Enlarge image

Clear Form

DO NOT WRITE IN THIS SPACE

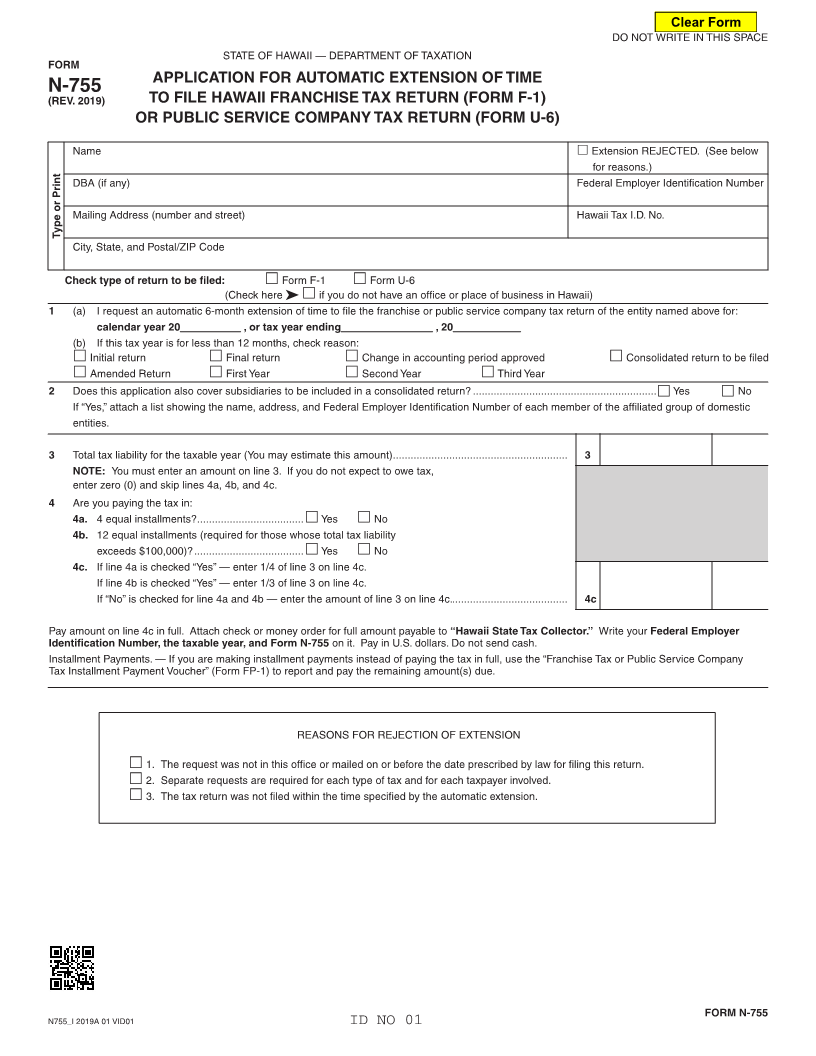

STATE OF HAWAII — DEPARTMENT OF TAXATION

FORM

APPLICATION FOR AUTOMATIC EXTENSION OF TIME

N-755

(REV. 2019) TO FILE HAWAII FRANCHISE TAX RETURN (FORM F-1)

OR PUBLIC SERVICE COMPANY TAX RETURN (FORM U-6)

Name Extension REJECTED. (See below

for reasons.)

DBA (if any) Federal Employer Identification Number

Mailing Address (number and street) Hawaii Tax I.D. No.

Type or Print

City, State, and Postal/ZIP Code

Check type of return to be filed: Form F-1 Form U-6

(Check here if you do not have an office or place of business in Hawaii)

1 (a) I request an automatic 6-month extension of time to file the franchise or public service company tax return of the entity named above for:

calendar year 20 , or tax year ending , 20

(b) If this tax year is for less than 12 months, check reason:

Initial return Final return Change in accounting period approved Consolidated return to be filed

Amended Return First Year Second Year Third Year

2 Does this application also cover subsidiaries to be included in a consolidated return? .............................................................. Yes No

If “Yes,” attach a list showing the name, address, and Federal Employer Identification Number of each member of the affiliated group of domestic

entities.

3 Total tax liability for the taxable year (You may estimate this amount) ........................................................... 3

NOTE: You must enter an amount on line 3. If you do not expect to owe tax,

enter zero (0) and skip lines 4a, 4b, and 4c.

4 Are you paying the tax in:

4a. 4 equal installments? .................................... Yes No

4b. 12 equal installments (required for those whose total tax liability

exceeds $100,000)? ..................................... Yes No

4c. If line 4a is checked “Yes” — enter 1/4 of line 3 on line 4c.

If line 4b is checked “Yes” — enter 1/3 of line 3 on line 4c.

If “No” is checked for line 4a and 4b — enter the amount of line 3 on line 4c........................................ 4c

Pay amount on line 4c in full. Attach check or money order for full amount payable to “Hawaii State Tax Collector.” Write your Federal Employer

Identification Number, the taxable year, and Form N-755 on it. Pay in U.S. dollars. Do not send cash.

Installment Payments. — If you are making installment payments instead of paying the tax in full, use the “Franchise Tax or Public Service Company

Tax Installment Payment Voucher” (Form FP-1) to report and pay the remaining amount(s) due.

REASONS FOR REJECTION OF EXTENSION

1. The request was not in this office or mailed on or before the date prescribed by law for filing this return.

2. Separate requests are required for each type of tax and for each taxpayer involved.

3. The tax return was not filed within the time specified by the automatic extension.

FORM N-755

N755_I 2019A 01 VID01 ID NO 01