Enlarge image

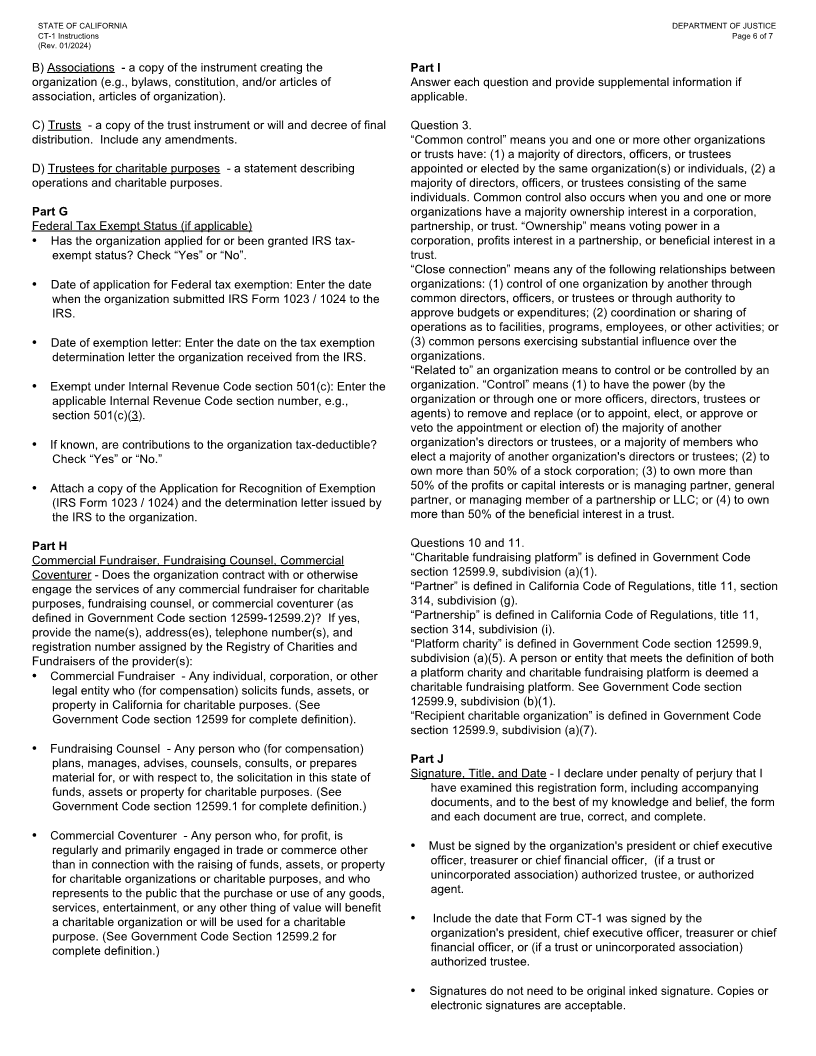

STATE OF CALIFORNIA DEPARTMENT OF JUSTICE

CT-1 PAGE 1 of 7

(Rev. 01/2024)

MAIL TO:

Office of the Attorney General INITIAL

Registry of Charities and Fundraisers

P.O. Box 903447 REGISTRATION FORM

Sacramento, CA 94203-4470

STATE OF CALIFORNIA

STREET ADDRESS:

1300 I Street OFFICE OF THE ATTORNEY GENERAL

Sacramento, CA 95814

REGISTRY OF CHARITIES AND

WEBSITE ADDRESS:

www.oag.ca.gov/charities FUNDRAISERS

(Government Code Sections 12580-12599.10) (For Registry Use Only)

Part A - Identification of Organization

Name of Organization:

Mailing Address: Check if:

Organization requests email notifications

City:

State: Email address:

ZIP Code: Fax number:

Telephone number: Website:

Federal Employer Identification Number (FEIN): Corporation or Organization Number:

Part B - Registration Fee

A $50 REGISTRATION FEE must accompany this registration form. Make check payable to DEPARTMENT OF JUSTICE.

Part C - List of Trustees or Directors and Officers

Names and addresses of ALL trustees or directors and officers (attach a list if necessary):

Name: Position:

Address: City: State: ZIP Code:

Name: Position:

Address: City: State: ZIP Code:

Name: Position:

Address: City: State: ZIP Code:

Name: Position:

Address: City: State: ZIP Code:

Part D - Organization Activities

Describe the primary activity of the organization (a copy of the material submitted with the application for federal or state tax

exemption will normally provide this information). If the organization is based outside California, comment fully on the extent of

activities in California and how the California activities relate to total activities. In addition, list all funds, property, and other assets

held or expected to be held in California. Attach additional sheets if necessary.