Enlarge image

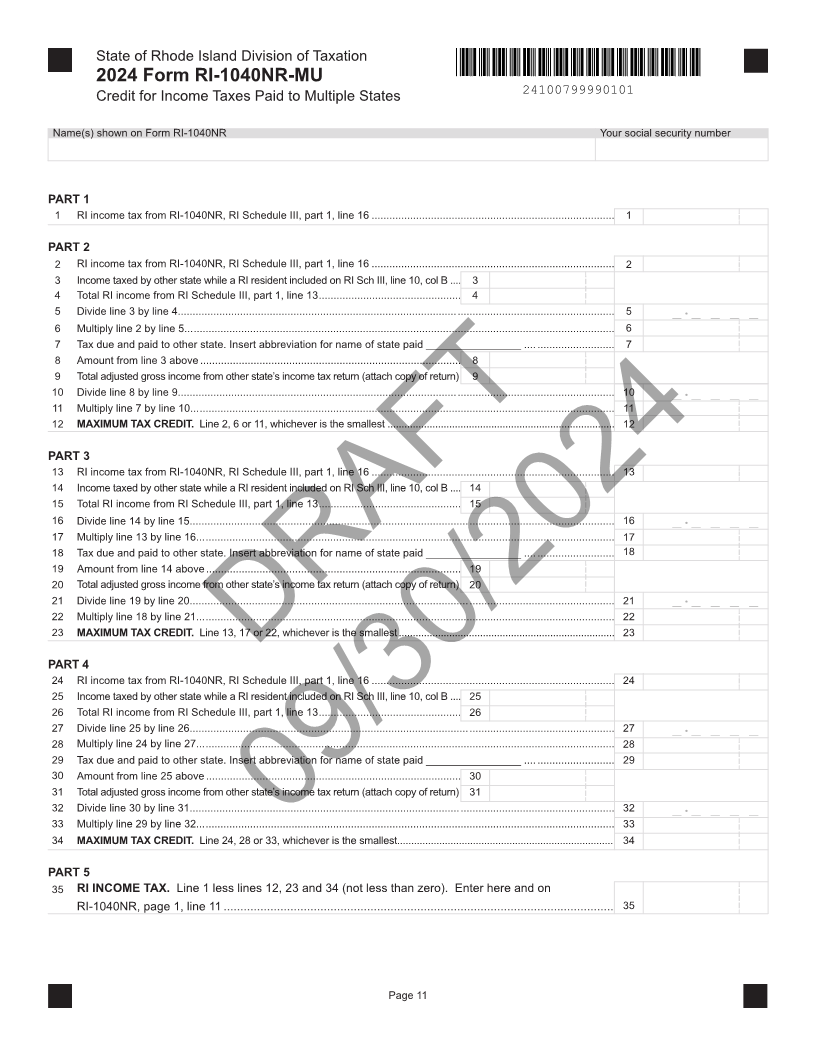

State of Rhode Island Division of Taxation

2024 Form RI-1040NR-MU

Credit for Income Taxes Paid to Multiple States 24100799990101

Name(s) shown on Form RI-1040NR Your social security number

PART 1

1 RI income tax from RI-1040NR, RI Schedule III, part 1, line 16 .................................................................................. 1

PART 2

2 RI income tax from RI-1040NR, RI Schedule III, part 1, line 16 .................................................................................. 2

3 Income taxed by other state while a RI resident included on RI Sch III, line 10, col B .... 3

4 Total RI income from RI Schedule III, part 1, line 13................................................ 4

5 Divide line 3 by line 4................................................................................................................................................... 5 _._ _ _ _

6 Multiply line 2 by line 5................................................................................................................................................. 6

7 Tax due and paid to other state. Insert abbreviation for name of state paid ________________ .............................. 7

8 Amount from line 3 above ........................................................................................ 8

9 Total adjusted gross income from other state’s income tax return (attach copy of return) 9

10 Divide line 8 by line 9................................................................................................................................................... 10 _._ _ _ _

11 Multiply line 7 by line 10............................................................................................................................................... 11

12 MAXIMUM TAX CREDIT. Line 2, 6 or 11, whichever is the smallest ................................................................................. 12

PART 3

13 RI income tax from RI-1040NR, RI Schedule III, part 1, line 16 .................................................................................. 13

14 Income taxed by other state while a RI resident included on RI Sch III, line 10, col B .... 14

15 Total RI income from RI Schedule III, part 1, line 13................................................ 15

16 Divide line 14 by line 15............................................................................................................................................... 16 _._ _ _ _

17 Multiply line 13 by line 16............................................................................................................................................. 17

18 Tax due and paid to other state. Insert abbreviation for name of state paid ________________ .............................. 18

19 Amount from line 14 above...................................................................................... 19

20 Total adjusted gross income from other state’s income tax return (attach copy of return) 20

21 Divide line 19 by line 20............................................................................................................................................... 21 _._ _ _ _

22 Multiply line 18 by line 21............................................................................................................................................. 22

23 MAXIMUM TAX CREDIT. Line 13, 17 or 22, whichever is the smallest............................................................................. 23

PART 4

DRAFT

24 RI income tax from RI-1040NR, RI Schedule III, part 1, line 16 .................................................................................. 24

25 Income taxed by other state while a RI resident included on RI Sch III, line 10, col B .... 25

26 Total RI income from RI Schedule III, part 1, line 13................................................ 26

27 Divide line 25 by line 26............................................................................................................................................... 27 _._ _ _ _

28 Multiply line 24 by line 27............................................................................................................................................. 28

29 Tax due and paid to other state. Insert abbreviation for name of state paid ________________ .............................. 29

30 Amount from line 25 above ...................................................................................... 30

31 Total adjusted gross income from other state’s income tax return (attach copy of return) 31

32 Divide line 30 by line 31............................................................................................................................................... 32 _._ _ _ _

33 Multiply line 29 by line 32............................................................................................................................................. 33

34 MAXIMUM TAX LineCREDIT.24, 28 or 33, whichever is the smallest.............................................................................09/30/202434

PART 5

35 RI INCOME TAX. Line 1 less lines 12, 23 and 34 (not less than zero). Enter here and on

RI-1040NR, page 1, line 11 ..................................................................................................................... 35

Page 11