Enlarge image

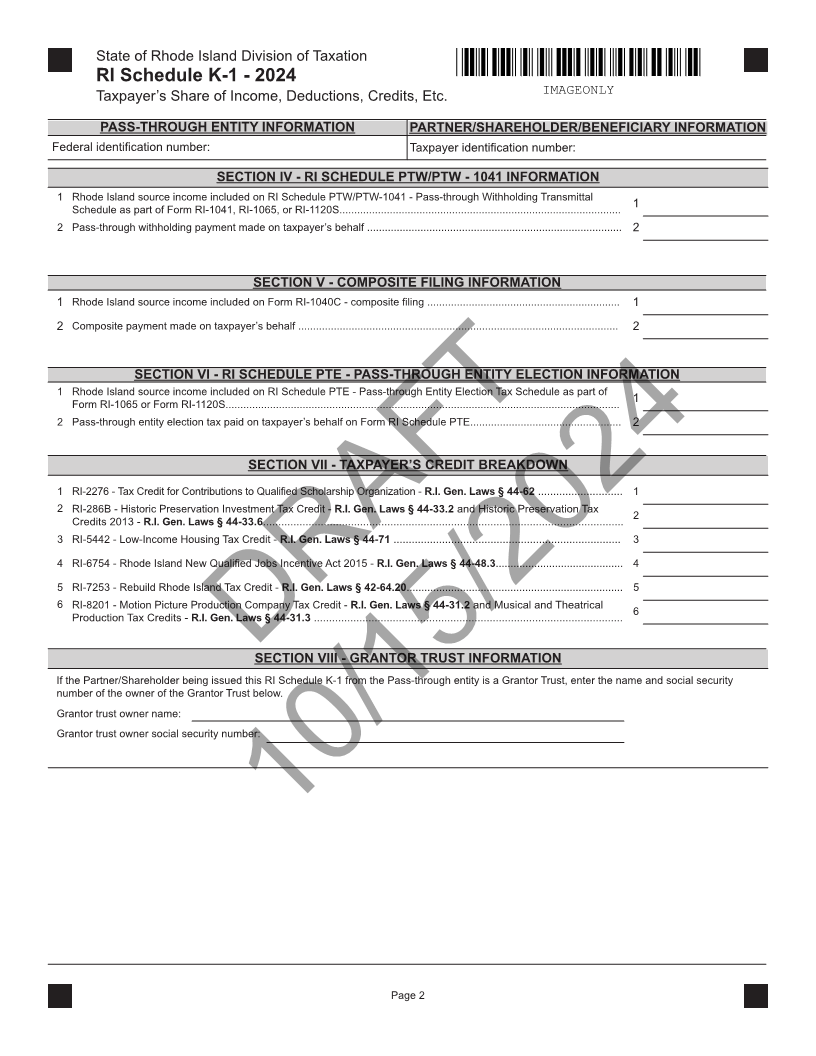

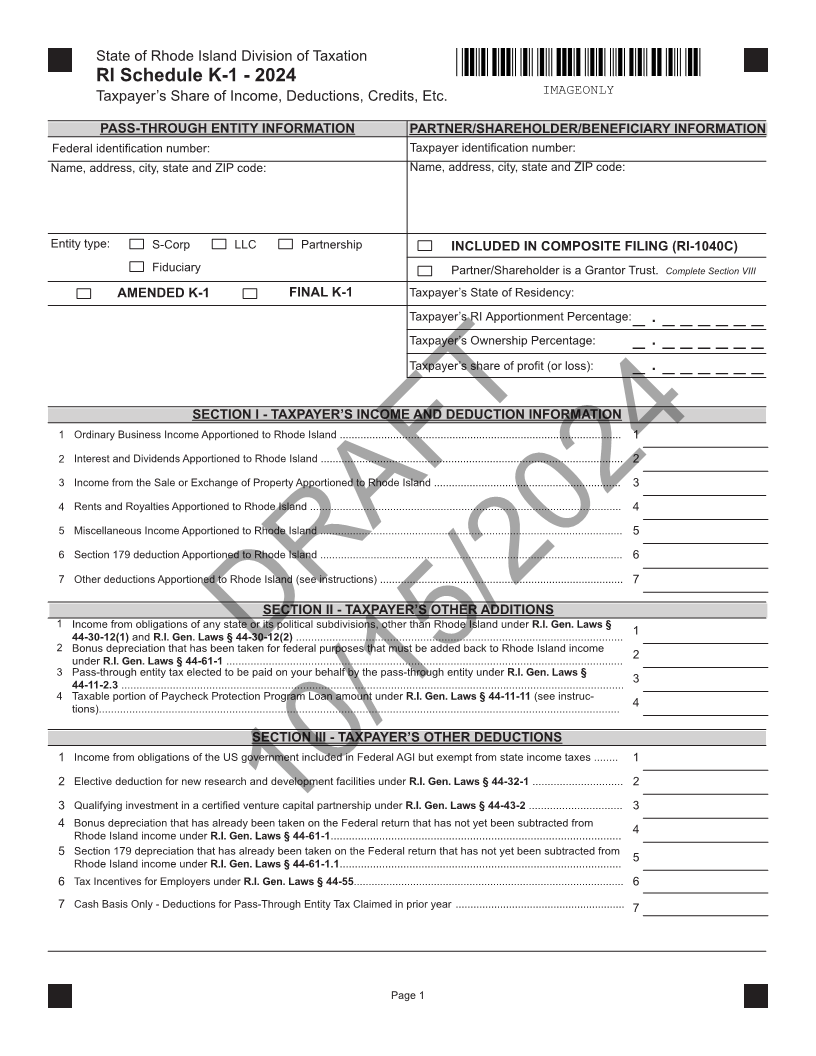

State of Rhode Island Division of Taxation

RI Schedule K-1 - 2024

Taxpayer’s Share of Income, Deductions, Credits, Etc. IMAGEONLY

PASS-THROUGH ENTITY INFORMATION PARTNER/SHAREHOLDER/BENEFICIARY INFORMATION

Federal identification number: Taxpayer identification number:

Name, address, city, state and ZIP code: Name, address, city, state and ZIP code:

Entity type: S-Corp LLC Partnership INCLUDED IN COMPOSITE FILING (RI-1040C)

Fiduciary Partner/Shareholder is a Grantor Trust. Complete Section VIII

AMENDED K-1 FINAL K-1 Taxpayer’s State of Residency:

Taxpayer’s RI Apportionment Percentage: _ . _ _ _ _ _ _

Taxpayer’s Ownership Percentage: _ . _ _ _ _ _ _

Taxpayer’s share of profit (or loss): _ . _ _ _ _ _ _

SECTION I - TAXPAYER’S INCOME AND DEDUCTION INFORMATION

1 Ordinary Business Income Apportioned to Rhode Island ............................................................................................... 1

2 Interest and Dividends Apportioned to Rhode Island ...................................................................................................... 2

3 Income from the Sale or Exchange of Property Apportioned to Rhode Island ............................................................... 3

4 Rents and Royalties Apportioned to Rhode Island ......................................................................................................... 4

5 Miscellaneous Income Apportioned to Rhode Island ...................................................................................................... 5

6 Section 179 deduction Apportioned to Rhode Island ...................................................................................................... 6

7 Other deductions Apportioned to Rhode Island (see instructions) .................................................................................. 7

SECTION II - TAXPAYER’S OTHER ADDITIONS

1 Income from obligations of any state or its political subdivisions, other than Rhode Island under R.I. Gen. Laws §

44-30-12(1) and R.I. Gen. Laws § 44-30-12(2) ............................................................................................................ 1

2 Bonus depreciation that has been taken for federal purposes that must be added back to Rhode Island income

under R.I. Gen. Laws § 44-61-1 ................................................................................................................................... 2

3 Pass-through entity tax elected to be paid on your behalf by the pass-through entity under DRAFT R.I. Gen. Laws §

44-11-2.3 ...................................................................................................................................................................... 3

4 Taxable portion of Paycheck Protection Program Loan amount under R.I. Gen. Laws § 44-11-11 (see instruc-

tions)............................................................................................................................................................................ 4

SECTION III - TAXPAYER’S OTHER DEDUCTIONS

1 Income from obligations of the US government included in Federal AGI but exempt from state income taxes ........ 1

2 Elective deduction for new research and development facilities under R.I. Gen. Laws § 44-32-1 .............................. 2

3 Qualifying investment in a certified venture capital partnership under R.I. Gen. Laws § 44-43-2 ............................... 3

4 Bonus depreciation that has already been taken on the Federal return that has not yet been subtracted from

Rhode Island income under R.I. Gen. Laws § 44-61-1................................................................................................ 4

10/15/2024

5 Section 179 depreciation that has already been taken on the Federal return that has not yet been subtracted from

Rhode Island income under R.I. Gen. Laws § 44-61-1.1............................................................................................. 5

6 Tax Incentives for Employers under R.I. Gen. Laws § 44-55........................................................................................... 6

7 Cash Basis Only - Deductions for Pass-Through Entity Tax Claimed in prior year ......................................................... 7

Page 1