Enlarge image

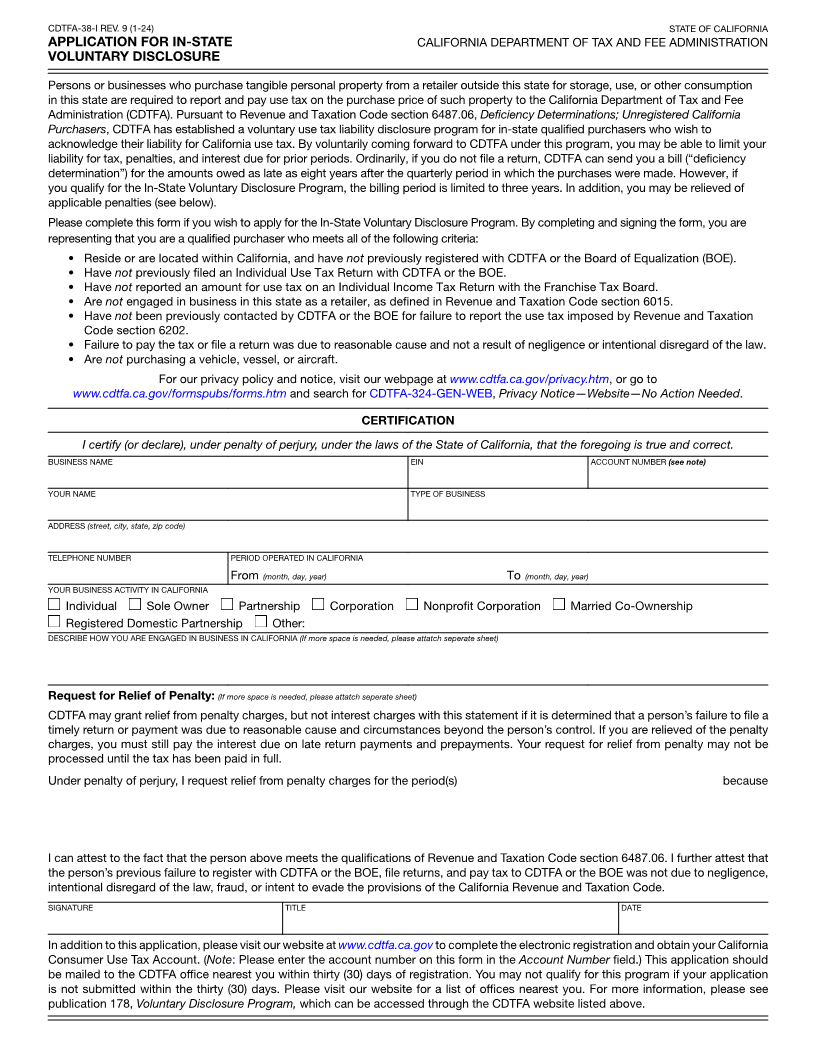

CDTFA-38-I REV. 9 (1-24) STATE OF CALIFORNIA

APPLICATION FOR IN-STATE CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION

VOLUNTARY DISCLOSURE

Persons or businesses who purchase tangible personal property from a retailer outside this state for storage, use, or other consumption

in this state are required to report and pay use tax on the purchase price of such property to the California Department of Tax and Fee

Administration (CDTFA). Pursuant to Revenue and Taxation Code section 6487.06, Deficiency Determinations; Unregistered California

Purchasers, CDTFA has established a voluntary use tax liability disclosure program for in-state qualified purchasers who wish to

acknowledge their liability for California use tax. By voluntarily coming forward to CDTFA under this program, you may be able to limit your

liability for tax, penalties, and interest due for prior periods. Ordinarily, if you do not file a return, CDTFA can send you a bill (“deficiency

determination”) for the amounts owed as late as eight years after the quarterly period in which the purchases were made. However, if

you qualify for the In-State Voluntary Disclosure Program, the billing period is limited to three years. In addition, you may be relieved of

applicable penalties (see below).

Please complete this form if you wish to apply for the In-State Voluntary Disclosure Program. By completing and signing the form, you are

representing that you are a qualified purchaser who meets all of the following criteria:

• Reside or are located within California, and have not previously registered with CDTFA or the Board of Equalization (BOE).

• Have not previously filed an Individual Use Tax Return with CDTFA or the BOE.

• Have not reported an amount for use tax on an Individual Income Tax Return with the Franchise Tax Board.

• Are not engaged in business in this state as a retailer, as defined in Revenue and Taxation Code section 6015.

• Have not been previously contacted by CDTFA or the BOE for failure to report the use tax imposed by Revenue and Taxation

Code section 6202.

• Failure to pay the tax or file a return was due to reasonable cause and not a result of negligence or intentional disregard of the law.

• Are not purchasing a vehicle, vessel, or aircraft.

For our privacy policy and notice, visit our webpage at www.cdtfa.ca.gov/privacy.htm, or go to

www.cdtfa.ca.gov/formspubs/forms.htm and search for CDTFA-324-GEN-WEB, Privacy Notice—Website—No Action Needed.

CERTIFICATION

I certify (or declare), under penalty of perjury, under the laws of the State of California, that the foregoing is true and correct.

BUSINESS NAME EIN ACCOUNT NUMBER (see note)

YOUR NAME TYPE OF BUSINESS

ADDRESS (street, city, state, zip code)

TELEPHONE NUMBER PERIOD OPERATED IN CALIFORNIA

From (month, day, year) To (month, day, year)

YOUR BUSINESS ACTIVITY IN CALIFORNIA

Individual Sole Owner Partnership Corporation Nonprofit Corporation Married Co-Ownership

Registered Domestic Partnership Other:

DESCRIBE HOW YOU ARE ENGAGED IN BUSINESS IN CALIFORNIA (If more space is needed, please attatch seperate sheet)

Request for Relief of Penalty: (If more space is needed, please attatch seperate sheet)

CDTFA may grant relief from penalty charges, but not interest charges with this statement if it is determined that a person’s failure to file a

timely return or payment was due to reasonable cause and circumstances beyond the person’s control. If you are relieved of the penalty

charges, you must still pay the interest due on late return payments and prepayments. Your request for relief from penalty may not be

processed until the tax has been paid in full.

Under penalty of perjury, I request relief from penalty charges for the period(s) because

I can attest to the fact that the person above meets the qualifications of Revenue and Taxation Code section 6487.06. I further attest that

the person’s previous failure to register with CDTFA or the BOE, file returns, and pay tax to CDTFA or the BOE was not due to negligence,

intentional disregard of the law, fraud, or intent to evade the provisions of the California Revenue and Taxation Code.

SIGNATURE TITLE DATE

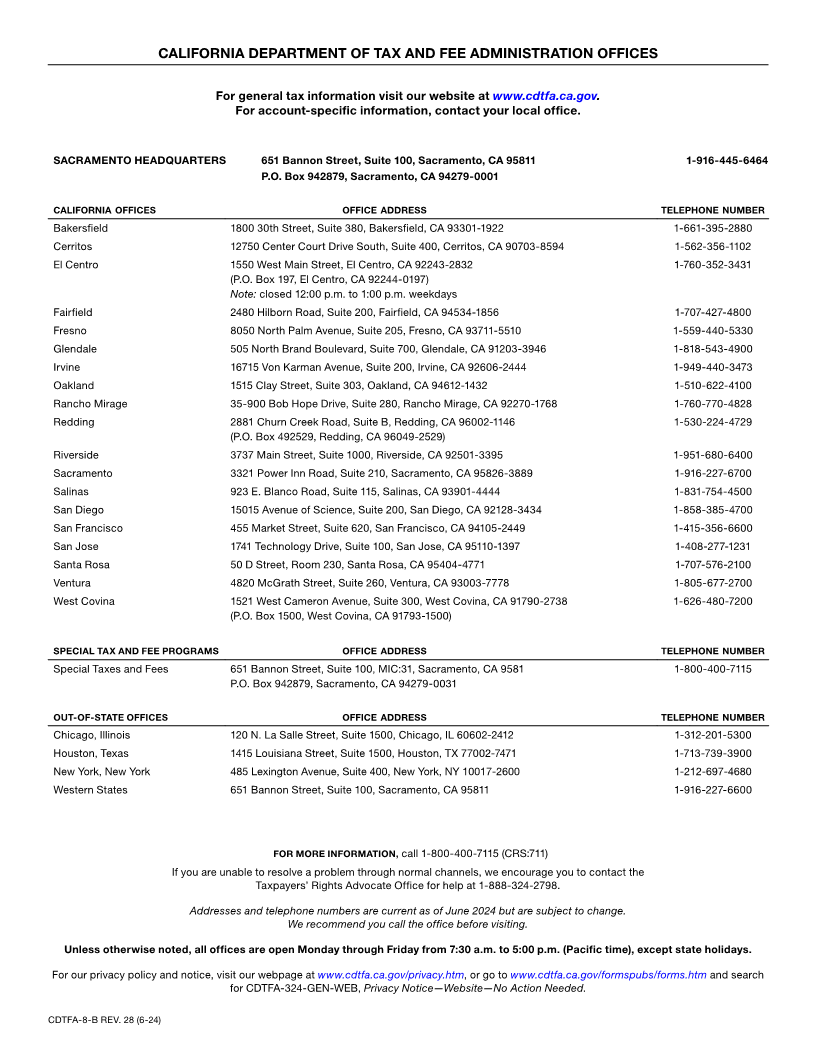

In addition to this application, please visit our website at www.cdtfa.ca.gov to complete the electronic registration and obtain your California

Consumer Use Tax Account. (Note: Please enter the account number on this form in the Account Number field.) This application should

be mailed to the CDTFA office nearest you within thirty (30) days of registration. You may not qualify for this program if your application

is not submitted within the thirty (30) days. Please visit our website for a list of offices nearest you. For more information, please see

publication 178, Voluntary Disclosure Program, which can be accessed through the CDTFA website listed above.