Enlarge image

1111111111222222222233333333334444444444555555555566666666667777777777888

34567890123456789012345678901234567890123456789012345678901234567890123456789012

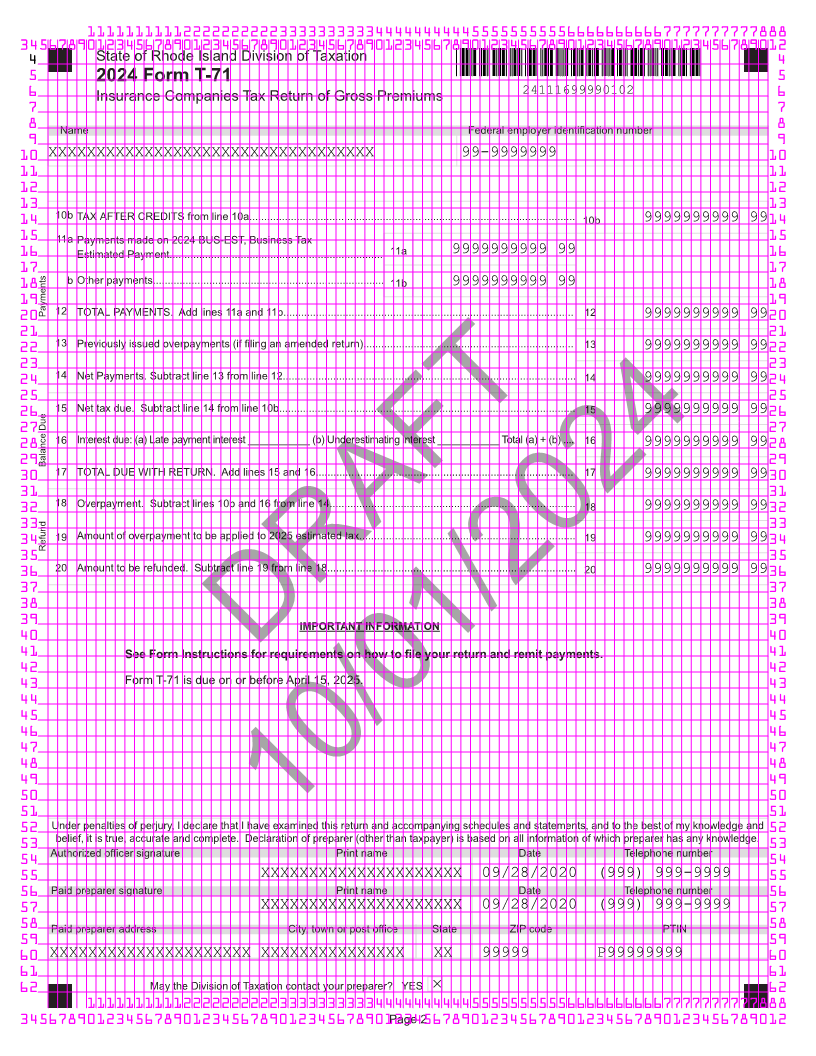

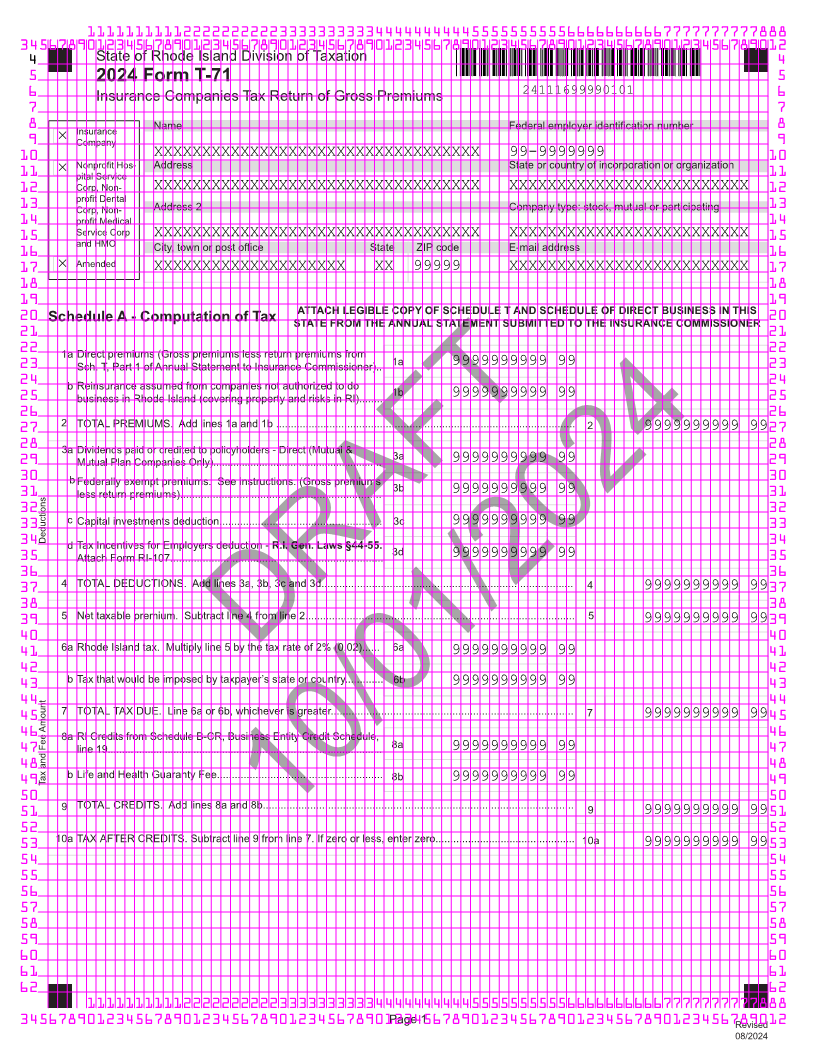

4 State of Rhode Island Division of Taxation 4

5 2024 Form T-71 5

6 Insurance Companies Tax Return of Gross Premiums 24111699990101 6

7 7

8 Insurance Name Federal employer identification number 8

9 Company 9

10 10

Nonprofit Hos- AddressXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 99-9999999State or country of incorporation or organization

11 pital Service 11

12 Corp, Non- XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXXXXX 12

profit Dental

13 Corp, Non- Address 2 Company type: stock, mutual or participating 13

14 profit Medical 14

15 Service Corp XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXXXXX 15

16 and HMO City, town or post office State ZIP code E-mail address 16

17 Amended XXXXXXXXXXXXXXXXXXXX XX 99999 XXXXXXXXXXXXXXXXXXXXXXXXX 17

18 18

19 19

ATTACH LEGIBLE COPY OF SCHEDULE T AND SCHEDULE OF DIRECT BUSINESS IN THIS

20 Schedule A - Computation of Tax STATE FROM THE ANNUAL STATEMENT SUBMITTED TO THE INSURANCE COMMISSIONER 20

21 21

22 1 a Direct premiums (Gross premiums less return premiums from 22

23 Sch. T, Part 1 of Annual Statement to Insurance Commissioner).. 1a 9999999999 99 23

24 b Reinsurance assumed from companies not authorized to do 1b 24

25 business in Rhode Island (covering property and risks in RI)........ 9999999999 99 25

26 26

27 2 TOTAL PREMIUMS. Add lines 1a and 1b ..................................................................................................... 2 9999999999 99 27

28 3 a Dividends paid or credited to policyholders - Direct (Mutual & 3a 28

29 Mutual Plan Companies Only)........................................................... 9999999999 99 29

30 b 30

less return premiums)....................................................................

31 Federally exempt premiums. See instructions. (Gross premiums 3b 9999999999 99 31

32 32

33 c Capital investments deduction....................................................... 3c 9999999999 99 33

Deductions

34 d Tax Incentives for Employers deduction - R.I. Gen. Laws §44-55. 3d 34

35 Attach Form RI-107........................................................................ 9999999999 99 35

36 36

37 4 TOTAL DEDUCTIONS. Add lines 3a, 3b, 3c and 3d..................................................................................... 4 9999999999 99 37

38 38

39 5 Net taxable premium. Subtract line 4 from line 2........................................................................................... 5 9999999999 99 39

40 40

41 6a Rhode Island tax. Multiply line 5 by the tax rate of 2% (0.02)...... 6a 9999999999 99 41

42 DRAFT 42

43 b Tax that would be imposed by taxpayer’s state or country............. 6b 9999999999 99 43

44 44

45 7 TOTAL TAX DUE. Line 6a or 6b, whichever is greater.................................................................................. 7 9999999999 99 45

46 8 a RI Credits from Schedule B-CR, Business Entity Credit Schedule, 46

47 line 19................................................................................................ 8a 9999999999 99 47

48 48

49 Tax and Fee Amount b Life and Health Guaranty Fee........................................................ 8b 9999999999 99 49

50 50

51 9 TOTAL CREDITS. Add lines 8a and 8b......................................................................................................... 9 9999999999 99 51

52 52

10aTAX AFTER CREDITS. Subtract line 9 from line 7.10/01/2024If zero or less, enter zero............................................... 10a

53 9999999999 99 53

54 54

55 55

56 56

57 57

58 58

59 59

60 60

61 61

62 62

1111111111222222222233333333334444444444555555555566666666667777777777888

34567890123456789012345678901234567890123456789012345678901234567890123456789012Page 1 Revised

08/2024