Enlarge image

Offer In Compromise

Application for Individuals

CDTFA-490 REV. 4 (4-24)

Enlarge image |

Offer In Compromise

Application for Individuals

CDTFA-490 REV. 4 (4-24)

|

Enlarge image |

WHAT YOU SHOULD KNOW BEFORE PREPARING AN OFFER IN COMPROMISE

Are you an Offer in Compromise candidate? OIC Pre-Qualifier Tool

The Offer in Compromise (OIC) program is for taxpayers that If your business is closed, please see our online

do not have the income, assets, or means to pay their tax Pre-Qualifier Tool to assist you in determining whether an OIC

liabilities in full, and who will not have the resources to pay is right for you.

their liabilities in the foreseeable future. It allows a taxpayer

to offer a lesser amount for payment of their undisputed final

tax liability. In order to apply for an OIC, a taxpayer must no Should you continue to make payments on an installment

longer own the items that were taxed, as they might incur an payment agreement?

additional tax or fee later. Yes, in most cases, you should continue making periodic

Effective January 1, 2009, through January 1, 2028, the OIC payments as called for in any existing installment payment

program will extend to qualified active businesses where the agreement while we consider your offer. We will strive to

taxpayer has not received tax or fee reimbursement for tax process your offer and respond within 30 days of receiving

and fees owed to the state, to successors of businesses that your completed application along with the required

may have inherited tax liabilities of the predecessors, and to documentation.

consumers who incurred a use tax liability.

Generally, we approve an OIC when the amount offered Are collections suspended?

represents the most we can expect to receive from the We will usually suspend collection action until the OIC

taxpayer’s current income or assets and future income evaluation is completed. However, we may continue with

for a reasonable period of time, and the OIC is in the best collection efforts if delaying collection activity jeopardizes our

interest of the state. ability to collect the tax.

Although we evaluate each case based on its own unique

set of facts and circumstances, we give the following factors

strong consideration: When should you submit offered funds?

• The taxpayer’s ability to pay We will notify you when it's time to submit your offered

amount. We will hold the funds in the form of a noninterest

• The amount of equity in the taxpayer’s assets bearing deposit, and we will refund the funds to you if your

• The taxpayer’s present and future income offer is denied. We will not pay credit interest to you on the

• The taxpayer’s present and future expenses deposited amount if your offer is denied.

• The potential for changed circumstances

Who should use this application? For more specific information on the OIC process, you may

contact the OIC Section at 1-916-322-7931.

If you are making an offer as an individual or an individual of a

partnership, please use this application. To make an offer as

a corporation, LLC, trust, organization, or a limited or general

partnership (where the partners are not individuals), please

download CDTFA-490-C, Offer in Compromise Application for

Corporations, LLCs, Partnerships, Etc., from our website, or

contact your local office.

Can we process your application?

We will only process your OIC if you fully complete the

application and provide all supporting documentation.

If you have been assessed a fraud penalty, we generally

require a minimum offer of the outstanding tax and fraud

penalty to consider an OIC. However, if you have been

assessed a fraud penalty on a sales or use tax, alternate

(use) fuel tax, or Underground Storage Tank fee matter, we

have discretion to consider whether it is in the state’s best

interest to accept less than the full amount of tax plus the

fraud penalty. We will not consider an offer if you have been

convicted of felony tax evasion.

|

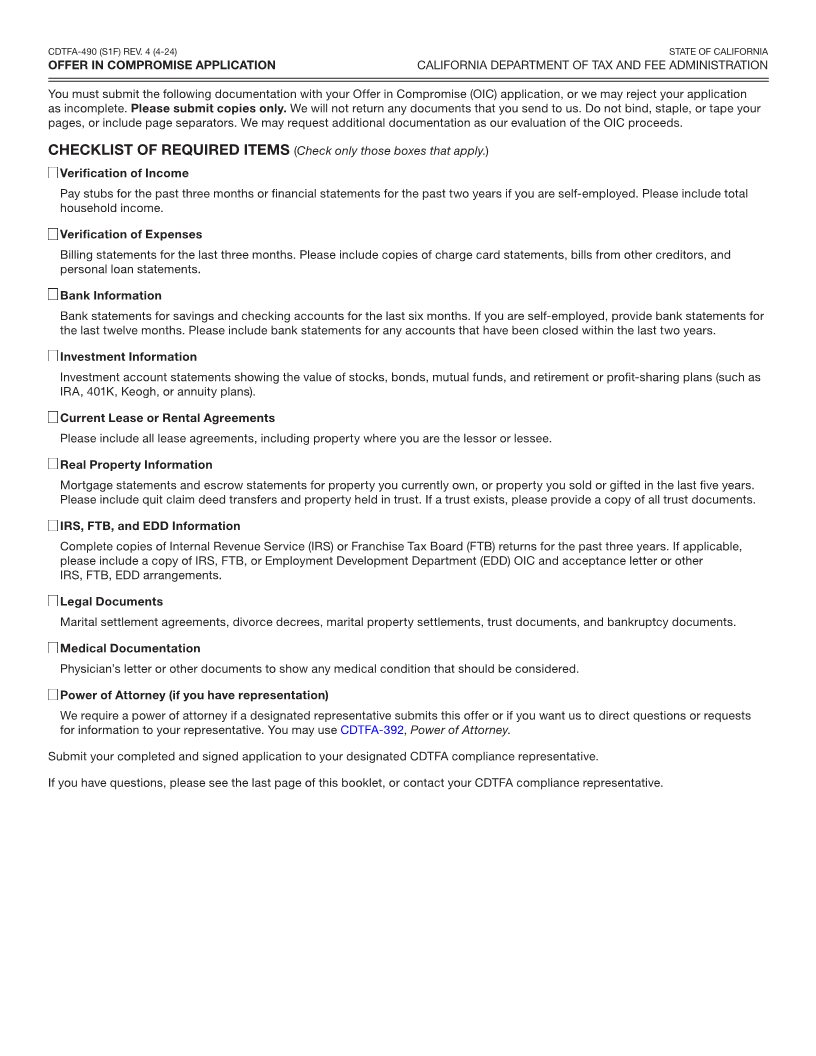

Enlarge image | CDTFA-490 (S1F) REV. 4 (4-24) STATE OF CALIFORNIA OFFER IN COMPROMISE APPLICATION CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION You must submit the following documentation with your Offer in Compromise (OIC) application, or we may reject your application as incomplete. Please submit copies only. We will not return any documents that you send to us. Do not bind, staple, or tape your pages, or include page separators. We may request additional documentation as our evaluation of the OIC proceeds. CHECKLIST OF REQUIRED ITEMS (Check only those boxes that apply.) Verification of Income Pay stubs for the past three months or financial statements for the past two years if you are self-employed. Please include total household income. Verification of Expenses Billing statements for the last three months. Please include copies of charge card statements, bills from other creditors, and personal loan statements. Bank Information Bank statements for savings and checking accounts for the last six months. If you are self-employed, provide bank statements for the last twelve months. Please include bank statements for any accounts that have been closed within the last two years. Investment Information Investment account statements showing the value of stocks, bonds, mutual funds, and retirement or profit-sharing plans (such as IRA, 401K, Keogh, or annuity plans). Current Lease or Rental Agreements Please include all lease agreements, including property where you are the lessor or lessee. Real Property Information Mortgage statements and escrow statements for property you currently own, or property you sold or gifted in the last five years. Please include quit claim deed transfers and property held in trust. If a trust exists, please provide a copy of all trust documents. IRS, FTB, and EDD Information Complete copies of Internal Revenue Service (IRS) or Franchise Tax Board (FTB) returns for the past three years. If applicable, please include a copy of IRS, FTB, or Employment Development Department (EDD) OIC and acceptance letter or other IRS, FTB, EDD arrangements. Legal Documents Marital settlement agreements, divorce decrees, marital property settlements, trust documents, and bankruptcy documents. Medical Documentation Physician’s letter or other documents to show any medical condition that should be considered. Power of Attorney (if you have representation) We require a power of attorney if a designated representative submits this offer or if you want us to direct questions or requests for information to your representative. You may use CDTFA-392, Power of Attorney. Submit your completed and signed application to your designated CDTFA compliance representative. If you have questions, please see the last page of this booklet, or contact your CDTFA compliance representative. |

Enlarge image |

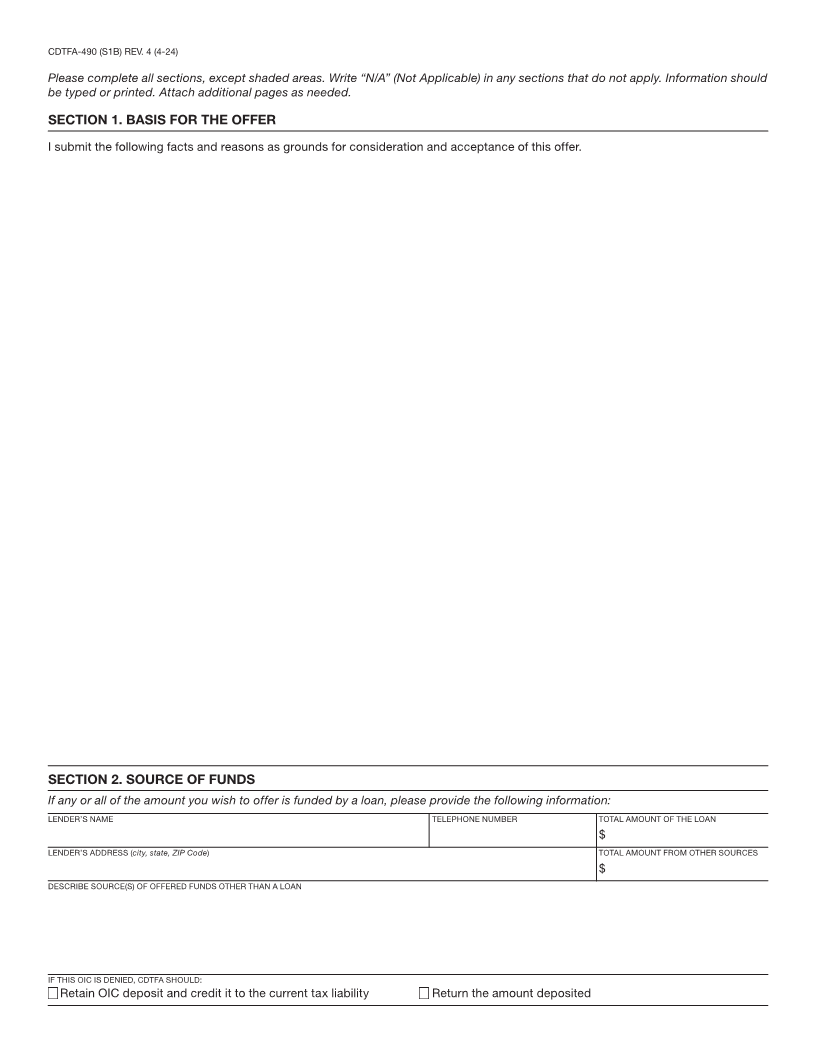

CDTFA-490 (S1B) REV. 4 (4-24)

Please complete all sections, except shaded areas. Write “N/A” (Not Applicable) in any sections that do not apply. Information should

be typed or printed. Attach additional pages as needed.

SECTION 1. BASIS FOR THE OFFER

I submit the following facts and reasons as grounds for consideration and acceptance of this offer.

SECTION 2. SOURCE OF FUNDS

If any or all of the amount you wish to offer is funded by a loan, please provide the following information:

LENDER’S NAME TELEPHONE NUMBER TOTAL AMOUNT OF THE LOAN

$

LENDER’S ADDRESS (city, state, ZIP Code) TOTAL AMOUNT FROM OTHER SOURCES

$

DESCRIBE SOURCE(S) OF OFFERED FUNDS OTHER THAN A LOAN

IF THIS OIC IS DENIED, CDTFA SHOULD:

Retain OIC deposit and credit it to the current tax liability Return the amount deposited

|

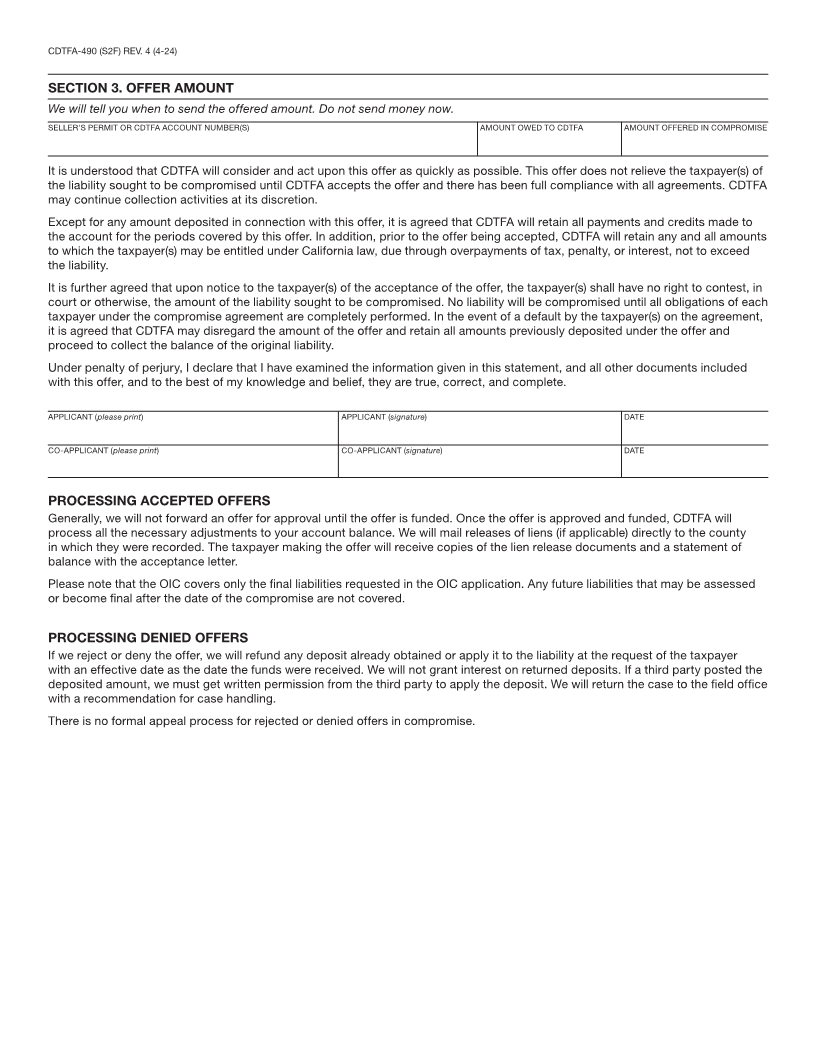

Enlarge image | CDTFA-490 (S2F) REV. 4 (4-24) SECTION 3. OFFER AMOUNT We will tell you when to send the offered amount. Do not send money now. SELLER'S PERMIT OR CDTFA ACCOUNT NUMBER(S) AMOUNT OWED TO CDTFA AMOUNT OFFERED IN COMPROMISE It is understood that CDTFA will consider and act upon this offer as quickly as possible. This offer does not relieve the taxpayer(s) of the liability sought to be compromised until CDTFA accepts the offer and there has been full compliance with all agreements. CDTFA may continue collection activities at its discretion. Except for any amount deposited in connection with this offer, it is agreed that CDTFA will retain all payments and credits made to the account for the periods covered by this offer. In addition, prior to the offer being accepted, CDTFA will retain any and all amounts to which the taxpayer(s) may be entitled under California law, due through overpayments of tax, penalty, or interest, not to exceed the liability. It is further agreed that upon notice to the taxpayer(s) of the acceptance of the offer, the taxpayer(s) shall have no right to contest, in court or otherwise, the amount of the liability sought to be compromised. No liability will be compromised until all obligations of each taxpayer under the compromise agreement are completely performed. In the event of a default by the taxpayer(s) on the agreement, it is agreed that CDTFA may disregard the amount of the offer and retain all amounts previously deposited under the offer and proceed to collect the balance of the original liability. Under penalty of perjury, I declare that I have examined the information given in this statement, and all other documents included with this offer, and to the best of my knowledge and belief, they are true, correct, and complete. APPLICANT (please print) APPLICANT (signature) DATE CO-APPLICANT (please print) CO-APPLICANT (signature) DATE PROCESSING ACCEPTED OFFERS Generally, we will not forward an offer for approval until the offer is funded. Once the offer is approved and funded, CDTFA will process all the necessary adjustments to your account balance. We will mail releases of liens (if applicable) directly to the county in which they were recorded. The taxpayer making the offer will receive copies of the lien release documents and a statement of balance with the acceptance letter. Please note that the OIC covers only the final liabilities requested in the OIC application. Any future liabilities that may be assessed or become final after the date of the compromise are not covered. PROCESSING DENIED OFFERS If we reject or deny the offer, we will refund any deposit already obtained or apply it to the liability at the request of the taxpayer with an effective date as the date the funds were received. We will not grant interest on returned deposits. If a third party posted the deposited amount, we must get written permission from the third party to apply the deposit. We will return the case to the field office with a recommendation for case handling. There is no formal appeal process for rejected or denied offers in compromise. |

Enlarge image |

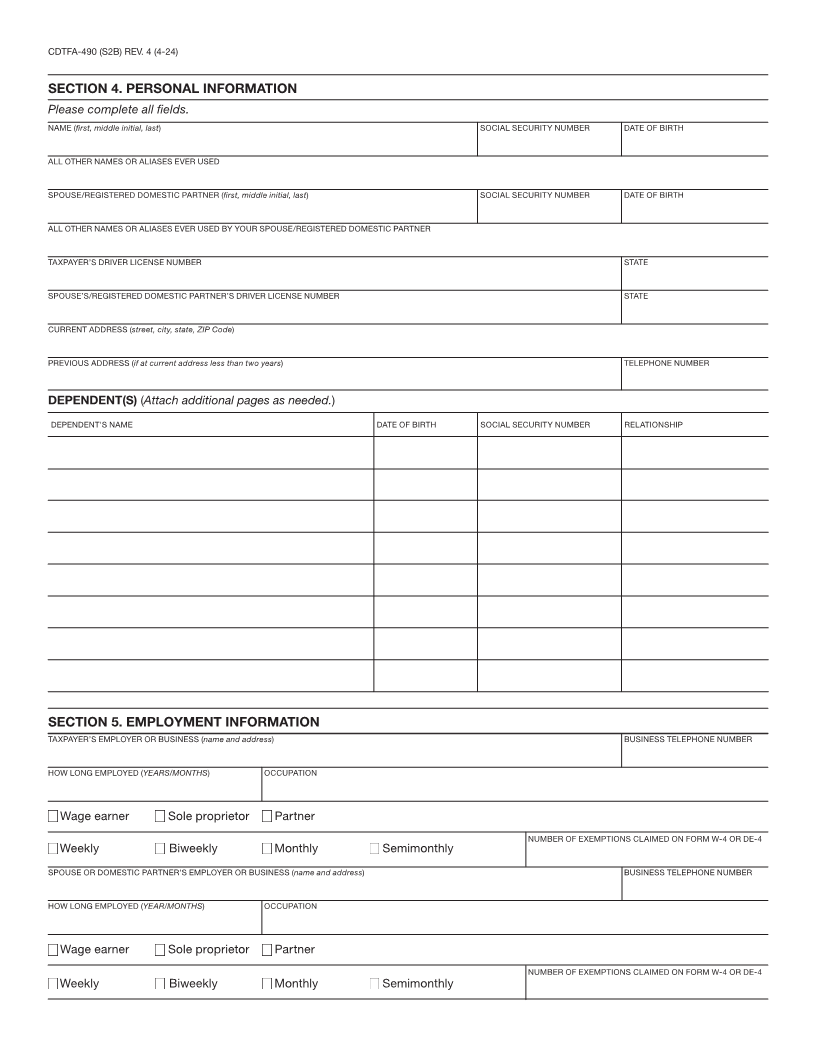

CDTFA-490 (S2B) REV. 4 (4-24)

SECTION 4. PERSONAL INFORMATION

Please complete all fields.

NAME (first, middle initial, last) SOCIAL SECURITY NUMBER DATE OF BIRTH

ALL OTHER NAMES OR ALIASES EVER USED

SPOUSE/REGISTERED DOMESTIC PARTNER (first, middle initial, last) SOCIAL SECURITY NUMBER DATE OF BIRTH

ALL OTHER NAMES OR ALIASES EVER USED BY YOUR SPOUSE/REGISTERED DOMESTIC PARTNER

TAXPAYER’S DRIVER LICENSE NUMBER STATE

SPOUSE’S/REGISTERED DOMESTIC PARTNER’S DRIVER LICENSE NUMBER STATE

CURRENT ADDRESS (street, city, state, ZIP Code)

PREVIOUS ADDRESS (if at current address less than two years) TELEPHONE NUMBER

DEPENDENT(S) (Attach additional pages as needed.)

DEPENDENT'S NAME DATE OF BIRTH SOCIAL SECURITY NUMBER RELATIONSHIP

SECTION 5. EMPLOYMENT INFORMATION

TAXPAYER’S EMPLOYER OR BUSINESS (name and address) BUSINESS TELEPHONE NUMBER

HOW LONG EMPLOYED (YEARS/MONTHS) OCCUPATION

Wage earner Sole proprietor Partner

NUMBER OF EXEMPTIONS CLAIMED ON FORM W-4 OR DE-4

Weekly Biweekly Monthly Semimonthly

SPOUSE OR DOMESTIC PARTNER'S EMPLOYER OR BUSINESS (name and address) BUSINESS TELEPHONE NUMBER

HOW LONG EMPLOYED (YEAR/MONTHS) OCCUPATION

Wage earner Sole proprietor Partner

NUMBER OF EXEMPTIONS CLAIMED ON FORM W-4 OR DE-4

Weekly Biweekly Monthly Semimonthly

|

Enlarge image |

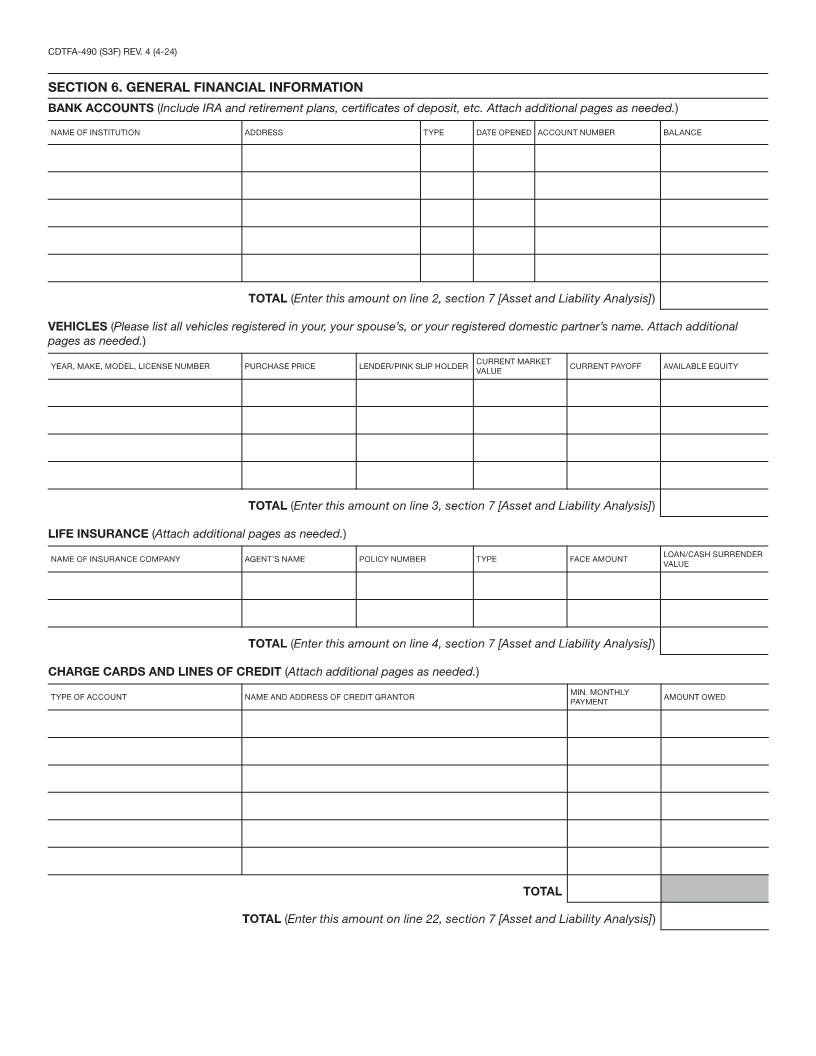

CDTFA-490 (S3F) REV. 4 (4-24)

SECTION 6. GENERAL FINANCIAL INFORMATION

BANK ACCOUNTS (Include IRA and retirement plans, certificates of deposit, etc. Attach additional pages as needed.)

NAME OF INSTITUTION ADDRESS TYPE DATE OPENED ACCOUNT NUMBER BALANCE

TOTAL (Enter this amount on line 2, section 7 [Asset and Liability Analysis] )

VEHICLES (Please list all vehicles registered in your, your spouse’s, or your registered domestic partner’s name. Attach additional

pages as needed.)

YEAR, MAKE, MODEL, LICENSE NUMBER PURCHASE PRICE LENDER/PINK SLIP HOLDER CURRENT MARKET CURRENT PAYOFF AVAILABLE EQUITY

VALUE

TOTAL (Enter this amount on line 3, section 7 [Asset and Liability Analysis] )

LIFE INSURANCE (Attach additional pages as needed.)

NAME OF INSURANCE COMPANY AGENT’S NAME POLICY NUMBER TYPE FACE AMOUNT LOAN/CASH SURRENDER

VALUE

TOTAL (Enter this amount on line 4, section 7 [Asset and Liability Analysis] )

CHARGE CARDS AND LINES OF CREDIT (Attach additional pages as needed.)

TYPE OF ACCOUNT NAME AND ADDRESS OF CREDIT GRANTOR MIN. MONTHLY AMOUNT OWED

PAYMENT

TOTAL

TOTAL (Enter this amount on line 22, section 7 [Asset and Liability Analysis])

|

Enlarge image |

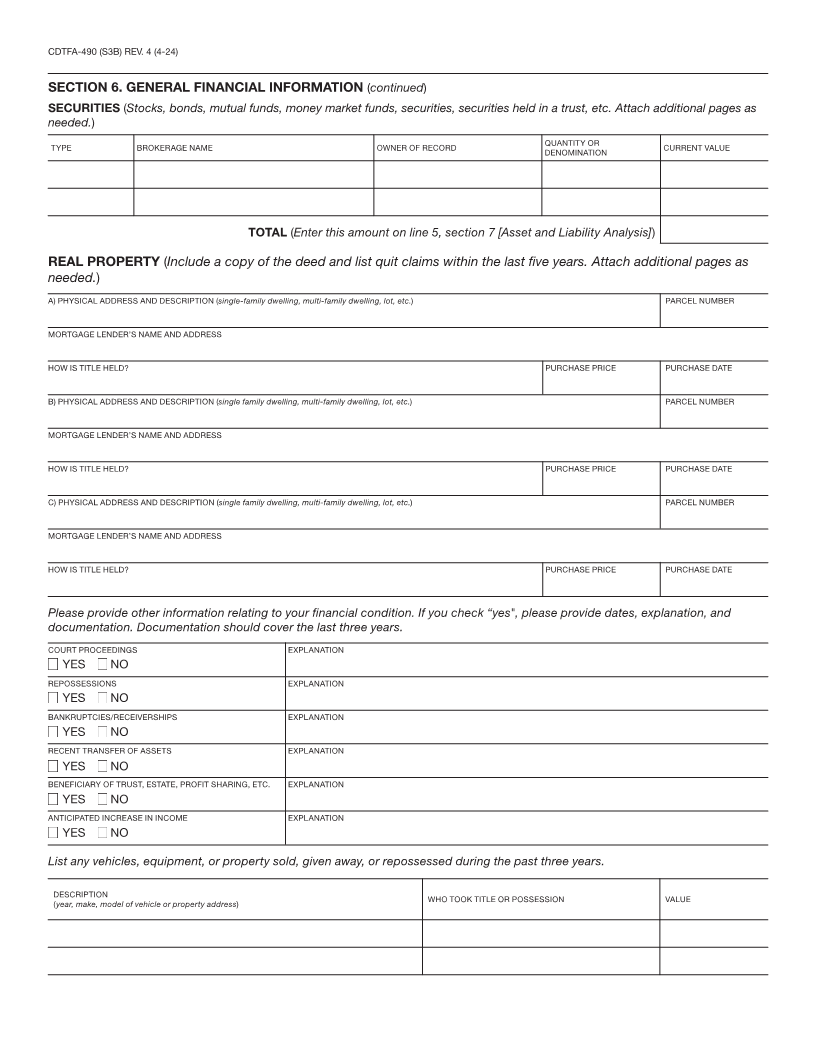

CDTFA-490 (S3B) REV. 4 (4-24)

SECTION 6. GENERAL FINANCIAL INFORMATION (continued)

SECURITIES (Stocks, bonds, mutual funds, money market funds, securities, securities held in a trust, etc. Attach additional pages as

needed.)

TYPE BROKERAGE NAME OWNER OF RECORD QUANTITY OR CURRENT VALUE

DENOMINATION

TOTAL (Enter this amount on line 5, section 7 [Asset and Liability Analysis])

REAL PROPERTY (Include a copy of the deed and list quit claims within the last five years. Attach additional pages as

needed.)

A) PHYSICAL ADDRESS AND DESCRIPTION (single-family dwelling, multi-family dwelling, lot, etc.) PARCEL NUMBER

MORTGAGE LENDER’S NAME AND ADDRESS

HOW IS TITLE HELD? PURCHASE PRICE PURCHASE DATE

B) PHYSICAL ADDRESS AND DESCRIPTION (single family dwelling, multi-family dwelling, lot, etc.) PARCEL NUMBER

MORTGAGE LENDER’S NAME AND ADDRESS

HOW IS TITLE HELD? PURCHASE PRICE PURCHASE DATE

C) PHYSICAL ADDRESS AND DESCRIPTION (single family dwelling, multi-family dwelling, lot, etc.) PARCEL NUMBER

MORTGAGE LENDER’S NAME AND ADDRESS

HOW IS TITLE HELD? PURCHASE PRICE PURCHASE DATE

Please provide other information relating to your financial condition. If you check “yes", please provide dates, explanation, and

documentation. Documentation should cover the last three years.

COURT PROCEEDINGS EXPLANATION

YES NO

REPOSSESSIONS EXPLANATION

YES NO

BANKRUPTCIES/RECEIVERSHIPS EXPLANATION

YES NO

RECENT TRANSFER OF ASSETS EXPLANATION

YES NO

BENEFICIARY OF TRUST, ESTATE, PROFIT SHARING, ETC. EXPLANATION

YES NO

ANTICIPATED INCREASE IN INCOME EXPLANATION

YES NO

List any vehicles, equipment, or property sold, given away, or repossessed during the past three years.

DESCRIPTION WHO TOOK TITLE OR POSSESSION VALUE

(year, make, model of vehicle or property address)

|

Enlarge image |

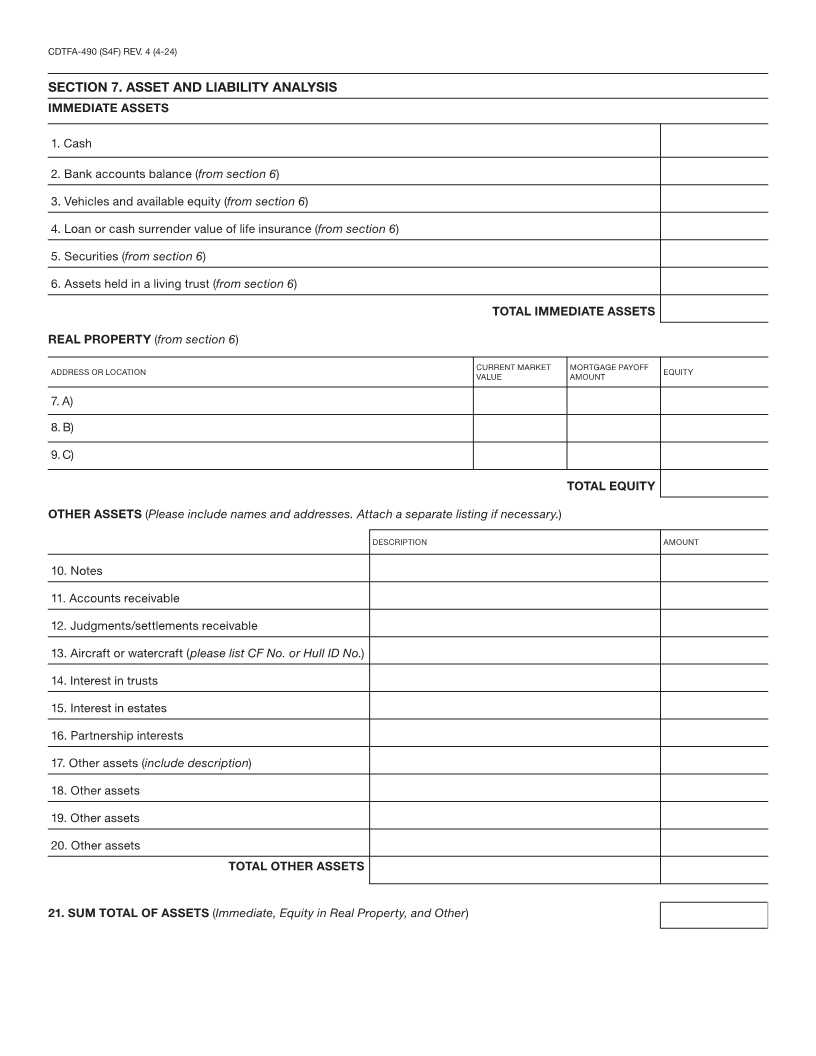

CDTFA-490 (S4F) REV. 4 (4-24)

SECTION 7. ASSET AND LIABILITY ANALYSIS

IMMEDIATE ASSETS

1. Cash

2. Bank accounts balance (from section 6)

3. Vehicles and available equity (from section 6)

4. Loan or cash surrender value of life insurance (from section 6)

5. Securities (from section 6)

6. Assets held in a living trust (from section 6)

TOTAL IMMEDIATE ASSETS

REAL PROPERTY (from section 6)

ADDRESS OR LOCATION CURRENT MARKET MORTGAGE PAYOFF EQUITY

VALUE AMOUNT

7. A)

8. B)

9. C)

TOTAL EQUITY

OTHER ASSETS (Please include names and addresses. Attach a separate listing if necessary.)

DESCRIPTION AMOUNT

10. Notes

11. Accounts receivable

12. Judgments/settlements receivable

13. Aircraft or watercraft ( please list CF No. or Hull ID No.)

14. Interest in trusts

15. Interest in estates

16. Partnership interests

17. Other assets (include description)

18. Other assets

19. Other assets

20. Other assets

TOTAL OTHER ASSETS

21. SUM TOTAL OF ASSETS (Immediate, Equity in Real Property, and Other )

|

Enlarge image |

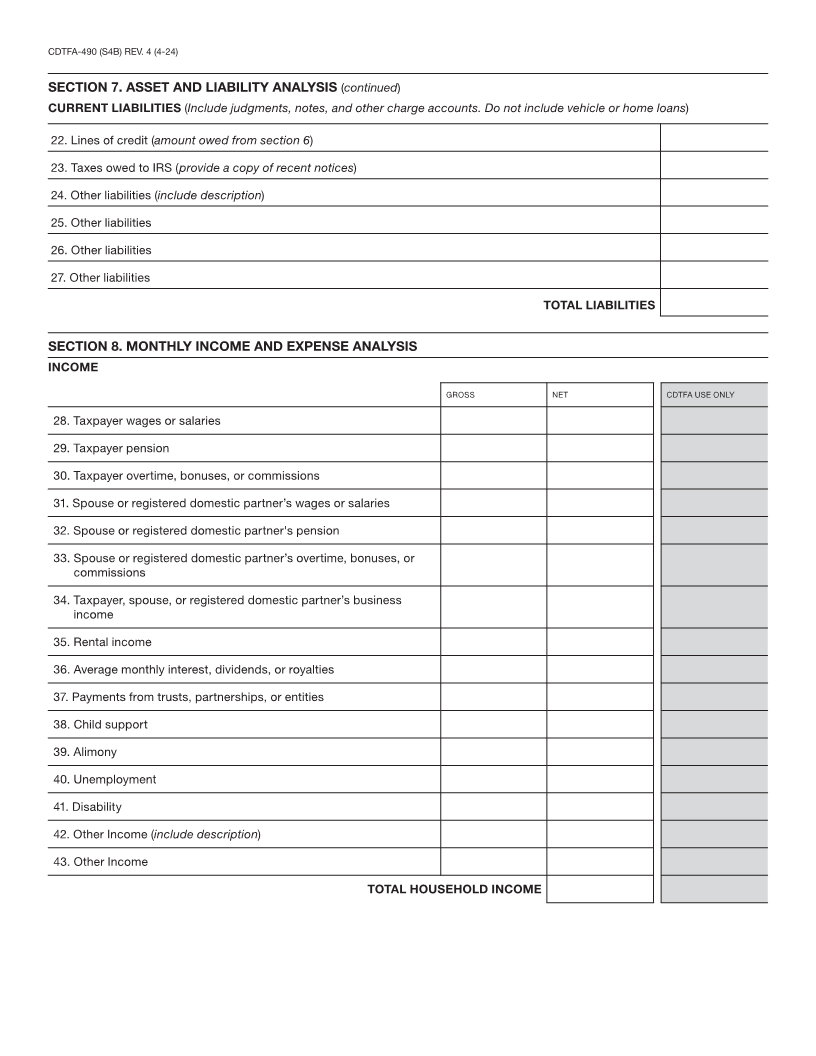

CDTFA-490 (S4B) REV. 4 (4-24)

SECTION 7. ASSET AND LIABILITY ANALYSIS (continued)

CURRENT LIABILITIES (Include judgments, notes, and other charge accounts. Do not include vehicle or home loans)

22. Lines of credit (amount owed from section 6)

23. Taxes owed to IRS ( provide a copy of recent notices)

24. Other liabilities (include description)

25. Other liabilities

26. Other liabilities

27. Other liabilities

TOTAL LIABILITIES

SECTION 8. MONTHLY INCOME AND EXPENSE ANALYSIS

INCOME

GROSS NET CDTFA USE ONLY

28. Taxpayer wages or salaries

29. Taxpayer pension

30. Taxpayer overtime, bonuses, or commissions

31. Spouse or registered domestic partner’s wages or salaries

32. Spouse or registered domestic partner's pension

33. Spouse or registered domestic partner’s overtime, bonuses, or

commissions

34. Taxpayer, spouse, or registered domestic partner’s business

income

35. Rental income

36. Average monthly interest, dividends, or royalties

37. Payments from trusts, partnerships, or entities

38. Child support

39. Alimony

40. Unemployment

41. Disability

42. Other Income (include description)

43. Other Income

TOTAL HOUSEHOLD INCOME

|

Enlarge image |

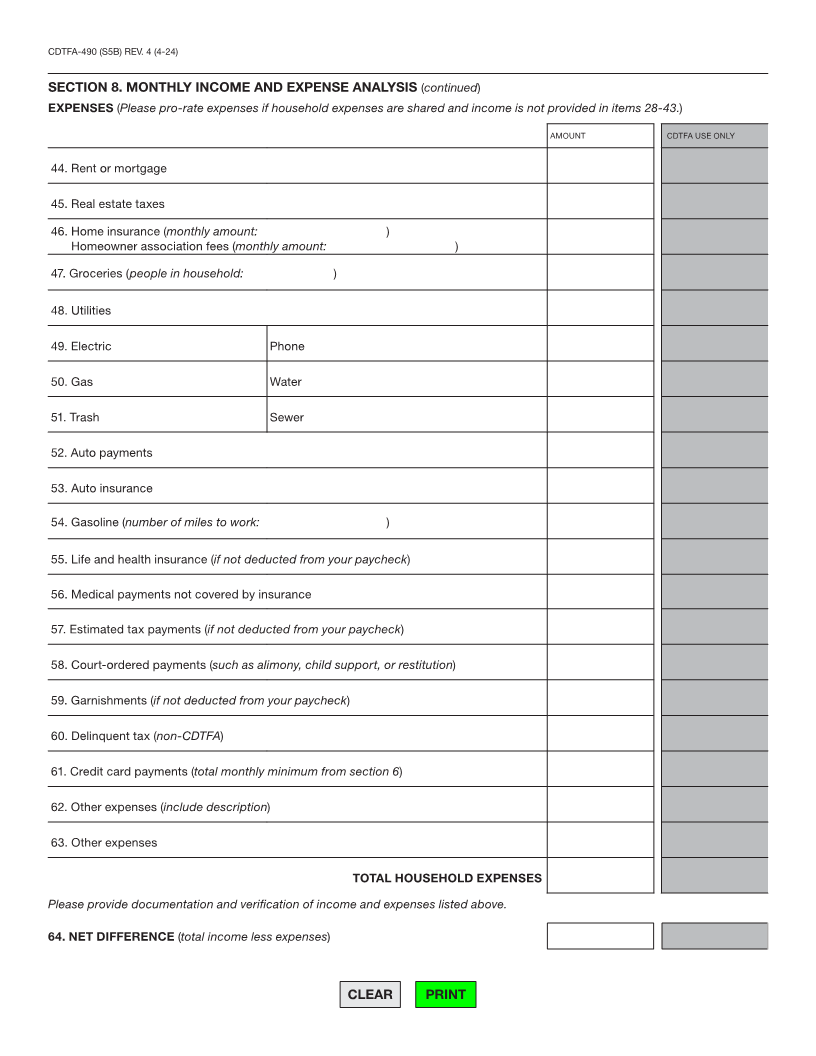

CDTFA-490 (S5B) REV. 4 (4-24)

SECTION 8. MONTHLY INCOME AND EXPENSE ANALYSIS (continued)

EXPENSES (Please pro-rate expenses if household expenses are shared and income is not provided in items 28-43.)

AMOUNT CDTFA USE ONLY

44. Rent or mortgage

45. Real estate taxes

46. Home insurance (monthly amount: )

Homeowner association fees (monthly amount: )

47. Groceries (people in household: )

48. Utilities

49. Electric Phone

50. Gas Water

51. Trash Sewer

52. Auto payments

53. Auto insurance

54. Gasoline (number of miles to work: )

55. Life and health insurance (if not deducted from your paycheck)

56. Medical payments not covered by insurance

57. Estimated tax payments (if not deducted from your paycheck)

58. Court-ordered payments (such as alimony, child support, or restitution)

59. Garnishments (if not deducted from your paycheck)

60. Delinquent tax (non-CDTFA)

61. Credit card payments (total monthly minimum from section 6 )

62. Other expenses (include description)

63. Other expenses

TOTAL HOUSEHOLD EXPENSES

Please provide documentation and verification of income and expenses listed above.

64. NET DIFFERENCE (total income less expenses)

CLEAR PRINT

|

Enlarge image | CDTFA-490 (S5B) REV. 4 (4-24) QUESTION AND ANSWERS Q What does the California Department of Tax and Fee Administration (CDTFA) consider a fair Offer in Compromise (OIC) in relation to the amount due? A Generally, we will accept an offer when the amount offered is more than CDTFA can expect to collect within a reasonable period of time (typically four years), and the offered amount is in the best interest of the state. We generally give more favorable consideration to offers that include repayment of at least the tax or fee portion of the liability. Q How long will it take to get a response on my OIC? A We are able to respond to most accepted applications within 30 days of receipt. However, more complex accounts may take longer than 30 days to review. Q Can I make installment payments on the offered amount? A The department may, in its discretion, enter into a written agreement that permits the taxpayer to pay the compromise in installments for a period not exceeding one year. Q Can prior payments be applied to the offered amount? A No. We do not accept prior payments towards the offered amount. However, we do consider prior payments and the offered amount compared to the total liability when we evaluate your OIC. Q My IRS or FTB OIC has been accepted. Will CDTFA automatically approve my offer? A No. We will evaluate your offer separately from your IRS or FTB offer. Q Will CDTFA contact me if my offer is declined? A Yes. We will send you a letter informing you of our decision, and in most cases, we will contact you to discuss your account and to determine the most appropriate resolution. For example, if we determine that you have the ability to make monthly payments that exceed the amount offered, we will work with you to set up an installment payment agreement that will allow you to pay the liability in full over time. Q Will state tax liens be released if my OIC is accepted? A Yes, we release state tax liens upon final approval of your OIC. If another partner existed on the permit, we will not cancel that person’s liability, nor will we release the other partner’s lien. We will issue a partial release to release you from the effects of the lien. Q Do I need to have someone represent me? A We do not require you to have representation. The OIC application and process are available to all taxpayers, with or without representation. If you think you need representation, there are many tax professionals who have experience with the OIC process. Q Can I get relief from the tax liability by filing bankruptcy? A Part or all of your taxes may be dischargeable under the bankruptcy code. If this is a consideration, you may want to seek legal advice. Q If my OIC is declined, can I apply the deposit to my liability? A Yes. In this case, the effective date of the payment will be the date the deposit was made. If the deposit was posted by a third party, we must obtain their approval before applying the payment. Q Will CDTFA suspend collection action while my offer is being evaluated? A Sometimes. Typically, we suspend collection action when we receive a complete application. However, if you already have an installment payment agreement, you must continue making those payments while we review your offer. If delaying collection activity jeopardizes our ability to collect the tax, we may continue with collection efforts. Q Where can I find forms such as CDTFA-392, Power of Attorney ? A Many CDTFA forms and publications, including CDTFA-392, Power of Attorney, can be downloaded from our website at www.cdtfa.ca.gov. If you do not have access to the Internet or you prefer to speak to someone, you can contact your local office or our Customer Service Center at 1-800-400-7115 (TTY:711). Customer service representatives are available Monday through Friday from 7:30 a.m. to 5:00 p.m. (Pacific time), except state holidays. For more specific information on the OIC process, you may contact the OIC Section at 1-916-322-7931. |

Enlarge image |

FOR MORE INFORMATION

For additional information or assistance, please take advantage of the resources listed below.

CUSTOMER SERVICE CENTER OFFICES

1-800-400-7115 (TTY:711) Please visit our website at

Customer service representatives are available Monday www.cdtfa.ca.gov/office-locations.htm

through Friday from 7:30 a.m. to 5:00 p.m. (Pacific for a complete listing of our office locations. If you

time), except state holidays. In addition to English, cannot access this page, please contact our

assistance is available in other languages. Customer Service Center at 1-800-400-7115 (TTY:711).

INTERNET

www.cdtfa.ca.gov

You can visit our website for additional information—such as laws, regulations, forms, publications, industry guides, and policy

manuals—that will help you understand how the law applies to your business.

You can also verify seller’s permit numbers on our website (see Verify a Permit, License, or Account).

Multilingual versions of publications are available on our website at www.cdtfa.ca.gov/formspubs/pubs.htm.

Another good resource—especially for starting businesses—is the California Tax Service Center at www.taxes.ca.gov.

TAX INFORMATION BULLETIN

The quarterly Tax Information Bulletin (TIB) includes articles on the application of law to specific types of transactions, announcements

about new and revised publications, and other articles of interest. You can find current TIBs on our website at www.cdtfa.ca.gov/

taxes-and-fees/tax-bulletins.htm. Sign up for our CDTFA updates email list and receive notification when the latest issue of the TIB

has been posted to our website.

FREE CLASSES AND SEMINARS

We offer free online basic sales and use tax classes including a tutorial on how to file your tax returns. Some classes are offered in

multiple languages. If you would like further information on specific classes, please call your local office.

WRITTEN TAX ADVICE

For your protection, it is best to get tax advice in writing. You may be relieved of tax, penalty, or interest charges that are due on a

transaction if we determine that we gave you incorrect written advice regarding the transaction and that you reasonably relied on that

advice in failing to pay the proper amount of tax. For this relief to apply, a request for advice must be in writing, identify the taxpayer to

whom the advice applies, and fully describe the facts and circumstances of the transaction.

For written advice on general tax and fee information, please visit our website at www.cdtfa.ca.gov/email to email your request.

You may also send your request in a letter. For general sales and use tax information, including the California Lumber Products

Assessment, or Prepaid Mobile Telephony Services (MTS) Surcharge, send your request to: Audit and Information Section, MIC:44,

California Department of Tax and Fee Administration, P.O. Box 942879, Sacramento, CA 94279-0044.

For written advice on all other special tax and fee programs, send your request to: Program Administration Branch, MIC:31,

California Department of Tax and Fee Administration, P.O. Box 942879, Sacramento, CA 94279-0031.

TAXPAYERS’ RIGHTS ADVOCATE

If you would like to know more about your rights as a taxpayer or if you have not been able to resolve a problem through normal

channels (for example, by speaking to a supervisor), please see publication 70, Understanding Your Rights as a California Taxpayer,

or contact the Taxpayers’ Rights Advocate Office for help at 1-888-324-2798. Their fax number is 1-916-323-3319.

If you prefer, you can write to: Taxpayers’ Rights Advocate, MIC:70, California Department of Tax and Fee Administration,

P.O. Box 942879, Sacramento, CA 94279-0070.

|