Enlarge image

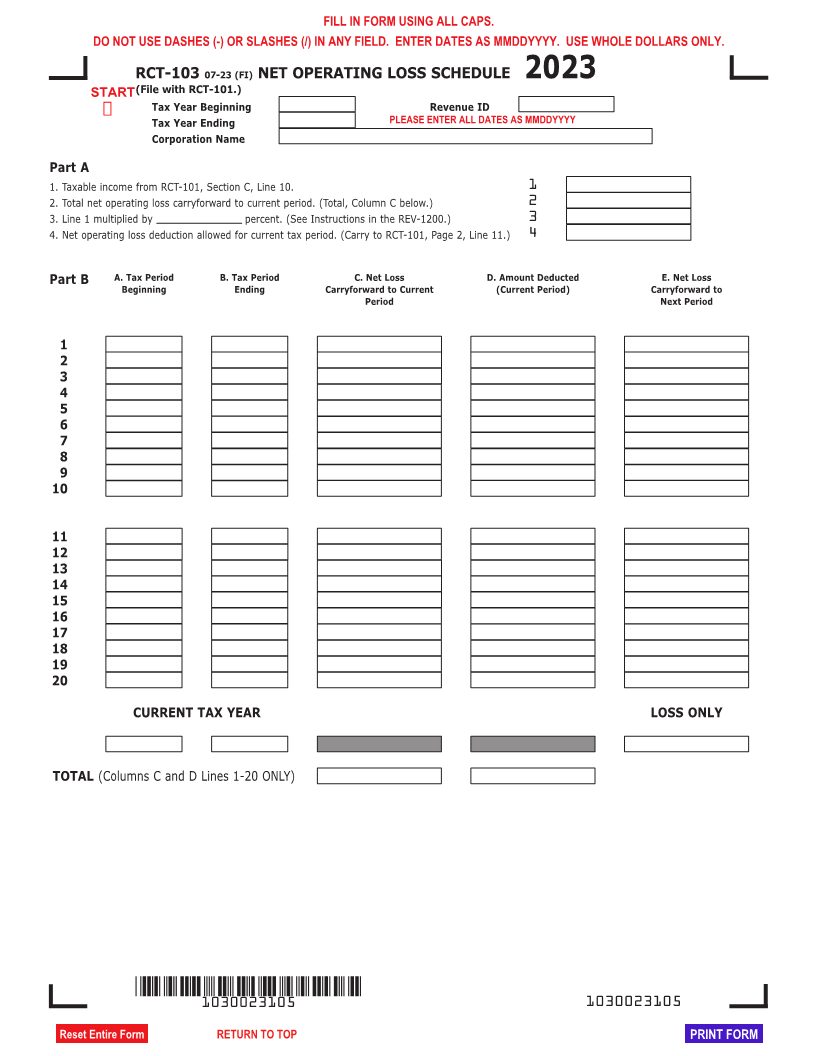

FILL IN FORM USING ALL CAPS.

DO NOT USE DASHES (-) OR SLASHES (/) IN ANY FIELD. ENTER DATES AS MMDDYYYY. USE WHOLE DOLLARS ONLY.

RCT-103 07-23 (FI) NET OPERATING LOSS SCHEDULE 2023

START(File with RCT-101.)

Ü Tax Year Beginning Revenue ID

Tax Year Ending PLEASE ENTER ALL DATES AS MMDDYYYY

Corporation Name

Part A

1. Taxable income from RCT-101, Section C, Line 10. 1

2. Total net operating loss carryforward to current period. (Total, Column C below.) 2

3. Line 1 multiplied by percent. (See Instructions in the REV-1200.) 3

4. Net operating loss deduction allowed for current tax period. (Carry to RCT-101, Page 2, Line 11.) 4

Part B A. Tax Period B. Tax Period C. Net Loss D. Amount Deducted E. Net Loss

Beginning Ending Carryforward to Current (Current Period) Carryforward to

Period Next Period

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

CURRENT TAX YEAR LOSS ONLY

TOTAL (Columns C and D Lines 1-20 ONLY)

1030023105 1030023105

Reset Entire Form RETURN TO TOP PRINT FORM