Enlarge image

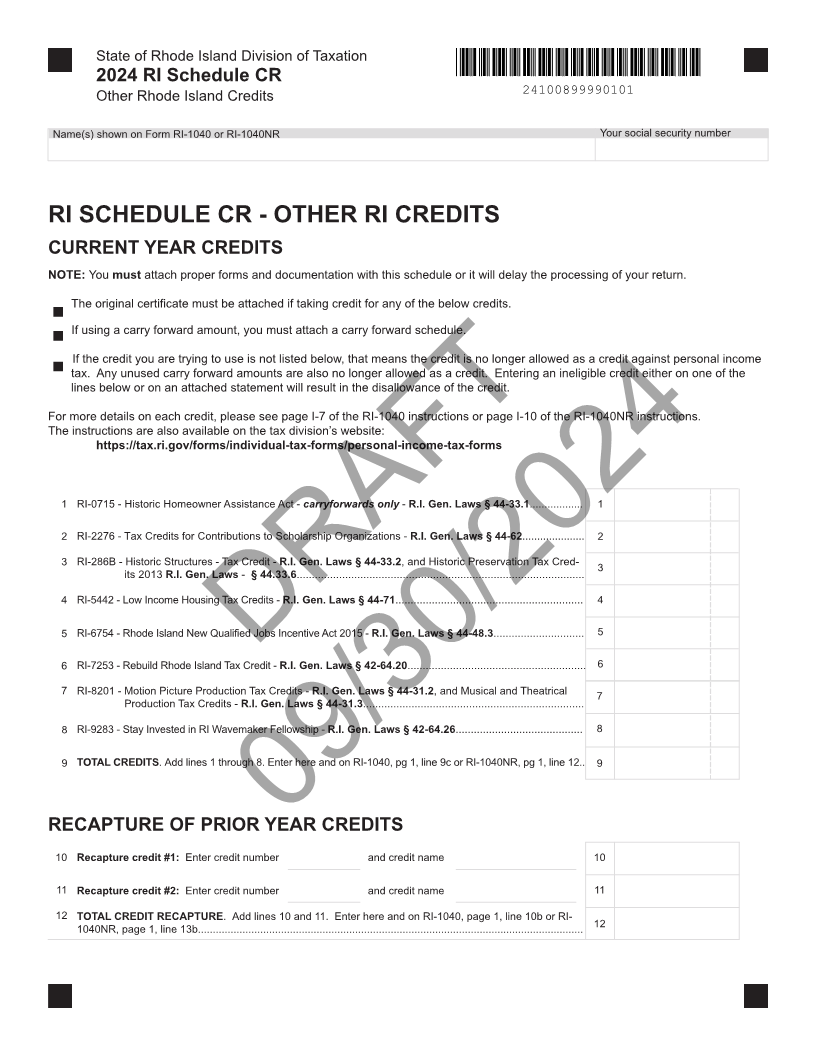

State of Rhode Island Division of Taxation

2024 RI Schedule CR

Other Rhode Island Credits 24100899990101

Name(s) shown on Form RI-1040 or RI-1040NR Your social security number

RI SCHEDULE CR - OTHER RI CREDITS

CURRENT YEAR CREDITS

NOTE: mustYou attach proper forms and documentation with this schedule or it will delay the processing of your return.

The original certificate must be attached if taking credit for any of the below credits.

If using a carry forward amount, you must attach a carry forward schedule.

If the credit you are trying to use is not listed below, that means the credit is no longer allowed as a credit against personal income

tax. Any unused carry forward amounts are also no longer allowed as a credit. Entering an ineligible credit either on one of the

lines below or on an attached statement will result in the disallowance of the credit.

For more details on each credit, please see page I-7 of the RI-1040 instructions or page I-10 of the RI-1040NR instructions.

The instructions are also available on the tax division’s website:

https://tax.ri.gov/forms/individual-tax-forms/personal-income-tax-forms

1 RI-0715 - Historic Homeowner Assistance Act - carryforwards -R.I. Gen.onlyLaws § 44-33.1 .................. 1

2 RI-2276 - Tax Credits for Contributions to Scholarship Organizations - R.I. Gen. Laws § 44-62..................... 2

3 RI-286B - Historic StructuresR.I. Gen.-LawsTax Credit - § 44-33.2, and Historic Preservation Tax Cred- 3

its 2013 R.I. Gen. Laws - § 44.33.6...............................................................................................

4 RI-5442 - Low Income Housing Tax Credits - R.I. Gen. Laws § 44-71.............................................................. 4

5 RI-6754 - Rhode Island New Qualified Jobs Incentive Act 2015 - R.I. Gen. Laws § 44-48.3.............................. 5

6 RI-7253 - Rebuild Rhode Island Tax CreditR.I.DRAFT- Gen. Laws§ 42-64.20 ........................................................... 6

7 RI-8201 - Motion Picture Production Tax Credits - R.I. Gen. Laws § 44-31.2 , and Musical and Theatrical 7

Production Tax Credits - R.I. Gen. Laws § 44-31.3.........................................................................

8 RI-9283 - Stay Invested in RI Wavemaker Fellowship - R.I. Gen. Laws § 42-64.26.......................................... 8

9 TOTAL CREDITS . Add lines 1 through 8. Enter here and on RI-1040, pg 1, line 9c or RI-1040NR, pg 1, line 12..9

RECAPTURE OF PRIOR YEAR CREDITS

09/30/2024

10 Recapture credit #1: Enter credit number and credit name 10

11 Recapture credit #2: Enter credit number and credit name 11

12 TOTAL CREDIT RECAPTURE . Add lines 10 and 11. Enter here and on RI-1040, page 1, line 10b or RI-

1040NR, page 1, line 13b.................................................................................................................................. 12