- 3 -

Enlarge image

|

CDTFA-101 (BACK) REV. 21 (5-24)

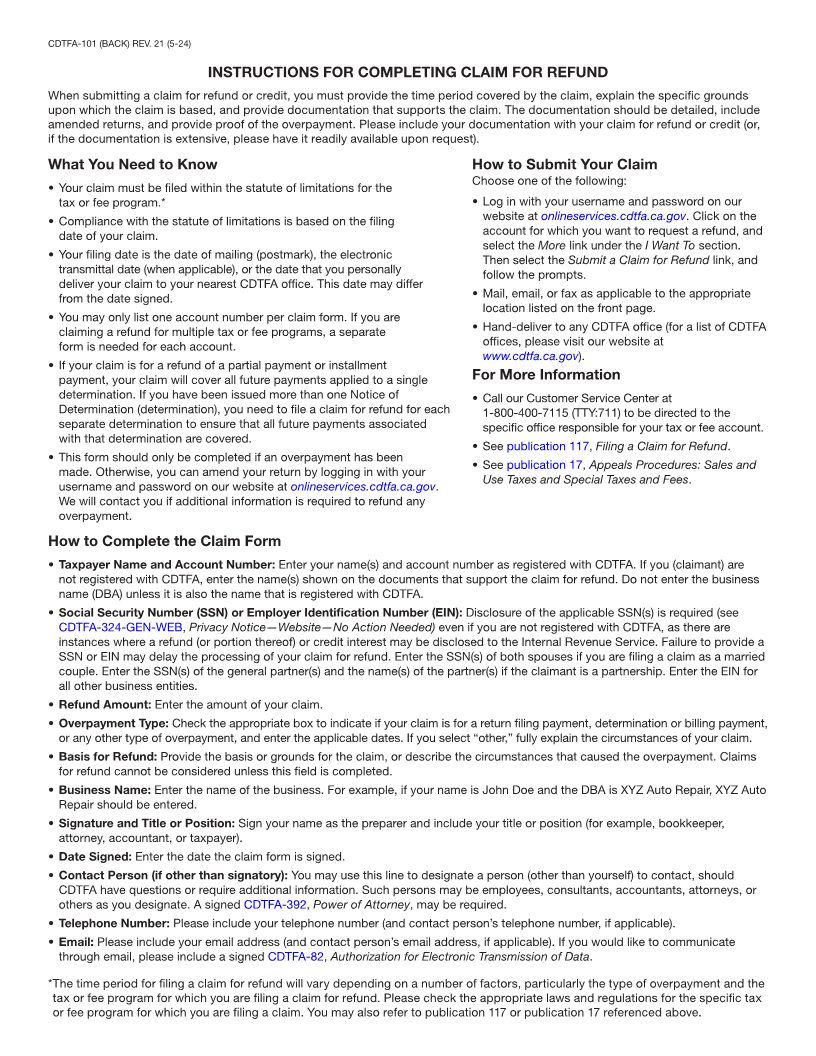

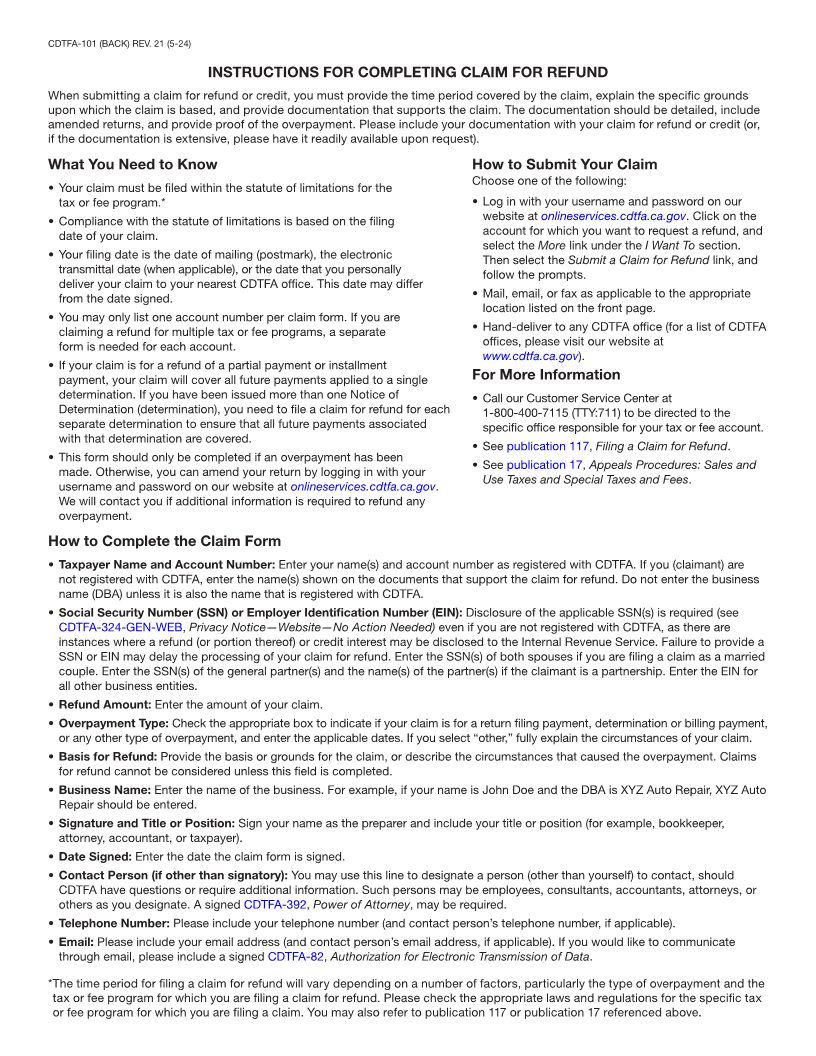

INSTRUCTIONS FOR COMPLETING CLAIM FOR REFUND

When submitting a claim for refund or credit, you must provide the time period covered by the claim, explain the specific grounds

upon which the claim is based, and provide documentation that supports the claim. The documentation should be detailed, include

amended returns, and provide proof of the overpayment. Please include your documentation with your claim for refund or credit (or,

if the documentation is extensive, please have it readily available upon request).

What You Need to Know How to Submit Your Claim

Choose one of the following:

• Your claim must be filed within the statute of limitations for the

tax or fee program.* • Log in with your username and password on our

• Compliance with the statute of limitations is based on the filing website at onlineservices.cdtfa.ca.gov. Click on the

date of your claim. account for which you want to request a refund, and

select the More link under the I Want To section.

• Your filing date is the date of mailing (postmark), the electronic Then select the Submit a Claim for Refund link, and

transmittal date (when applicable), or the date that you personally follow the prompts.

deliver your claim to your nearest CDTFA office. This date may differ

from the date signed. • Mail, email, or fax as applicable to the appropriate

location listed on the front page.

• You may only list one account number per claim form. If you are

claiming a refund for multiple tax or fee programs, a separate • Hand-deliver to any CDTFA office (for a list of CDTFA

form is needed for each account. offices, please visit our website at

www.cdtfa.ca.gov).

• If your claim is for a refund of a partial payment or installment

payment, your claim will cover all future payments applied to a single For More Information

determination. If you have been issued more than one Notice of • Call our Customer Service Center at

Determination (determination), you need to file a claim for refund for each 1-800-400-7115 (TTY:711) to be directed to the

separate determination to ensure that all future payments associated specific office responsible for your tax or fee account.

with that determination are covered.

• See publication 117, Filing a Claim for Refund.

• This form should only be completed if an overpayment has been

• See publication 17, Appeals Procedures: Sales and

made. Otherwise, you can amend your return by logging in with your

Use Taxes and Special Taxes and Fees.

username and password on our website at onlineservices.cdtfa.ca.gov.

We will contact you if additional information is required to refund any

overpayment.

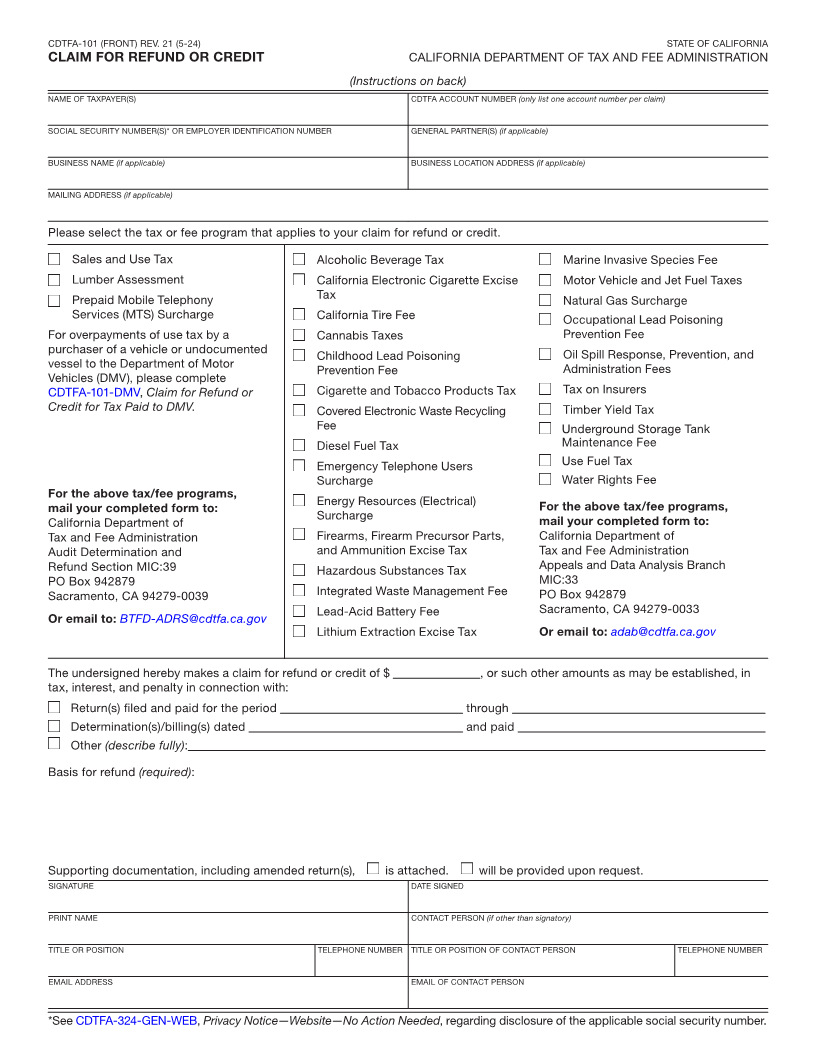

How to Complete the Claim Form

• Taxpayer Name and Account Number: Enter your name(s) and account number as registered with CDTFA. If you (claimant) are

not registered with CDTFA, enter the name(s) shown on the documents that support the claim for refund. Do not enter the business

name (DBA) unless it is also the name that is registered with CDTFA.

• Social Security Number (SSN) or Employer Identification Number (EIN): Disclosure of the applicable SSN(s) is required (see

CDTFA-324-GEN-WEB, Privacy Notice—Website—No Action Needed) even if you are not registered with CDTFA, as there are

instances where a refund (or portion thereof) or credit interest may be disclosed to the Internal Revenue Service. Failure to provide a

SSN or EIN may delay the processing of your claim for refund. Enter the SSN(s) of both spouses if you are filing a claim as a married

couple. Enter the SSN(s) of the general partner(s) and the name(s) of the partner(s) if the claimant is a partnership. Enter the EIN for

all other business entities.

• Refund Amount: Enter the amount of your claim.

• Overpayment Type: Check the appropriate box to indicate if your claim is for a return filing payment, determination or billing payment,

or any other type of overpayment, and enter the applicable dates. If you select “other,” fully explain the circumstances of your claim.

• Basis for Refund: Provide the basis or grounds for the claim, or describe the circumstances that caused the overpayment. Claims

for refund cannot be considered unless this field is completed.

• Business Name: Enter the name of the business. For example, if your name is John Doe and the DBA is XYZ Auto Repair, XYZ Auto

Repair should be entered.

• Signature and Title or Position: Sign your name as the preparer and include your title or position (for example, bookkeeper,

attorney, accountant, or taxpayer).

• Date Signed: Enter the date the claim form is signed.

• Contact Person (if other than signatory): You may use this line to designate a person (other than yourself) to contact, should

CDTFA have questions or require additional information. Such persons may be employees, consultants, accountants, attorneys, or

others as you designate. A signed CDTFA-392, Power of Attorney, may be required.

• Telephone Number: Please include your telephone number (and contact person’s telephone number, if applicable).

• Email: Please include your email address (and contact person’s email address, if applicable). If you would like to communicate

through email, please include a signed CDTFA-82, Authorization for Electronic Transmission of Data.

* The time period for filing a claim for refund will vary depending on a number of factors, particularly the type of overpayment and the

tax or fee program for which you are filing a claim for refund. Please check the appropriate laws and regulations for the specific tax

or fee program for which you are filing a claim. You may also refer to publication 117 or publication 17 referenced above.

|