Enlarge image

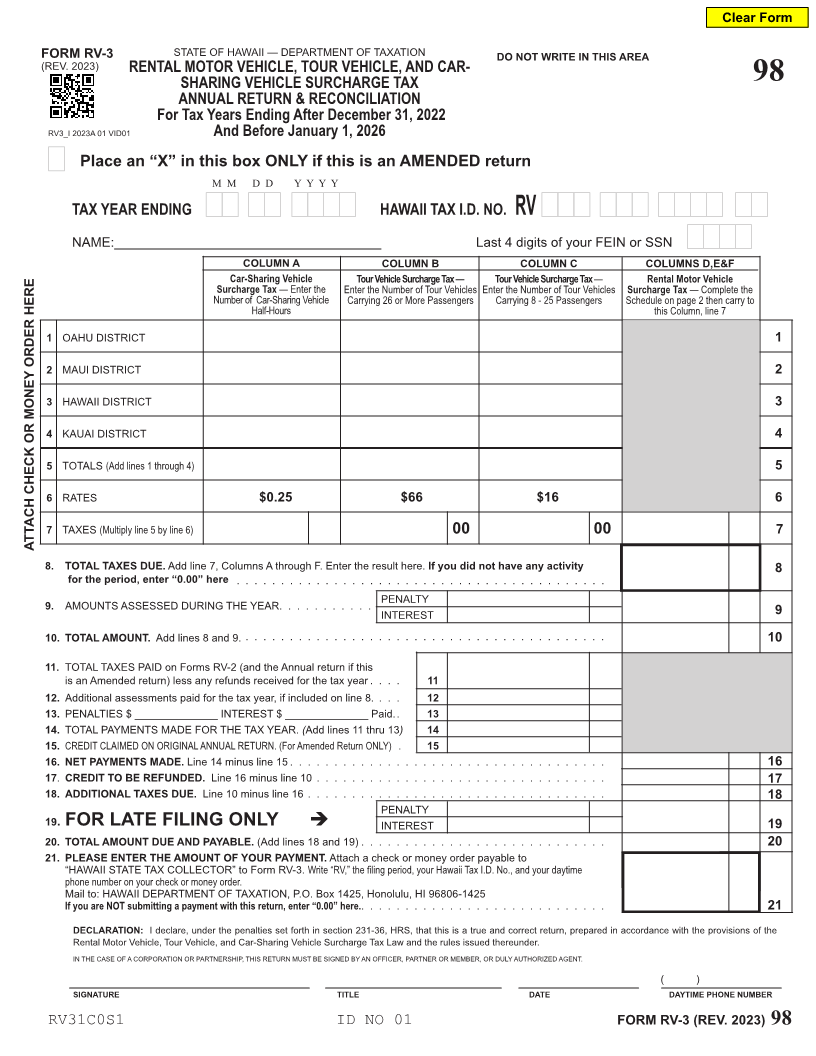

Clear Form FORM RV-3 STATE OF HAWAII — DEPARTMENT OF TAXATION DO NOT WRITE IN THIS AREA (REV. 2023) RENTAL MOTOR VEHICLE, TOUR VEHICLE, AND CAR- SHARING VEHICLE SURCHARGE TAX 98 ANNUAL RETURN & RECONCILIATION For Tax Years Ending After December 31, 2022 RV3_I 2023A 01 VID01 And Before January 1, 2026 Place an “X” in this box ONLY if this is an AMENDED return M M D D Y Y Y Y TAX YEAR ENDING HAWAII TAX I.D. NO. RV NAME:____________________________________ Last 4 digits of your FEIN or SSN COLUMN A COLUMN B COLUMN C COLUMNS D,E&F Car-Sharing Vehicle Tour Vehicle Surcharge Tax — Tour Vehicle Surcharge Tax — Rental Motor Vehicle Surcharge Tax — Enter the Enter the Number of Tour Vehicles Enter the Number of Tour Vehicles Surcharge Tax — Complete the Number CarryingCarrying Scheduleof 268onor-pageCar-SharingMore252VehiclePassengersPassengersthen carry to Half-Hoursthis Column, line 7 1 OAHU DISTRICT 1 2 MAUI DISTRICT 2 3 HAWAII DISTRICT 3 4 KAUAI DISTRICT 4 5 TOTALS (Add lines 1 through 4) 5 6 RATES $0.25 $66 $16 $5.50 6 7 TAXES (Multiply line 5 by line 6) 00 00 7 ATTACH CHECK OR MONEY ORDER HERE 8. TOTAL TAXES DUE. Add line 7, Columns A through F. Enter the result here. If you did not have any activity 8 for the period, enter “0.00” here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9. AMOUNTS ASSESSED DURING THE YEAR. . . . . . . . . . . PENALTY INTEREST 9 10. TOTAL AMOUNT. Add lines 8 and 9. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10 11. TOTAL TAXES PAID on Forms RV-2 (and the Annual return if this is an Amended return) less any refunds received for the tax year . . . . 11 12. Additional assessments paid for the tax year, if included on line 8. . . . 12 13. PENALTIES $ ______________ INTEREST $ ______________ Paid. . 13 14. TOTAL PAYMENTS MADE FOR THE TAX YEAR. (Add lines 11 thru 13) 14 15. CREDIT CLAIMED ON ORIGINAL ANNUAL RETURN. (For Amended Return ONLY) . 15 16. NET PAYMENTS MADE. Line 14 minus line 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16 17.CREDIT TO BE REFUNDED. Line 16 minus line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17 18. ADDITIONAL TAXES DUE. Line 10 minus line 16 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18 PENALTY 19. FOR LATE FILING ONLY INTEREST 19 20. TOTAL AMOUNT DUE AND PAYABLE. (Add lines 18 and 19) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20 21. PLEASE ENTER THE AMOUNT OF YOUR PAYMENT. Attach a check or money order payable to “HAWAII STATE TAX COLLECTOR” to Form RV-3. Write “RV,” the filing period, your Hawaii Tax I.D. No., and your daytime phone number on your check or money order. Mail to: HAWAII DEPARTMENT OF TAXATION, P.O. Box 1425, Honolulu, HI 96806-1425 If you are NOT submitting a payment with this return, enter “0.00” here. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21 DECLARATION: I declare, under the penalties set forth in section 231-36, HRS, that this is a true and correct return, prepared in accordance with the provisions of the Rental Motor Vehicle, Tour Vehicle, and Car-Sharing Vehicle Surcharge Tax Law and the rules issued thereunder. IN THE CASE OF A CORPORATION OR PARTNERSHIP, THIS RETURN MUST BE SIGNED BY AN OFFICER, PARTNER OR MEMBER, OR DULY AUTHORIZED AGENT. ( ) SIGNATURE TITLE DATE DAYTIME PHONE NUMBER RV31C0S1 ID NO 01 FORM RV-3 (REV. 2023) 98