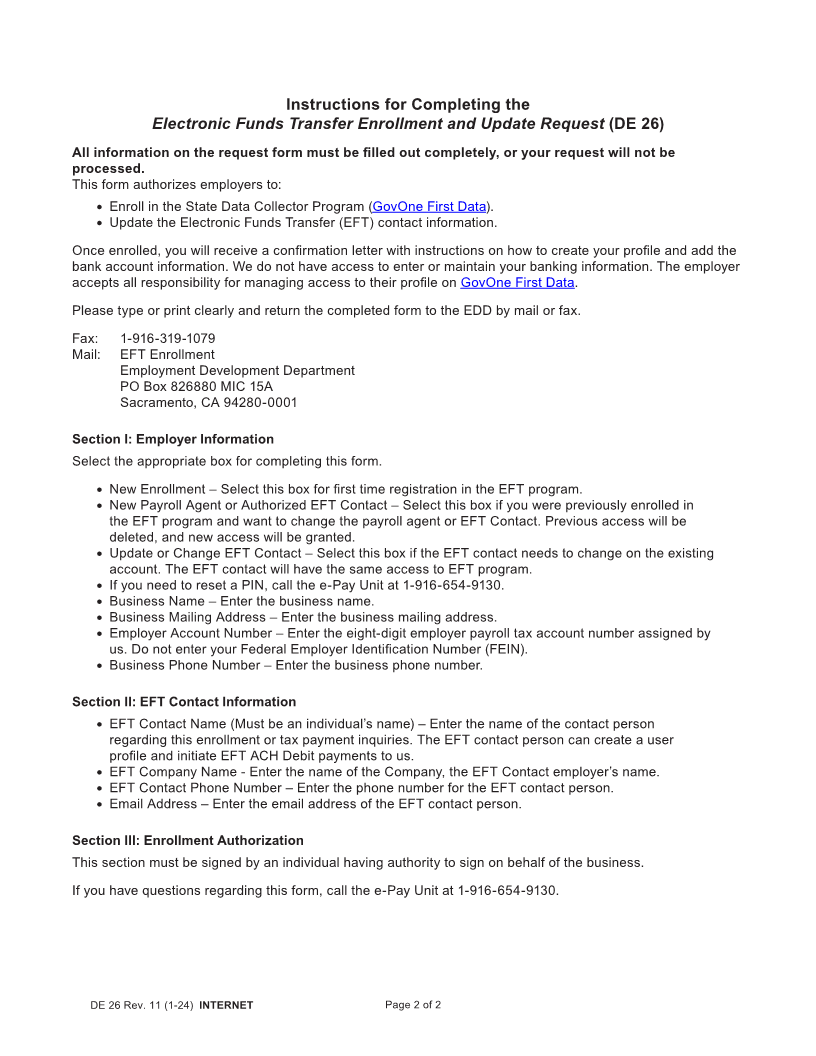

Department Use Only

Electronic Funds Transfer Enrollment and Update Request

This form allows employers to:

• Enroll in the State Data Collector Program (GovOne First Data).

• Update Electronic Funds Transfer (EFT) contact information on the current account.

For instructions, see page 2.

Complete all sections to ensure proper processing and authorization.

Section I: Employer Information (Must be completed)

Select the appropriate box: New Enrollment Update or Change EFT Contact

New Payroll Agent or Authorized EFT Contact

Business Name Employer Account Number

Business Mailing Address (Number, Street, or Box Number) Business Phone Number

Business Mailing Address (City, State, ZIP Code)

Section II: EFT Contact Information (Must be completed)

Person designated to create a user profile and initiate EFT Automated Clearing House (ACH) debit payments

to the Employment Development Department (EDD).

EFT Contact Name EFT Company Name

Email Address Phone Number

Section III: Enrollment Authorization (Must be completed)

I hereby authorize the EDD to enroll or update the employer payroll tax account in the State Data Collector

program as indicated above. I understand that once an enrollment is processed, a temporary security code

will be mailed to the address on record. I will be required to visit GovOne First Data (govone.com/PAYCAL) to

complete the remaining registration steps. This includes adding a bank account number and a routing number

before any payments can be initiated by me or the EFT contact person listed above.

Signature Title

Print Name Date Phone Number

Fax the completed form to 1-916-319-1079, or

Mail to EFT Enrollment

Employment Development Department

PO Box 826880 MIC 15A

Sacramento, CA 94280-0001

If you have questions regarding this form, call the e-Pay Unit at 1-916-654-9130.

DE 26 Rev. 11 (1-24) INTERNET Page 1 of 2 CU