Enlarge image

1111111111222222222233333333334444444444555555555566666666667777777777888

34567890123456789012345678901234567890123456789012345678901234567890123456789012

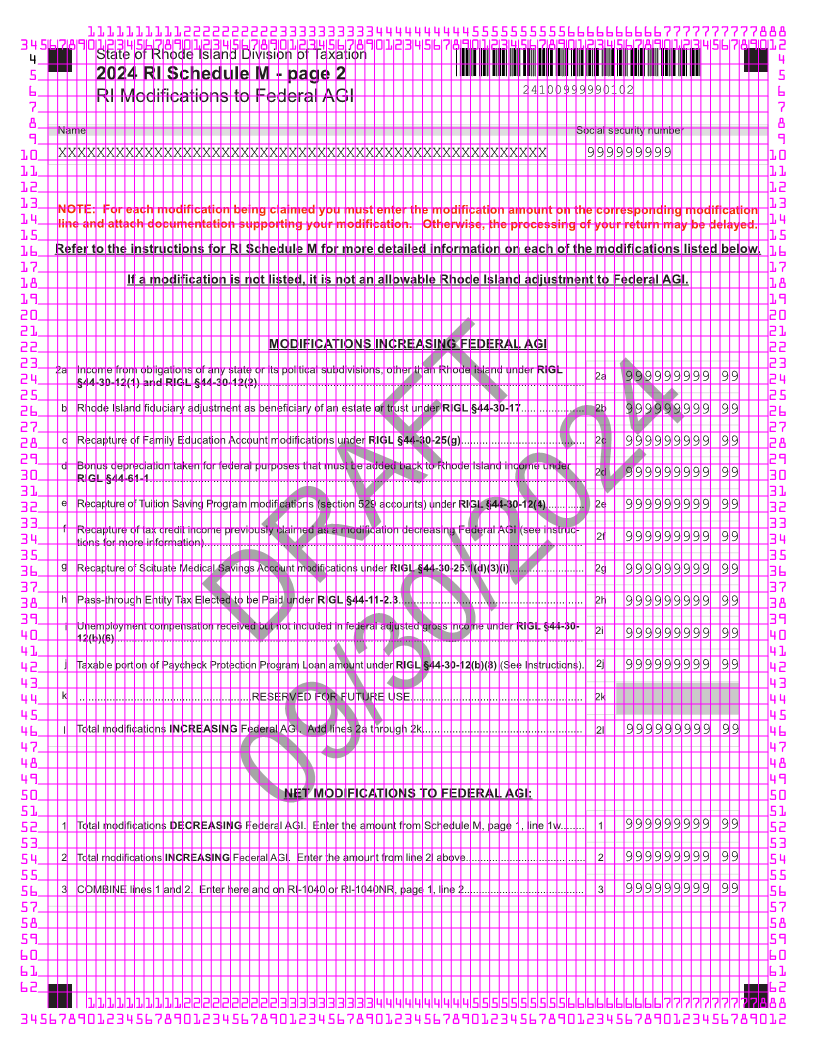

4 State of Rhode Island Division of Taxation 4

5 2024 RI Schedule M - page 1 5

6 RI Modifications to Federal AGI 24100999990101 6

7 7

8 Name Social security number 8

9 9

10 XXXXXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXXXXXX 999999999 10

11 11

NOTE: For each modification being claimed you must enter the modification amount on the corresponding modification line and attach

12 documentation supporting your modification. Otherwise, the processing of your return may be delayed. Refer to the instructions for 12

13 more information on each modification. If a modification is not listed below, it is not valid and, therefore, not allowable. 13

14 MODIFICATIONS DECREASING FEDERAL AGI 14

15 1a Income from obligations of the US government included in Federal AGI but exempt from state income taxes 1a 15

16 reduced by investment interest on the obligations taken as a federal itemized deduction................................... 999999999 99 16

17 17

18 b Rhode Island fiduciary adjustment as beneficiary of an estate or trust under RIGL §44-30-17..................... 1b 999999999 99 18

19 19

20 c Elective deduction for new research and development facilities under RIGL §44-32-1................................. 1c 999999999 99 20

21 21

22 d Railroad Retirement benefits paid by the Railroad Retirement Board............................................................ 1d 999999999 99 22

23 23

24 e Qualifying investment in a certified venture capital partnership under RIGL §44-43-2.................................. 1e 999999999 99 24

25 25

26 f Family Education Accounts under RIGL §44-30-25....................................................................................... 1f 999999999 99 26

27 g Tuition Saving Program contributions (section 529 accounts) under RIGL §44-30-12. 1g 27

28 Not to exceed $500 ($1,000 if joint return)..................................................................................................... 999999999 99 28

29 29

30 h Exemptions from tax on profit or gain for writers, composers and artists under RIGL §44-30-1.1................. 1h 999999999 99 30

31 i Bonus depreciation taken on the Federal return that has not yet been subtracted from Rhode Island 1i 31

32 income underRIGL §44-61-1......................................................................................................................... 999999999 99 32

33 j Section 179 depreciation taken on the Federal return that has not yet been subtracted from Rhode Island 1j 33

34 under RIGL §44-61-1.1.................................................................................................................................. 999999999 99 34

35 k Modification for performance based compensation realized by an eligible employee under the Jobs 1k 35

36 Growth Act under RIGL §42-64.11-4.............................................................................................................. 999999999 99 36

37 l Modification for exclusion for qualifying option underRIGL §44-39.3 ANDmodification for exclusion for quali- 1l 37

38 fying securities or investment under RIGL §44-43-8.............................................................................................. 999999999 99 38

39 39

40 m Modification for Tax Incentives for Employers under RIGL §44-55-4.1.......................................................... 1m 999999999 99 40

41 n Tax Credit income reported on Federal return exempt for Rhode Island purposes (see instructions for eligible 1n 41

42 credits)...................................................................................................................................................................DRAFT 999999999 99 42

43 o Active duty militaryNonresidentspay of stationed in Rhode Island and income for services performed in 1o 43

44 Rhode Island by the servicemember’s spouse............................................................................................... 999999999 99 44

45 p Scituate Medical Savings Account contributions taxable on the Federal Return but exempt from Rhode Island 1p 45

46 under RIGL §44-30-25.1(d)(3)(i).................................................................................................................................. 999999999 99 46

47 q Amounts of insurance benefits for dependents and domestic partners included in Federal AGI pursuant to 1q 47

48 chapter 12 of title 36 or other coverage plan under RIGL §44-30-12(c)(6)................................................... 999999999 99 48

49 r Modification for Organ Transplantation for specific unreimbursed expenses incurred by Rhode Island 1r 49

50 Resident pursuantRIGLto§44-30-12(c)(7) .................................................................................................. 999999999 99 50

51 Modification for taxable Social Security Primary Spouse 1s 51

s

52 Date of Birth Date of Birth 52

incomeRIGLunder§44-30-12(c)(8) (Required) 09/30/2024 / 12/31/2023 / (Required) 12/31/2023/ / 999999999 99

53 t Modification for taxable Retirement in- Primary Spouse 53

54 come from certain pension plans or an- Date of Birth / 12/31/2023 / Date of Birth 12/31/2023/ / 1t 999999999 99 54

nuities under RIGL §44-30-12(c)(9) (Required) (Required)

55 55

56 u CASH BASIS ONLY - Deduction for Pass-Through Entity Tax claimed in Prior Year (See Instructions)............... 1u 999999999 99 56

57 57

58 v Modification for taxpayers receiving military service pensions under RIGL §44-30-12(c)(11)............................ 1v 999999999 99 58

59 59

60 w Total modifications DECREASING Federal AGI. Add lines 1a through 1v and enter as a negative amount......... 1w 999999999 99 60

61 61

62 62

1111111111222222222233333333334444444444555555555566666666667777777777888

34567890123456789012345678901234567890123456789012345678901234567890123456789012