Enlarge image

2024 INSTRUCTIONS FOR FILING RI-1040

WHAT’S NEW FOR TAX YEAR 2024

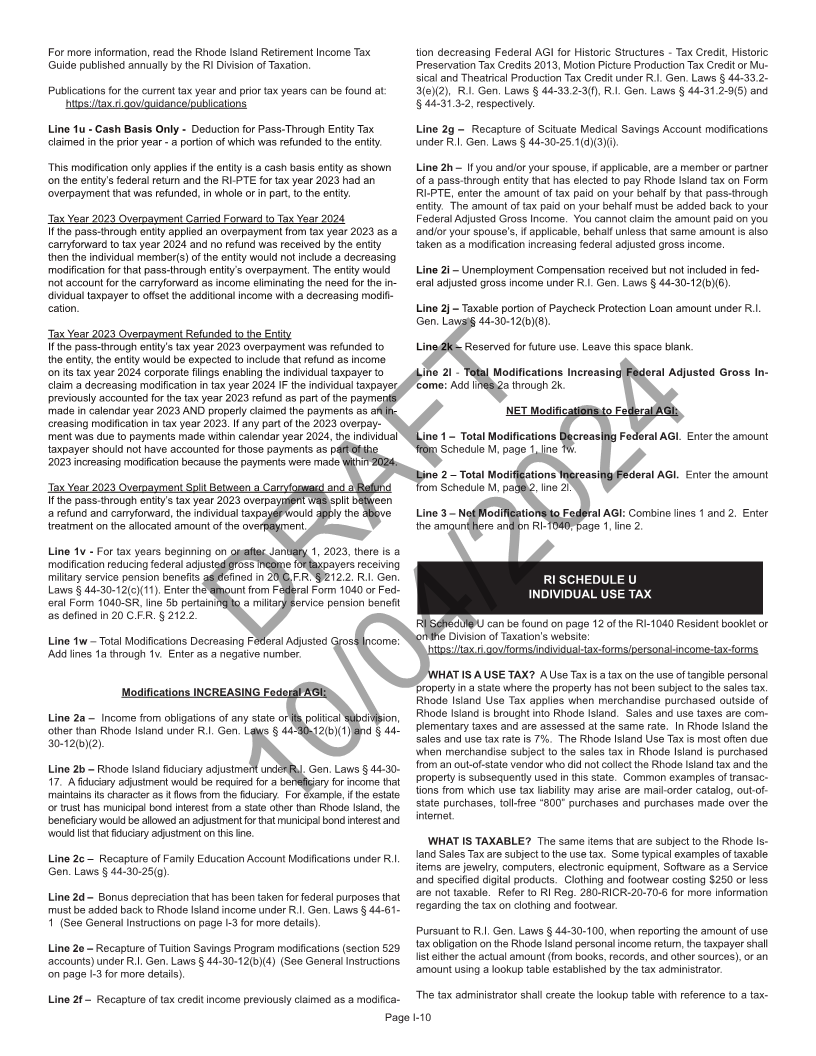

Each year the RI Division of Taxation is required to make an inflationary adjustment for the following amounts:

• Standard deduction amounts (see page I-4 for the increased amounts)

• Exemption amount (see page I-4 for the increased amount)

• Income tax brackets (see page I-11 for the new tiers)

• Increased Standard Deduction and Exemption phaseout amount (see page I-4 for the increased amount)

• Federal AGI amounts for the social security modification (see worksheet on page 18)

• Federal AGI amounts for the pension and annuity modification (see instructions on page I-9)

• RI-1040H - Property Tax Relief Credit (see Form RI-1040H)

Additional changes for tax year 2024 include:

• New Charitable Contribution Check-off for Behavioral Health Education, Training and Coordination Fund (see instructions on page I-6)

• Discontinuance of exemption for Medicaid recipients on Form IND-HEALTH (see instructions on page IND-6)

•

GENERAL INSTRUCTIONS

The RI-1040 Resident booklet contains returns and instructions for filing Any person asserting a change in domicile must show:

the 2024 Rhode Island Resident Individual Income Tax Return. Read the in- (1) an intent to abandon the former domicile,

structions in this booklet carefully. For your convenience we have provided (2) an intent to acquire a new domicile and

“line by line instructions” which will aid you in completing your return. Please (3) actual physical presence in a new domicile.

print or type so that it will be legible. Fillable forms are available on our web-

site at www.tax.ri.gov. Check the accuracy of your name(s), address, social

security number(s) and the federal identification numbers listed on RI Sched- JOINT AND SEPARATE RETURNS

ule W. JOINT RETURNS: Generally, if two married individuals file a joint federal

Most resident taxpayers will only need to complete the first three pages income tax return, they also must file a joint Rhode Island income tax return.

of Form RI-1040, RI Schedule W, RI Schedule E and RI Schedule U. Those However, if either one of the married individuals is a resident and the other

taxpayers claiming modifications to federal adjusted gross income must is a nonresident, they must file separate returns, unless they elect to file a

complete RI Schedule M on pages 9 and 10 of the RI-1040 Resident booklet. joint return as if both were residents of Rhode Island. If the resident spouse

Taxpayers claiming a credit for income taxes paid to another state must com- files separately in Rhode Island and a joint federal return is filed for both

plete RI Schedule II on page 3 of the RI-1040 Resident booklet. See page spouses, the resident spouse must compute income, exemptions, credits

I-6 of these instructions if claiming credit for multiple states. and tax as if a separate federal return had been filed.

These instructions are to be used for full year resident taxpayers only. If neither spouse is required to file a federal income tax return and either

Nonresidents and part-year residents will file their Rhode Island Individual or both are required to file a Rhode Island income tax return, they may elect

Income Tax Returns using Form RI-1040NR. to file a joint Rhode Island income tax return.

Forms and instructions are available upon request at the Rhode Island Individuals filing joint Rhode Island income tax returns are both equally li-

Division of Taxation and on the Division of Taxation’s website at: able to pay the tax. They incur what is known as “joint and several liability”

https://tax.ri.gov/forms/individual-tax-forms/personal-income-tax-forms. for Rhode Island income tax.

Complete your 2024Federal. Income Tax Return first SEPARATE RETURNS:Married individuals filing separate federal income

It is the basis for preparing your Rhode Island income tax return. In gen- tax returns must file separate Rhode Island income tax returns.

eral, the Rhode Island income tax is based on your federal adjusted gross

income.

DRAFT

Accuracy and attention to detail in completing the return in accordance MILITARY PERSONNEL

with these instructions will facilitate the processing of your tax return. You Under the provisions of the Soldiers and Sailors Civil Relief Act, the serv-

may find the following points helpful in preparing your Rhode Island Personal ice pay of members of the armed forces can only be subject to income tax

Income Tax Return. by the state of which they are legal residents. Place of legal residence at

the time of entry into the service is normally presumed to be the legal state

of residence and remains so until legal residence in another state is estab-

WHO MUST FILE A RETURN lished and service records are changed accordingly. The Rhode Island in-

RESIDENT INDIVIDUALS – Every resident individual of Rhode Island come tax is imposed on all the federal taxable income of a resident who is

who is required to file a federal income tax return must file a Rhode Island a member of the armed forces, regardless of where such income is received.

individual income tax return (RI-1040). Military pay received by a nonresident service person stationed in Rhode

A resident individual who is not required to file a federal income tax return Island is not subject to Rhode Island income tax. This does not apply to

may be required to file a Rhode Island income tax return if his/her income other income derived from Rhode Island sources, e.g., if the service person

for the taxable year is in excess of the sum of his/her Rhode Island personal 10/04/2024holds a separate job, not connected with his or her military service, income

exemptions and applicable standard deduction. received from that job is subject to Rhode Island income tax.

In addition, under the provisions of the Military Spouses Residency Relief

“Resident” means an individual who is domiciled in the State of Rhode Act, income for services performed by the servicemember’s spouse can only

Island or an individual who maintains a permanent place of abode in Rhode be subject to income tax by the state of his/her legal residency if the ser-

Island and spends more than 183 days of the year in Rhode Island. vicemember’s spouse meets certain conditions.

For purposes of the above definition, domicile is found to be a place an Income for services performed by the servicemember’s spouse in Rhode

individual regards as his or her permanent home – the place to which he or Island would be exempt from Rhode Island income tax if the servicemem-

she intends to return after a period of absence. A domicile, once established, ber’s spouse moved to Rhode Island solely to be with the servicemember

continues until a new fixed and permanent home is acquired. No change of complying with military orders sending the servicemember to Rhode Island.

domicile results from moving to a new location if the intention is to remain The servicemember and the servicemember’s spouse must also share the

only for a limited time, even if it is for a relatively long duration. For a married same non-Rhode Island domicile.

couple, normally both individuals have the same domicile. However, other income derived from Rhode Island sources such as busi-

ness income, ownership or disposition of any interest in real or tangible per-

Page I-1 Revised 09/2024