Enlarge image

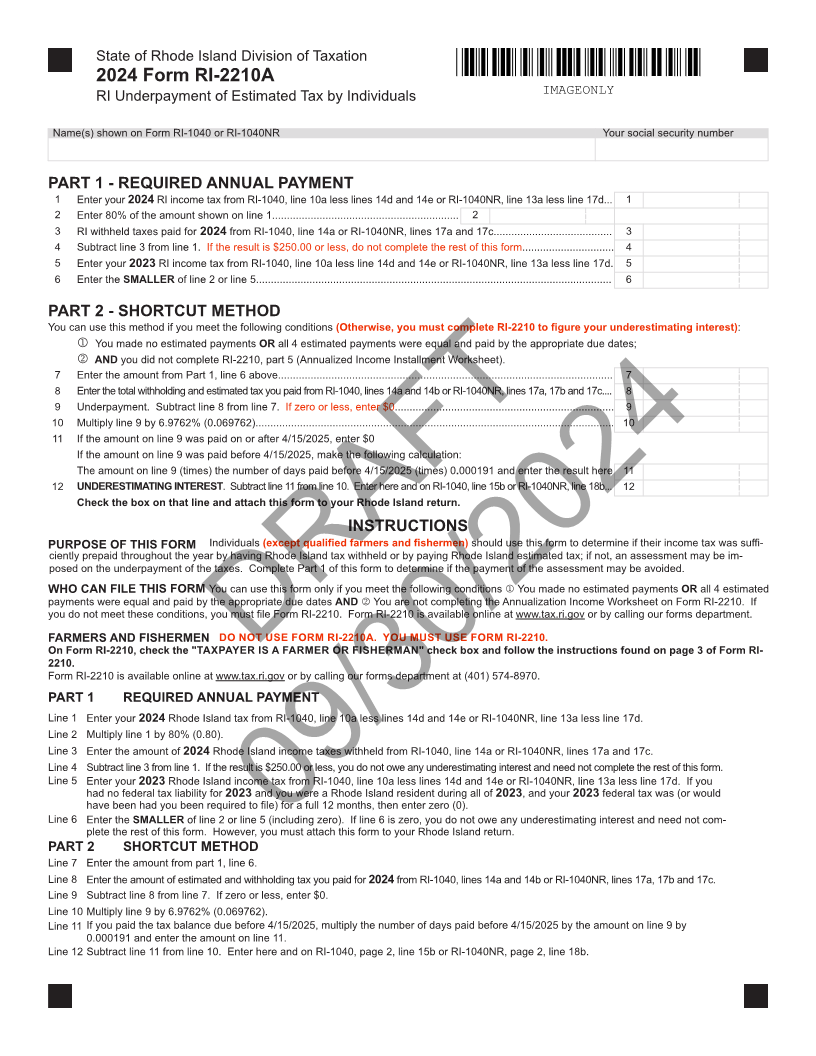

State of Rhode Island Division of Taxation

2024 Form RI-2210A

RI Underpayment of Estimated Tax by Individuals IMAGEONLY

Name(s) shown on Form RI-1040 or RI-1040NR Your social security number

PART 1 - REQUIRED ANNUAL PAYMENT

1 Enter your 2024 RI income tax from RI-1040, line 10a less lines 14d and 14e or RI-1040NR, line 13a less line 17d... 1

2 Enter 80% of the amount shown on line 1............................................................... 2

3 RI withheld taxes paid for 2024 from RI-1040, line 14a or RI-1040NR, lines 17a and 17c........................................ 3

4 Subtract line 3Iffromthe resultline 1. is $250.00 or less, do...............................not complete the rest of this form 4

5 Enter your 2023 RI income tax from RI-1040, line 10a less line 14d and 14e or RI-1040NR, line 13a less line 17d. 5

6 EnterSMALLERthe of line 2 or line 5........................................................................................................................ 6

PART 2 - SHORTCUT METHOD

You can use this method if you meet the following conditions (Otherwise, you must complete RI-2210 to figure your underestimating interest):

1 You made no estimated payments ORall 4 estimated payments were equal and paid by the appropriate due dates;

2 ANDyou did not complete RI-2210, part 5 (Annualized Income Installment Worksheet).

7 Enter the amount from Part 1, line 6 above................................................................................................................. 7

8 Enter the total withholding and estimated tax you paid from RI-1040, lines 14a and 14b or RI-1040NR, lines 17a, 17b and 17c.... 8

9 Underpayment. Subtract line 8 from line 7. If zero or less, enter $0.......................................................................... 9

10 Multiply line 9 by 6.9762% (0069762).......................................................................................................................... 10

11 If the amount on line 9 was paid on or after 4/15/2025, enter $0

If the amount on line 9 was paid before 4/15/2025, make the following calculation:

The amount on line 9 (times) the number of days paid before 4/15/2025 (times) 0.000191 and enter the result here 11

12 UNDERESTIMATING INTEREST. Subtract line 11 from line 10. Enter here and on RI-1040, line 15b or RI-1040NR, line 18b... 12

Check the box on that line and attach this form to your Rhode Island return.

INSTRUCTIONS

PURPOSE OF THIS FORM Individuals (except qualified farmers and fishermen) should use this form to determine if their income tax was suffi-

ciently prepaid throughout the year by having Rhode Island tax withheld or by paying Rhode Island estimated tax; if not, an assessment may be im-

posed on the underpayment of the taxes. Complete Part 1 of this form to determine if the payment of the assessment may be avoided.

WHO CAN FILE THIS FORM You can use this form only if you meet the following conditions 1You made no estimated payments ORall 4 estimated

payments were equal and paid by the appropriate due dates AND 2You are not completing the Annualization Income Worksheet on Form RI-2210. If

you do not meet these conditions, you must file Form RI-2210. Form RI-2210 is available online at www.tax.ri.gov or by calling our forms department.

FARMERS AND FISHERMEN DO NOT USE FORM RI-2210A. YOU MUST USE FORM RI-2210.

On Form RI-2210, check the "TAXPAYER IS A FARMER OR FISHERMAN" check box and follow the instructions found on page 3 of Form RI-

2210.

Form RI-2210 is available online at www.tax.ri.gov or by calling our forms department at (401) 574-8970.DRAFT

PART 1 REQUIRED ANNUAL PAYMENT

Line 1 Enter your 2024 Rhode Island tax from RI-1040, line 10a less lines 14d and 14e or RI-1040NR, line 13a less line 17d.

Line 2 Multiply line 1 by 80% (0.80).

Line 3 Enter the amount of 2024 Rhode Island income taxes withheld from RI-1040, line 14a or RI-1040NR, lines 17a and 17c.

Line 4 Subtract line 3 from line 1. If the result is $250.00 or less, you do not owe any underestimating interest and need not complete the rest of this form.

Line 5 Enter your 2023 Rhode Island income tax from RI-1040, line 10a less lines 14d and 14e or RI-1040NR, line 13a less line 17d. If you

had no federal tax liability for 2023 and you were a Rhode Island resident during all of 2023, and your 2023 federal tax was (or would

have been had you been required to file) for a full 12 months, then enter zero (0).

Line 6 Enter the SMALLERof line 2 or line 5 (including zero). If line 6 is zero, you do not owe any underestimating interest and need not com-

plete the rest of this form. However, you must attach this form to your Rhode Island return.09/30/2024

PART 2 SHORTCUT METHOD

Line 7 Enter the amount from part 1, line 6.

Line 8 Enter the amount of estimated and withholding tax you paid for 2024 from RI-1040, lines 14a and 14b or RI-1040NR, lines 17a, 17b and 17c.

Line 9 Subtract line 8 from line 7. If zero or less, enter $0.

Line 10 Multiply line 9 by 6.9762% (0.069762).

Line 11 If you paid the tax balance due before 4/15/2025, multiply the number of days paid before 4/15/2025 by the amount on line 9 by

0.000191 and enter the amount on line 11.

Line 12 Subtract line 11 from line 10. Enter here and on RI-1040, page 2, line 15b or RI-1040NR, page 2, line 18b.