Enlarge image

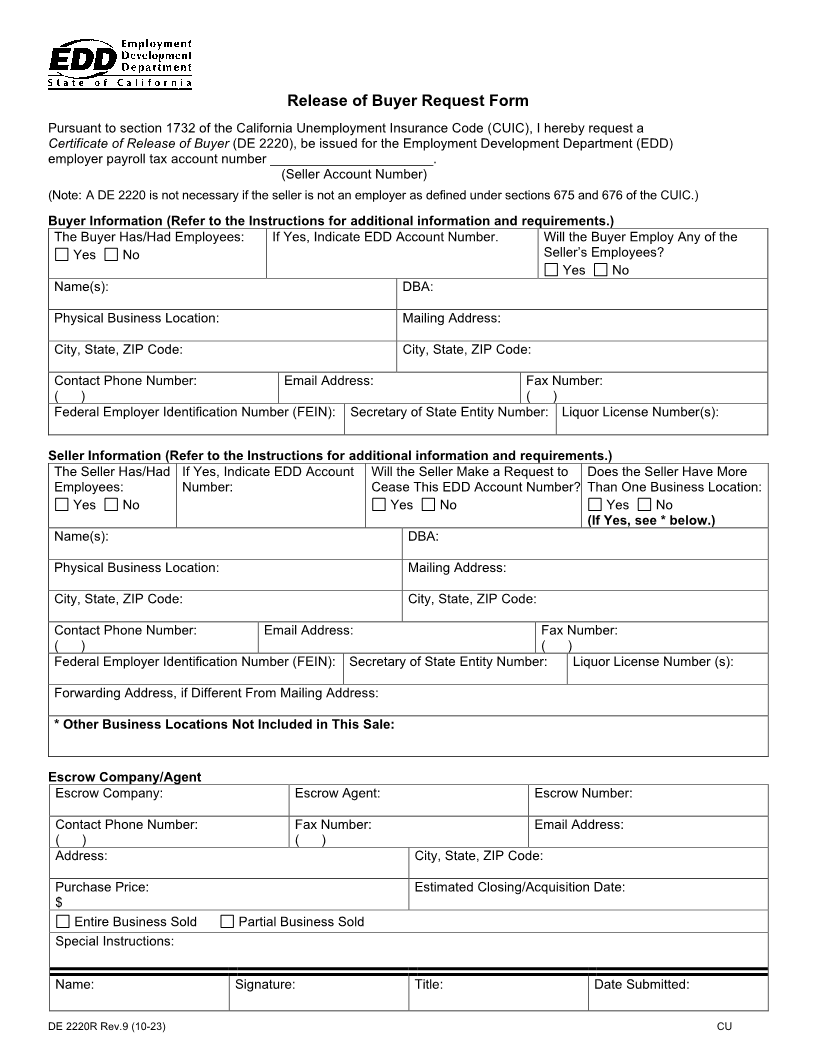

Release of Buyer Request Form

Pursuant to section 1732 of the California Unemployment Insurance Code (CUIC), I hereby request a

Certificate of Release of Buyer (DE 2220), be issued for the Employment Development Department (EDD)

employer payroll tax account number ______________________.

(Seller Account Number)

(Note: A DE 2220 is not necessary if the seller is not an employer as defined under sections 675 and 676 of the CUIC.)

Buyer Information (Refer to the Instructions for additional information and requirements.)

The Buyer Has/Had Employees: If Yes, Indicate EDD Account Number. Will the Buyer Employ Any of the

Yes No Seller’s Employees?

Yes No

Name(s): DBA:

Physical Business Location: Mailing Address:

City, State, ZIP Code: City, State, ZIP Code:

Contact Phone Number: Email Address: Fax Number:

( ) ( )

Federal Employer Identification Number (FEIN): Secretary of State Entity Number: Liquor License Number(s):

Seller Information (Refer to the Instructions for additional information and requirements.)

The Seller Has/Had If Yes, Indicate EDD Account Will the Seller Make a Request to Does the Seller Have More

Employees: Number: Cease This EDD Account Number? Than One Business Location:

Yes No Yes No Yes No

(If Yes, see * below.)

Name(s): DBA:

Physical Business Location: Mailing Address:

City, State, ZIP Code: City, State, ZIP Code:

Contact Phone Number: Email Address: Fax Number:

( ) ( )

Federal Employer Identification Number (FEIN): Secretary of State Entity Number: Liquor License Number (s):

Forwarding Address, if Different From Mailing Address:

* Other Business Locations Not Included in This Sale:

Escrow Company/Agent

Escrow Company: Escrow Agent: Escrow Number:

Contact Phone Number: Fax Number: Email Address:

( ) ( )

Address: City, State, ZIP Code:

Purchase Price: Estimated Closing/Acquisition Date:

$

Entire Business Sold Partial Business Sold

Special Instructions:

Name: Signature: Title: Date Submitted:

DE 2220R Rev.9 (10-23) CU