Enlarge image

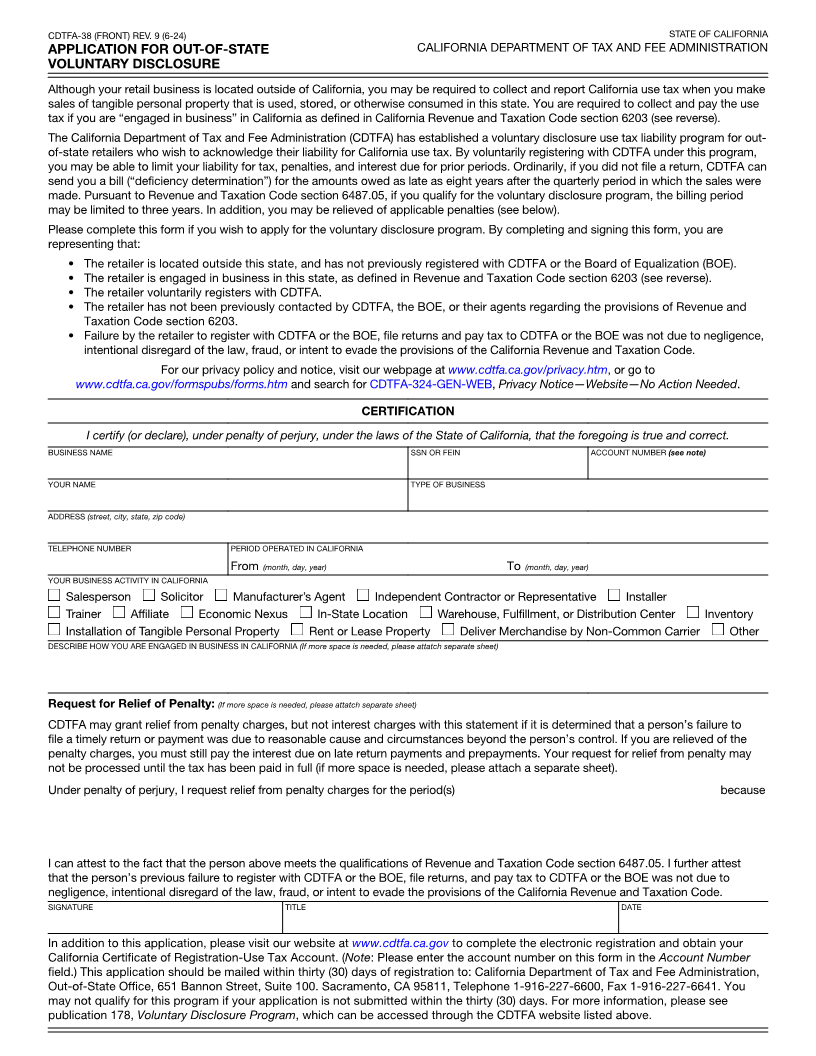

CDTFA-38 (FRONT) REV. 9 (6-24) STATE OF CALIFORNIA

APPLICATION FOR OUT-OF-STATE CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION

VOLUNTARY DISCLOSURE

Although your retail business is located outside of California, you may be required to collect and report California use tax when you make

sales of tangible personal property that is used, stored, or otherwise consumed in this state. You are required to collect and pay the use

tax if you are “engaged in business” in California as defined in California Revenue and Taxation Code section 6203 (see reverse).

The California Department of Tax and Fee Administration (CDTFA) has established a voluntary disclosure use tax liability program for out-

of-state retailers who wish to acknowledge their liability for California use tax. By voluntarily registering with CDTFA under this program,

you may be able to limit your liability for tax, penalties, and interest due for prior periods. Ordinarily, if you did not file a return, CDTFA can

send you a bill (“deficiency determination”) for the amounts owed as late as eight years after the quarterly period in which the sales were

made. Pursuant to Revenue and Taxation Code section 6487.05, if you qualify for the voluntary disclosure program, the billing period

may be limited to three years. In addition, you may be relieved of applicable penalties (see below).

Please complete this form if you wish to apply for the voluntary disclosure program. By completing and signing this form, you are

representing that:

• The retailer is located outside this state, and has not previously registered with CDTFA or the Board of Equalization (BOE).

• The retailer is engaged in business in this state, as defined in Revenue and Taxation Code section 6203 (see reverse).

• The retailer voluntarily registers with CDTFA.

• The retailer has not been previously contacted by CDTFA, the BOE, or their agents regarding the provisions of Revenue and

Taxation Code section 6203.

• Failure by the retailer to register with CDTFA or the BOE, file returns and pay tax to CDTFA or the BOE was not due to negligence,

intentional disregard of the law, fraud, or intent to evade the provisions of the California Revenue and Taxation Code.

For our privacy policy and notice, visit our webpage at www.cdtfa.ca.gov/privacy.htm, or go to

www.cdtfa.ca.gov/formspubs/forms.htm and search for CDTFA-324-GEN-WEB, Privacy Notice—Website—No Action Needed.

CERTIFICATION

I certify (or declare), under penalty of perjury, under the laws of the State of California, that the foregoing is true and correct.

BUSINESS NAME SSN OR FEIN ACCOUNT NUMBER (see note)

YOUR NAME TYPE OF BUSINESS

ADDRESS (street, city, state, zip code)

TELEPHONE NUMBER PERIOD OPERATED IN CALIFORNIA

From (month, day, year) To (month, day, year)

YOUR BUSINESS ACTIVITY IN CALIFORNIA

Salesperson Solicitor Manufacturer’s Agent Independent Contractor or Representative Installer

Trainer Affiliate Economic Nexus In-State Location Warehouse, Fulfillment, or Distribution Center Inventory

Installation of Tangible Personal Property Rent or Lease Property Deliver Merchandise by Non-Common Carrier Other

DESCRIBE HOW YOU ARE ENGAGED IN BUSINESS IN CALIFORNIA (If more space is needed, please attatch separate sheet)

Request for Relief of Penalty: (If more space is needed, please attatch separate sheet)

CDTFA may grant relief from penalty charges, but not interest charges with this statement if it is determined that a person’s failure to

file a timely return or payment was due to reasonable cause and circumstances beyond the person’s control. If you are relieved of the

penalty charges, you must still pay the interest due on late return payments and prepayments. Your request for relief from penalty may

not be processed until the tax has been paid in full (if more space is needed, please attach a separate sheet).

Under penalty of perjury, I request relief from penalty charges for the period(s) because

I can attest to the fact that the person above meets the qualifications of Revenue and Taxation Code section 6487.05. I further attest

that the person’s previous failure to register with CDTFA or the BOE, file returns, and pay tax to CDTFA or the BOE was not due to

negligence, intentional disregard of the law, fraud, or intent to evade the provisions of the California Revenue and Taxation Code.

SIGNATURE TITLE DATE

In addition to this application, please visit our website at www.cdtfa.ca.gov to complete the electronic registration and obtain your

California Certificate of Registration-Use Tax Account. (Note: Please enter the account number on this form in the Account Number

field.) This application should be mailed within thirty (30) days of registration to: California Department of Tax and Fee Administration,

Out-of-State Office, 651 Bannon Street, Suite 100. Sacramento, CA 95811, Telephone 1-916-227-6600, Fax 1-916-227-6641. You

may not qualify for this program if your application is not submitted within the thirty (30) days. For more information, please see

publication 178, Voluntary Disclosure Program, which can be accessed through the CDTFA website listed above.