Enlarge image

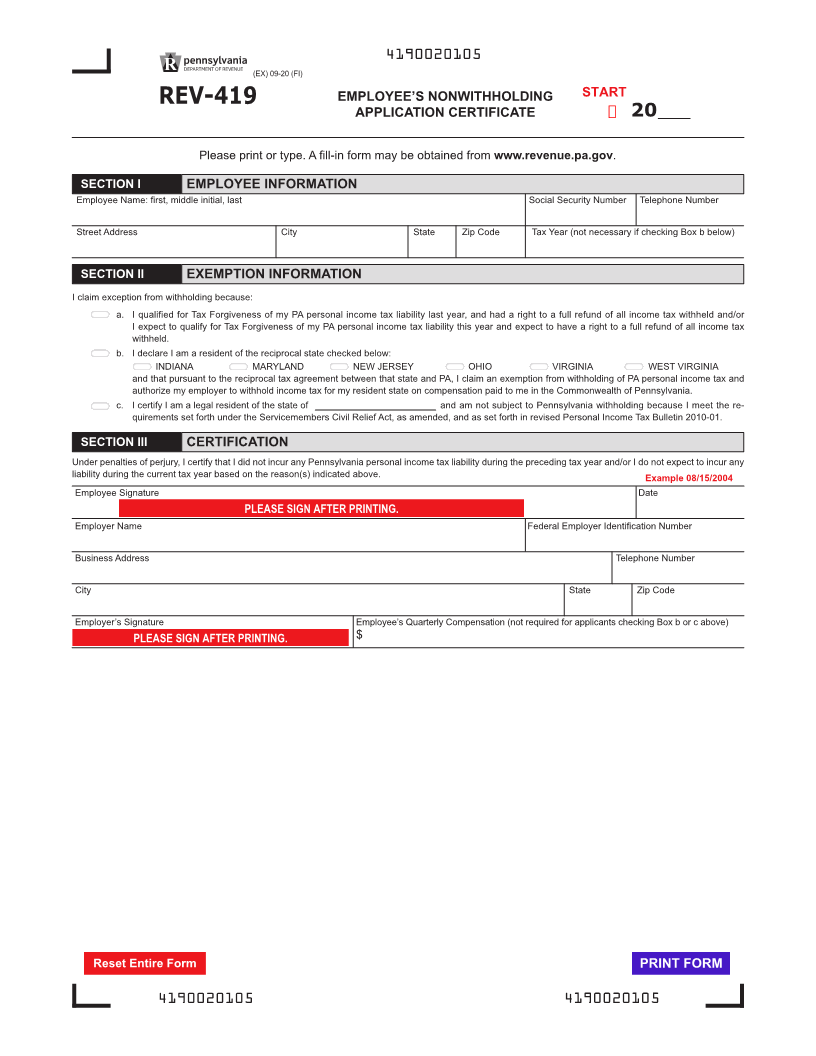

4190020105

(EX) 09-20 (FI)

REV-419 EMPLOYEE’S NONWITHHOLDING START

APPLICATION CERTIFICATE Ü 20

Please print or type. A fill-in form may be obtained from www.revenue.pa.gov.

SECTION I EMPLOYEE INFORMATION

Employee Name: first, middle initial, last Social Security Number Telephone Number

Street Address City State Zip Code Tax Year (not necessary if checking Box b below)

SECTION II EXEMPTION INFORMATION

I claim exception from withholding because:

a. I qualified for Tax Forgiveness of my PA personal income tax liability last year, and had a right to a full refund of all income tax withheld and/or

I expect to qualify for Tax Forgiveness of my PA personal income tax liability this year and expect to have a right to a full refund of all income tax

withheld.

b. I declare I am a resident of the reciprocal state checked below:

INDIANA MARYLAND NEW JERSEY OHIO VIRGINIA WEST VIRGINIA

and that pursuant to the reciprocal tax agreement between that state and PA, I claim an exemption from withholding of PA personal income tax and

authorize my employer to withhold income tax for my resident state on compensation paid to me in the Commonwealth of Pennsylvania.

c. I certify I am a legal resident of the state of and am not subject to Pennsylvania withholding because I meet the re-

quirements set forth under the Servicemembers Civil Relief Act, as amended, and as set forth in revised Personal Income Tax Bulletin 2010-01.

SECTION III CERTIFICATION

Under penalties of perjury, I certify that I did not incur any Pennsylvania personal income tax liability during the preceding tax year and/or I do not expect to incur any

liability during the current tax year based on the reason(s) indicated above. Example 08/15/2004

Employee Signature Date

PLEASE SIGN AFTER PRINTING.

Employer Name Federal Employer Identification Number

Business Address Telephone Number

City State Zip Code

Employer’s Signature Employee’s Quarterly Compensation (not required for applicants checking Box b or c above)

$PLEASE SIGN AFTER PRINTING.

Reset Entire Form PRINT FORM

4190020105 4190020105