Enlarge image

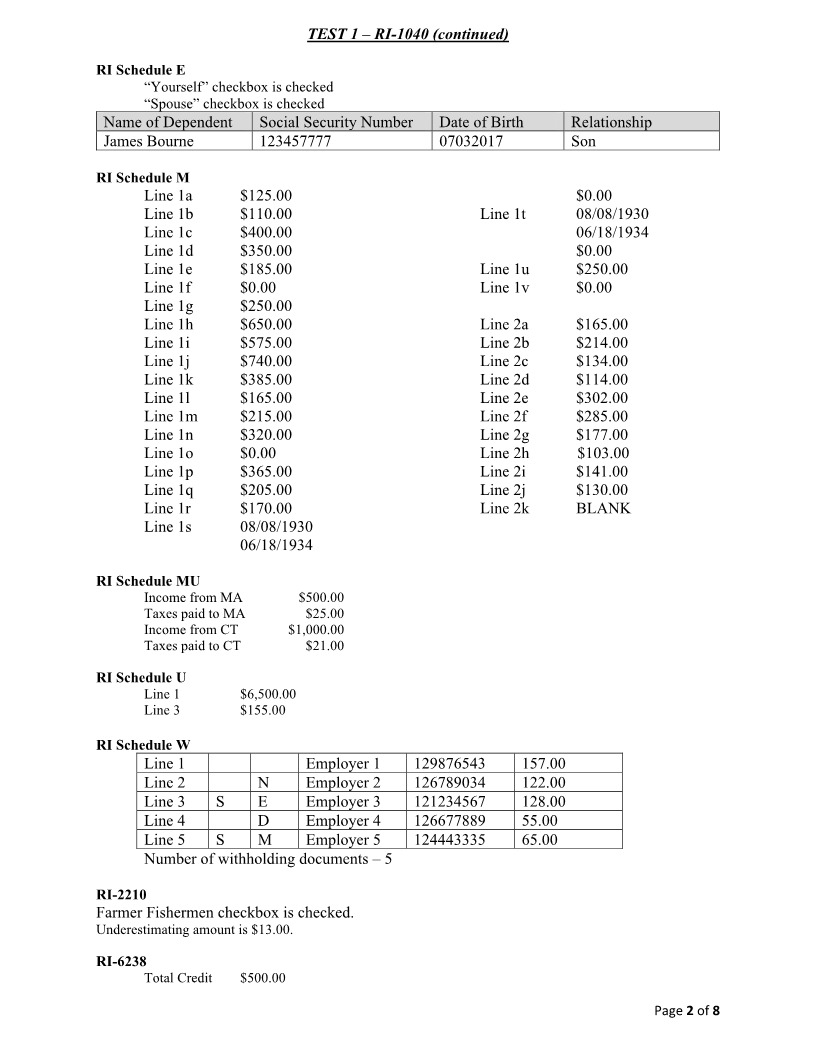

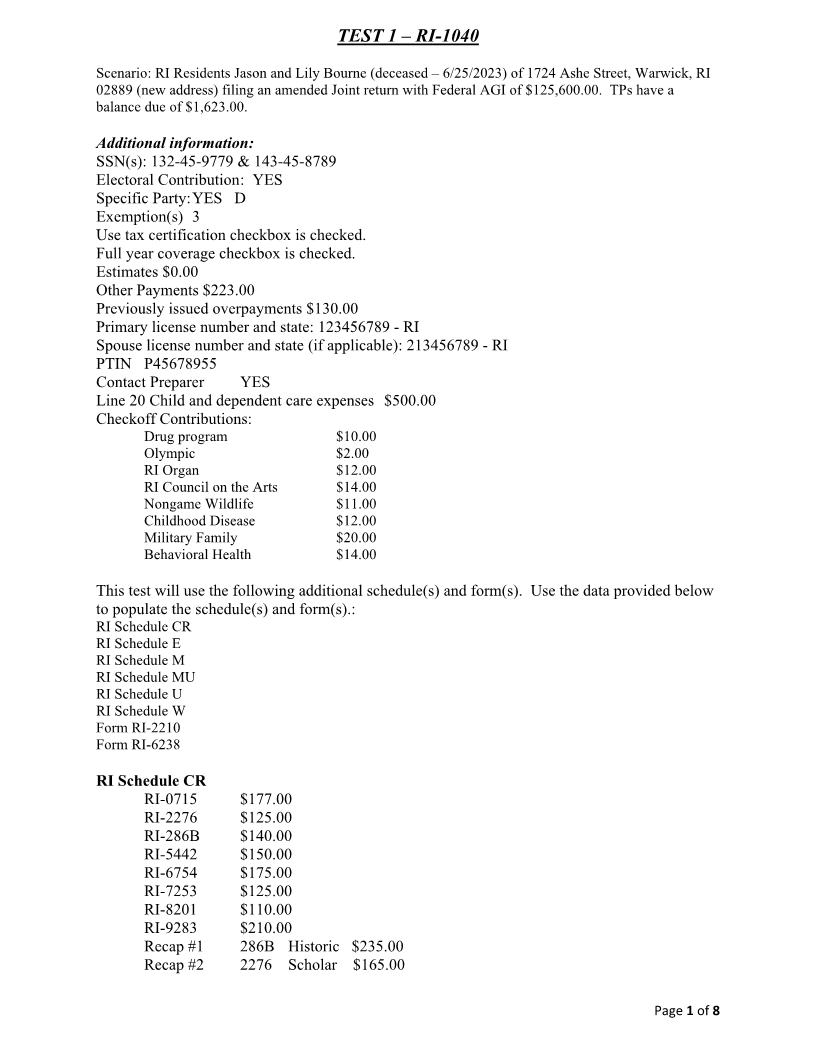

TEST 1 – RI-1040

Scenario: RI Residents Jason and Lily Bourne (deceased – 6/25/2023) of 1724 Ashe Street, Warwick, RI

02889 (new address) filing an amended Joint return with Federal AGI of $125,600.00. TPs have a

balance due of $1,623.00.

Additional information:

SSN(s): 132-45-9779 & 143-45-8789

Electoral Contribution : YES

Specific Party: YES D

Exemption(s) 3

Use tax certification checkbox is checked.

Full year coverage checkbox is checked.

Estimates $0.00

Other Payments $223.00

Previously issued overpayments $130.00

Primary license number and state: 123456789 - RI

Spouse license number and state (if applicable): 213456789 - RI

PTIN P45678955

Contact Preparer YES

Line 20 Child and dependent care expenses $500.00

Checkoff Contributions:

Drug program $10.00

Olympic $2.00

RI Organ $12.00

RI Council on the Arts $14.00

Nongame Wildlife $11.00

Childhood Disease $12.00

Military Family $20.00

Behavioral Health $14.00

This test will use the following additional schedule(s) and form(s). Use the data provided below

to populate the schedule(s) and form(s).:

RI Schedule CR

RI Schedule E

RI Schedule M

RI Schedule MU

RI Schedule U

RI Schedule W

Form RI-2210

Form RI-6238

RI Schedule CR

RI-0715 $177.00

RI-2276 $125.00

RI-286B $140.00

RI-5442 $150.00

RI-6754 $175.00

RI-7253 $125.00

RI-8201 $110.00

RI-9283 $210.00

Recap #1 286B Historic $235.00

Recap #2 2276 Scholar $165.00

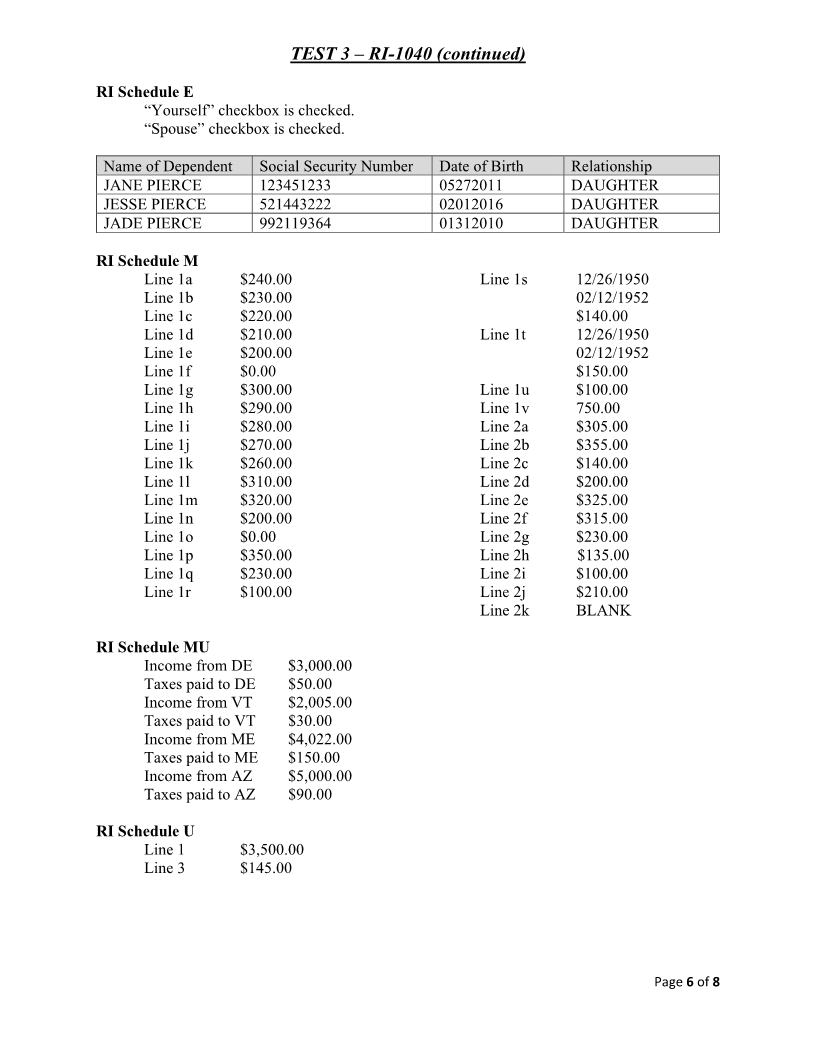

Page of 1 8