Enlarge image

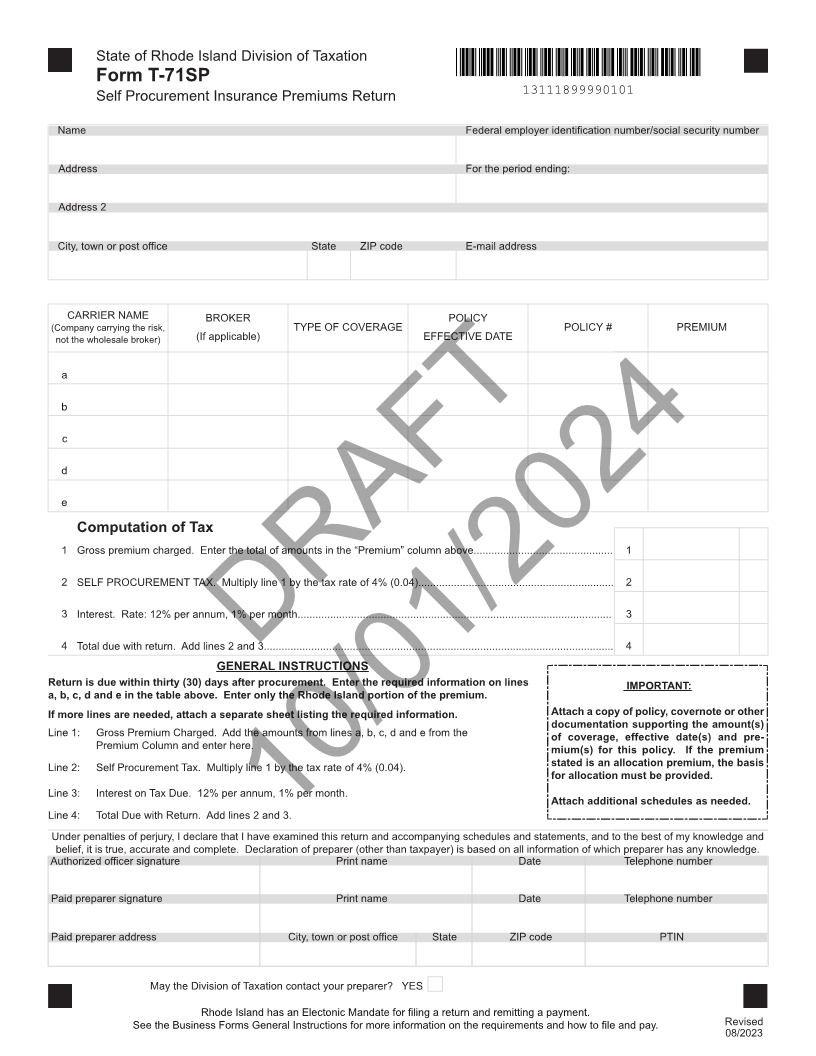

State of Rhode Island Division of Taxation

Form T-71SP

Self Procurement Insurance Premiums Return 13111899990101

Name Federal employer identification number/social security number

Address For the period ending:

Address 2

City, town or post office State ZIP code E-mail address

CARRIER NAME BROKER POLICY

(Company carrying the risk, TYPE OF COVERAGE POLICY # PREMIUM

not the wholesale broker) (If applicable) EFFECTIVE DATE

a

b

c

d

e

Computation of Tax

1 Gross premium charged. Enter the total of amounts in the “Premium” column above............................................... 1

2 SELF PROCUREMENT TAX. Multiply line 1 by the tax rate of 4% (0.04).................................................................. 2

3 Interest. Rate: 12% per annum, 1% per month.......................................................................................................... 3

4 Total due with return. Add lines 2 and 3...................................................................................................................... 4

GENERAL INSTRUCTIONSDRAFT

Return is due within thirty (30) days after procurement. Enter the required information on lines IMPORTANT:

a, b, c, d and e in the table above. Enter only the Rhode Island portion of the premium.

Attach a copy of policy, covernote or other

If more lines are needed, attach a separate sheet listing the required information. documentation supporting the amount(s)

Line 1: Gross Premium Charged. Add the amounts from lines a, b, c, d and e from the of coverage, effective date(s) and pre-

Premium Column and enter here. mium(s) for this policy. If the premium

Line 2: Self Procurement Tax. Multiply line 1 by the tax rate of 4% (0.04). stated is an allocation premium, the basis

for allocation must be provided.

Line 3: Interest on Tax Due. 12% per annum, 1% per month.

Attach additional schedules as needed.

Line 4: Total Due with Return. Add lines 2 and 3.

Under penalties of perjury, I declare that I have examined10/01/2024this return and accompanying schedules and statements, and to the best of my knowledge and

belief, it is true, accurate and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Authorized officer signature Print name Date Telephone number

Paid preparer signature Print name Date Telephone number

Paid preparer address City, town or post office State ZIP code PTIN

May the Division of Taxation contact your preparer? YES

Rhode Island has an Electonic Mandate for filing a return and remitting a payment.

See the Business Forms General Instructions for more information on the requirements and how to file and pay. Revised

08/2023