Enlarge image

Clear Form

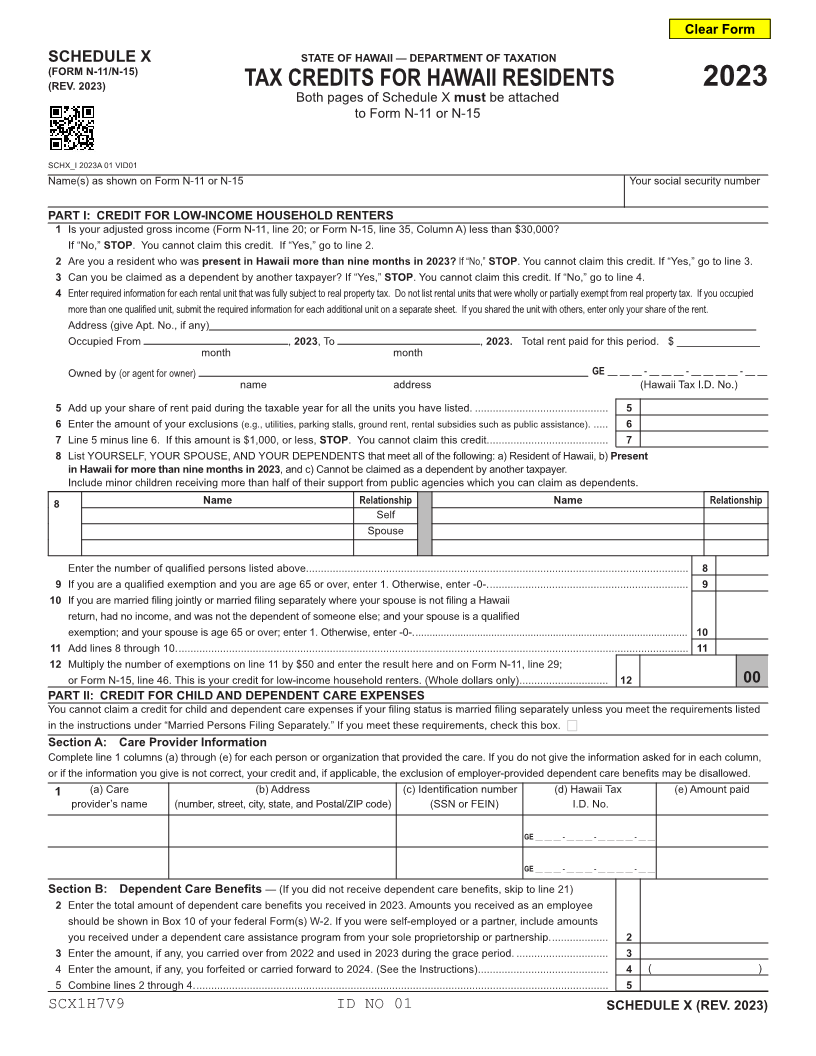

SCHEDULE X STATE OF HAWAII — DEPARTMENT OF TAXATION

(FORM N-11/N-15)

(REV. 2023) TAX CREDITS FOR HAWAII RESIDENTS 2023

Both pages of Schedule X must be attached

to Form N-11 or N-15

SCHX_I 2023A 01 VID01

Name(s) as shown on Form N-11 or N-15 Your social security number

PART I: CREDIT FOR LOW-INCOME HOUSEHOLD RENTERS

1 Is your adjusted gross income (Form N-11, line 20; or Form N-15, line 35, Column A) less than $30,000?

If “No,” STOP. You cannot claim this credit. If “Yes,” go to line 2.

2Are you a resident who was present in Hawaii more than nine months in 2023? If “No,” STOP. You cannot claim this credit. If “Yes,” go to line 3.

3Can you be claimed as a dependent by another taxpayer? If “Yes,” STOP. You cannot claim this credit. If “No,” go to line 4.

4 Enter required information for each rental unit that was fully subject to real property tax. Do not list rental units that were wholly or partially exempt from real property tax. If you occupied

more than one qualified unit, submit the required information for each additional unit on a separate sheet. If you shared the unit with others, enter only your share of the rent.

Address (give Apt. No., if any)

Occupied From , 2023, To , 2023. Total rent paid for this period. $ ______________

month month

Owned by (or agent for owner) GE __ __ __ - __ __ __ - __ __ __ __ - __ __

name address (Hawaii Tax I.D. No.)

5 Add up your share of rent paid during the taxable year for all the units you have listed. ............................................. 5

6Enter the amount of your exclusions (e.g., utilities, parking stalls, ground rent, rental subsidies such as public assistance). ..... 6

7Line 5 minus line 6. If this amount is $1,000, or less, STOP. You cannot claim this credit. ........................................ 7

8List YOURSELF, YOUR SPOUSE, AND YOUR DEPENDENTS that meet all of the following: a) Resident of Hawaii, b)Present

in Hawaii for more than nine months in 2023, and c) Cannot be claimed as a dependent by another taxpayer.

Include minor children receiving more than half of their support from public agencies which you can claim as dependents.

8 Name Relationship Name Relationship

Self

Spouse

Enter the number of qualified persons listed above. ................................................................................................................................ 8

9 If you are a qualified exemption and you are age 65 or over, enter 1. Otherwise, enter -0-. ................................................................... 9

10 If you are married filing jointly or married filing separately where your spouse is not filing a Hawaii

return, had no income, and was not the dependent of someone else; and your spouse is a qualified

exemption; and your spouse is age 65 or over; enter 1. Otherwise, enter -0-. ................................................................................................. 10

11Add lines 8 through 10. ............................................................................................................................................................................ 11

12Multiply the number of exemptions on line 11 by $50 and enter the result here and on Form N-11, line 29;

or Form N-15, line 46. This is your credit for low-income household renters. (Whole dollars only) .............................. 12 00

PART II: CREDIT FOR CHILD AND DEPENDENT CARE EXPENSES

You cannot claim a credit for child and dependent care expenses if your filing status is married filing separately unless you meet the requirements listed

in the instructions under “Married Persons Filing Separately.” If you meet these requirements, check this box.

Section A: Care Provider Information

Complete line 1 columns (a) through (e) for each person or organization that provided the care. If you do not give the information asked for in each column,

or if the information you give is not correct, your credit and, if applicable, the exclusion of employer-provided dependent care benefits may be disallowed.

1 (a) Care (b) Address (c) Identification number (d) Hawaii Tax (e) Amount paid

provider’s name (number, street, city, state, and Postal/ZIP code) (SSN or FEIN) I.D. No.

GE __ __ __ - __ __ __ - __ __ __ __ - __ __

GE __ __ __ - __ __ __ - __ __ __ __ - __ __

Section B: Dependent Care Benefits — (If you did not receive dependent care benefits, skip to line 21)

2 Enter the total amount of dependent care benefits you received in 2023. Amounts you received as an employee

should be shown in Box 10 of your federal Form(s) W-2. If you were self-employed or a partner, include amounts

you received under a dependent care assistance program from your sole proprietorship or partnership. ................... 2

3Enter the amount, if any, you carried over from 2022 and used in 2023 during the grace period. ............................... 3

4 Enter the amount, if any, you forfeited or carried forward to 2024. (See the Instructions) ............................................ 4 ( )

5 Combine lines 2 through 4. ........................................................................................................................................... 5

SCX1H7V9 ID NO 01 SCHEDULE X (REV. 2023)