Enlarge image

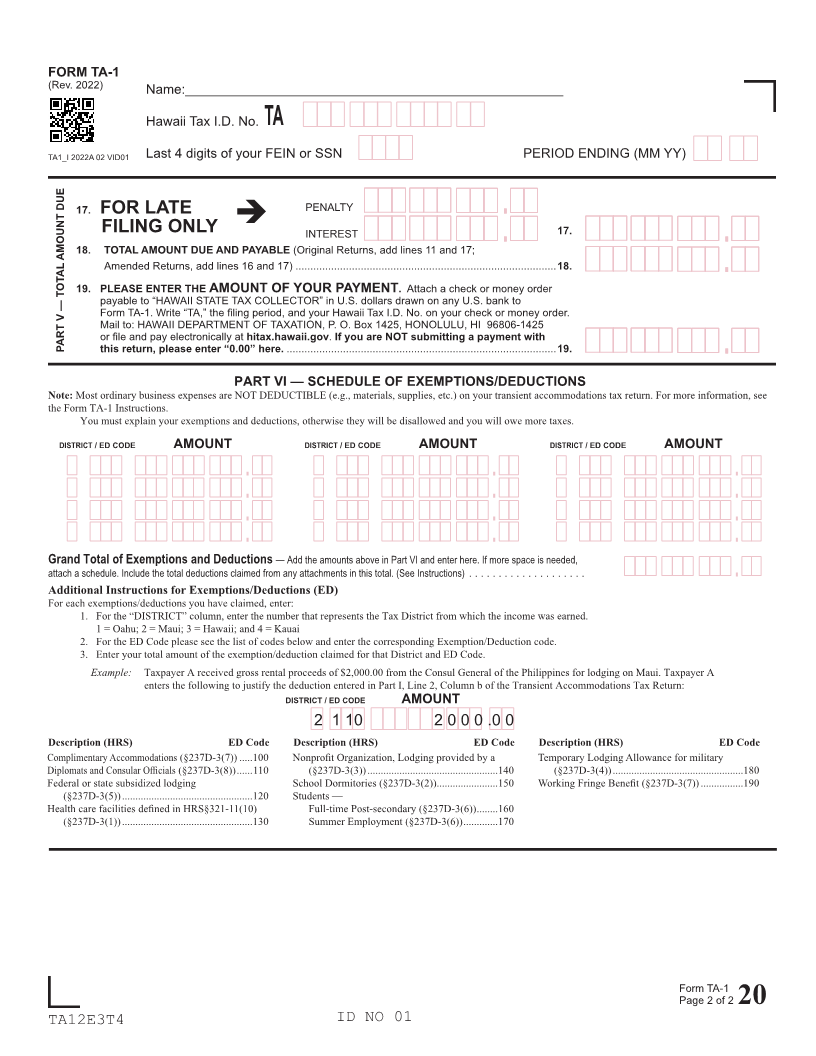

FORM TA-1 STATE OF HAWAII — DEPARTMENT OF TAXATION

(Rev. 2022) DO NOT WRITE IN THIS AREA 20

TRANSIENT ACCOMMODATIONS

ID NO 01 TAX RETURN

For periods beginning AFTER December 31, 2017

TA1_I 2022A 01 VID01

Place an “X” in this box ONLY if this is an AMENDED return

PERIOD ENDING (MM YY) HAWAII TAX I.D. NO. TA

NAME:____________________________________ Last 4 digits of your FEIN or SSN

Column a Column b Column c

DISTRICT GROSS RENTAL OR EXEMPTIONS/DEDUCTIONS TAXABLE PROCEEDS

GROSS RENTAL PROCEEDS (Explain on Reverse Side) (Column a minus Column b)

1. OAHU 1

. . .

2. MAUI, MOLOKAI, LANAI 2

. . . . . .

PART I — TRANSIENT 3. HAWAII . . . . . . 3

ACCOMMODATIONS TAX

4. KAUAI 4

. . . . . .

TOTAL FAIR MARKET RENTAL VALUE

5. OAHU DISTRICT ...................................................................................................................... 5.

. .

6. MAUI, MOLOKAI, LANAI DISTRICT ......................................................................................... 6.

. .

7. HAWAII DISTRICT .................................................................................................................... 7.

OCCUPANCY TAX . .

PART II — TIMESHARE

8. KAUAI DISTRICT ...................................................................................................................... 8.

. .

9. TOTAL AMOUNT TAXABLE. Add Column c of lines 1 through 4 and lines 5

through 8. Enter result here (but not less than zero). ...............................................................................9.

. .

10. Tax Rate 10. x0.1025

PART III —COMPUTATION 11. TAX TOTAL TAXES DUE. Multiply line 9 by line 10 and enter the result here. If you did

• ATTACH CHECK OR MONEY ORDER HERE • not have any activity for the period, enter “0.00” here ...................................................... 11.

. .

12. Amounts Assessed During the Period... PENALTY

. .

(For Amended Return ONLY) 12.

INTEREST . . . .

13. TOTAL AMOUNT. Add lines 11 and 12. (For Amended Return ONLY) ........................... 13.

. .

14. TOTAL PAYMENTS MADE FOR THE PERIOD (For Amended Return ONLY) ....................... 14.

. .

PART IV — ADJUSTMENTS 15. CREDIT TO BE REFUNDED. Line 14 minus line 13 (For Amended Return ONLY) .............. 15. . .

16. ADDITIONAL TAXES DUE. Line 13 minus line 14 (For Amended Return ONLY) ................. 16.

. .

DECLARATION - I declare, under the penalties set forth in section 231-36, HRS, that this return (including any accompanying schedules or statements) has been

examined by me and, to the best of my knowledge and belief, is a true, correct, and complete return, made in good faith for the tax period stated, pursuant to the

Transient Accommodations Tax Laws, and the rules issued thereunder.

IN THE CASE OF A CORPORATION OR PARTNERSHIP, THIS RETURN MUST BE SIGNED BY AN OFFICER, PARTNER OR MEMBER, OR DULY AUTHORIZED AGENT.

SIGNATURE TITLE DATE DAYTIME PHONE NUMBER

Continued on page 2 — Parts V & VI (Rev. 2022)

TA11E3T4 MUST be completed Form TA-1

20