Enlarge image

State of Rhode Island Division of Taxation

2024 Form T-71A

Surplus Line Broker Return of Gross Premiums 24111799990101

Name Federal employer identification number

Address State or country of incorporation or organization

Address 2 National producer number

City, town or post office State ZIP code E-mail address

Initial

Return Final Amended

Return Return

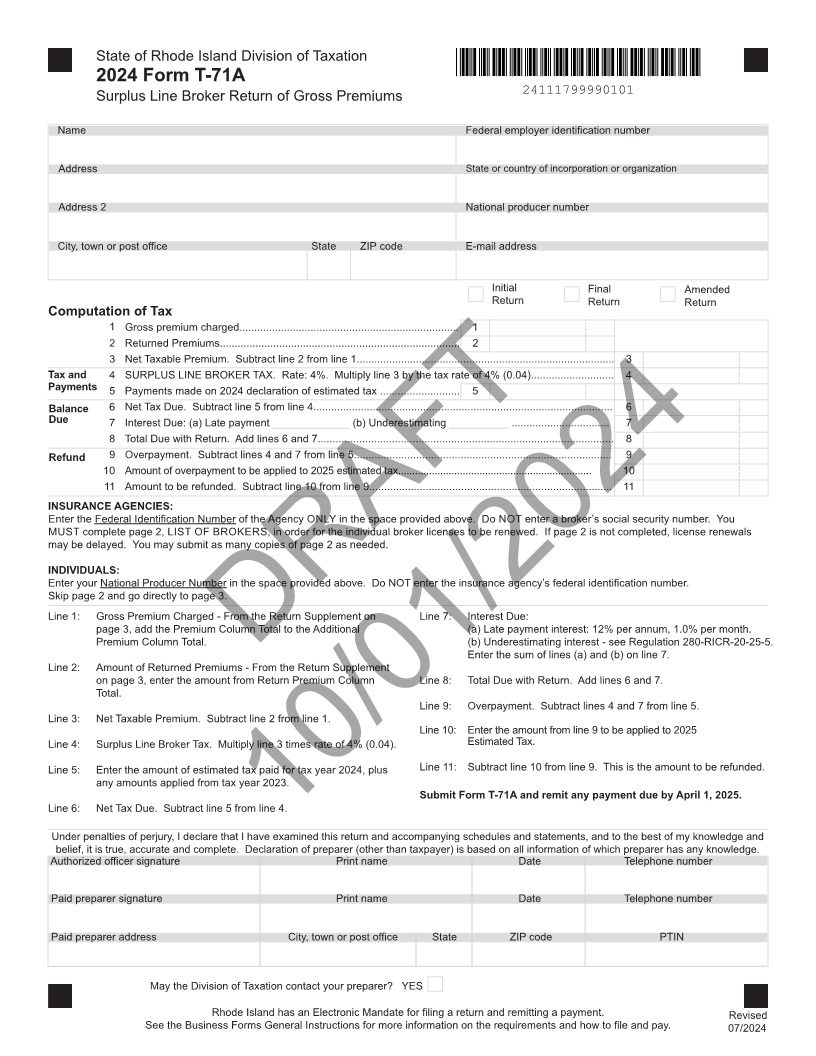

Computation of Tax

1 Gross premium charged.......................................................................... 1

2 Returned Premiums................................................................................. 2

3 Net Taxable Premium. Subtract line 2 from line 1....................................................................................... 3

Tax and 4 SURPLUS LINE BROKER TAX. Rate: 4%. Multiply line 3 by the tax rate of 4% (0.04)............................ 4

Payments 5 Payments made on 2024 declaration of estimated tax ........................... 5

Balance 6 Net Tax Due. Subtract line 5 from line 4..................................................................................................... 6

Due 7 Interest Due: (a) Late payment _____________ (b) Underestimating __________ ................................. 7

8 Total Due with Return. Add lines 6 and 7.................................................................................................... 8

Refund 9 Overpayment. Subtract lines 4 and 7 from line 5....................................................................................... 9

10 Amount of overpayment to be applied to 2025 estimated tax..................................................................... 10

11 Amount to be refunded. Subtract line 10 from line 9.................................................................................. 11

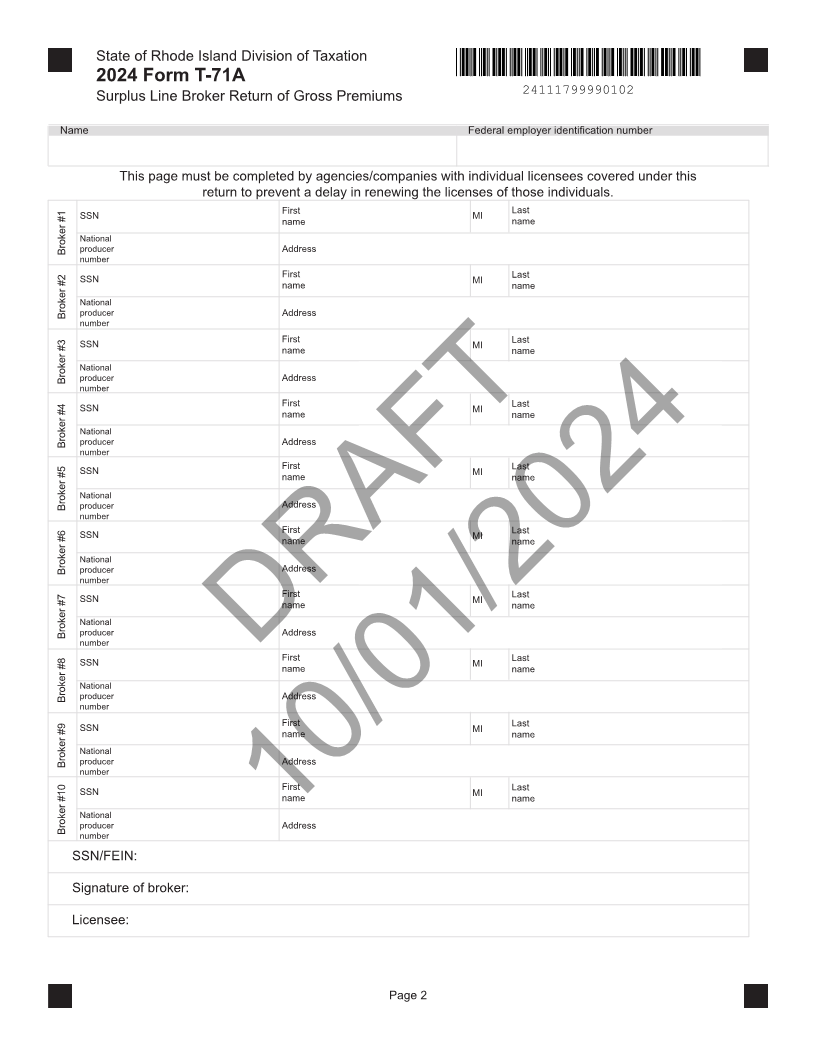

INSURANCE AGENCIES:

Enter the Federal Identification Number of the Agency ONLY in the space provided above. Do NOT enter a broker’s social security number. You

MUST complete page 2, LIST OF BROKERS, in order for the individual broker licenses to be renewed. If page 2 is not completed, license renewals

may be delayed. You may submit as many copies of page 2 as needed.

INDIVIDUALS:

Enter your National Producer Number in the space provided above. Do NOT enter the insurance agency’s federal identification number.

Skip page 2 and go directly to page 3.

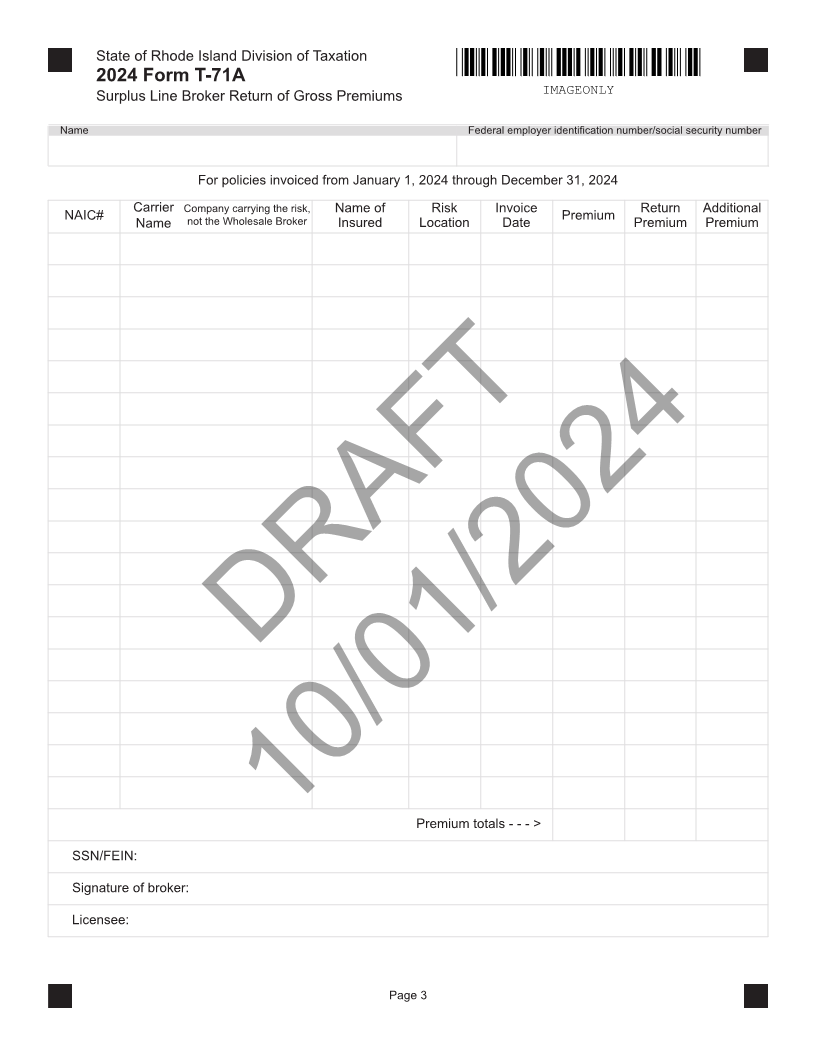

Line 1: Gross Premium Charged - From the Return Supplement on Line 7: Interest Due:

page 3, add the Premium Column Total to the Additional (a) Late payment interest: 12% per annum, 1.0% per month.

Premium Column Total. (b) Underestimating interest - see Regulation 280-RICR-20-25-5.

Enter the sum of lines (a) and (b) on line 7.

Line 2: Amount of Returned Premiums - From theDRAFTReturn Supplement

on page 3, enter the amount from Return Premium Column Line 8: Total Due with Return. Add lines 6 and 7.

Total.

Line 9: Overpayment. Subtract lines 4 and 7 from line 5.

Line 3: Net Taxable Premium. Subtract line 2 from line 1.

Line 10: Enter the amount from line 9 to be applied to 2025

Line 4: Surplus Line Broker Tax. Multiply line 3 times rate of 4% (0.04). Estimated Tax.

Line 5: Enter the amount of estimated tax paid for tax year 2024, plus Line 11: Subtract line 10 from line 9. This is the amount to be refunded.

any amounts applied from tax year 2023. Submit Form T-71A and remit any payment due by April 1, 2025.

Line 6: Net Tax Due. Subtract line 5 from line 4.

Under penalties of perjury, I declare that I have examined10/01/2024this return and accompanying schedules and statements, and to the best of my knowledge and

belief, it is true, accurate and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Authorized officer signature Print name Date Telephone number

Paid preparer signature Print name Date Telephone number

Paid preparer address City, town or post office State ZIP code PTIN

May the Division of Taxation contact your preparer? YES

Rhode Island has an Electronic Mandate for filing a return and remitting a payment. Revised

See the Business Forms General Instructions for more information on the requirements and how to file and pay. 07/2024