Enlarge image

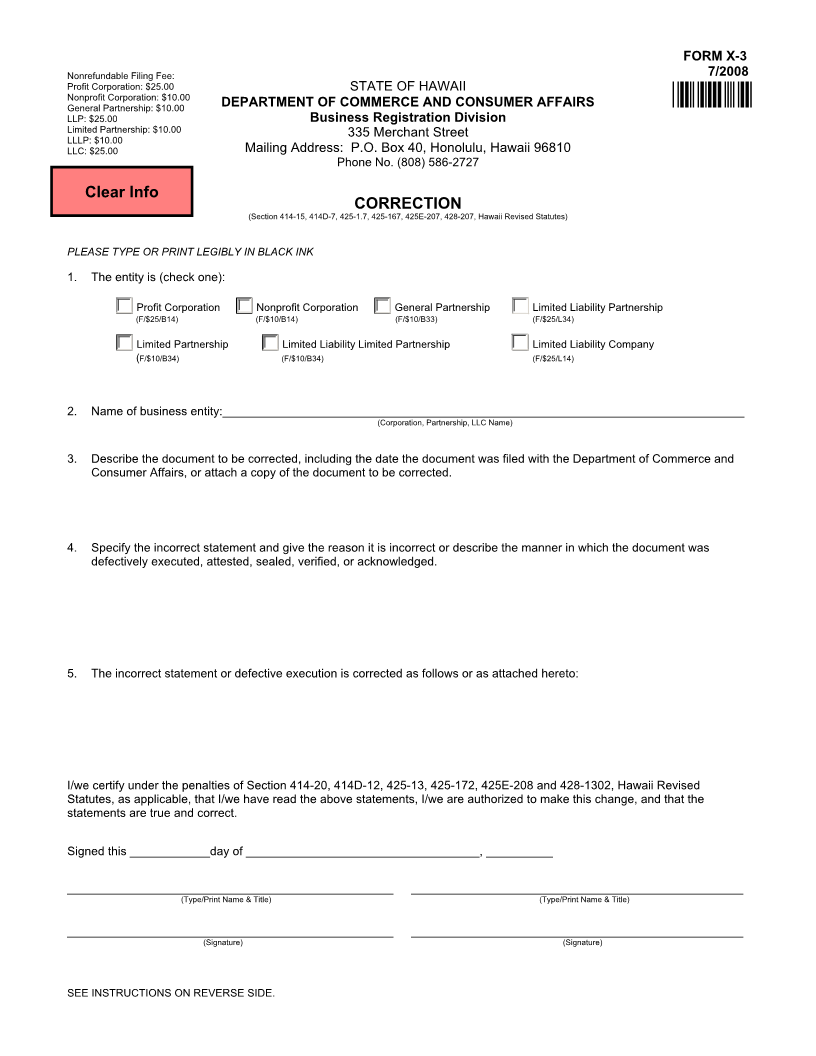

FORM X-3

Nonrefundable Filing Fee: 7/2008

Profit Corporation: $25.00 STATE OF HAWAII

Nonprofit Corporation: $10.00

General Partnership: $10.00 DEPARTMENT OF COMMERCE AND CONSUMER AFFAIRS *X3*

LLP: $25.00 Business Registration Division

Limited Partnership: $10.00 335 Merchant Street

LLLP: $10.00

LLC: $25.00 Mailing Address: P.O. Box 40, Honolulu, Hawaii 96810

Phone No. (808) 586-2727

Clear Info

CORRECTION

(Section 414-15, 414D-7, 425-1.7, 425-167, 425E-207, 428-207, Hawaii Revised Statutes)

PLEASE TYPE OR PRINT LEGIBLY IN BLACK INK

1. The entity is (check one):

Profit Corporation Nonprofit Corporation General Partnership Limited Liability Partnership

(F/$25/B14) (F/$10/B14) (F/$10/B33) (F/$25/L34)

Limited Partnership Limited Liability Limited Partnership Limited Liability Company

(F/$10/B34) (F/$10/B34) (F/$25/L14)

2. Name of business entity:________________________________________________________________________________________

(Corporation, Partnership, LLC Name)

3. Describe the document to be corrected, including the date the document was filed with the Department of Commerce and

Consumer Affairs, or attach a copy of the document to be corrected.

4. Specify the incorrect statement and give the reason it is incorrect or describe the manner in which the document was

defectively executed, attested, sealed, verified, or acknowledged.

5. The incorrect statement or defective execution is corrected as follows or as attached hereto:

I/we certify under the penalties of Section 414-20, 414D-12, 425-13, 425-172, 425E-208 and 428-1302, Hawaii Revised

Statutes, as applicable, that I/we have read the above statements, I/we are authorized to make this change, and that the

statements are true and correct.

Signed this ____________day of ___________________________________, __________

_______________________________________________________ ________________________________________________________

(Type/Print Name & Title) (Type/Print Name & Title)

_______________________________________________________ ________________________________________________________

(Signature) (Signature)

SEE INSTRUCTIONS ON REVERSE SIDE.