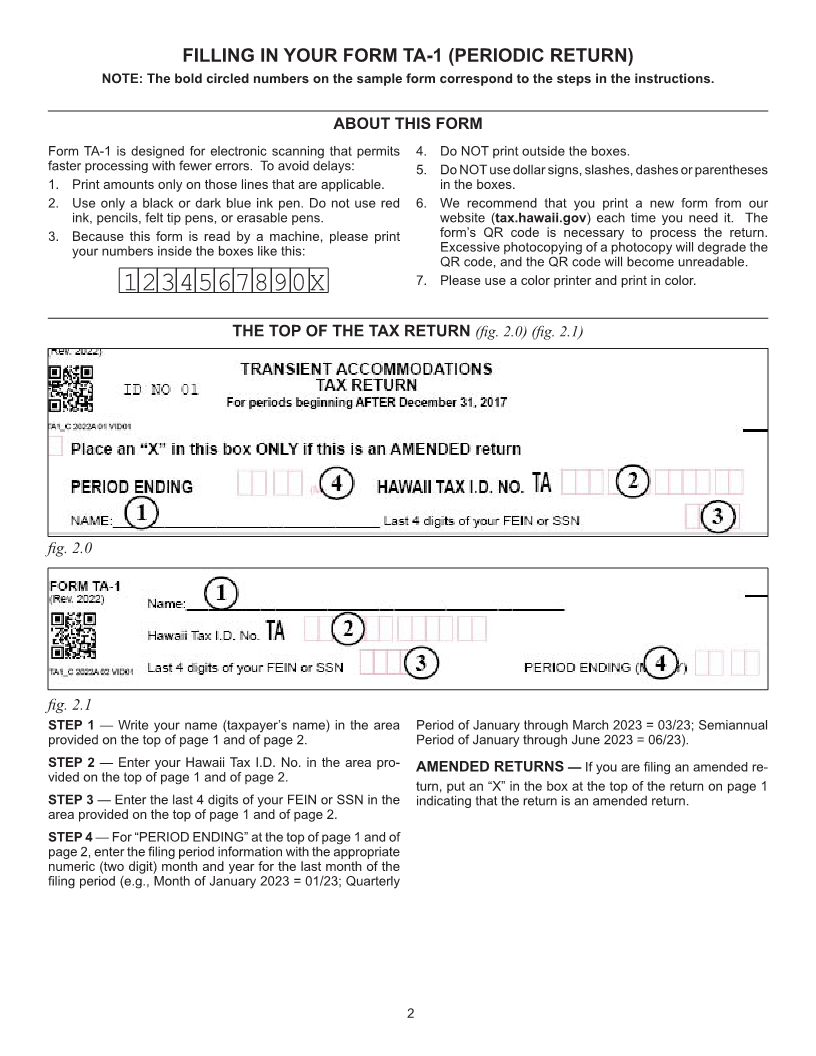

Enlarge image

FORM TA-1 HOW TO COMPLETE YOUR PERIODIC

INSTRUCTIONS

(REV. 2022) TRANSIENT ACCOMMODATIONS TAX RETURN

(FORM TA-1)

INTRODUCTION commodations taxes, resort fees, and other costs including

payments required for reserves or sinking funds. Amounts

The transient accommodations tax (TAT) is levied on the paid for optional goods and services such as food and bev-

gross rental or gross rental proceeds derived from furnishing erage services or beach chair or umbrella rentals shall be

transient accommodations. For taxable years beginning after excluded from fair market rental value.

December 31, 2018, the TAT is also levied on the share of

The TAT returns (Form TA-1) must be filed on a periodic ba-

gross rental proceeds received by transient accommodations

sis depending on the amount of TAT or TSO tax you have to

brokers, travel agents, and tour packagers who enter into

pay during the year. You must file monthly if you will pay

arrangements to furnish transient accommodations at non-

more than $4,000 in TAT or TSO tax per year. You may file

commissioned negotiated contract rates. The rate is 10.25%.

quarterly if you will pay $4,000 or less in TAT or TSO tax per

A “transient accommodation” is a room, apartment, house, year. You may file semiannually if you will pay $2,000 or less

condominium, beach house, hotel room or suite, or similar in TAT or TSO tax per year. When changing your filing period,

living accommodation furnished to a transient person for less please complete Form BB-1.

than 180 consecutive days.

Taxpayers filing more frequently than is required are filing

“Gross rental or gross rental proceeds” includes amounts returns that cannot be properly tracked. To address this the

paid to you in the form of cash, goods, or services as compen- Department of Taxation will change the required filing fre-

sation for furnishing a transient accommodation without any quency of taxpayers who file more frequently than is required.

deductions for costs incurred in the operation of the transient

Form TA-1 is due with payment on or before the 20th day of

accommodation. Gross rental or gross rental proceeds also

the calendar month following the close of the filing period.

includes amounts received for entering into arrangements to

furnish transient accommodation and amounts received for The Department requires taxpayers whose TAT liability ex-

mandatory resort fees. The gross rental or gross proceeds ceeds $4,000 for the taxable year, to file returns electronically.

do not include the items shown at the top of the “SCHEDULE

Taxpayers whose liability for the TAT exceeds $100,000 per

OF TRANSIENT ACCOMMODATIONS TAX EXCLUSIONS,

year are required to pay the tax by Electronic Funds Transfer

EXEMPTIONS AND DEDUCTIONS” (under Section 237D-1)

(EFT).

on page 6 of these instructions.

If a payment is being made with Form TA-1, make your check

The transient accommodations tax on time share occupancy

or money order payable to “Hawaii State Tax Collector.” Write

(TSO tax) is levied on the occupant of a time share vaca-

“TA,” the filing period, your Hawaii Tax I.D. No., and your

tion unit at the rate of 10.25% on the unit’s fair market rental

daytime phone number on the check. Attach your check or

value. The time share plan manager shall be liable for, and

money order where indicated on the front of Form TA-1.

pay to the State, the TSO tax.

“Fair market rental value” is defined as an amount equal to Protective Claim — A protective refund claim is a claim filed

to protect a taxpayer’s right to a potential refund based on

one-half of the gross daily maintenance fees that are paid

a contingent event for a taxable period for which the statute

by the owner and that are attributable to the time share unit

of limitations is about to expire. A protective claim is usually

located in Hawaii. Gross daily maintenance fees include

based on contingencies such as pending litigation or an on-

maintenance costs, operational costs, insurance, repair

going federal income tax audit or an audit in another state.

costs, administrative costs, taxes, other than transient ac-

For more information see Tax Facts 2021-2.

IMPORTANT!!!

Write “TA,” the filing period, your Hawaii Tax I.D. No. and your Forms, instructions, and publications are available on the De-

daytime phone number on your check so that it may be prop- partment’s website at tax.hawaii.gov or you may contact a

erly credited to your account. If you do not have any gross customer service representative at:

rental or gross rental proceeds and do not have any fair

Voice: 808-587-4242

market rental value and the result is no TAT and TSO tax

1-800-222-3229 (Toll-Free)

liability, enter “0.00” on line 11. Please note that this pe-

riodic return must be filed. Telephone for the Hearing Impaired:

808-587-1418

To correct a previously filed Form TA-1, file an amended re-

1-800-887-8974 (Toll-Free)

turn on Form TA-1.

Fax: 808-587-1488

Mail: Taxpayer Services Branch

P.O. Box 259

Honolulu, HI 96809-0259

1