Enlarge image

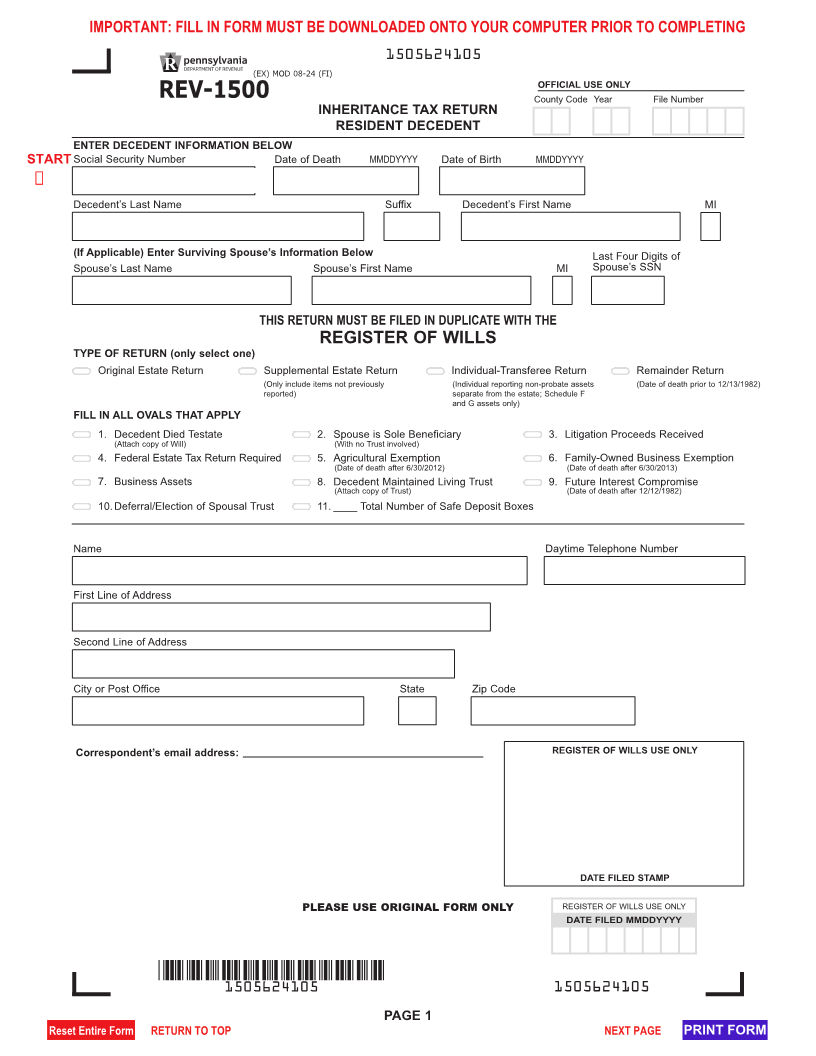

IMPORTANT: FILL IN FORM MUST BE DOWNLOADED ONTO YOUR COMPUTER PRIOR TO COMPLETING

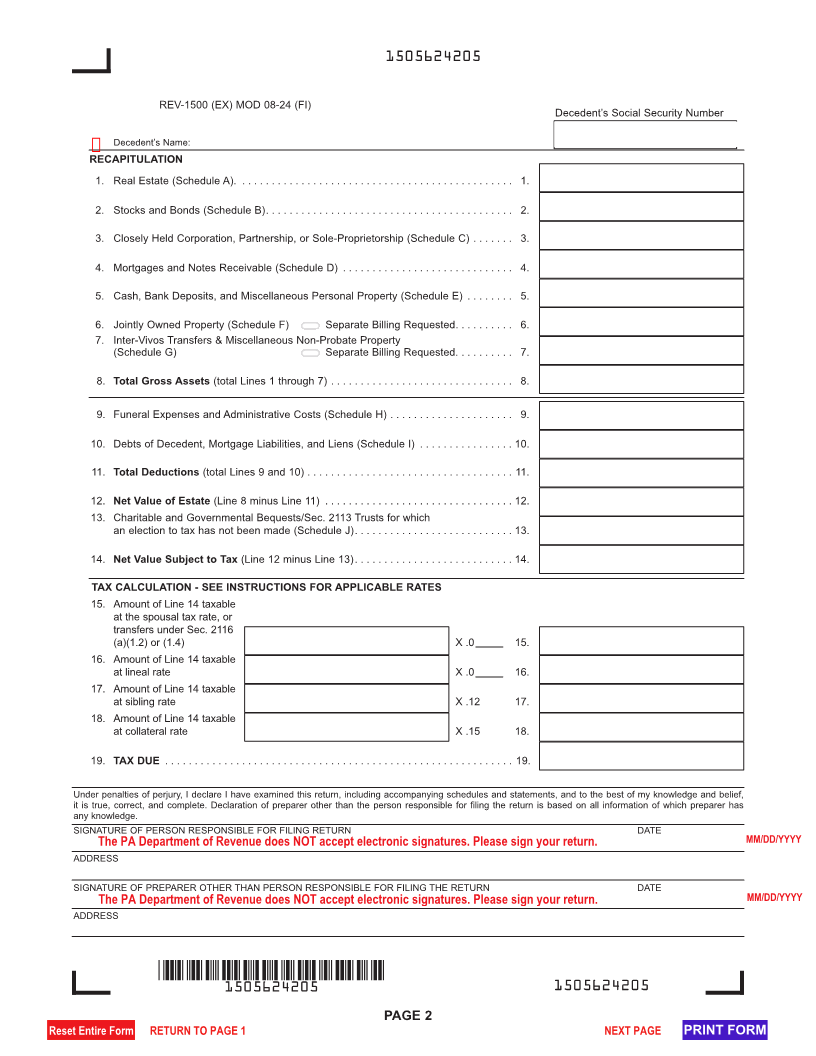

1505624105

(EX) MOD 08-24 (FI)

OFFICIAL USE ONLY

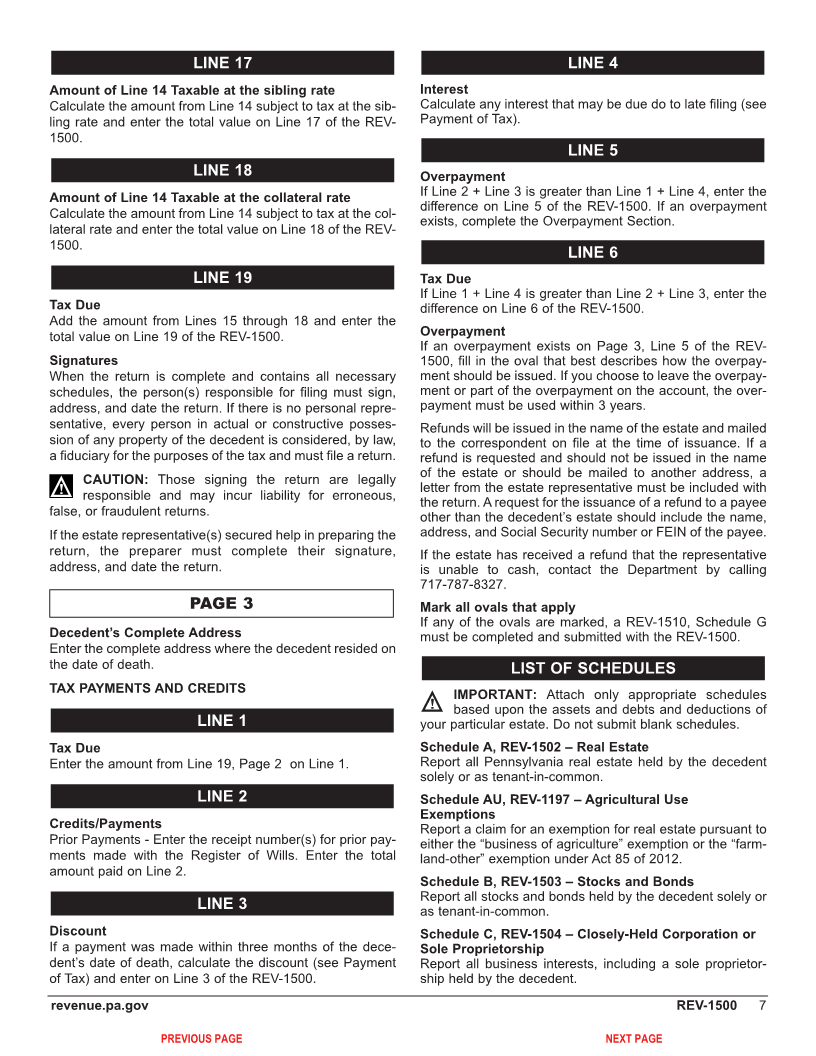

REV-1500 County Code Year File Number

INHERITANCE TAX RETURN

RESIDENT DECEDENT

ENTER DECEDENT INFORMATION BELOW

START Social Security Number Date of Death MMDDYYYY Date of Birth MMDDYYYY

Ü

Decedent’s Last Name Suffix Decedent’s First Name MI

(If Applicable) Enter Surviving Spouse’s Information Below Last Four Digits of

Spouse’s Last Name Spouse’s First Name MI Spouse’s SSN

THIS RETURN MUST BE FILED IN DUPLICATE WITH THE

REGISTER OF WILLS

TYPE OF RETURN (only select one)

Original Estate Return Supplemental Estate Return Individual-Transferee Return Remainder Return

(Only include items not previously (Individual reporting non-probate assets (Date of death prior to 12/13/1982)

reported) separate from the estate; Schedule F

and G assets only)

FILL IN ALL OVALS THAT APPLY

1. Decedent Died Testate 2. Spouse is Sole Beneficiary 3. Litigation Proceeds Received

(Attach copy of Will) (With no Trust involved)

4. Federal Estate Tax Return Required 5. Agricultural Exemption 6. Family-Owned Business Exemption

(Date of death after 6/30/2012) (Date of death after 6/30/2013)

7. Business Assets 8. Decedent Maintained Living Trust 9. Future Interest Compromise

(Attach copy of Trust) (Date of death after 12/12/1982)

10.Deferral/Election of Spousal Trust 11. ____ Total Number of Safe Deposit Boxes

Name Daytime Telephone Number

First Line of Address

Second Line of Address

City or Post Office State Zip Code

Correspondent’s email address: REGISTER OF WILLS USE ONLY

DATE FILED STAMP

PLEASE USE ORIGINAL FORM ONLY REGISTER OF WILLS USE ONLY

DATE FILED MMDDYYYY

1505624105 1505624105

PAGE 1

Reset Entire Form RETURN TO TOP NEXT PAGE PRINT FORM