Enlarge image

1111111111222222222233333333334444444444555555555566666666667777777777888

34567890123456789012345678901234567890123456789012345678901234567890123456789012

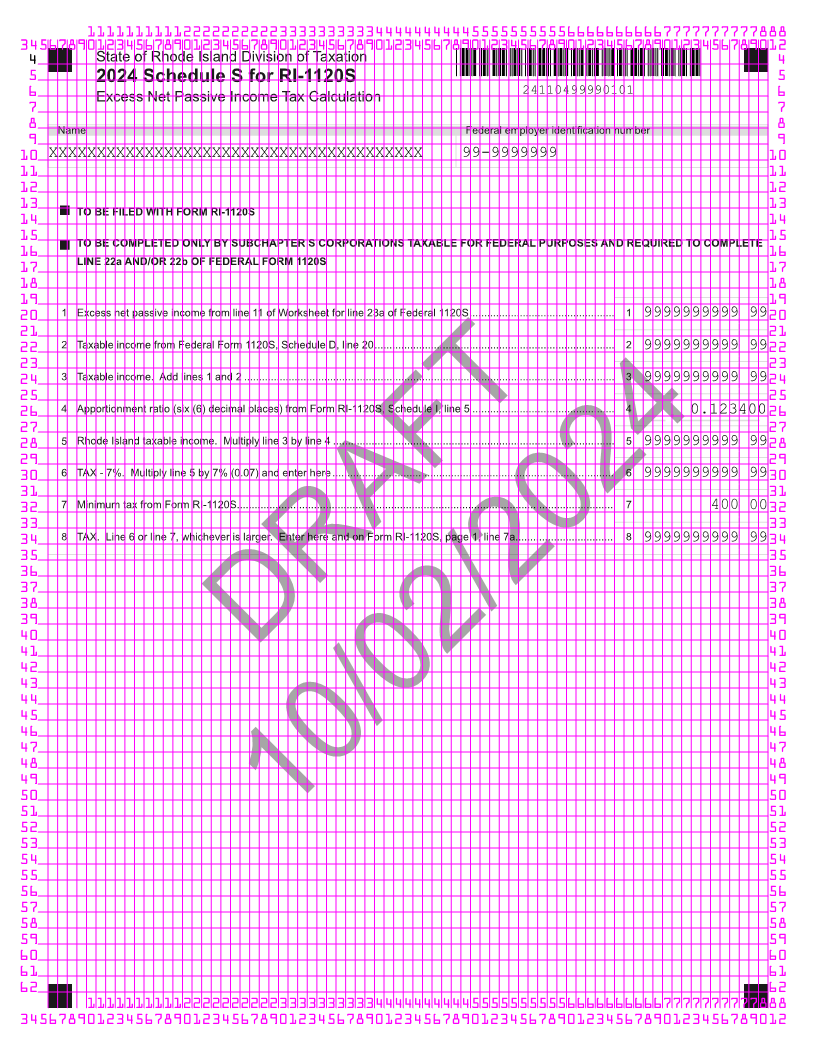

4 State of Rhode Island Division of Taxation 4

5 2024 Schedule S for RI-1120S 5

6 Excess Net Passive Income Tax Calculation 24110499990101 6

7 7

8 Name Federal employer identification number 8

9 9

10 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 99-9999999 10

11 11

12 12

13 TO BE FILED WITH FORM RI-1120S 13

14 14

15 TO BE COMPLETED ONLY BY SUBCHAPTER S CORPORATIONS TAXABLE FOR FEDERAL PURPOSES AND REQUIRED TO COMPLETE 15

16 LINE 22a AND/OR 22b OF FEDERAL FORM 1120S 16

17 17

18 18

19 19

20 1 Excess net passive income from line 11 of Worksheet for line 23a of Federal 1120S................................................. 1 9999999999 9920

21 21

22 2 Taxable income from Federal Form 1120S, Schedule D, line 20................................................................................. 2 9999999999 9922

23 23

24 3 Taxable income. Add lines 1 and 2 ............................................................................................................................. 3 9999999999 9924

25 25

_ . ______

26 4 Apportionment ratio (six (6) decimal places) from Form RI-1120S, Schedule I, line 5 ................................................ 4 0.123400 26

27 27

28 5 Rhode Island taxable income. Multiply line 3 by line 4 ............................................................................................... 5 9999999999 9928

29 29

30 6 TAX - 7%. Multiply line 5 by 7% (0.07) and enter here............................................................................................... 6 9999999999 9930

31 31

32 7 Minimum tax from Form RI-1120S............................................................................................................................... 7 32

400 00

33 33

34 8 TAX. Line 6 or line 7, whichever is larger. Enter here and on Form RI-1120S, page 1, line 7a................................. 8 9999999999 9934

35 35

36 36

37 37

38 38

39 39

40 40

41 41

42 DRAFT 42

43 43

44 44

45 45

46 46

47 47

48 48

49 49

50 50

51 51

52 52

10/02/2024

53 53

54 54

55 55

56 56

57 57

58 58

59 59

60 60

61 61

62 62

1111111111222222222233333333334444444444555555555566666666667777777777888

34567890123456789012345678901234567890123456789012345678901234567890123456789012