Enlarge image

Clear Form

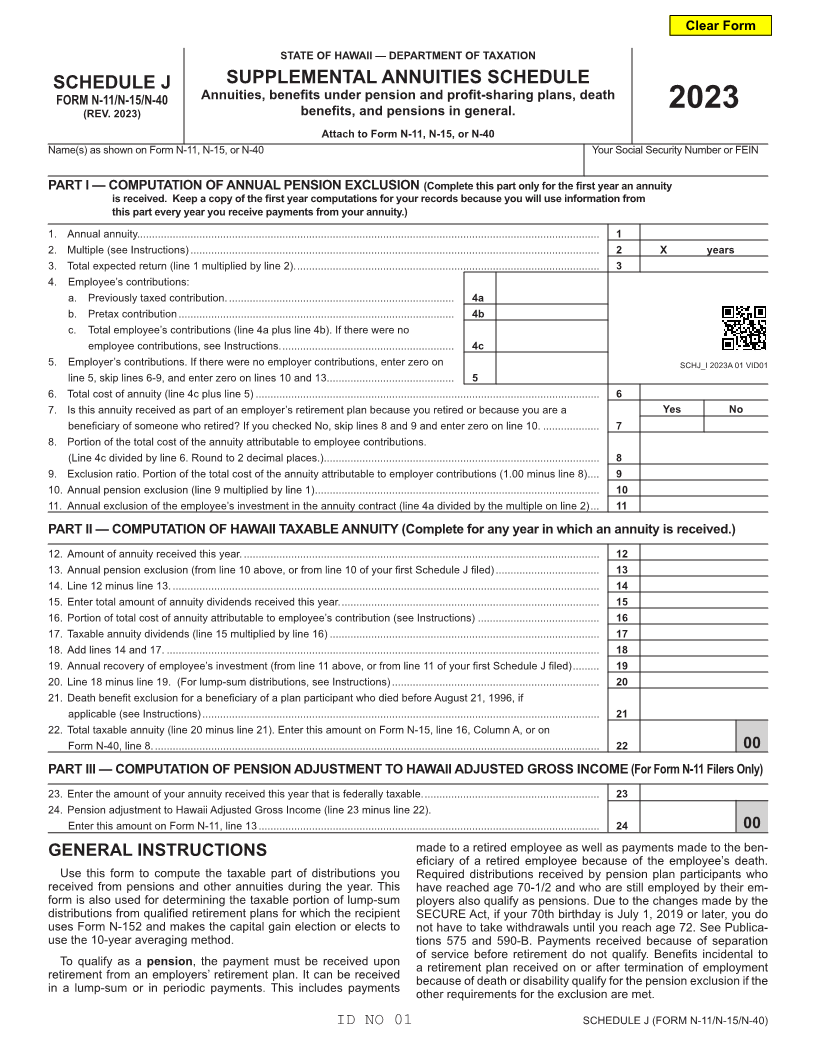

STATE OF HAWAII — DEPARTMENT OF TAXATION

SCHEDULE J SUPPLEMENTAL ANNUITIES SCHEDULE

FORM N-11/N-15/N-40 Annuities, benefits under pension and profit-sharing plans, death

(REV.benefits,2023 2023)and pensions in general.

Attach to Form N-11, N-15, or N-40

Name(s) as shown on Form N-11, N-15, or N-40 Your Social Security Number or FEIN

PART I — COMPUTATION OF ANNUAL PENSION EXCLUSION (Complete this part only for the first year an annuity

is received. Keep a copy of the first year computations for your records because you will use information from

this part every year you receive payments from your annuity.)

1. Annual annuity............................................................................................................................................................ 1

2. Multiple (see Instructions) .......................................................................................................................................... 2 X years

3. Total expected return (line 1 multiplied by line 2). ...................................................................................................... 3

4. Employee’s contributions:

a. Previously taxed contribution. ............................................................................ 4a

b. Pretax contribution ............................................................................................. 4b

c. Total employee’s contributions (line 4a plus line 4b). If there were no

employee contributions, see Instructions. .......................................................... 4c

5. Employer’s contributions. If there were no employer contributions, enter zero on SCHJ_I 2023A 01 VID01

line 5, skip lines 6-9, and enter zero on lines 10 and 13. .......................................... 5

6. Total cost of annuity (line 4c plus line 5) .................................................................................................................... 6

7. Is this annuity received as part of an employer’s retirement plan because you retired or because you are a Yes No

beneficiary of someone who retired? If you checked No, skip lines 8 and 9 and enter zero on line 10. ................... 7

8. Portion of the total cost of the annuity attributable to employee contributions.

(Line 4c divided by line 6. Round to 2 decimal places.) ............................................................................................. 8

9. Exclusion ratio. Portion of the total cost of the annuity attributable to employer contributions (1.00 minus line 8) .... 9

10. Annual pension exclusion (line 9 multiplied by line 1) ................................................................................................ 10

11. Annual exclusion of the employee’s investment in the annuity contract (line 4a divided by the multiple on line 2) ... 11

PART II — COMPUTATION OF HAWAII TAXABLE ANNUITY (Complete for any year in which an annuity is received.)

12. Amount of annuity received this year. ........................................................................................................................ 12

13. Annual pension exclusion (from line 10 above, or from line 10 of your first Schedule J filed) ................................... 13

14. Line 12 minus line 13. ................................................................................................................................................ 14

15. Enter total amount of annuity dividends received this year. ....................................................................................... 15

16. Portion of total cost of annuity attributable to employee’s contribution (see Instructions) ......................................... 16

17. Taxable annuity dividends (line 15 multiplied by line 16) ........................................................................................... 17

18. Add lines 14 and 17. .................................................................................................................................................. 18

19. Annual recovery of employee’s investment (from line 11 above, or from line 11 of your first Schedule J filed) ......... 19

20. Line 18 minus line 19. (For lump-sum distributions, see Instructions) ...................................................................... 20

21. Death benefit exclusion for a beneficiary of a plan participant who died before August 21, 1996, if

applicable (see Instructions) ...................................................................................................................................... 21

22. Total taxable annuity (line 20 minus line 21). Enter this amount on Form N-15, line 16, Column A, or on

Form N-40, line 8. ...................................................................................................................................................... 22 00

PART III — COMPUTATION OF PENSION ADJUSTMENT TO HAWAII ADJUSTED GROSS INCOME (For Form N-11 Filers Only)

23. Enter the amount of your annuity received this year that is federally taxable. ........................................................... 23

24. Pension adjustment to Hawaii Adjusted Gross Income (line 23 minus line 22).

Enter this amount on Form N-11, line 13 ................................................................................................................... 24 00

made to a retired employee as well as payments made to the ben-

GENERAL INSTRUCTIONS eficiary of a retired employee because of the employee’s death.

Use this form to compute the taxable part of distributions you Required distributions received by pension plan participants who

received from pensions and other annuities during the year. This have reached age 70-1/2 and who are still employed by their em-

form is also used for determining the taxable portion of lump-sum ployers also qualify as pensions. Due to the changes made by the

distributions from qualified retirement plans for which the recipient SECURE Act, if your 70th birthday is July 1, 2019 or later, you do

uses Form N-152 and makes the capital gain election or elects to not have to take withdrawals until you reach age 72. See Publica -

use the 10-year averaging method. tions 575 and 590-B. Payments received because of separation

of service before retirement do not qualify. Benefits incidental to

To qualify as a pension, the payment must be received upon a retirement plan received on or after termination of employment

retirement from an employers’ retirement plan. It can be received because of death or disability qualify for the pension exclusion if the

in a lump-sum or in periodic payments. This includes payments other requirements for the exclusion are met.

ID NO 01 SCHEDULE J (FORM N-11/N-15/N-40)