Enlarge image

1111111111222222222233333333334444444444555555555566666666667777777777888

34567890123456789012345678901234567890123456789012345678901234567890123456789012

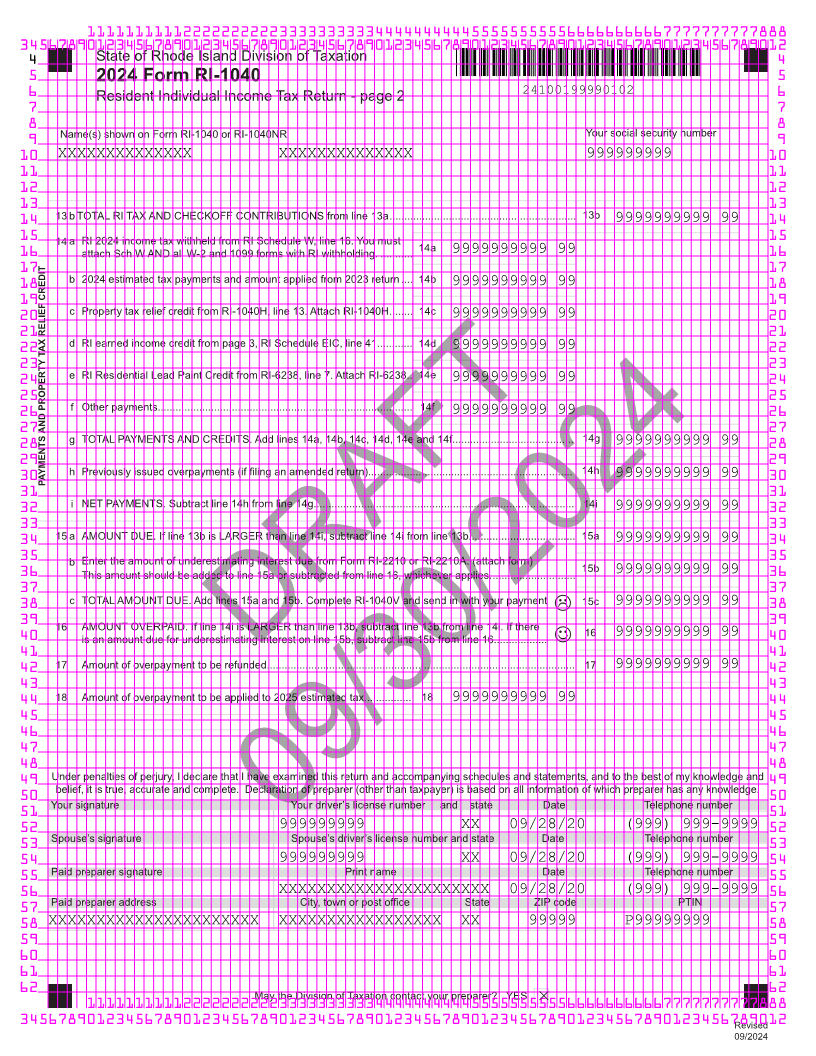

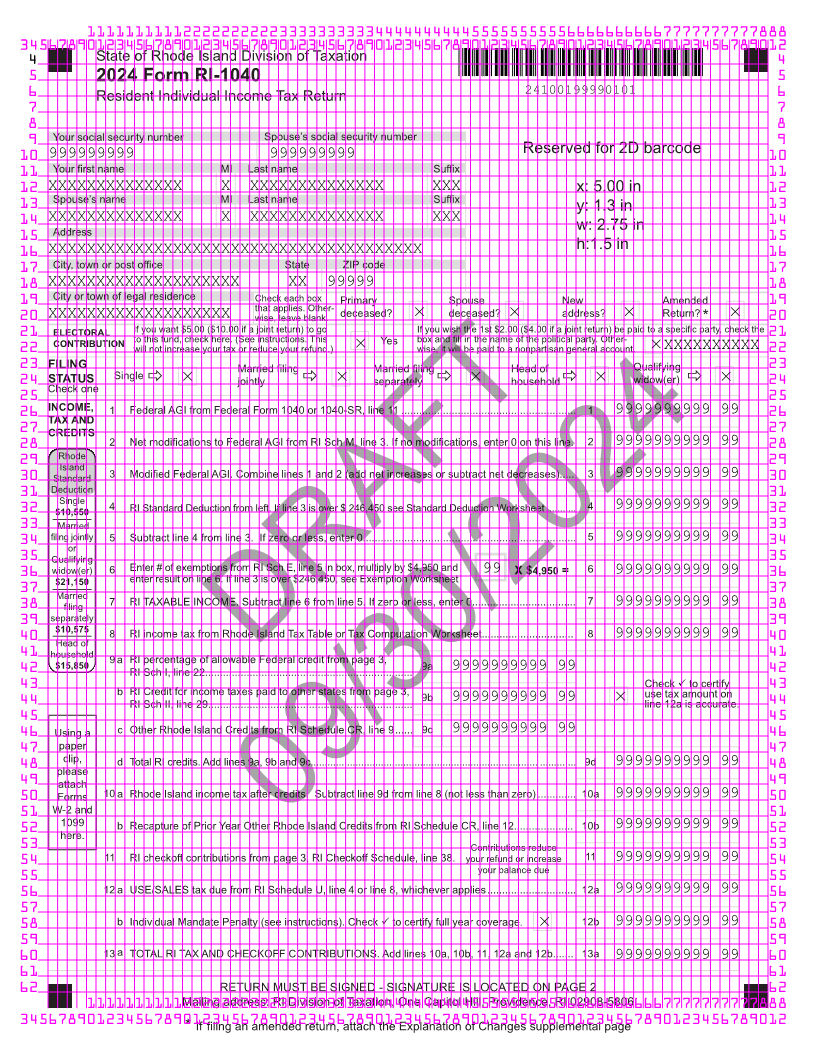

4 State of Rhode Island Division of Taxation 4

5 2024 Form RI-1040 5

6 Resident Individual Income Tax Return 24100199990101 6

7 7

8 8

9 Your social security number Spouse’s social security number 9

10 999999999 999999999 Reserved for 2D barcode 10

11 Your first name MI Last name Suffix 11

12 XXXXXXXXXXXXXX X XXXXXXXXXXXXXX XXX x: 5.00 in 12

13 Spouse’s name MI Last name Suffix 13

y: 1.3 in

14 XXXXXXXXXXXXXXAddress X XXXXXXXXXXXXXX XXX w: 2.75 in 14

15 15

16 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX h:1.5 in 16

17 City, town or post office State ZIP code 17

18 XXXXXXXXXXXXXXXXXXXX XX 99999 18

19 City or town of legal residence Check each box Primary Spouse New Amended 19

that applies. Other-

20 XXXXXXXXXXXXXXXXXXX wise, leave blank. deceased? deceased? address? Return? * 20

ELECTORAL If you want $5.00 ($10.00 if a joint return) to go If you wish the 1st $2.00 ($4.00 if a joint return) be paid to a specific party, check the

21 CONTRIBUTION to this fund, check here. (See instructions. This Yes box and fill in the name of the political party. Other- 21

22 will not increase your tax or reduce your refund.) wise, it will be paid to a nonpartisan general account. XXXXXXXXXX 22

23 FILING Married filing Married filing Head of Qualifying 23

24 STATUS Singleððððjointly separately household widow(er) ð24

Check one

25 25

26 INCOME, 1 Federal AGI from Federal Form 1040 or 1040-SR, line 11 ........................................................... 1 9999999999 99 26

TAX AND

27 CREDITS 27

28 2 Net modifications to Federal AGI from RI Sch M, line 3. If no modifications, enter 0 on this line. 2 9999999999 99 28

29 Rhode 29

Island

30 Standard 3 Modified Federal AGI. Combine lines 1 and 2 (add net increases or subtract net decreases)..... 3 9999999999 99 30

31 Deduction 31

32 Single 4 RI Standard Deduction from left. If line 3 is over $ 246,450 see Standard Deduction Worksheet ........... 4 9999999999 99 32

$10,550

33 Married 33

34 filing jointly 5 Subtract line 4 from line 3. If zero or less, enter 0........................................................................ 5 9999999999 99 34

or

35 Qualifying 35

36 widow(er) 6 Enter # of exemptions from RI Sch E, line 5 in box, multiply by $4,950 and 99 X $4,950 = 6 9999999999 99 36

$21,150 enter result on line 6. If line 3 is over $246,450, see Exemption Worksheet

37 37

filing RI TAXABLE INCOME. Subtract line 6 from line 5. If zero or less, enter 0...................................

38 Married 7 7 9999999999 99 38

39 separately 39

40 $10,575 8 RI income tax from Rhode Island Tax Table or Tax Computation Worksheet............................... 8 9999999999 99 40

Head of

41 household 9 a RI percentage of allowable Federal credit from page 3, 41

42 $15,850 RI Sch I, line 22......................................................................DRAFT9a 9999999999 99 42

43 Check ü to certify 43

b RI Credit for income taxes paid to other states from page 3, 9b use tax amount on

44 RI Sch II, line 29..................................................................... 9999999999 99 line 12a is accurate. 44

45 45

46 Using a c Other Rhode Island Credits from RI Schedule CR, line 9...... 9c 9999999999 99 46

47 paper 47

48 clip, d Total RI credits. Add lines 9a, 9b and 9c................................................................................. ............. 9d 9999999999 99 48

please

49 attach 49

50 Forms 10 a Rhode Island income tax after credits. Subtract line 9d from line 8 (not less than zero) ............. 10a 9999999999 99 50

51 W-2 and 51

52 1099 b Recapture of Prior Year Other Rhode Island Credits from RI Schedule CR, line 12.................... 10b 9999999999 99 52

here. 09/30/2024

53 Contributions reduce 53

54 11 RI checkoff contributions from page 3, RI Checkoff Schedule, line 38. your refund or increase 11 9999999999 99 54

your balance due

55 55

56 12 a USE/SALES tax due from RI Schedule U, line 4 or line 8, whichever applies.............................. 12a 9999999999 99 56

57 57

58 b Individual Mandate Penalty (see instructions). Check ü to certify full year coverage . 12b 9999999999 99 58

59 59

60 13 a TOTAL RI TAX AND CHECKOFF CONTRIBUTIONS. Add lines 10a, 10b, 11, 12a and 12b....... 13a 9999999999 99 60

61 61

62 RETURN MUST BE SIGNED - SIGNATURE IS LOCATED ON PAGE 2 62

1111111111222222222233333333334444444444555555555566666666667777777777888Mailing address: RI Division of Taxation, One Capitol Hill, Providence, RI 02908-5806

34567890123456789012345678901234567890123456789012345678901234567890123456789012* If filing an amended return, attach the Explanation of Changes supplemental page