Enlarge image

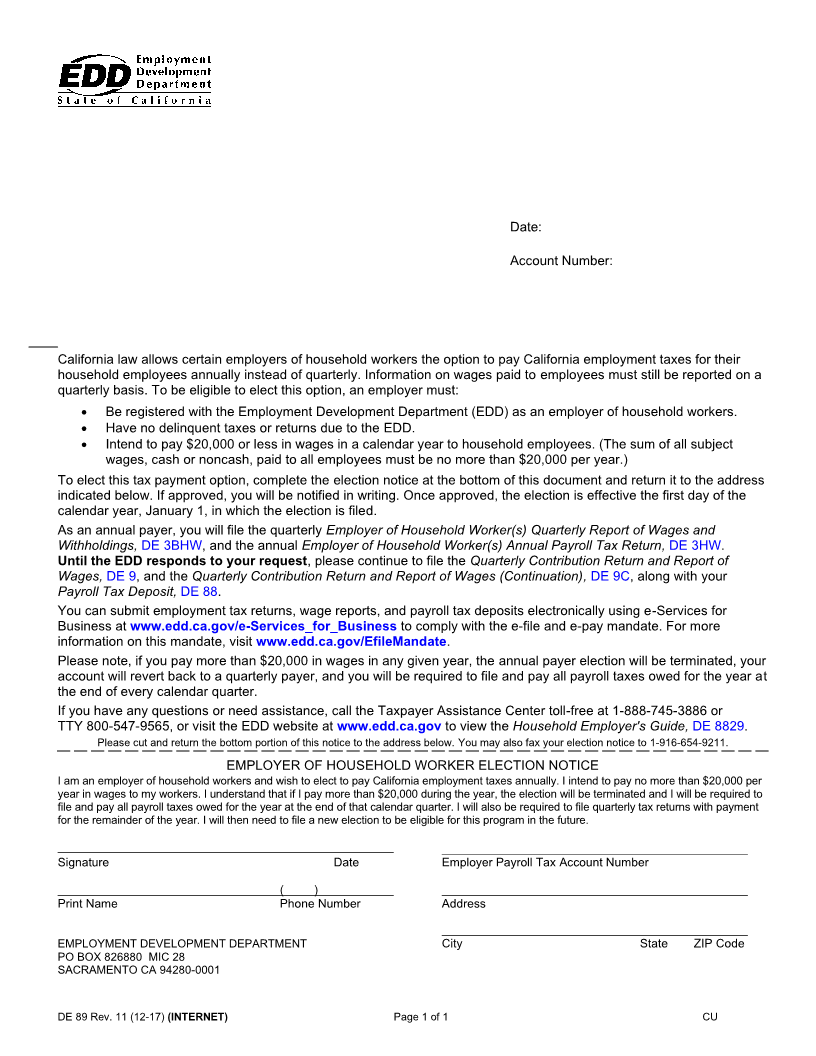

Date:

Account Number:

California law allows certain employers of household workers the option to pay California employment taxes for their

household employees annually instead of quarterly. Information on wages paid to employees must still be reported on a

quarterly basis. To be eligible to elect this option, an employer must:

• Be registered with the Employment Development Department (EDD) as an employer of household workers.

• Have no delinquent taxes or returns due to the EDD.

• Intend to pay $20,000 or less in wages in a calendar year to household employees. (The sum of all subject

wages, cash or noncash, paid to all employees must be no more than $20,000 per year.)

To elect this tax payment option, complete the election notice at the bottom of this document and return it to the address

indicated below. If approved, you will be notified in writing. Once approved, the election is effective the first day of the

calendar year, January 1, in which the election is filed.

As an annual payer, you will file the quarterly Employer of Household Worker(s) Quarterly Report of Wages and

Withholdings, DE 3BHW, and the annual Employer of Household Worker(s) Annual Payroll Tax Return, DE 3HW.

Until the EDD responds to your request, please continue to file the Quarterly Contribution Return and Report of

Wages, DE 9, and the Quarterly Contribution Return and Report of Wages (Continuation), DE 9C, along with your

Payroll Tax Deposit, DE 88.

You can submit employment tax returns, wage reports, and payroll tax deposits electronically using e-Services for

Business at www.edd.ca.gov/e-Services_for_Business to comply with the e-file and e-pay mandate. For more

information on this mandate, visit www.edd.ca.gov/EfileMandate.

Please note, if you pay more than $20,000 in wages in any given year, the annual payer election will be terminated, your

account will revert back to a quarterly payer, and you will be required to file and pay all payroll taxes owed for the year at

the end of every calendar quarter.

If you have any questions or need assistance, call the Taxpayer Assistance Center toll-free at 1-888-745-3886 or

TTY 800-547-9565, or visit the EDD website at www.edd.ca.gov to view the Household Employer's Guide, DE 8829.

Please cut and return the bottom portion of this notice to the address below. You may also fax your election notice to 1-916-654-9211.

— — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — —

EMPLOYER OF HOUSEHOLD WORKER ELECTION NOTICE

I am an employer of household workers and wish to elect to pay California employment taxes annually. I intend to pay no more than $20,000 per

year in wages to my workers. I understand that if I pay more than $20,000 during the year, the election will be terminated and I will be required to

file and pay all payroll taxes owed for the year at the end of that calendar quarter. I will also be required to file quarterly tax returns with payment

for the remainder of the year. I will then need to file a new election to be eligible for this program in the future.

Signature Date Employer Payroll Tax Account Number

( )

Print Name Phone Number Address

EMPLOYMENT DEVELOPMENT DEPARTMENT City State ZIP Code

PO BOX 826880 MIC 28

SACRAMENTO CA 94280-0001

DE 89 Rev. 11 (12-17) (INTERNET) Page 1 of 1 CU