Enlarge image

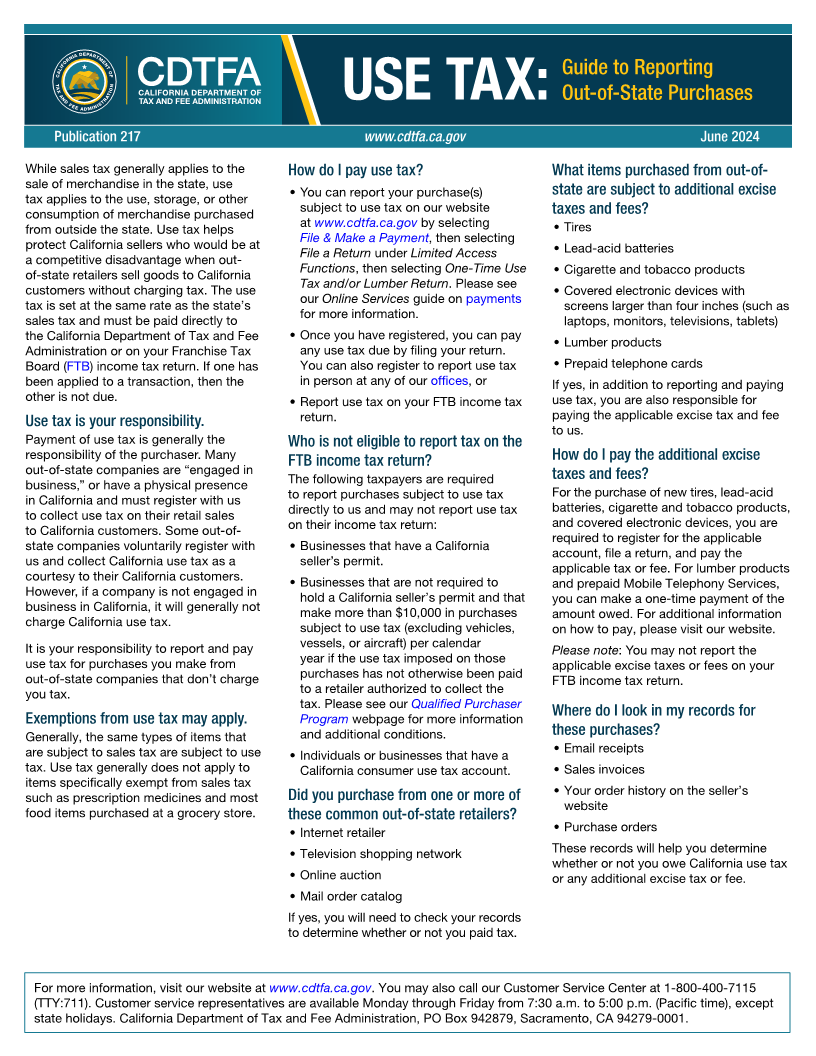

Guide to Reporting

Out-of-State Purchases

USE TAX:

Publication 217 www.cdtfa.ca.gov June 2024

While sales tax generally applies to the How do I pay use tax? What items purchased from out-of-

sale of merchandise in the state, use

• You can report your purchase(s) state are subject to additional excise

tax applies to the use, storage, or other

subject to use tax on our website

consumption of merchandise purchased taxes and fees?

at www.cdtfa.ca.gov by selecting

from outside the state. Use tax helps • Tires

File & Make a Payment, then selecting

protect California sellers who would be at • Lead-acid batteries

File a Return under Limited Access

a competitive disadvantage when out-

Functions, then selecting One-Time Use

of-state retailers sell goods to California • Cigarette and tobacco products

Tax and/or Lumber Return. Please see

customers without charging tax. The use • Covered electronic devices with

our Online Services guide on payments

tax is set at the same rate as the state’s screens larger than four inches (such as

for more information.

sales tax and must be paid directly to laptops, monitors, televisions, tablets)

the California Department of Tax and Fee • Once you have registered, you can pay • Lumber products

Administration or on your Franchise Tax any use tax due by filing your return.

Board (FTB) income tax return. If one has You can also register to report use tax • Prepaid telephone cards

been applied to a transaction, then the in person at any of our offices, or If yes, in addition to reporting and paying

other is not due. • Report use tax on your FTB income tax use tax, you are also responsible for

return. paying the applicable excise tax and fee

Use tax is your responsibility.

to us.

Payment of use tax is generally the Who is not eligible to report tax on the

responsibility of the purchaser. Many How do I pay the additional excise

FTB income tax return?

out-of-state companies are “engaged in taxes and fees?

business,” or have a physical presence The following taxpayers are required

to report purchases subject to use tax For the purchase of new tires, lead-acid

in California and must register with us

directly to us and may not report use tax batteries, cigarette and tobacco products,

to collect use tax on their retail sales

on their income tax return: and covered electronic devices, you are

to California customers. Some out-of-

required to register for the applicable

state companies voluntarily register with • Businesses that have a California

account, file a return, and pay the

us and collect California use tax as a seller’s permit.

applicable tax or fee. For lumber products

courtesy to their California customers.

• Businesses that are not required to and prepaid Mobile Telephony Services,

However, if a company is not engaged in

hold a California seller’s permit and that you can make a one-time payment of the

business in California, it will generally not

make more than $10,000 in purchases amount owed. For additional information

charge California use tax.

subject to use tax (excluding vehicles, on how to pay, please visit our website.

It is your responsibility to report and pay vessels, or aircraft) per calendar Please note: You may not report the

use tax for purchases you make from year if the use tax imposed on those applicable excise taxes or fees on your

out-of-state companies that don’t charge purchases has not otherwise been paid FTB income tax return.

you tax. to a retailer authorized to collect the

tax. Please see our Qualified Purchaser

Where do I look in my records for

Exemptions from use tax may apply. Program webpage for more information

Generally, the same types of items that and additional conditions. these purchases?

are subject to sales tax are subject to use • Individuals or businesses that have a • Email receipts

tax. Use tax generally does not apply to California consumer use tax account. • Sales invoices

items specifically exempt from sales tax

Did you purchase from one or more of • Your order history on the seller’s

such as prescription medicines and most

website

food items purchased at a grocery store. these common out-of-state retailers?

• Internet retailer • Purchase orders

• Television shopping network These records will help you determine

whether or not you owe California use tax

• Online auction or any additional excise tax or fee.

• Mail order catalog

If yes, you will need to check your records

to determine whether or not you paid tax.

For more information, visit our website at www.cdtfa.ca.gov. You may also call our Customer Service Center at 1-800-400-7115

(TTY:711). Customer service representatives are available Monday through Friday from 7:30 a.m. to 5:00 p.m. (Pacific time), except

state holidays. California Department of Tax and Fee Administration, PO Box 942879, Sacramento, CA 94279-0001.