Enlarge image

REV (5/30/2024) Department of Revenue | Bureau of Audits | Sut Audit Manual

BUREAU OF AUDITS

Sales and Use Tax

Manual

Enlarge image |

REV (5/30/2024) Department of Revenue | Bureau of Audits | Sut Audit Manual

BUREAU OF AUDITS

Sales and Use Tax

Manual

|

Enlarge image |

Table of Contents

Introduction ................................................. 10

Department’s Purpose .............................. 10

Department’s Mission ............................... 10

Department’s Vision ................................. 10

Department’s Values ................................ 10

Audit’s Mission ......................................... 10

Audit Guide .............................................. 11

Quality Control ......................................... 11

Chapter 1- Tax Overview ............................ 12

Nexus ....................................................... 12

Physical Nexus ...................................... 12

Marketplace Nexus ................................ 13

Economic Nexus ................................... 14

Certified Service Providers .................... 14

Tax Types ................................................ 14

Sales, Use, and Hotel Occupancy Tax .. 15

Employer Withholding of Pennsylvania

Personal Income Tax ............................. 25

Chapter 2- Audit Function .......................... 28

Record Keeping Requirements ................ 28

Examination of Records ........................... 28

Confidentiality ........................................... 28

Data Governance ..................................... 29

Federal Tax Information ........................... 30

Measuring Compliance ............................. 30

Taxpayer’s Rights and Responsibilities .... 31

Chapter 3-Pre-Audit Procedures ............... 32

ii

|

Enlarge image | Assignment Research .............................. 32 Audit Assignment................................... 32 Taxpayer Research ............................... 32 Tax Research ........................................ 37 Contacting the Taxpayer .......................... 41 Audit Engagement Letter ....................... 41 Telephone Contact ................................ 41 Confirmation Letter ................................ 42 Order to Appear Letter ........................... 42 Secretary’s Writ ..................................... 43 Taxpayer Delay ..................................... 44 Pre-Audit Conference ............................... 44 Preliminary Information .......................... 45 Statement of Purpose and Request for Cooperation ........................................... 45 Business Activities ................................. 45 System Survey ...................................... 46 Registration ........................................... 47 Requirement for the Audit Review of Third- Party Credits .......................................... 48 Discussion and Preliminary Conclusion . 48 Arrangements ........................................ 48 Direct Payment Permit Holders ............. 49 KOZ/KOEZ ............................................ 49 Plant Tour .............................................. 50 Chapter 4- Audit Procedures ..................... 51 Sales Tax ................................................. 51 Gross Sales ........................................... 51 Sales Tax Accrual.................................. 55 |

Enlarge image | Taxed and Nontaxed Sales ................... 58 Hotel Occupancy Tax ............................... 63 General .................................................. 63 Types of Hotel Occupancy Tax Audits ... 64 Test Audits ............................................ 64 Use Tax .................................................... 65 Use Tax Accrual .................................... 65 Capital Purchases ................................. 66 Expense Purchases ............................... 67 Use Tax Credits Recognized by Auditors .............................................................. 69 Other Use Tax Consideration ................ 72 Conducting Plant Tours ............................ 74 Procedures ............................................ 74 E-911 PEMA ............................................ 74 Public Transportation Assistance Tax and Fees ......................................................... 75 Minimum Requirements ......................... 75 Obtaining Reported PTA Information ..... 76 PTA Audit Assignments ......................... 76 Vehicle Rental Tax ................................... 79 Minimum Requirements ......................... 79 Obtaining Reported VRT Amounts ........ 80 VRT Assignments .................................. 80 Employer Withholding of Pennsylvania Personal Income Tax ............................... 82 Minimum Requirements ......................... 82 Obtaining Reported EW Amounts ......... 85 EW Audit Assignments .......................... 85 |

Enlarge image | Pennsylvania Personal Income Tax ......... 86 General .................................................. 86 Minimum Requirements ......................... 87 Required Audit Documentation .............. 88 Limited Liability Company-Filing Guidelines ............................................. 89 Chapter 5-Examination Methods ............... 90 Determination of the Examination Method ................................................................. 90 Factors in Determining Method ............. 91 Complete Audit ......................................... 92 Modified Complete Audit .......................... 92 Test Audit ................................................. 93 Taxpayer’s Concurrence with Test Audit Plan ....................................................... 93 Inclusion of Credits in the Test Period Audit Findings ........................................ 95 Test Methods ......................................... 96 Chapter 6- Post-Audit Procedures .......... 114 Concluding and Summarizing Audit Work ............................................................... 114 Pre-Review Procedures ......................... 114 Post-Audit Conference Requirements .... 116 Payments Received from the Taxpayer During an Audit .................................... 117 Post-Audit Conference by Phone ........... 117 Inability to Schedule Post-Audit Conference ............................................................... 118 Inability to Schedule Post-Audit Conference Letter ................................ 118 Other Post-audit Considerations ............ 119 |

Enlarge image | Audit Referrals ..................................... 119 Criminal Tax Program .......................... 121 Major Penalties .................................... 124 Review and Submission of Audit Report to Headquarters ......................................... 125 Appeal Process ...................................... 126 Board of Appeals ................................. 126 Board of Finance and Revenue ........... 127 Commonwealth Court of Pennsylvania 127 Chapter 7-Audit Report ............................ 129 SLS Narrative Report and Audit Findings ............................................................... 129 General Rules ..................................... 129 Sections of the Narrative ..................... 130 Sales and Use Report ............................ 148 Tax Codes and Rate Categories ......... 148 Reports ................................................ 150 Schedules ............................................ 153 Exhibits ................................................... 161 Required Exhibits ................................ 161 Suggested Exhibits .............................. 162 Forms ..................................................... 162 Taxpayer Information ........................... 163 IRS Disclosure Limitations ................... 166 Audit Package Checklist (Index) .......... 166 Audit Report and Basis of Assessment 167 Conflict of Interest and Auditor’s Comments ........................................... 168 Taxpayer’s Acknowledgement of Post Audit Conference ................................. 168 |

Enlarge image | Request for Financial Records ............ 169 Taxpayer’s Concurrence with Test Audit Plan ..................................................... 170 Taxpayer’s Acknowledgement of Precision Level-Stratified Random Sample ......... 172 Consent to Extend Time Limit for Assessment/Determination of Tax and to Extend Period of Time for Record Retention (Waiver) ............................... 172 Power of Attorney and Declaration of Representative (REV 667) ................... 174 Bureau of Audits-Registration Verification ............................................................ 175 Requirements for the Audit Review of Third Party Credits ............................... 178 Tally Sheet (REV-153) ......................... 179 Additional Headquarters Processing Request ............................................... 179 Business/Account Cancellation Form (REV-1706) ......................................... 179 Notice of Assessment .......................... 180 Secretary’s Writ ................................... 181 Penalty Abatement Forms ................... 181 Audit Staging and Attributes ................... 182 Multi-Region Audit Assignment .............. 182 Submission and Distribution of the Report ............................................................... 182 Corrections to the Findings .................... 183 Chapter- 8 Audit Policy ............................ 184 Audit Period-Statute of Limitations ......... 184 General ................................................ 184 Exceptions ........................................... 184 |

Enlarge image | Extension of the Audit Period for Assignments ........................................ 185 Bankruptcy Audits .................................. 186 Procedures .......................................... 186 Multi-Court Voice Case Information System (McVCIS) ................................ 187 Field Bankruptcy Notification Form ...... 188 Billing for Out-of-State Audit Expenses .. 188 Bulk Sales Assessments ........................ 189 Business Activities Questionnaire .......... 189 Consolidation of Entities for Sales and Use Tax Audits .............................................. 190 Coupon Sales ......................................... 190 Credit Memos Issued by the Department ............................................................... 191 Determination of Fair Rental Amounts Between Affiliated Interest ...................... 191 Drop Shipments ..................................... 192 Erroneously Charged Sales Tax On Sales/Installation of Real Property ......... 193 Computation of Tax When Sales Tax Is Not Separately Stated ................................... 194 Interim/Temporary Storage .................... 194 Institutions of Purely Public Charity (IPPCs) ............................................................... 195 IPPC Audits ......................................... 195 Purchases by IPPCs ............................ 195 Agency Agreements with Exempt Entities ............................................................... 196 Locating Taxpayers ................................ 197 Mergers .................................................. 197 |

Enlarge image | Assessments ....................................... 197 Consent/Waivers ................................. 198 Motor Vehicles ....................................... 200 Demonstrator Vehicles ........................ 200 Early Termination of Leases ................ 201 Reciprocity ............................................. 202 Audit Site & Records Location ................ 204 Removing Records from Audit Site...... 205 Remote Auditing .................................. 205 Requesting Records ............................... 205 Requesting Records from Taxpayer .... 205 Requesting Records from Third Party . 207 Penalty Abatement ................................. 207 Research & Development-Testing Laboratories ........................................... 208 Services-Employee Cost ........................ 209 Taxable Use of Equipment Purchased for Resale, Rental or Charter ....................... 209 Consent/Waivers .................................... 210 Issuing a Waiver and Waiver Extensions ............................................................ 210 Board of Appeals (BOA) and Board of Finance & Revenue (BFR) Decisions ..... 212 Audit Plan and Audit Status Worksheet .. 213 Procedures .......................................... 213 Entity Changes ....................................... 213 Refund of Sales Tax Paid – (REV-1890) 215 |

Enlarge image |

INTRODUCTION

Department’s Purpose

Funding Programs and services to benefit all Pennsylvanians.

Department’s Mission

To fairly, efficiently, and accurately administer Pennsylvania tax and Lottery programs.

Department’s Vision

To be an innovative, customer-focused, and employee-centered agency.

Department’s Values

We act with integrity

We are inclusive

We are connected

We are service-oriented

We are adaptable

We are continuously learning

Audit’s Mission

To ensure and stimulate compliance with Pennsylvania tax laws and policies through an

equitable, efficient, and informative audit process.

10

|

Enlarge image |

Audit Guide

The primary objective of this manual is to provide instructions on the performance of a

Pennsylvania sales, use and hotel occupancy tax compliance audit. In addition, minimum

requirements for taxpayers with exposure to the employer withholding tax, personal income tax,

public transportation assistance fund taxes and fees and vehicle rental tax are outlined.

Instructions are based on current state tax statutes, Department regulations and policies, court

cases, previous audits, appeal decisions, and general accounting and auditing principles.

This manual is intended as guidance to the audit staff. Auditing methods and techniques

suggested in the manual may not be necessary or applicable for every audit. This manual is not

authoritative and may neither be cited to support an audit position nor relied on by the taxpayer.

This manual and its auditing procedures will be continuously evolving as it is impacted by

changes in tax statutes, regulations, court cases, Departmental policies, and Information

Technology (IT) resources.

Quality Control

This manual is designed for use by Bureau personnel in maintaining quality control. Audit reports

must be in compliance with the requirements outlined herein as well as any additional regional

instructions prior to final approval and the issuing of an assessment. This process will help

ensure the audit reports prepared by the Bureau throughout the state are accurate, consistent,

professional, and sustainable through the appeal process.

11

|

Enlarge image |

CHAPTER 1- TAX OVERVIEW

Entities that have nexus with Pennsylvania are required to charge, collect, report, and remit

various taxes on certain sales transactions. These taxes include the following:

Sales and Use Tax (SLS)

Hotel Occupancy Tax (HOT)

Public Transportation Assistance Taxes and Fees (PTA)

Vehicle Rental Tax (VRT)

In addition, Pennsylvania employers are responsible for the withholding of Pennsylvania

personal income tax from employee wages subject to the tax. The personal income withheld

from employees is also considered a business trust fund tax.

Nexus

“Nexus” is the term used to describe when an entity (business or individual) conducts sufficient

activities within the taxing jurisdiction (Pennsylvania) to create an obligation to collect and remit

its taxes. There are three types of nexus situations which can trigger an entity’s obligation to

charge, collect, and remit the previously mentioned taxes:

Physical Nexus

Marketplace Nexus

Economic Nexus

Each type of nexus is described below. Any questions relating to nexus determinations must be

reviewed with the Division. The regional staff should consult with the Division to identify the

questionnaires and additional information the taxpayer needs to provide.

Physical Nexus

An entity has nexus if it conducts activities within Pennsylvania that constitute maintaining a

place of business under 72 P.S. § 7201(b). One or more of the following activities conducted

within the Commonwealth constitutes maintaining a place of business in Pennsylvania:

An entity owns, rents, leases, maintains, or has the right to use tangible personal or real

property that is permanently or temporarily physically located in the Commonwealth.

An entity’s employees own, rents, leases, uses, or maintains an office, distribution house,

sales warehouse, service enterprise or other place of business in Pennsylvania.

An entity has goods delivered to Pennsylvania in vehicles the entity owns, rents, leases,

uses, or maintains or has goods delivered by a related party acting as a representative of

the entity.

12

|

Enlarge image |

An entity’s agents, representatives, independent contractors, brokers, or others, acting

on its behalf, own, rent lease, use, or maintain an office distribution house, sales house,

warehouse, service enterprise or other place of business in Pennsylvania and this

property is used in the representation of the entity in Pennsylvania.

An entity’s agents, representatives, independent contractors, brokers, or others acting on

behalf of an entity, are regularly and systematically present in Pennsylvania conducting

activities to establish or maintain the market for the entity whether or not these individuals

or organizations reside in Pennsylvania.

Activities that establish or maintain the market in the Commonwealth. These activities

include soliciting sales; servicing property sold or to be sold; collection on accounts

related to the sale of tangible personal property or services; delivering property sold to

customers; installation at or after shipment or delivery; conducting training for employees,

agents, customers, or potential customers; providing customer support; providing

consultation services or soliciting, negotiating, or entering franchising, licensing, or similar

agreements.

Marketplace Nexus

Certain online marketplace sales first became subject to sales tax following the passage of Act

43 of 2017, effective March 1, 2018. Certain marketplace facilitators, remote sellers, and

referrers have the option to either collect and remit the sales tax that is due on taxable sales

within the Commonwealth or elect to notify their customers that use tax may be due, and report

to the Department the customers names, addresses, and aggregate dollar amounts of each

customer’s purchases . Effective July 1, 2019, Act 13 of 2019 now controls, but the provisions

of ACT 43 of 2017 were suspended and not repealed. Act 43 added the following definitions to

the Tax Reform Code.

Act 43 definitions:

Remote Seller

Anyone other than a marketplace facilitator, marketplace seller, or referrer, who does not

maintain a place of business in Pennsylvania, but who sells tangible personal property that would

be subject to sales tax here.

Marketplace Facilitators

Persons, including vendors, who list or advertise tangible personal property for sale in any forum,

directly or indirectly, collect the payment from the purchaser, and transmit the payment to the

marketplace seller.

Referrer

Receives consideration to advertise a seller’s products, and transfers a buyer to the seller,

facilitator, or other party to complete a sale, without collecting a receipt from the purchaser.

Marketplace Seller

13

|

Enlarge image |

One who uses a marketplace facilitator to facilitate a sale.

Economic Nexus

Following the passage of Act 13 of 2019, taxpayers making more than $100,000 in gross sales

into the Commonwealth during the previous twelve months constitutes maintaining a place of

business in Pennsylvania and establishes economic nexus.

In determining gross sales for economic nexus purposes, a marketplace or remote seller

with no physical nexus should determine their gross sales using only their direct sales

and those made through a marketplace facilitator that does not collect on their behalf into

the Commonwealth.

The passage of Act 13 of 2019 resulted in the suspension of Act 43. Therefore, the

election to collect sales tax or comply with the use tax reporting requirement is not

available for vendors with economic nexus (gross sales > $100K).

If the vendor’s annual PA gross sales fall below the threshold in the following year,

vendors are encouraged to continue charging and collecting sales tax, but they are not

required.

A marketplace facilitator that does not have physical nexus but has economic nexus must

collect and remit the tax on their sales into the Commonwealth and those made on behalf

of marketplace sellers, even if the marketplace seller does not individually have any

nexus.

Certified Service Providers

Certified Service Providers (CSP) are third-party companies that work with the Department of

Revenue to collect and remit the tax of online sellers. CSPs also provide software that can help

an online seller determine what products they sell are subject to the tax. The Bureau of Audits

will periodically examine these reports to ensure the tax determinations are accurate.

Marketplace and remote sellers that do not have physical nexus in the Commonwealth may

outsource most of their sale tax administration responsibilities to a CSP. The CSP will facilitate

the registration process, file tax returns, and collect and forward tax payments to the Department

of behalf of their clients.

Tax Types

The audit of sales, use and hotel occupancy tax records is the auditor’s primary area of

responsibility. However, the auditor is also responsible for auditing records that deal with related

taxes. A brief description of each tax is given below.

14

|

Enlarge image |

Sales, Use, and Hotel Occupancy Tax

State Sales, Use, and Hotel Occupancy Tax

Imposition and Reporting

Article II of the Tax Reform Code (TRC) of 1971 (passed as Act 2 of March 4, 1971) imposes a

six percent sales tax on the sale at retail in Pennsylvania of tangible personal property and

selected services (72 P.S. §7202(a)). This tax is normally charged, collected, reported, and

remitted by the vendor.

The code also imposes a six percent use tax upon the use of tangible personal property and

selected services within Pennsylvania (72 P.S. §7202(b)). Use tax is self-assessed, reported,

and remitted to the Commonwealth by the purchaser when the vendor does not charge the sales

tax.

In addition, the code imposes a six percent hotel occupancy tax on the rental charge for each

occupancy of a hotel room in Pennsylvania (72 P.S. §7210). Article II of the Tax Reform Code

of 1971 is published at Title 72 of the Pennsylvania Statutes.

Taxpayers must report the charging and self-assessment of these taxes, as well as their

Pennsylvania sales activity, on a PA-3, Sales, Use, and Hotel Occupancy Tax Return,

electronically either online through myPATH or by allingcthe business TeleFile phone system

at 1.800.748.8299. Any TeleFile users are required to complete the TeleFile Request Form

and cite the reason why they cannot use the online filing options. The request form must be

submitted to the Department 30 days prior to the due date of filing requirement. Taxpayers

with a recurring obligation should register for an account by registering online at

https://mypath.pa.gov/. Taxpayers that do not have a recurring obligation may self-assess use

tax on a PA-1, Use Tax Return, online at https://mypath.pa.gov/.

Taxpayers are required to pay amounts of $1,000 or more using an approved electronic funds

transfer (EFT) method. Failure to use an approved EFT method will result in additional penalty

equal to 3% of the amount of tax reported, not to exceed $500. Taxpayers may register for

electronic funds transfer online through myPATH at https://mypath.pa.gov/.

In addition, any taxpayer whose actual liability for the third calendar quarter of the preceding

year is more than $25,000 have a requirement to make accelerated sales tax payments

(prepayments). Taxpayer’s that remit more than $25,000 but less than $100,000 in the third

quarter of the previous year must remit 50% of the actual tax liability for the current period.

Taxpayers that remit over $100,000 in tax in third quarter of the previous year must remit 50%

th

of the actual tax liability for the same month of the previous year. Prepayments are due the 20

of each month. Separate payments must be remitted for the current month’s prepayments and

the prior month’s remaining tax liability. Failure to properly calculate and pay the prepayment

will result in a penalty.

15

|

Enlarge image |

Bracket schedule

The 6% Pennsylvania state sales, use, and hotel occupancy taxes are computed in accordance

with a bracket schedule detailed in 72 P.S. §7203 and on the Sales and Use Tax Rates (REV-

221) (pa.gov)).

The tax on purchases in excess of $1 is 6% of each dollar plus the amount from the bracket on

any fraction of a dollar.

Basic Rules

Situs

Situs, for tax purposes, refers to the jurisdiction that has the legal authority to tax a transaction.

The Commonwealth has jurisdiction to tax transactions reflecting sales to or use of tangible

personal property within the boundaries of the Commonwealth. Use includes a right to use,

possession, ownership, or custody. Goods or services that are delivered outside of the

Commonwealth are not subject to tax.

Tangible Personal Property

The TRC defines tangible personal property as corporeal personal property. It includes goods,

merchandise, digital products no matter how accessed or obtained, and other items. (See 72

P.S.§ 7201(m).) The sale, use, or service of cleaning, altering, or repairing of tangible personal

property is also subject to tax. The tax is due upon the total purchase price.

Services

In general, services are not subject to tax; however, the law has enumerated certain services

that are taxable. These include building maintenance or building cleaning services, lawn care

services, disinfecting or pest control services, help supply services, employment agency

services, lobbying services, credit-reporting services, secretarial and editing services, premium

cable services, adjustment and collection services, self-storage services and telecommunication

services.

Purchase Price

For taxable transactions, tax is applicable upon the total purchase price. The purchase price is

defined as the total value of anything paid or delivered, or promised to be paid or delivered,

whether it be money or otherwise, in complete performance of a sale a retail, without any

deductions on account of expenses incurred such as travel time or rental or rooms, or equipment

16

|

Enlarge image |

even when those items are separately itemized in billing to customers (see 72 P.S. §7201(g)

and 61 Pa. Code §§32.1 & 33.2).

When the purchase price of taxable and nontaxable items are not separately stated on the

invoice, the entire amount billed is subject to the tax.

Statutory Exclusions

Certain items are excluded from sales and use tax by statute (see 72 P.S. §7204). These items

include such things as unprepared food, clothing for everyday wear, water, coal, medicine,

Pennsylvania state flags, and US flags.

Exemptions

Pennsylvania sales and use tax law exempts certain transactions based on the type of

transaction, the manner of use or the nature of the entity involved with the transaction. There

are also several exemptions for sales and use tax that are found outside of the Tax Reform

Code. These various exemptions are listed below. It is important to note that the specific criteria

used to determine the basis for an exemption might vary among the different taxes. Therefore,

the law and appropriate regulations must be consulted to determine proper application.

General Exemptions

The Tax Reform Code (TRC)includes several exemptions from the tax that are not dependent

on the nature of entity involved with the transaction, but with the type of transaction or manner

of use. These exemptions are listed below.

Sales For Resale

This exemption applies to property and/or services that will be resold or rented to another

party in the ordinary course of business by a vendor who is in the business of selling

those same goods and services (see 72 P.S. §7201(i) and 61 Pa. Code §32.3).

Note: Wholesalers prior to the implementation of prior Business Tax System (BTS) were

issued a license number prefixed with a “95” to signify that they may purchase items for

resale. After the implementation of BTS, the Department does not distinguish between

wholesale license number and sales tax license number.

Isolated Sales

This exemption applies to the infrequent, nonrecurring sale of tangible personal property

or services acquired by a business and not sold in the regular course of business or sold

by someone who is not engaged in a business. (See 72 P.S. §7204(1) and 61 Pa. Code

§32.4). The Bureau has typically considered any sales or series of sales conducted more

than three times or more than a total of seven days in any calendar year to no longer be

of an infrequent or nonrecurring basis.

Multi-State Sales

This exemption applies to property delivered to a location within the Commonwealth

solely for the purpose of being processed, fabricated, or manufactured into, attached to,

or incorporated into personal property and thereafter transported outside of the

17

|

Enlarge image |

Commonwealth for exclusive use outside of the Commonwealth (see 72 P.S. §7201 (k)

and 61 Pa. Code §32.5). This exemption is referred to as “special resale” as it is deemed

to be a resale.

Wrapping Supplies

Returnable containers for the ultimate consumer and wrapping supplies may be

purchased exempt from tax by a seller/vendor when the use is incidental to the delivery

of property which the seller/vendor sells. (See 72 P.S. §7204(13) and 61 Pa. Code §32.6).

Nonbusiness Exemptions

There are several exemptions that are available based on who the entity is, not their business

activities. Generally, there is an exemption on sales made to instrumentalities of federal and

Pennsylvania state governments, municipal authorities, federal credit unions, and certain electric

and agricultural cooperatives. It also extends to federal employees for Hotel Occupancy tax (72

P.S. §7204(12)). In addition, a limited exemption applies to institutions of purely public charity,

volunteer fire departments, individuals holding diplomatic ID and tourist promotion agencies.

(72 P.S. §7204(10)).

Business Exemptions

A limited exemption applies to purchases made by taxpayers for direct use in an exempt

business activity. Examples include manufacturing, processing, mining, farming, dairying, public

utilities, etc. (72 P.S. §7201(k)). The exemption generally applies to equipment, machinery,

parts, and supplies used directly and predominantly in the exempt business activity.

Direct Pay Permits

Qualifying businesses may elect to obtain a direct pay permit. Some businesses are not

able to determine the manner in which items they purchase will be used at the time of

purchase. Direct pay permits allow taxpayers to purchase most goods and services

exempt from tax (72 P.S. §7237(d)) with the exception of those items listed in 61 Pa.

Code §34.45(e).

In order to qualify for a direct pay permit, companies must:

• Remitted at least $10,000 in use tax to Pennsylvania during the prior year.

• Must be in compliance with all Pennsylvania state tax requirements.

• Maintain auditable records.

• Direct Pay Permits are issued at the discretion of the Department.

Geographic Exemptions

An exemption applies to purchases made by a qualifying business located within a designated

geographic area. The geographic areas entitled to an exemption include Keystone Opportunity

Zones (KOZs), Keystone Opportunity Expansion Zones (KOEZ’s), Keystone Opportunity

Improvement Zones (KOIZs), and Strategic Development Areas (SDAs).

Generally, the exemption applies to the purchase of all tangible personal property and services

used exclusively within these designated areas (73 P.S. §820.511). It also applies to contractors

18

|

Enlarge image |

making purchases for use within the area as part of a contract with an entity located in a

KOZ/KOEZ. For SDAs, the contractor may only purchase Building Machinery and Equipment

(BME) tax exempt pursuant to contraction contract with an entity located in SDA.

Effective January 1, 2019, items purchased for exclusive use by an employee assigned to a SDA

are exempt, even if the items may be taken out of the SDA.

Exemptions not Found in the Tax Reform Code

There are a number of exemptions from the tax that are not found within the Tax Reform Code

(TRC). These entities have an exemption from sales and use tax from a different section of the

law. The division maintains a list of entities at Sales Tax Exemption Not Found in the Tax Reform

Code .

Pennsylvania Exemption Certificate (REV-1220)

A purchase claiming an exemption on purchases of taxable goods and/or services is required to

provide the vendor with a properly completed Pennsylvania Exemption Certificate (REV-1220)

(72 P.S.§7237(c)). However, it is important to note that an exemption certificate is not required

for items specifically excluded by statute, items shipped out-of-state by the vendor, or for the

sale of taxable items where the sales invoice clearly shows the purchaser to be a federal or

Pennsylvania state agency.

Taxpayers use this form to claim an exemption from state or local sales and use tax, hotel

occupancy tax, PTA, and VRT taxes. Specific form requirements are provided in 61 Pa Code

§32.23. The auditor is required to review the taxpayer’s exemption certificates to determine if

each form provides a valid basis for exemption and the certificate was accepted in good faith.

The form is valid only when properly completed. The auditor is encouraged to make copies of

any exemption certificates disallowed in an audit and include them as exhibits in the audit report.

Completion of Form

Proper completion of the form is discussed below.

Type of Tax

The appropriate box must be checked to indicate the type of tax exemption for which the form is

intended.

Unit or Blanket Exemption

The appropriate box must be checked indicating whether the certificate applies to one or several

transactions.

Name of Seller or Lessor

The form must accurately provide the name and address of the seller or lessor.

Exemption Reason

The basis for exemption is indicated by marking the appropriate box.

19

|

Enlarge image |

• If box #8-Other is marked, there must be a written explanation provided in the appropriate

space for the form to be valid.

Name, Address and Signature of Purchaser

This section of the form must correctly identify the purchase claiming the exemption.

Date

The date of the purchaser’s signature is the date used to determine whether or not the exemption

certificate was provided within 60 days of the related sale.

Exempt Organization Declaration of Sales Tax Exemption Form (REV-1715)

Exempt organizations can provide a vendor with an Exempt Organization Declaration of Sales

Tax Exemption Form (REV-1715) in connection with the REV-1220 to claim an exemption on

purchases of $200 or more of items that may appear not to be entitled to the exemption such as

for use in an unrelated trade or business or construction materials not used for routine

maintenance. The certificate and the form together create a presumption of good faith

acceptance on the part of the vendor and relieves the vendor from collecting sales tax. This

form is only used by registered charitable organizations (exempt organizations) with a valid “75”

number. The form may only be used for one invoice.

The use of the form is optional. Therefore, a vendor may elect to accept a properly completed

exemption certificate from an exempt organization without this form. However, the vendor may

later incur a tax liability if the Department determines that the transaction was subject to tax.

Completion of the form consist of both the vendor and the purchaser signing pre-written

declaration verifying the nature of the transaction and acknowledging potential liability. The

related invoice must be attached to the form.

Tax liabilities will be enforced against the purchaser if the vendor can demonstrate that the tax-

exempt sale was made “in good faith” in the following situations:

• Sales of less than $200 supported by a properly completed exemption certificate.

• Sales of $200 or more supported by properly completed and retained REV-1715 and

exemption certificate.

The auditor is required to document these types of transactions on a separate set of worksheets.

These worksheets are then sent with a cover letter to the Sales and Use Tax Program

Administrator. Complete names and addresses of the exempt organization making the

purchases are mandatory for documenting these transactions.

Uniform Sales & Use Tax Exemption/Resale Certificate-Multi-

Jurisdictions

The Multi-State Commission created the Uniform Sales & Use Tax Exemption/Resale

Certificate-Multijurisdictional for entities operating in multiple states. Purchasers may use this

form only when claiming the resale exemption subject to the provision of 61 Pa. Code §32.3.

20

|

Enlarge image |

Local Sales, Use, and Hotel Occupancy Tax

Imposition and Reporting

Pennsylvania state law authorizes certain counties to impose a tax on each separate sale at

retail of tangible personal property or service that originates within the county. The law also

authorizes the counties to impose a tax on the use within those same counties as well as on the

rental charge for a hotel room. This tax is commonly referred to as the “local” sales or use tax.

The rules for imposition, collection, reporting, and remittance are generally the same as those

for state sales tax under Article II of the Tax Reform Code of 1971. However, unlike state sales

tax, local tax is a point of origin tax, meaning that the local tax is only due when a sale originates

from, or the items are used within the taxable county. Currently, Philadelphia and Allegheny

counties are the only counties imposing the tax. Currently, the tax rate for Allegheny sales, use

and hotel occupancy tax is one percent. The tax rate for Philadelphia sales and use tax is two

percent and the rate for hotel occupancy is one percent. Taxpayers report these taxes under

the local tax columns of the PA-3.

Bracket schedule

The 1% Allegheny County sales and use tax, and the 1% Allegheny and Philadelphia County

hotel occupancy taxes are computed in accordance with (72 P. S. §7203) and on the Sales and

Use Tax Rates (REV-221) (pa.gov).

The tax on purchases in excess of $10.00 is 1% of each dollar plus the above bracket amounts

on any fraction of a dollar.

The 2% Philadelphia County sales and use taxes are computed in accordance with (72 P. S.

§7203) and on the Sales and Use Tax Rates (REV-221) (pa.gov).

The tax on purchases in excess of $10.00 is 2% of each dollar plus the above bracket amounts

on any fraction of a dollar.

Related Taxes

Public Transportation Assistance (PTA) Taxes and Fees

Article XXIII of the Tax Reform Code (TRC) of 1971 imposes taxes and fees on transactions

involving the sale or use of new tires, motor vehicle lease tax, motor vehicle rentals, and car

sharing. The provisions of Article II of the Tax Reform Code of 1971 apply to PTA taxes and

fees (72 P.S. §9301 & 61 Pa. Code § 47.19). This tax is also referred to as the Mass Transit

Tax.

Taxpayers must report the charging and self-assessment of these taxes and fees on a PA-4,

Public Transportation Assistance Fund Taxes and Fees (PTA) Return, electronically either

online through at myPATH or by calling the business TeleFile phone system at 1.800.748.8299.

PA-4 is filed on a quarterly basis.

21

|

Enlarge image |

Tire Fee

There is a fee of $1.00 on each new tire sold at retail for on highway use. This would include

new tires sold in conjunction with the sales of other property, such as a new car. The

nonbusiness and business exemptions discussed above do not apply to the tire fee, except for

sales of new tires to governmental entities.

Motor Vehicle Lease Tax

There is a 3% motor vehicle lease tax imposed on the total lease price on a contract for the use

of a motor vehicle for 30 or more days (lease). If a lease is exempt from the sales and use tax,

then the lease is exempt from the motor vehicle lease tax.

Motor Vehicle Rental Fee

There is a $2.00 per day motor vehicle rental fee imposed on each day of a contract for the

rental of a motor vehicle for less than 30 days. A rental that extends beyond the initial 29-day

contract is still a rental and subject to the fee until the contract is terminated. If a rental is exempt

from sales and use tax, then the rental is exempt from the motor vehicle rental fee.

Peer-to-Peer Car Sharing Fee

Car sharing is a membership-based service that allows a person to rent a vehicle. Members

can rent a vehicle per minute, per hour, per day or on a per trip basis.

Effective October 30, 2017, an incremental car-sharing fee is computed in accordance with the

following fee schedule:

Time Used Fee

Less than 2 hours 25 cents

2 to 3 hours 50 cents

More than 3 hours but less than 6 hours $1.25

6 or more hours $2.00

Figure 1.1- Peer-To-Peer Car Sharing Fees

Effective January 1, 2023, in accordance with Act 53, peer-to-peer car-sharing programs or car

sharing by a shared vehicle owner is subject to state sales tax, local sales tax and Public

Transportation Assistance Fund Fees.

Vehicle Rental Tax

The Vehicle Rental Tax (VRT) is listed under Article XVI-A under the Tax Reform Code of 1971.

Article II of the TRC and regulations promulgated there under apply to the VRT (72 P.S. §8601-

A ff & 61 Pa. Code §47.20).

22

|

Enlarge image |

Rental contracts involving motor vehicles designed to transport 15 or fewer passengers, or a

truck, trailer or semitrailer used in the transportation of property other than commercial freight, a

tax of 2% is imposed upon the rental payments. If the vehicle rental company fails to collect the

applicable tax, the purchaser shall pay the tax directly to the Department on a form prescribed

by the Department. A vehicle rental company is defined as a business engaged in the business

of renting five or more rental vehicles in this Commonwealth.

Taxpayers must report the charging and self-assessment of these taxes and fees on a PA-5,

Vehicle Rental Tax (VRT) Return, electronically either online through myPATH or by calling the

business TeleFile phone system at 1.800.748.8299. PA-5 is filed on a quarterly basis.

E911 – Pennsylvania Emergency Management Agency (PEMA)

Retailers that sell wireless telephones or pre-paid telecommunication services (i.e., pre-paid cell

phone minutes or phone cards) are subject to the pre-paid wireless emergency-911 surcharge

at a rate of $1.95 per retail transaction. This surcharge is collected on each retail transaction

regardless of whether the service or pre-paid wireless telephone is purchased in person, by

telephone, internet or by any other method.

The pre-paid E-911 surcharge is to be charged and collected by the retailer and is excluded from

the purchase price when calculating the sales tax.

The E-911 surcharge is to be reported on the sales and use tax return through myPATH with the

same filing frequency and the same due dates as the seller’s sales and use tax returns.

Retailers that timely report and remit the E-911 surcharge, are entitled to a 1.5 percent discount.

This discount is separate from the 1 percent discount received for timely remitting sales and use

tax returns and payments.

Note: The E-911 fee is $1.65 per transaction through February 29, 2024, and $1.95

thereafter.

Tax Collection

Amounts collected from customers from each of the taxes referenced above are considered

trust fund money. Vendors are considered agents of the Commonwealth in the collection of

these taxes as these taxes are paid by someone else and held in trust until they are reported

and paid to the state. Consequently, vendors are required to charge, collect, report and timely

remit this money to the Commonwealth (72 P.S §7237 & 61 Pa. Code § 34.3). Failure by the

vendors to fulfill their fiduciary responsibilities in relation to these taxes successfully may result

in the imposition of additional interest, penalties, fines, and/or imprisonment.

Interest and Penalty

Interest

The interest rate for any given year is established by the U.S. Treasury Secretary and is

st

effective on January 1 of each year. The per diem rate is arrived at by dividing the announced

interest rate by 365 (representing the number of days in a year) and the result becomes the per

diem rate.

23

|

Enlarge image |

For taxes due after January 1, 1982, the rate of interest will vary from year to year. The date

that the tax is first due and payable will determine the applicable rate of interest. This

information is updated yearly on the REV-161 1 Interest Rate and Calculation Method for Title

72 Taxes Due after Jan. 1, 1982.

Interest on credits will be calculated for each reporting period based on the cumulative balance

of the tax amount. Interest on periods with a net cumulative balance overpayment will be

calculated at 2% less than the interest charged on underpayments.

Penalties

Understatement Penalty

A penalty is applied anytime an understatement of reported tax is determined in the amount of

5% of the amount of the understatement.

Failure to File/Major Understatement Penalty

A taxpayer failing to file any return will be charged 5% of the tax due for each month or fraction

of a month that a proper return for the period remains unfiled, up to a maximum of 25% of the

amount of the tax due for the period. In no case shall such charge be less than $2.00.

If the taxpayer understates more than 50% of the true amount due, they will be charged 5% of

the of the amount that was understated for each month or fraction of a month a proper return for

the period remains unfiled, up to a maximus of 25% of the amount of the understatement. In no

case shall such charge be less than $2.00.

Tax Evasion (Major Penalty)

For attempt to evade or defeat a tax, there is a penalty charge of one-half of the total amount of

the tax evaded. These penalties are posted under “Major Penalty”.

Multiple Additions/Penalties

A taxpayer who files a return but understates the true amount due by more than 50%, is subject

to both the flat 5% understatement penalty and the 5% per month (to a maximum of 25%).

A taxpayer who fails to file a return is subject to both the flat 5% understatement penalty and

the 5% per month (to a maximum of 25%), failure to file penalty for each month or fraction of a

month that a proper return for the period remains unfiled.

A taxpayer who attempted to evade or defeat the tax is subject to both the charge of one-half

the total amount of the tax evaded, and either one of the above referenced additions in this sub

section.

Administration and Enforcement of Tax Laws

The Pennsylvania Department of Revenue is charged by the State Legislature to administer

and enforce the state sales and use tax laws. Accordingly, the Department has authority to

issue regulations, general rulings, and statements of policy (See 72 P.S. §6 & 61 Pa. Code

§3). The Department may also issue confidential letter rulings to individual taxpayers that

24

|

Enlarge image |

address specific questions. In addition, the Department provides general information in the

form of instruction booklets, Tax Updates, tax bulletins, etc.

If there appears to be a conflict between documents within the Revenue Information System,

the order of precedence shall be as follows:

• Statutes

• Regulations

• Statements of Policy

• Bulletins

• Letter Rulings

• Revenue Information

The PA Code also requires the Department of Revenue to publish a general listing of taxable

and nontaxable goods and services every three years. This list is published as the "Retailers'

Information" Handbook (REV-717) and is also posted in the Pennsylvania Bulletin.

Information Resources

A list of useful information resources and links are listed below:

Information Resource List

Retailer's Information (REV-717)

Sales and Use Tax - Taxability of Medical & Surgical Supplies

Sales and Use Tax - Taxability of Dental Supplies List

Act-45 Contractor's Purchase for Exempt Entities

Pennsylvania Sales and Use Tax Mushroom Farming - Tax Exempt Items

Tax Information for Farmers (REV-1729)

Hotel Tax Matrix

Hotel Booking Fact Sheet

Figure 1.2- Information Resource Links

Employer Withholding of Pennsylvania Personal Income

Tax

The auditor is required to review a taxpayer’s compliance with Pennsylvania employer

withholding of Pennsylvania personal income tax concurrently with the sales tax audit.

25

|

Enlarge image |

Pennsylvania Personal Income Tax

Individuals

Each individual with gross taxable earnings over $33 of Pennsylvania sourced income or who

incurred a profit or loss from any transaction as a sole proprietor, partner in a partnership, or

shareholder in a Pennsylvania “S” corporation is required to pay personal income tax at the

state’s specified rate and to report their earnings to Pennsylvania (72 P.S. §7302). The

individual’s employer normally withholds tax due on wages received. The individual should

receive a W-2 Wage and Tax Statement, from the employer at the beginning of the subsequent

year in which the wages were earned. Individuals are required to report their earnings via a

Pennsylvania Income Tax Return (PA-40), by April 15 of the following year. The individual must

maintain the W-2 received from the individual’s employer in the event the Department requests

a copy of the W-2 to verify wages. The taxpayer is also responsible for paying any additional

tax due at this time. If the taxpayer is self-employed, schedules filed with the return must outline

all income and expenses.

A sales and use tax audit of a sole proprietor, partnership, or an “S” corporation also involves

the examination of the owner’s and partner’s PA-40s.

Partnerships

PA-20S/PA-65, Commonwealth of Pennsylvania PA S

Corporation/Partnership Information Return

Partnerships and “S” corporations are required to file a PA-20S/PA-65, Corporation/Partnership

Information Return (PA-20S/PA-65) if:

• During its taxable year, the partnership or “S” corporation earned, received, or acquired

any gross taxable income allocable to Pennsylvania or,

• The partnership had at least one partner or the “S” corporation had at least one

shareholder that was a Pennsylvania resident. The PA-20s/PA-65 details the

partnership’s or “S” corporation’s net profit or loss allocable to Pennsylvania.

In addition, beginning in 2006, a Partner/Member/Shareholder Directory is required to be

included. The form must be accompanied by PA-41 Schedule RK-1 - Resident Schedule of

Shareholder/Partner/Beneficiary Pass Through Income, Loss and Credits (PA-41 RK-1) or

2021 PA Schedule NRK-1 - Nonresident Schedule of Shareholder/Partner/Beneficiary Pass

Through Income, Loss and Credits (PA-20S/PA-65 NRK-1) showing the apportionment of

profits or losses allocable to Pennsylvania among each partner/shareholder. The individual

partner/shareholder uses the appropriate schedule to help calculate their Pennsylvania

personal income tax liability. The individual partner/shareholder must file a PA-40 to report the

allocation and appropriate personal income tax.

26

|

Enlarge image |

Personal Income Tax Rates

Pennsylvania personal income tax is imposed at the rate of 3.07 percent against taxable income

of resident and nonresident individuals, estates, trusts, partnerships, S corporations, business

trusts and limited liability companies not federally taxed as corporations.

Employer Withholding Requirements

Pennsylvania law requires each Pennsylvania employer to withhold personal income tax from

the taxable compensation of its employees. Employers are required to remit their withholding

semi-weekly, semi-monthly, or monthly and to report these withholding quarterly via myPATH

W-3, Employer Quarterly Return of Income Tax Withheld.

At the end of each year, the employer is responsible for issuing a W-2 Wage and Tax

Statement, to their employees reporting annual wages and the related tax withholdings. In

addition, the employer must file Annual Withholding Reconciliation Statement (REV-1667) , W-

2 Transmittal, reconciling all individual withholdings to the taxpayer’s annual wage and

withholding totals either by mail or electronically at myPATH. Records for employer withholding

of Pennsylvania personal income tax are generally audited in conjunction with sales and use

tax records.

27

|

Enlarge image |

CHAPTER 2- AUDIT FUNCTION

Record Keeping Requirements

The same law that imposes Pennsylvania sales, use and related taxes on certain transactions

also requires vendors to maintain appropriate tax records. Specifically, a taxpayer is required

to maintain records that support the information reported on all tax returns. These records must

distinguish between taxable and nontaxable transactions as well as document the proper

charging, collection and remitting of tax money to the Department. The taxpayer is responsible

for maintaining these records for three years from the end of the calendar year to which they

pertain. This requirement is determined by the time limitation on assessment and collection

imposed by 72 P.S. §7258.

Examination of Records

Title 72 P.S. §7272 states that the Department or any of its authorized agents is authorized to

examine the books, papers, and records of any taxpayer in order to verify the accuracy and

completeness of any return made or, if no return was made, to ascertain and assess the tax

imposed by Pennsylvania state law. This also includes the right to examine taxpayer records

to verify compliance with laws pertaining to employer withholding of Pennsylvania personal

income tax. Taxpayers are required to provide the Department with all necessary tax records

upon request. In addition, taxpayers must provide the opportunity and physical facilities to

enable the Department to examine the records. The Department may use Order to Appear

letters and Secretary’s Writs to obtain the records necessary to conduct an audit in situations

where the taxpayer fails to cooperate.

The Department is required to use audit procedures that are in conformity with the

Commonwealth’s statutes and the Department’s regulations, rulings, and policies. These

procedures involve examination of source documents, journals, ledgers, schedules, tax returns,

and other records used by the taxpayer to record sales and purchase transactions as well as

the withholding of Pennsylvania personal income tax. The auditor may conduct a complete

review or utilize test methods that allow for the examination of a representative portion of the

taxpayer’s business activities. Audit findings must be documented in a report that includes a

narrative, forms, schedules, and exhibits.

Confidentiality

Taxpayer records viewed by an auditor as part of an audit are confidential (see 72 P.S. §7274).

Therefore, specific discussion with those other than the taxpayer and appropriate Department

personnel is forbidden. The auditor should establish that a taxpayer’s representative is

authorized before any information is disclosed.

In addition, auditors are responsible for maintaining strict security of written and computerized

materials. Computer systems are tracked and subject to periodic monitoring and review.

28

|

Enlarge image |

The auditor must adhere to the restrictions listed below when handling private tax information.

• Confidential tax information may only be accessed and released for work related

purposes in accordance with the statutes, Standards of Conduct, and Department policy.

• Confidential tax information is not to be left unattended or available for access by non-

Department employees.

• The auditor must exercise care in the logging of their credentials into the Department’s

computer system so that no one else can access confidential tax information under the

auditor’s credentials.

• If an auditor is uncertain whether accessing tax information or releasing it has been

authorized, the auditor must consult their supervisor.

• All legal requests, subpoenas, and court orders for tax information should be promptly

sent to the Office of Chief Counsel for disposition.

Data Governance

During the course of an audit, an auditor may have access to or possession of a taxpayer’s

electronic financial data. It is the auditor’s responsibility to ensure that this data is secure at all

times.

The auditor must follow the best practices and restrictions below when handling taxpayer’s

data.

• All data is to be stored within the audit folder created by the Bureau’s audit application

software. Data should not be stored anywhere else on the auditor’s hard drive. This will

ensure that data is removed from the hard drive after the assignment is closed and that

any data needed for the appeal process is available from the Department’s secure

servers.

• Data should be saved to different folders within the folder created by the Bureau’s audit

software that make it clear and easy to understand where the data used for different

audit procedures is located. A suggested hierarchy would include sales, assets,

expenses, EW, PIT, and research.

• Files transferred electronically should be done so using the Department’s secure email

server. If the taxpayer or their representative has requested not to use the Department’s

secure email server, any information containing personally identifiable information (PII)

such as social security numbers (SSNs), driver license numbers, and financial account

information must still be transferred using the Department’s secure email server. At no

time should PII be sent using standard email systems.

Note: FTI is further limited in how it can be exchanged. If a need to exchange

this information electronically, discuss options with Computerized Audit Support

(CAS).

29

|

Enlarge image |

• The Bureau’s laptops are encrypted for data security. When working outside of a

Regional Office, auditors must be sure to properly shutdown their laptops at the end of

the day. Putting the machine into sleep mode or locking the screen is not sufficient to

ensure the encryption process is completed.

All employees are reminded to read and follow policies and procedures contained in the PA

Department of Revenue, Bureau of Audits, Electronic Device Acknowledgement Form.

Federal Tax Information

During the course of an audit, an auditor may need or may be provided tax information that was

obtained from the Internal Revenue Service (IRS). The Bureau has created a manual Federal

Tax Information and the PA Department of Revenue, Bureau of Audits that discusses in detail

what constitutes federal tax information (FTI) and how to properly handle and dispose of that

information. All employees are required to read and acknowledge the manual. Key highlights

from this document are below.

• FTI is tax return and return information provided by the federal government to the

Pennsylvania Department of Revenue.

• Calculations based on FTI, if the FTI is identifiable, become FTI.

• If information containing FTI needs to be exchanged electronically with the taxpayer,

please consult with Computerized Audit Support (CAS).

• Audit reports containing FTI are to be mailed following the procedures outlined in the

manual.

• Generally, FTI should not be printed. If a need to do so arises, FTI is only to be printed

using the region’s multifunction printer or the auditor’s mobile printer if at the taxpayer’s

location.

• Printed FTI must be stored in a secured cabinet or desk within the regional office. If a

need arises to store the FTI for a short period of time at an auditor’s home, the regional

manager is to be consulted. At no time should FTI be stored overnight in a vehicle.

Measuring Compliance

The measure of compliance with Pennsylvania’s sales and use tax statutes and regulations as

reflected in the taxpayer’s records is expressed in terms of a deficiency or credit. An audit that

finds a taxpayer to be in complete compliance with Pennsylvania sales and use tax laws results

in no deficiency (a “none” audit). In certain circumstances, the audit may result in a credit for

the taxpayer. An audit that finds the taxpayer not in compliance with the statutes and

regulations results in a tax deficiency. The deficiency is expressed in monetary terms and

30

|

Enlarge image |

results in the issuance of a tax assessment against the taxpayer. The assessment will also

include interest and penalty. The taxpayer may appeal the assessment to the Department’s

Board of Appeals and then to the Board of Finance and Revenue. The appeal process may

continue through the state courts.

Taxpayer’s Rights and Responsibilities

The Taxpayers’ Bill of Rights requires the Department to issue a disclosure statement to all

taxpayers contacted by the Department for purposes of audit (72 P.S. §3310-202). The

disclosure statement is to include:

• The rights of a taxpayer and the obligation of the Department during an audit.

Prepare a written basis of assessment of any additional tax due determined from

the audit.

Act upon requests to resolve concerns that come up during the course of an audit.

Allow taxpayers to make requests by going through the proper chain of command.

Explain the taxpayer’s right to appeal the assessment of any additional tax from

the audit.

• The procedures by which a taxpayer may appeal or seek review of any adverse

decision by the Department, including administrative and judicial appeals.

• The procedure for filing and processing refund claims and taxpayer complaints.

• The procedures that the Department may use in enforcing taxes.

Consistent with this requirement, the Department has prepared REV-554 (PO), "Your Rights

as a Taxpayer".

31

|

Enlarge image |

CHAPTER 3-PRE-AUDIT PROCEDURES

This chapter of the manual describes the procedures that must be followed or considered prior

to examining a taxpayer’s records.

Assignment Research

Audit Assignment

Every audit assignment is required to be created in the Department’s PATH system. The audit

will be assigned to the auditor responsible for the assignment through the PATH system in a

manner determined by the regional office as required by the Bureau’s policy.

Auditors should make every effort to complete audits on first in, first out basis. However, there

may be instances when the audit notes indicate special instructions that an assignment is given

a priority status.

Auditors will be notified of new assignments in the “My Work” Manager in the PATH system.

The PATH Guidebook and the “Help” link in PATH will assist the auditor with navigation

through the system. Regional offices may also notify auditors of an assignment in a different

manner as they determine.

Any special instructions included in the audit notes must be addressed during the audit. Any

special instructions that indicate to notify headquarters for a direct special instruction must be

thoroughly explained in the audit narrative, Conflict of Interest Statement and Auditors

Comments, or on the Additional Headquarters Processing Request form, whichever is

appropriate given the facts. In addition, notification of action required on information forwarded

to headquarters must be indicated on the Additional Headquarters Processing Request form.

Upon receiving a new audit, an auditor should create an audit folder in the Bureau’s audit

application software if it is not created by the regions’ Clerk-Typist or Management Tech.

Taxpayer Research

The auditor is to conduct preliminary research on a taxpayer such as reviewing their reporting

history, business activities, prior audits, and any interactions with the Department such as

appeals or letter rulings. An Initial Audit Research checklist is available that lists all of the steps

below.

Pennsylvania Tax Hub (PATH)

The Department’s Pennsylvania Tax Hub (PATH) will be utilized by an auditor in conducting pre-

audit research activities.

In addition to assignment tracking, PATH is used to download a taxpayer’s reported information

and research any notes concerning the Department’s interactions with a taxpayer.

32

|

Enlarge image |

Business Trust Fund Tax Returns Download

The download files for all business trust fund taxes will be generated in PATH. The generated

report for a taxpayer’s reported information will be imported into the Bureau’s audit application

software. The following download guide are available for these taxes:

• SUT Download

• EW Download

• Public Transportation Assistance (PTA) Download

• Vehicle Rental Tax (VRT) Download

When conducting pre-audit research, the auditor should conduct a download of all the business

trust fund taxes that a taxpayer is registered to report. The downloaded information is included

in the audit report as “Accrual Differences” and “Filing Detail” schedules. The auditor will review

these schedules to identify sales and sales tax reported, taxable to gross sales ratios, use tax

reported, credits taken on the return, fluctuation of reported amounts, and returns filed late.

It may be necessary to download the reported information again if the audit period is different

than the period included in the initial download.

Customer and Audit Notes

The Notes tab or the Recent Notes panel in the Customer and Audit Springboards of PATH

should be reviewed to see if there were any interactions between the Department and the

taxpayer. This transaction is useful to see any collection efforts taken by the Department, and

it may also contain information used to identify contact information.

Audit notes may contain special instructions or specific transactions that are to be reviewed as

part of the audit. The treatment of the instructions during the audit must be clearly addressed in

the narrative or the Conflict of Interest and Auditor’s Comments, whichever is more appropriate.

Identifying Non-Filed Returns

The PATH system is used for taxpayer management, returns, processing, tax account

management, revenue accounting and collections. While conducting pre-audit research, the

auditor should use PATH to identify any non-filed returns. The auditor will identify any non-filed

returns in the Account Springboard in the Financial tab and Expectation subtab.

Demographic information

The auditor should review the demographic information, which the taxpayer will verify during the

course of the audit. The auditor will use PATH to verify mailing and physical addresses for the

33

|

Enlarge image |

taxpayer. The taxpayer will have to correct any information in this section that is incorrect by

using myPATH.

Customer Accounts

The auditor should also be able to determine the accounts that the taxpayer is registered for

through the Customer Springboard, Registration Tab, and Accounts Subtab.

Prior Audits

Any prior audit for a taxpayer must be reviewed. The auditor can review any prior audits that

were closed in PATH through the Customer Springboard under Audit Tab. The auditor should

select “show history” hyperlink to display all prior audits closed in PATH.

Customer Contacts

Links are also available in PATH that will allow the auditor to determine a contact person for the

taxpayer. The auditor can view the Contacts subtab under Registration tab which will provide a

name, phone number for the person associated with, or representative of the customer in some

way.

Customer Returns

The Department uses the PATH system to maintain information on the filing of individual,

partnership, and S Corp income tax returns. The auditor may use these documents to determine

a contact person for taxpayers, affiliates, business activities, compare figures reported on the

sale tax return, etc. The corporate tax returns for the audit should be saved to the audit folder,

as they will be used during the audit.

34

|

Enlarge image |

When planning the audit for these types of entities, the auditor must access the Account

Springboard, Financial tab, and Returns subtab to review the taxpayer’s filing history as well as

the detail for the individual returns. Non-filed income tax returns must be addressed as part of

the audit report.

The auditor should review the returns for all principals of sole proprietorships, partnerships,

LLCs, and S-Corporations to ensure these principals filed a Pennsylvania personal income tax

return and to verify that the business income claimed on the return is consistent with the financial

records reviewed in the conduct of a sales and use tax audit. Returns can be accessed using

the taxpayer’s social security number or federal employer identification number.

Bankruptcy Information

If a taxpayer has filed for bankruptcy, an “Indicator” banner will appear on the Customer

Springboard and will also be displayed on the “Indicators” subtab under the “CRM” tab. The

auditor can click the indicator name (Bankruptcy) in the “Indicator” banner to view the list and

links.

The auditor can verify any information related to a bankruptcy filing for a taxpayer by reviewing

the Bankruptcies subtab in the Customer Springboard Collections tab.

PA DOR Bridges

Prior to the implementation of PATH, the Department has created a website that puts information

from the Department’s multiple information systems on one convenient website. This website is

called Bridges as it was intended to bridge the gap between all of Revenue’s information

systems. The website can be accessed through this link BRIDGES. The entire website provides

useful information; however, only information pertaining to historical data prior to November 30,

2022, will be available.

A link is available through the Bureau of Audit’s main menu tab that can be used to review

previous audit files and images. This page also provides a link to access previous audits closed

in PATH. Audits completed prior to 2013 will have images available on the Audit Main menu.

Audits completed after this date should have an image of the audit available and copy of the

audit software folder that can be opened.

35

|

Enlarge image |

The “View Imaged Returns” link is also available in this section that will allow the auditor to

review a copy of the corporate (IMG-CORP) and sales and use (IMG-S+E) tax returns filed on

or before 11/30/2022. The auditor may use these documents to determine a contact person for

the taxpayer, affiliates, business activities, compare figures reported on the sales tax return, etc.

The corporate tax returns for the audit should be saved to the audit folder, as they will be used

during the audit.

Revenue Appeals Processing System

This section provides information relating to any appeals that the taxpayer may have filed and

provides a link to the Revenue Appeals Processing System (RAPS). The auditor must review

RAPS for refund petitions filed for any period included in the current audit period to ensure

duplicate credit is not granted within the audit and for any appeals related to prior audits.

Supervisors may obtain refund decisions and file documents through email request to

headquarters’ personnel. Board decisions after January 1, 2003, may be viewed together with

supporting schedules via the RAPS system. The RAPS system may be accessed via this link

RAPS and the Audits main menu page. After accessing the link and inputting the appropriate

passwords, the auditor may select several search options from the RAPS “Main” page. If the

docket number is known, the auditor may enter it into the docket number field or select the

“Search” tab to query the system by taxpayer/practitioner name, business partner number, PATH

account ID, account number, or employer identification number (EIN). The actual written

decision will be listed under the “decision” link. Supporting documentation is listed under “Docs”.

Letter Rulings

A list of EINs of taxpayers with letter rulings is available for auditors to search. When

conducting pre-audit research, the auditor must search to determine if the taxpayer is on this

list. If the taxpayer is on the list, the auditor should obtain a copy of the letter ruling through an

email request to headquarters’ personnel.

Internet

Taxpayer’s Website

The auditor should search the Internet for the taxpayer’s website or other links that may provide

information on the taxpayer’s location, business activities, products, and annual reports. In

addition, the auditor may also use the Internet to gather information about the taxpayer’s

industry.

Department of State

The auditor should search the Pennsylvania Department of State (DOS) for taxpayer

information. DOS can provide information relating to fictitious names, name changes, mergers,

and incorporation or formation information. For taxpayers incorporated or formed in another

state, that state’s Department of State website should be reviewed also.

36

|

Enlarge image |

Headquarters Information Requests

Additional information concerning the taxpayer is available from the sales tax division. This

information can be requested through an email request to headquarters’ personnel. The

information available includes:

• Aircraft and Boat Registration

• Audit Research Questions and Account Referrals

• Bankruptcy

• Corporate Clearance

• Bulk Sale Certificate

• KOZ/KOEZ/KOIZ/SDA Exemption

• PennDOT records (vehicle registration information)

Tax Research

All pre-audit planning must include a review by the auditor of sales and use tax laws, regulations

and policies pertaining to the taxpayer’s business activities. The taxpayer’s business activities

are normally determined by the listed NAICS code, previous audit information, case notes,

Department files, the Internet, invoices, advertising materials, or other information. In addition

to determining the taxpayer’s exposure to sales and use tax, the auditor must also determine

the taxpayer’s exposure to:

• Public Transportation Assistance (PTA)

• Vehicle Rental Tax (VRT)

• Employer Withholding (WTH)

• Income Tax (PIT & CNI)

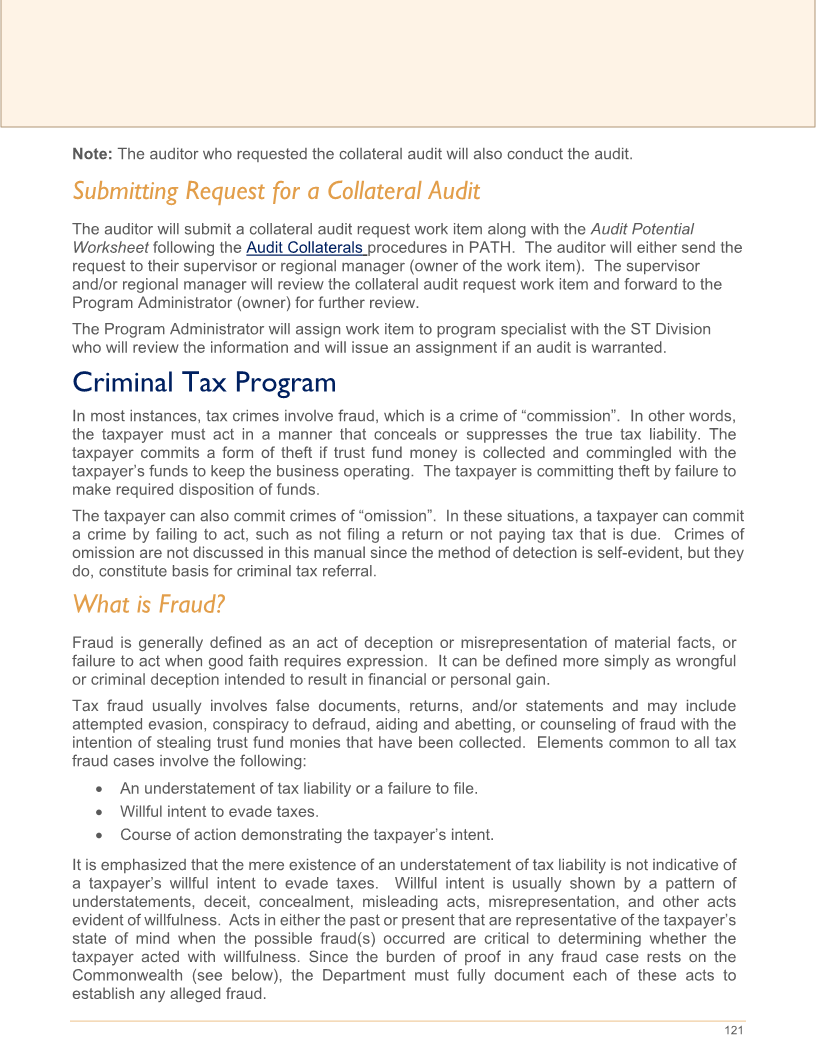

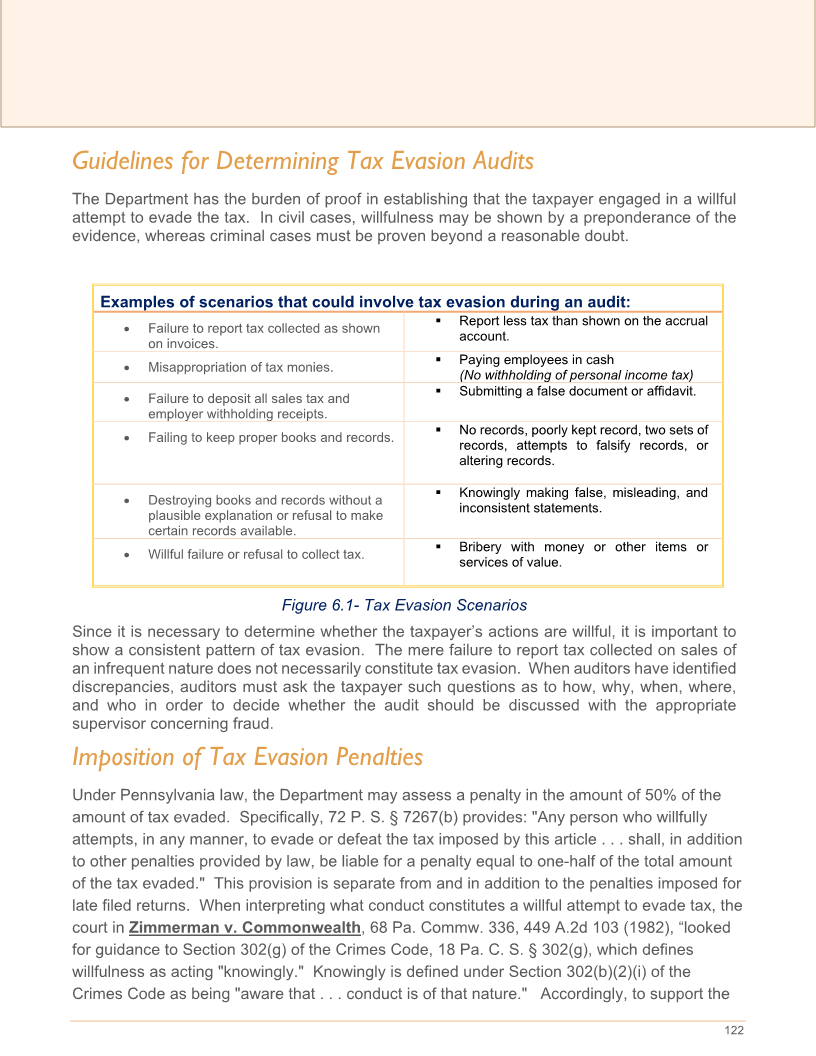

• Gross Receipts (GRE & GRT)