- 29 -

Enlarge image

|

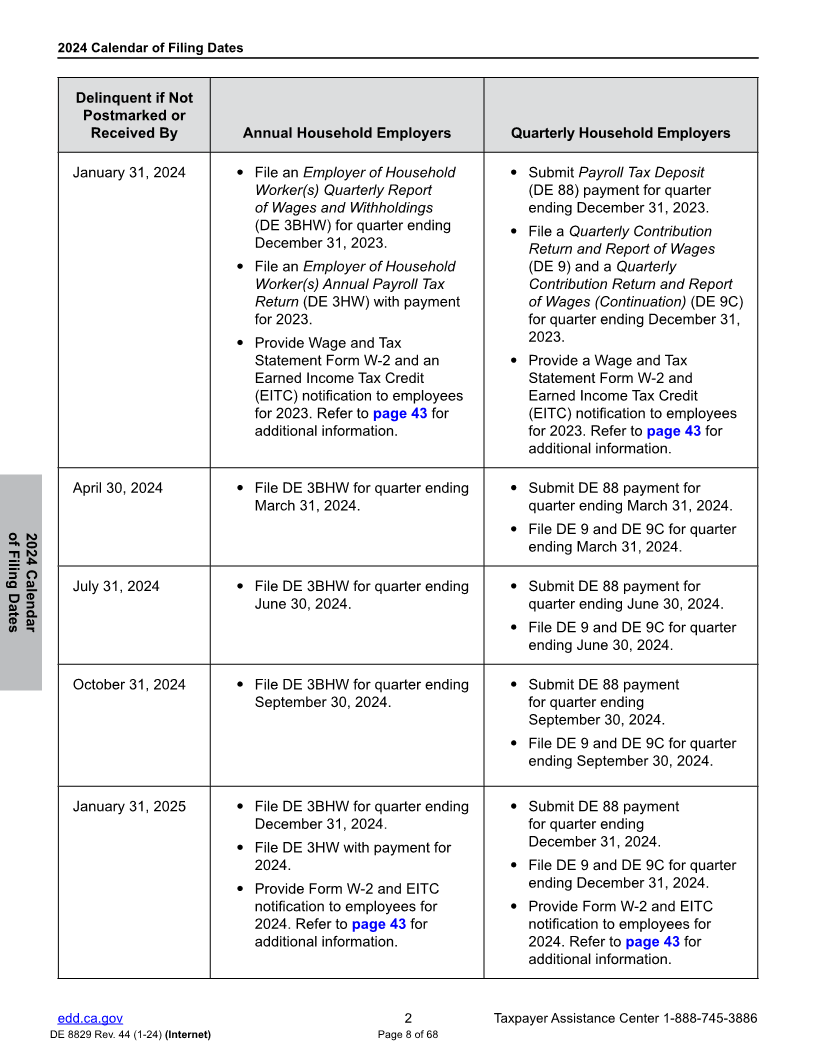

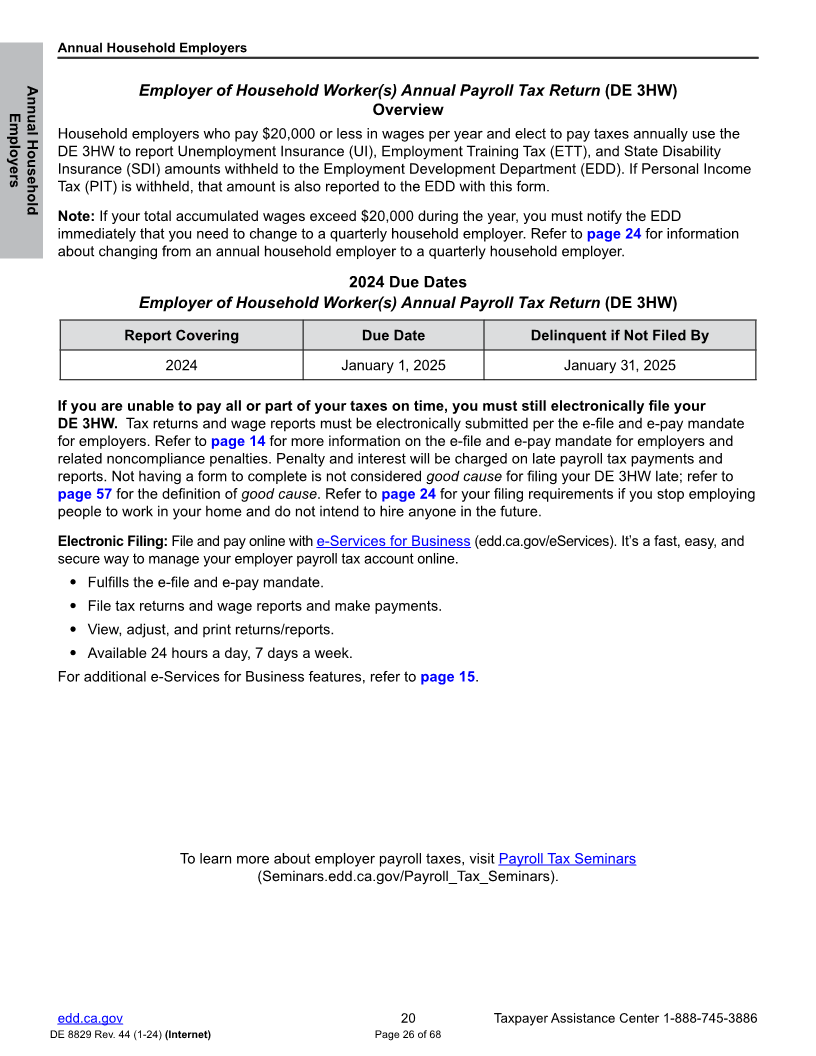

Annual Household Employers

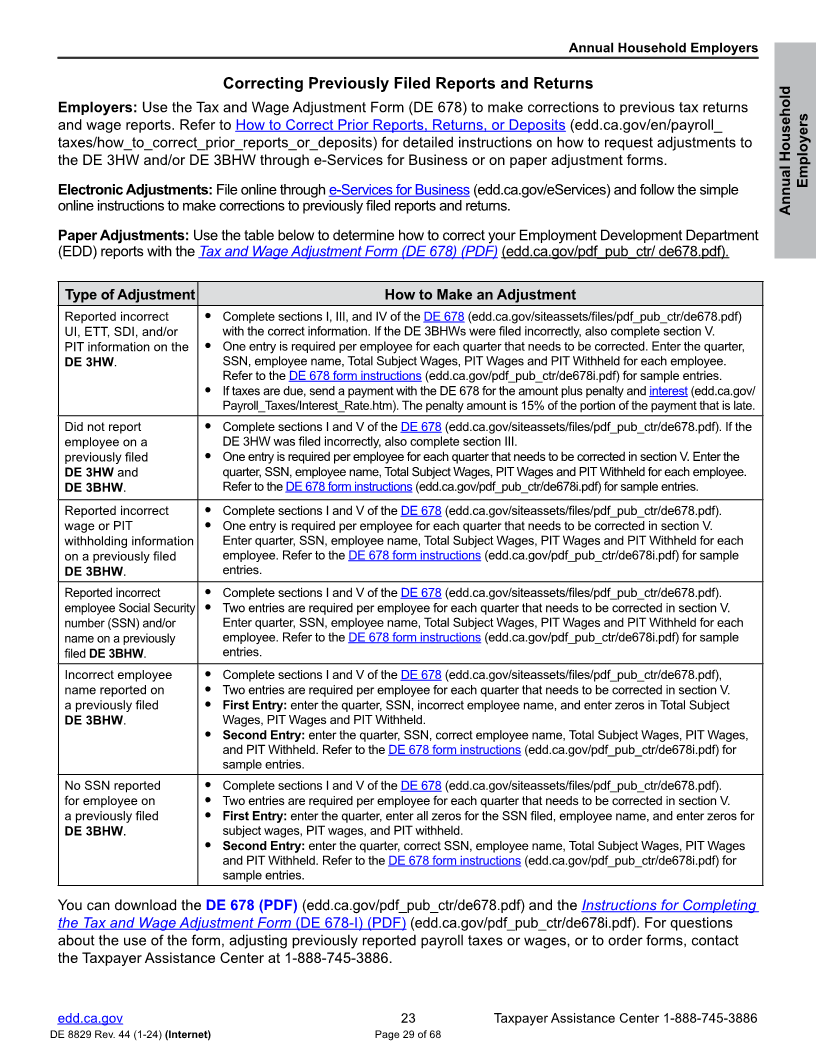

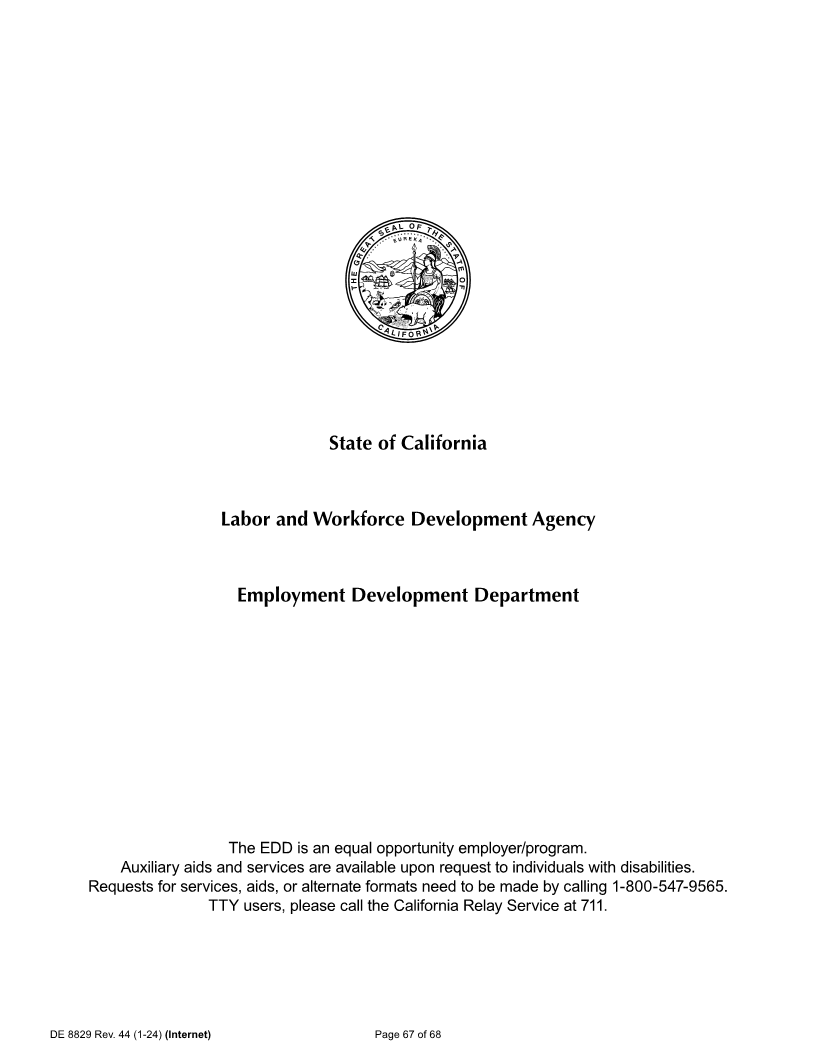

Correcting Previously Filed Reports and Returns

Employers: Use the Tax and Wage Adjustment Form (DE 678) to make corrections to previous tax returns

and wage reports. Refer to How to Correct Prior Reports, Returns, or Deposits (edd.ca.gov/en/payroll_

taxes/how_to_correct_prior_reports_or_deposits) for detailed instructions on how to request adjustments to

the DE 3HW and/or DE 3BHW through e-Services for Business or on paper adjustment forms.

Employers

Electronic Adjustments: File online throughe-Services for Business (edd.ca.gov/eServices) and follow the simple

online instructions to make corrections to previously filed reports and returns. Annual Household

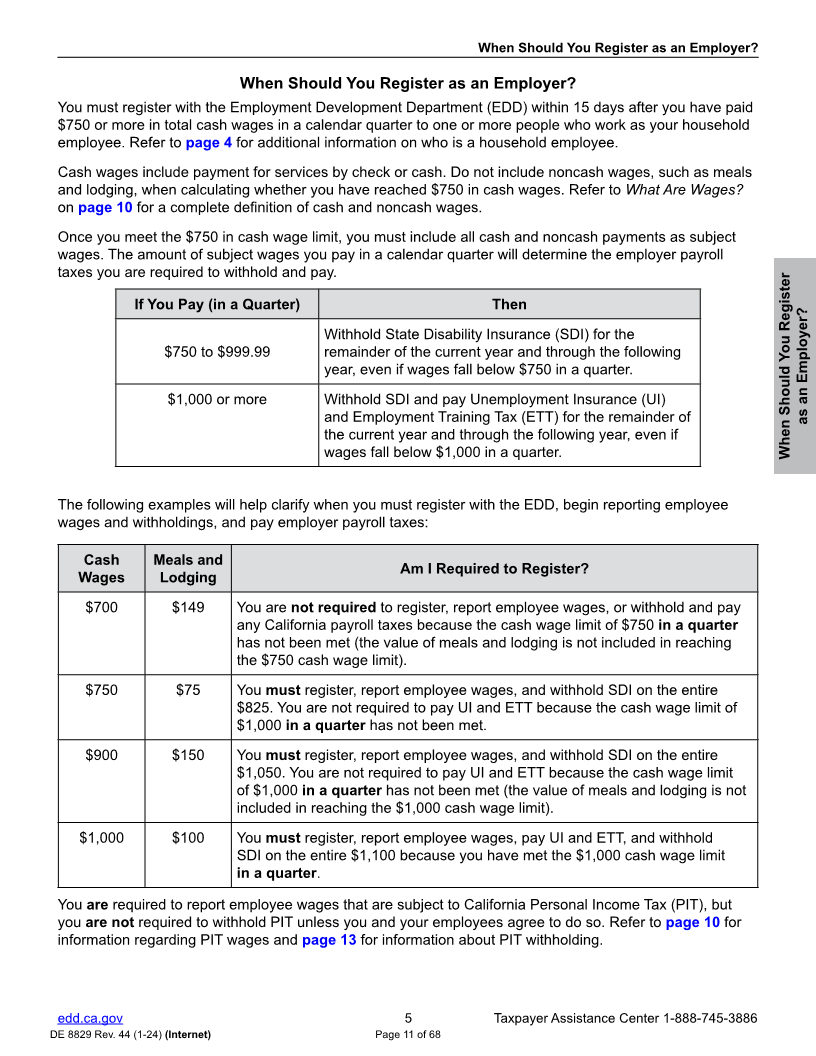

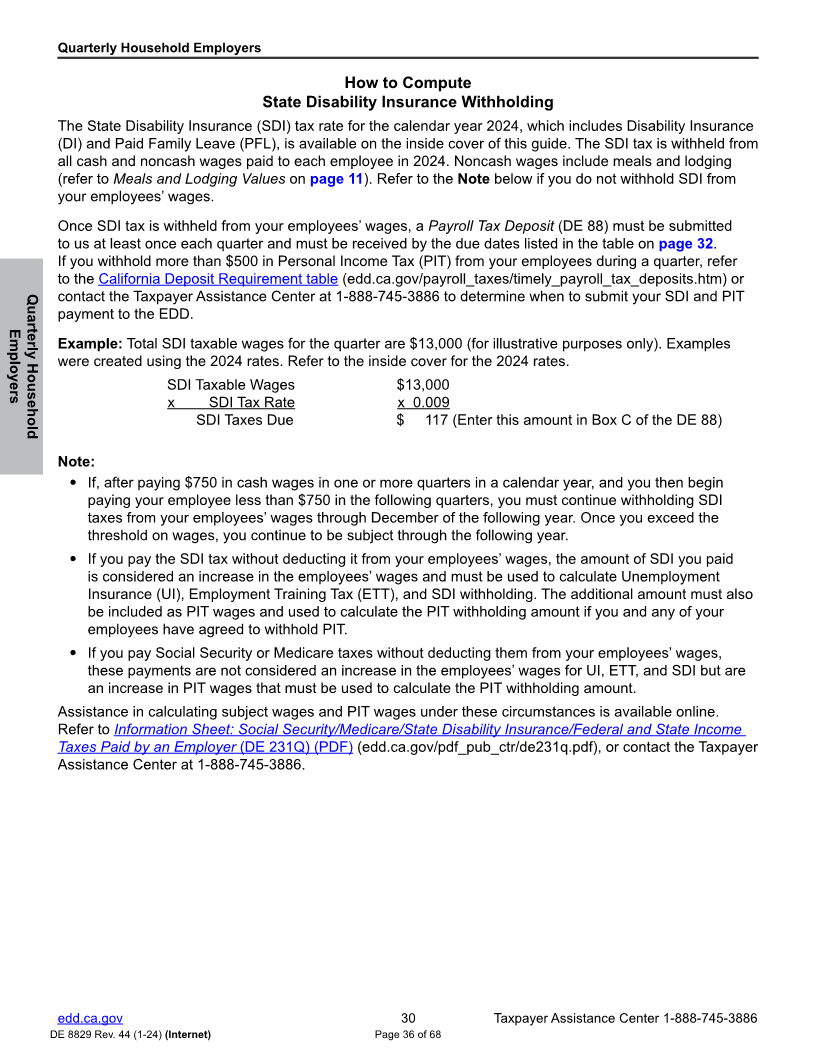

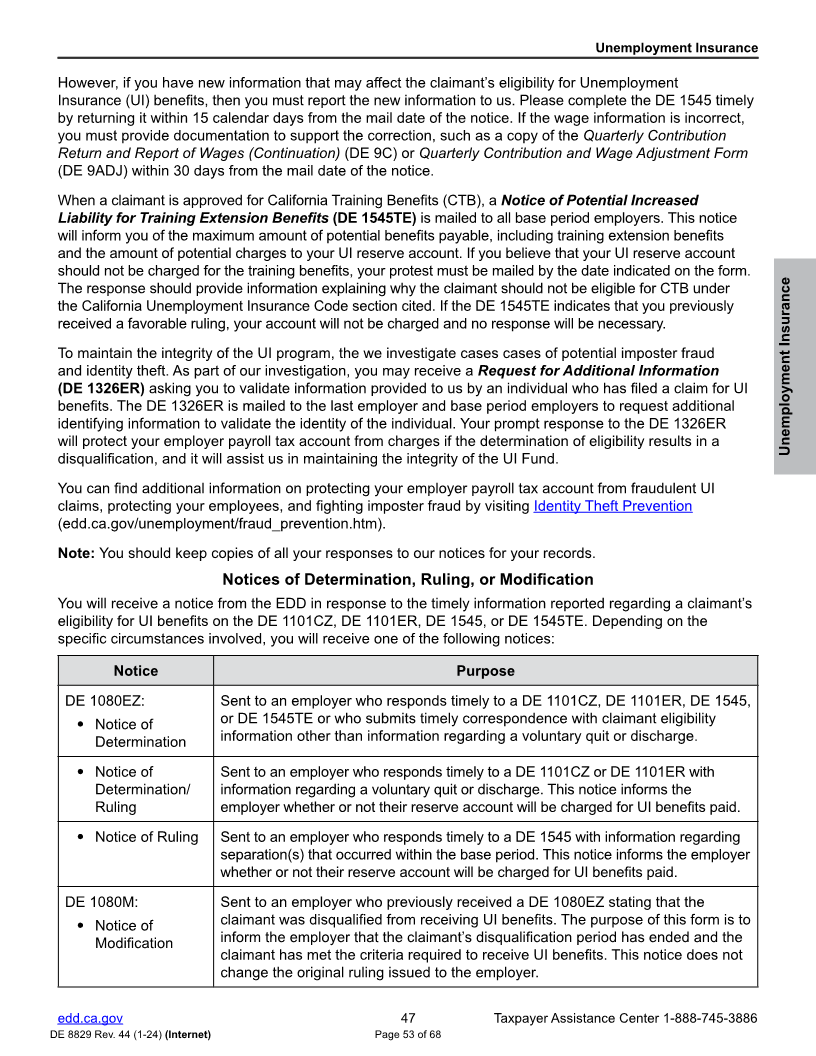

Paper Adjustments: Use the table below to determine how to correct your Employment Development Department

(EDD) reports with the Tax and Wage Adjustment Form (DE 678) (PDF) (edd.ca.gov/pdf_pub_ctr/ de678.pdf).

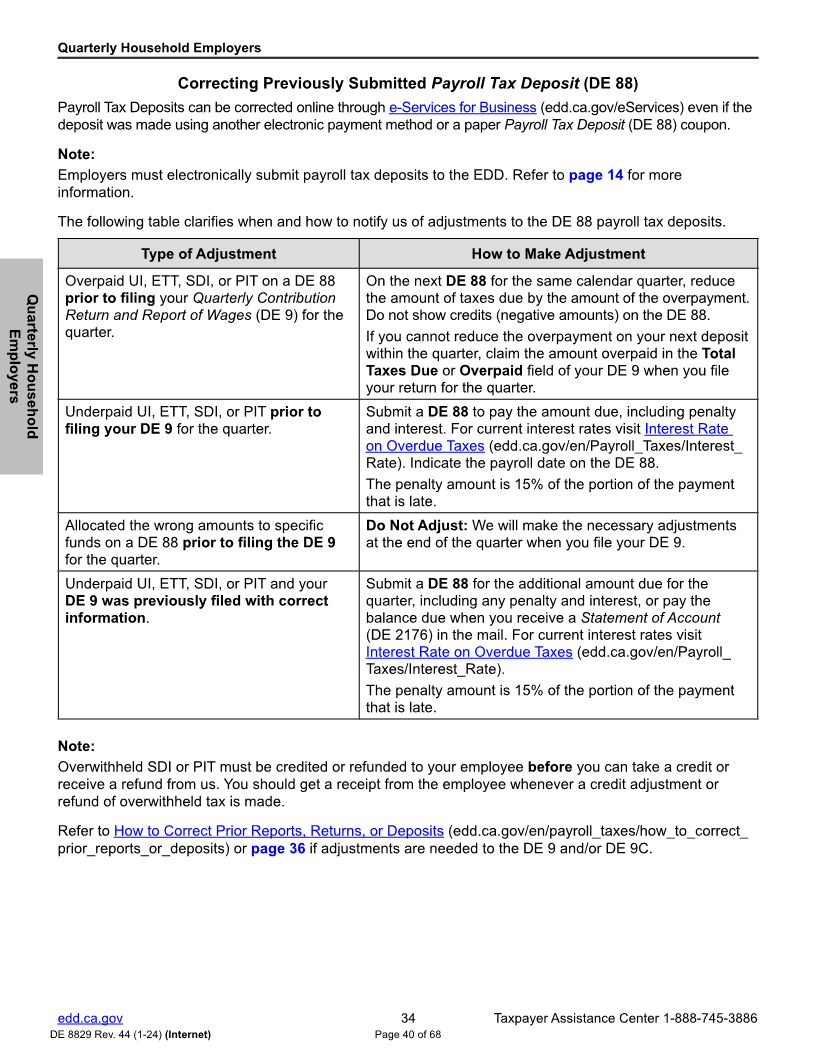

Type of Adjustment How to Make an Adjustment

Reported incorrect • Complete sections I, III, and IV of the DE 678 (edd.ca.gov/siteassets/files/pdf_pub_ctr/de678.pdf)

UI, ETT, SDI, and/or with the correct information. If the DE 3BHWs were filed incorrectly, also complete section V.

PIT information on the • One entry is required per employee for each quarter that needs to be corrected. Enter the quarter,

DE 3HW. SSN, employee name, Total Subject Wages, PIT Wages and PIT Withheld for each employee.

Refer to the DE 678 form instructions (edd.ca.gov/pdf_pub_ctr/de678i.pdf) for sample entries.

• If taxes are due, send a payment with the DE 678 for the amount plus penalty and interest (edd.ca.gov/

Payroll_Taxes/Interest_Rate.htm). The penalty amount is 15% of the portion of the payment that is late.

Did not report • Complete sections I and V of the DE 678 (edd.ca.gov/siteassets/files/pdf_pub_ctr/de678.pdf). If the

employee on a DE 3HW was filed incorrectly, also complete section III.

previously filed • One entry is required per employee for each quarter that needs to be corrected in section V. Enter the

DE 3HW and quarter, SSN, employee name, Total Subject Wages, PIT Wages and PIT Withheld for each employee.

DE 3BHW. Refer to the DE 678 form instructions (edd.ca.gov/pdf_pub_ctr/de678i.pdf) for sample entries.

Reported incorrect • Complete sections I and V of the DE 678 (edd.ca.gov/siteassets/files/pdf_pub_ctr/de678.pdf).

wage or PIT • One entry is required per employee for each quarter that needs to be corrected in section V.

withholding information Enter quarter, SSN, employee name, Total Subject Wages, PIT Wages and PIT Withheld for each

on a previously filed employee. Refer to the DE 678 form instructions (edd.ca.gov/pdf_pub_ctr/de678i.pdf) for sample

DE 3BHW. entries.

Reported incorrect • Complete sections I and V of the DE 678 (edd.ca.gov/siteassets/files/pdf_pub_ctr/de678.pdf).

employee Social Security • Two entries are required per employee for each quarter that needs to be corrected in section V.

number (SSN) and/or Enter quarter, SSN, employee name, Total Subject Wages, PIT Wages and PIT Withheld for each

name on a previously employee. Refer to the DE 678 form instructions (edd.ca.gov/pdf_pub_ctr/de678i.pdf) for sample

filed DE 3BHW. entries.

Incorrect employee • Complete sections I and V of the DE 678 (edd.ca.gov/siteassets/files/pdf_pub_ctr/de678.pdf),

name reported on • Two entries are required per employee for each quarter that needs to be corrected in section V.

a previously filed • First Entry: enter the quarter, SSN, incorrect employee name, and enter zeros in Total Subject

DE 3BHW. Wages, PIT Wages and PIT Withheld.

• Second Entry: enter the quarter, SSN, correct employee name, Total Subject Wages, PIT Wages,

and PIT Withheld. Refer to the DE 678 form instructions (edd.ca.gov/pdf_pub_ctr/de678i.pdf) for

sample entries.

No SSN reported • Complete sections I and V of the DE 678 (edd.ca.gov/siteassets/files/pdf_pub_ctr/de678.pdf).

for employee on • Two entries are required per employee for each quarter that needs to be corrected in section V.

a previously filed • First Entry: enter the quarter, enter all zeros for the SSN filed, employee name, and enter zeros for

DE 3BHW. subject wages, PIT wages, and PIT withheld.

• Second Entry: enter the quarter, correct SSN, employee name, Total Subject Wages, PIT Wages

and PIT Withheld. Refer to the DE 678 form instructions (edd.ca.gov/pdf_pub_ctr/de678i.pdf) for

sample entries.

You can download the DE 678 (PDF) (edd.ca.gov/pdf_pub_ctr/de678.pdf) and the Instructions for Completing

the Tax and Wage Adjustment Form (DE 678-I) (PDF) (edd.ca.gov/pdf_pub_ctr/de678i.pdf). For questions

about the use of the form, adjusting previously reported payroll taxes or wages, or to order forms, contact

the Taxpayer Assistance Center at 1-888-745-3886.

edd.ca.gov 23 Taxpayer Assistance Center 1-888-745-3886

DE 8829 Rev. 44 (1-24) (Internet) Page 29 of 68

|